Prophecy(?)

(This comment was written before US CPI was published)

Remember December 21, 2012? That day was supposed to end the world (again). Though, like all prophecies about the end of the world, it did not happen.

The people who thought the world was ending referred to the Maya calendar. December 21, 2012, ended the 13th cycle of the four-hundred-year calendar, and the Maya marked this day in their calendar. However, the idea that this meant the end of the world was coming emerged later, during the modern ages, according to scientists.

It was not the first time people expected the world to end. In fact, there have been a variety of prophecies about the end of the world throughout history. For example, 200 AC Hippolyt, the counter pope, forecasted doomsday because, according to him, the world was created around 5,000 BC and would only last for 6,000 years.

The founding father of Protestantism, Martin Luther, also forecasted the world's end. Still, after three predictions did not come true, he distanced himself from them and devoted himself again to his theological writings.

When the world passed the tail of Halley’s Comet in 1910, people panicked again after scientists discovered hydrocyanic acid within it. While some rushed to buy comet pills and gas masks, others precautionary committed suicide or gave away their money in a moment of hysteria. Retrospectively, one can say it was an awful decision.

Even mass murderer Charles Manson predicted doomsday, which should happen in 1969. He claimed that the Beatles were Angels of the Apocalypse, and their songs Helter Skelter and Revolution Number 9 contain cryptic messages about it. We all know how his delusions ended: in a series of murders that cost the life of actress Sharon Tate and the entrepreneurial couple LaBianca, among others.

In the end, all those prophecies shared the same fate, and people who believed in doomsday still waited for it, given they were still alive. But all of them were determined that the predicted scenario would become a reality…

This brings me to today’s topic: Prophecies about recession. Few analysts or economists do not predict a recession this year, and even fewer think that the Fed will follow through with its current restrictive monetary policy. All expect a Fed pivot.

Their prophecies gave stocks and bonds an excellent start to the year. After a bad year for both asset classes, most investors seem confident that last year’s moves will reverse. 10y Bunds are about 4 % higher, and 10y Treasuries are about 2.10 %. The S&P 500 gained 2 %, and the Eurostoxx 50 even rose 8.4 %.

Consumer price inflation has been slowing since June in the US, and last week’s CPI data from the eurozone nourished hopes that price inflation also peaked in the eurozone. Estimated CPI YoY for December 2022 came in at 9.2 %, substantially lower than the expected 9.5 % and 0.6 percentage points lower than in November.

Let us discuss the situation in the eurozone first before we deal with the state of the US economy. We should not forget that most European countries have implemented energy price caps, which artificially lower CPI numbers. For example, in Germany, the government paid natural gas bills from consumers in December. The latest fall in energy prices is the primary cause of why inflation was only 9.2 %. Yet, German core CPI rose slightly to 5.2 % in December.

Consumer price inflation also slowed in France, and as in Germany, the main driver is energy price caps. Still, from January 1, the price cap for consumers is increased by 15 %, while industries can expect energy bills to go up five to tenfold. Additionally, the discount for fuel prices also ended by New Year, and French consumers can expect a rise in prices down the road.

Because of all that, I think one should be cautious with the assumption that consumer prices really peaked in the eurozone. Moreover, it seems that prices are artificially depressed by government intervention. The short-term relaxation likely will translate into higher inflation rates in the eurozone later this year, which does not suggest that the ECB will slow the pace of its lately implemented restrictive monetary policy.

Above all, a look at M2 shows that the ECB is probably just starting. M2 money supply has stagnated since October, but in a year-over-year comparison, the money supply is still growing at 4.6 %, which means that it is growing as fast as back in 2017 when Mario Draghi was fighting deflation. Further, if we consider that economic production will probably fall because of high energy prices, we cannot conclude that consumer price inflation will decrease substantially.

In today’s literature, consumer price inflation is referred to as inflation. Nevertheless, one should not forget that rising prices result from actual inflation. In the classical sense, inflation means a rise in the quantity of money. The fact that the money supply in the eurozone is still growing at a 4.6 % rate suggests that the eurozone will continue to struggle with extraordinarily high price inflation this year.

On the other side of the pond, the situation is different. The Federal Reserve has raised interest rates substantially throughout last year and, different than the ECB, has already begun to shrink its balance sheet. Monetary policy measures have already led to deflation, which means a shrinking money supply. Thus, in the original definition, the US entered a period of deflation in March 2022.

During that time, the S&P was at the same level as it was in December of 2021, but the start of monetary deflation, which was caused by the beginning of a tighter Fed policy, led to big sell-offs in the stock and the bond market.

It took a bit longer to slow consumer price inflation until June 2022. If the Fed keeps monetary policy tight, that trend will continue this year. Additionally, one can expect that the current path of monetary policy will slow economic activity further. Jay Powell does not get tired of mentioning that this is the Fed’s goal because only a rise in the unemployment rate can dampen inflationary wage growth and bring consumer price inflation back to 2 %. The Fed hopes this can be orchestrated so that the US economy will experience only a slight recession. Further, the Fed plans to continue to raise the Fed Funds rate above 5 % and to keep it there throughout the year.

However, the Fed is now facing a problem: market participants do not believe it will continue its restrictive course for so long. They do not expect the Fed to raise rates above 5 %, nor do they think it will keep it there until year-end. The market expects rate cuts in the second half of 2023.

Most analysts and economists expect the US economy to fall into recession during the first half of 2023. That is probably the cause why market participants think that the Fed will have to reverse course in the second half, which explains why they are loading up on bonds and stocks. Stocks because they hope a pivot will support equity prices and bonds because of the expectation of lower rates.

Yet, the euphoria might be premature. I assume neither bonds nor stocks have reached their final lows in this cycle and that the current move is just another bear market rally that will reverse soon.

Firstly, let us assume that the analysts are proven correct and the US economy will experience a mild recession in the year's first half. If that is the case, there is no reason for the Fed to reverse course, and equity markets will have to go lower because current rate expectations are wrong. The same would be valid for the bond market, and it likely will pare the latest gains while the market chops sideways.

However, if the recession becomes more severe, one could probably observe that in falling corporate earnings. That means the current expected corporate earnings are too high, and stocks would be in for another sell-off. Maybe that will coincide with a credit event, which would also bring bonds under pressure. If the Fed pivots in such an event, history shows that this would not mean that stocks have bottomed because they usually bottom when rates reach the cycle's low.

In that case, the pivot would be a buy signal for bonds, not sooner. In a high inflationary environment, rates usually go up (bonds go down) until the central banks start to cut rates substantially, as an analysis of the recessions during the 1970s shows. During the latest recessions, inflation was low, and the bond market anticipated the rate cuts, but times are different today compared to the GFC. The Fed pivot is the sign to buy bonds.

Another possibility is that the recession will begin either in the second half of this year or in 2024. An opinion poll among US small businesses showed that they continue to see inflation as the most critical problem, while they see poor sales as the least important one. Small businesses still see high demand despite the latest rate hikes. If the Fed’s goal is a destruction of demand, those numbers give no hint that it has already accomplished that.

Additionally, the fact that consumers still have a significant savings cushion supports the theory that the recession will not begin in the first half of this year. Because of their excessive savings, consumers can keep their level of consumption. Although the savings rate is at all-time lows, the stimulus payments during the pandemic gave them a cushion that will hold at least until the year's second half. While that might not be true for low and medium-income groups, one should not forget that high-income groups are responsible for a large share of consumption.

Then, there is the fact that banks have lent way more in 2022 than during previous years, about threefold as much. 1.2 trillion dollars in loans were made in 2022, as former Fed trader Joseph Wang shows in one of his highly recommended blog posts.

That was expectable, as years of artificially low rates and QE turned the plumbing of the banking system upside down. Now, rate hikes translate directly into higher profit margins for banks because they swim in a sea of bank reserves and do not have to hike deposit rates to attract additional bank deposits, thus leaving their funding costs unchanged. Moreover, expansive fiscal policy has strengthened the financial position of businesses and households, supporting the credit boom.

Bank lending creates money out of thin air, fueling demand for goods and services. I have written about loosening financial conditions in various posts here, which, combined with rising equity prices and falling rates, might have helped to prolong the cycle. That suggests that consumption will stay elevated and the recession will be postponed later.

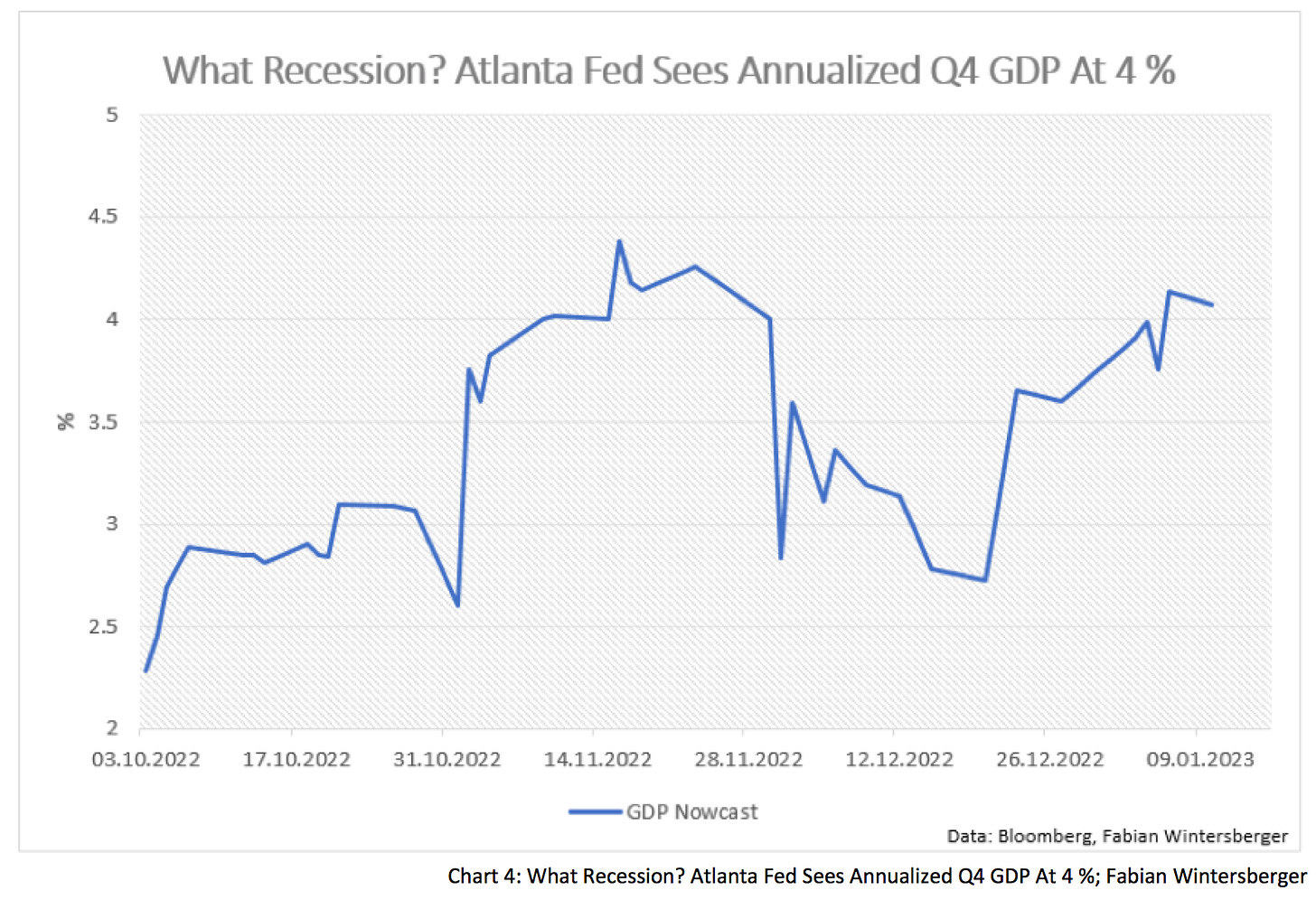

The Atlanta Fed’s GDP Nowcast also speaks against a recession soon. For the fourth quarter, annualized GDP should be about 4 %, far from recession territory.

Finally, the labor market stays tight and shows no sign of relaxation. Non-farm payrolls have beaten expectations for the ninth time in a row. However, one should remember that the labor market is a lagging indicator and usually starts to weaken when the economy is already experiencing a recession.

The main driver behind the tight labor market is the fall in the labor force participation rate, which has accelerated since 2020. Expansionary monetary and fiscal policy in 2020 and 2021 has fueled equity price gains and allowed people to drop out of the labor market and retire. The shrinking labor supply led to a rise in nominal wages, although real wages fell because of rising consumer prices.

Further, policy measures to fight the spread of covid changed the labor market composition. Suppose one is employed in the service sector, and the government can make you unemployed by decree. In that case, it causes people to switch to another sector of the economy where they will not get unemployed in case of another pandemic.

For example, they go into the tech sector, where employment numbers rose significantly as the demand for digital services experienced an enormous boom because of the pandemic. Many of those jobs are now cut by businesses, and because those white-collar workers quickly find employment elsewhere, thus, those lay-offs do not lead to a rise in unemployment.

Principally, the structural change in the labor market started during the GFC in 2008. Artificially low-interest rates directed investments away from the real economy into financials, tech, and business-related services.

As the Federal Reserve is now actively fighting inflation, that effect reverses. Should the Fed stay on its course, the US economy is in for a painful but necessary restructuring process. But that would lead to a severe recession in the US, although the reasons I mentioned above suggest that the recession probably happens later than most market participants currently assume.

Everything I discussed here supports the assumption that interest rates will stay higher for longer. Only an unforeseen event within financial markets could change that. According to the current state of conditions, I believe that it is more probable that such an event will happen somewhere during the first half of this year than that the recession will begin later. It is hard to say if it is a geopolitical event, a credit event, a combination of both, or something completely different. The possibilities are near endless.

For investors, both scenarios mean that they should stay defensive and that the recent bear market rallies in stocks and bonds will reverse soon. Don’t fight the Fed is still applying, even though Jeff Gundlach says one should listen to the bond market instead. A look at the yield curve at the beginning of 2022 shows that blindly trusting the bond market could end badly.

I see the money beggars on the last temptation,

We’re marching now through the devestationSoulfly - Prophecy

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice)