The history of monetary policy tells us that rushed decisions tend to be wrong decisions – Gabriel Makhlouf

When Donald Trump bragged that he could end the Ukraine war within 24 hours, few took him seriously. The thing with Trump, though, is that his statements shouldn’t always be taken literally but rather figuratively. One certainty about Trump is that he often speaks like a child, inflating his achievements and capabilities.

Nevertheless, most Western leaders and journalists interpreted his claim literally and later criticized him for failing to deliver. Now, everyone’s panicking as he pushes forward with efforts to resolve the Ukraine war. But if they’d understood Trump figuratively, this week’s developments wouldn’t have been such a shock.

On Tuesday, US Secretary of State Marco Rubio met with Sergei Lavrov in Riyadh, Saudi Arabia, to discuss ending the Ukraine conflict and rebuilding US-Russia relations. Though their agreements were somewhat vague, the Trump administration’s direction seems clear: it wants to end the war, possibly aligning Russia with the US and distancing it from China.

The meeting sparked outrage among EU officials who were excluded from the talks. I won’t dive too deeply into this now, as I’m planning a longer piece on Europe next week, but in my view, the EU remains stuck in the past, clinging to the stance of the previous US administration.

It’s not as if the European position was particularly original, so Rubio had a point when he noted that the EU had three years to arrange such a meeting and didn’t act. Though the process is still in its early stages and a final agreement is pending, the prospects for peace in Ukraine are rising—albeit with the sense that Trump might be throwing Ukraine under the bus.

Despite the political uproar, the financial markets barely reacted to the meeting, as other news dominated price action. Still, the Trump administration’s new stance on Ukraine played a role. As Bloomberg reported:

Annalena Baerbock, Germany’s foreign minister, has suggested that Europe’s response could include a major new defense package. “We will launch a large package that has never been seen in this dimension before,” Baerbock said in an interview on the sidelines of the Munich gathering.

Anticipation of hefty defense spending fueled a rally in defense stocks. Germany’s Rheinmetall surged 14%, pushing the DAX to a new all-time high. Meanwhile, bonds sold off, driving up yields on European government debt.

EUR/USD slipped from 1.05 to the 1.04 support level as markets viewed higher European defense spending as potentially inflationary and bearish for the euro. Calls for joint EU bonds to fund the expenditure added further pressure on European government bonds.

That aligned with my assumption last week that short-term pressure on bonds would persist. Friday’s counter-move was quickly sold off, though the news—originating from Europe, not the US—clearly contributed. Pressure on European bonds intensified Wednesday after ECB official Isabelle Schnabel suggested pausing rate cuts:

The data are showing that the degree of restriction has come down significantly, up to a point where we can no longer say with confidence that our monetary policy is still restrictive,” Schnabel said, adding: “We now have to start the discussion on how far we should go. I’m not saying that we’re there yet. But we have to start the discussion.

Gold held steady as the market’s preferred hedge against geopolitical uncertainty, trading near all-time highs. Oil (WTI) rebounded early in the week but hit resistance at $72 and continues trending lower. Trump’s push for tax cuts for oil companies suggests the sell-off could deepen, with a break below $70 possible.

For now, the takeaways are that the stock market’s bull run remains intact while bonds face dominant downward pressure. But as we know, today’s news is tomorrow’s history, so we must evaluate whether these trends will hold. A glance at the US and German yield curves shows the inversions have ended, and the curves are now positive.

If one recalls the debate about whether an inverted yield curve signals a recession, a common argument was that while inversion might hint at trouble ahead, the actual signal is the reversion. Unlike shorter, less severe inversions in the past, the latest one was prolonged and deep. Some might argue that the recession signal isn’t the reversion but when the curve turns positive again. Looking at reversions since 1990, US data suggest recessions followed only when the 10-2-year spread reached current or higher levels.

European markets largely follow the US, the world’s economic engine, so we must consider where the US economy is headed. First, though, let’s address a point affecting central banks on both sides of the Atlantic.

I’ve already mentioned Isabelle Schnabel’s recent comments. Though a hawk within the ECB’s Governing Council, she’s influential and close to Christine Lagarde. This suggests the ECB might now view Eurozone rates as nearing neutral, likely due to a recent uptick in inflation and persistent high services inflation.

In the US, markets have nearly ruled out rate cuts for 2025, reinforced by January’s inflation rise. Growing short-term inflation concerns imply the Fed might limit cuts to just one. As I noted last week, low unemployment still gives the Fed confidence to hold steady.

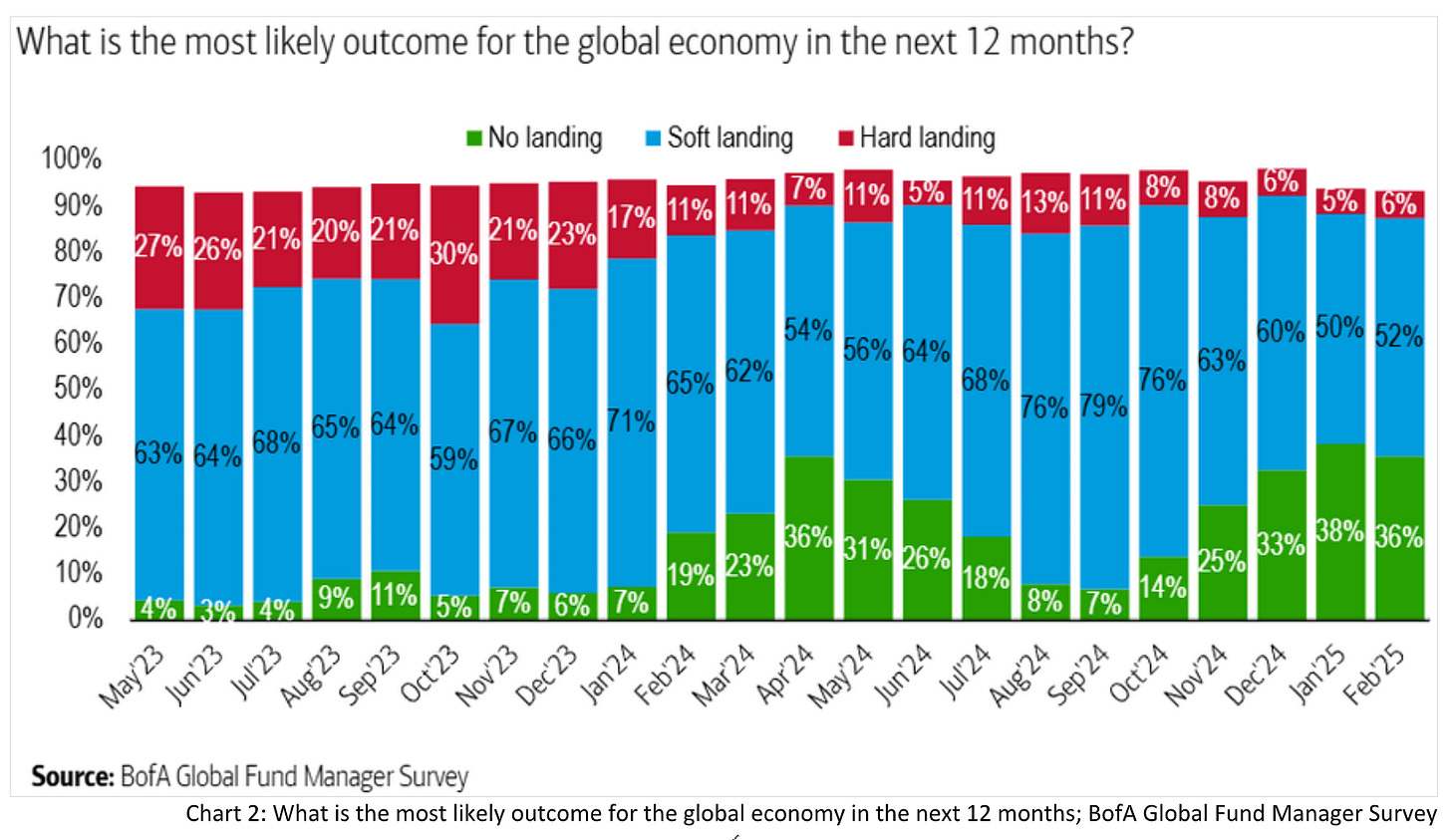

In short, the Fed and ECB now see rates as less restrictive than previously thought, and market expectations have turned hawkish. Beyond bonds, though, markets seem unperturbed. According to the BofA Fund Manager Survey, global recession fears are at a three-year low.

Thus, expectations lean toward robust growth, with no recession in sight for 2024. Still, the longer rates hover at current levels, the more restrictive they may become. The ECB, aligning with the Fed, is growing hawkish—suggesting it might halt further rate cuts.

I believe short-term rate hikes have limited room, but unexpected data shifts could reverse central banks’ stances and push rates down. Increasingly, it seems the low for long-term rates is in, though further sell-offs aren’t off the table. Central banks still have a bit of hawkish runway left.

That said, I think peak hawkishness is approaching, raising the drag on future growth. If Fed officials turn dovish again, the ECB will likely follow. Rates may have already priced in the hawkish outlook and could be nearing a turning point, making bond dips more attractive. While the US 10-year treasuries trade is in a tight range, the German 10-year bunds are nearing a key resistance level.

With all this priced in, resistance might hold, signaling the end of the downtrend. Given the global economy’s reliance on US strength, any US weakening could also push European yields lower.

Stocks are trickier. Upward momentum persists, but with rates steady and the Trump administration’s surprising push to cut spending, gains may be capped. US household equity allocations are also sky-high, suggesting a limited upside.

Still, the latest US push to an all-time high hints at an early-stage melt-up. Hence, I'd say it's not time to turn outright bearish, but a more defensive stance makes sense.

Finally, central banks have a shaky track record of foresight. In 2021, they insisted inflation would fade; now, they’re convinced it’ll persist and rates aren’t so restrictive. If growth slows, markets could jolt. For now, they might be stranded before reversing. Nothing’s certain.

Another day in the dark

No, no

Stranded in the night

Stranded in the coldGojira - Stranded

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.