In Waves

There are events either a vast majority or a minority expects to happen, but they do not happen at all or later than assumed. A few weeks ago, I wrote about that and referred to specific calls for the end of the world, often from esoteric circles, which never materialized.

However, economic history is also full of such expectations from market participants, which are false and do not happen at all. One example is the year 1980, when the general tenor was that bond yields, which had reached their post-WW2 all-time high, would not come down substantially. What happened is well-known: until last year, bonds in the US and Europe experienced a bull market that lasted more than forty years.

Another example is the forecast of the USSR’s economic collapse. The Austrian economist Ludwig von Mises had proven the impossibility of centrally planning a whole economy without market price signals in his book Socialism, published in the 1920s. Although Mises himself assumed that it would be a gradual decline that would take time, many others considered it as nearly impossible that it would take until the late 1980s when the Sowjet Union finally collapsed.

If people do a forecast that does not materialize for years and then suddenly becomes a reality, some critics point out that such warnings are basically worthless and that the reason they happened is more a result of recent events. Even a broken clock is correct two times a day, they say.

In the world of investing, a correctly but too soon anticipated event, at worst, leads to the total loss of capital that was put into the trade. John Maynard Keynes wrote in the 1930s that markets can stay irrational longer than you can stay solvent.

The well-known Movie, The Big Short, shows this wonderfully. You may remember the repeated scenes of Michael Burry (Christian Bale) being in front of his whiteboard and writing down another day of a loss in his PnL. As the movie passes, more and more investors are urging Burry to sell his CDS positions that he took to short the US housing market, but he refuses to do so. Finally, when he nearly has lost all the invested capital, markets adjust, and Burry’s investment eventually turns positive.

Sometimes it takes a little longer until forecasts become a reality. Another example is from the year 2019. When equity markets sold off in December 2018, nearly all public newspapers asked when the US economy would fall into recession in 2019—the New York Times published one article saying that a recession is right around the corner and another one asking their readers if they are ready for the financial crisis of 2019.

Ultimately, things turned out to be different than many market participants had expected. However, the Federal Reserve might have played a role there because they cut interest rates three times after the Summer of 2019, which supported markets. Interestingly, the Fed was criticized for cutting rates into a very tight labor market.

In April 2019, the US yield curve inverted (3ms10s), and many market participants thought a recession was near. However, the Fed’s rate cuts led to a steepening of the curve, and the 3ms10s spread turned positive again. Then, in 2020 the pandemic unleashed the recession everyone anticipated to happen in 2019. However, it will be a discussion among economic historians about whether the recession would have also happened without the pandemic.

Somehow, 2023 could remind one of 2019 because today, most analysts and economists expect a recession for the US economy. And just like in 2019, it may take longer than expected until the awaited recession finally materializes.

Not only the US economy does seem resistant, but also the economies within the Eurozone. Yet, the economic environment is not comparable between 2019 and 2023 regarding consumer price inflation. Back then, CPI YoY mostly remained below 2 %, currently 6.41 %.

While the Fed insisted in 2021 that the rise in consumer and producer price inflation would be transitory, 2022 marked a year of extraordinary rate hikes. Never in this century, the Fed has hiked interest rates faster than this time.

When the yield curve inverted in October 2022, many investors hoped that the rate hikes would finally end, and when 2023 started, many investors began to pile money into longer-term bonds. Consumer price inflation has slowed steadily since the Summer, so trust in economists and their econometric models rose again. Yet, most economists have forecasted that inflation will finally return to 2 % repeatedly since 2021.

Geopolitical pressures because of the Russian waged war against Ukraine did support a continuous rise in consumer price inflation, without a doubt, especially in the Eurozone, where governments rushed to buy significant amounts of natural gas, which pushed prices up. Currently, gas storages are filled higher than average, and less gas consumption and the warm weather brought down gas prices, which are now below where they were before the invasion.

This week one year has passed since Russia started, what they call, a special military operation. The war, which many military strategists thought to be over within days, has turned into static warfare, and both sides do not seem very interested in negotiations. Western arms deliveries have increased during the latest month, so one cannot assume that the war will end soon. Nevertheless, market participants seem to have adapted to the situation. The drop in natural gas prices points to that, resulting in a condition where it appears that Putin’s leverage has shrunk substantially.

But now, let us finally move to the main topic for this week. US CPI numbers for January were published last week and surprised many market participants. While the consensus-estimated a decline in year-over-year consumer price inflation to 6.2 %, the actual number was 6.4 %.

Somehow, my previously mentioned suspicion looks accurate that the Chinese reopening and the resulting boost for the European economy (where China is the most critical trading partner) also lead to consequences for the further development of US consumer price inflation numbers.

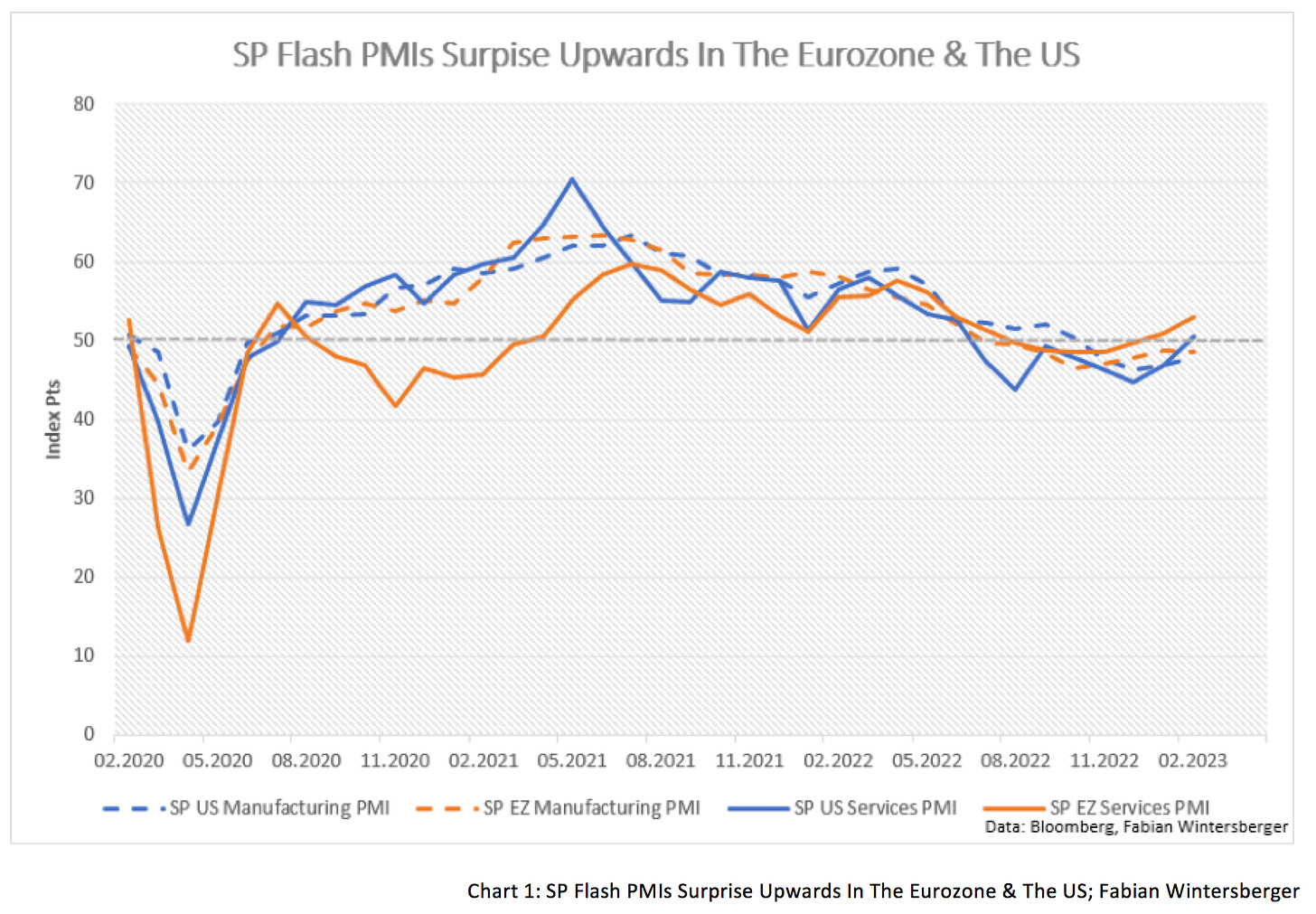

The latest flash S&P service sector PMIs for February fuel the assumption that inflation might accelerate. According to the numbers, services sectors in both the US and the European economies are expanding, while manufacturing in both economies is shrinking slower than expected.

That means the economy is expanding in both economies, as the share of the service sector in the total economy is between 70 and 80 %. However, reading through the press releases is valuable as they hint that price pressures are likely to regain steam in the coming months.

The S&P Eurozone PMI release points to slower but still elevated inflation (emphasis added):

Input cost inflation meanwhile cooled further, notably in the manufacturing sector. While rates of selling price inflation remained stubbornly high, especially in the service sector, in part linked to the impact of higher wage costs, the overall rate of selling price inflation also slowed, down to a 16-month low, in a further sign of moderating price pressures.

Although prices have continued to slow, the report should be seen as a warning for ECB officials not to slow down interest rate hikes prematurely from 50 to 25 basis points. As I mentioned in various posts in prior weeks, the year-over-year money supply is still at the same levels as in 2017, when Mario Draghi aimed to fight deflation. Even though the number will clearly go down in the coming months, the ECB is still far from normalizing monetary policy.

Monetary policy that is still too loose, expansive fiscal policy, and more robust demand for European goods from China will probably help the Eurozone economies to avoid a recession, as the ECB and other economists forecast. Still, in the truest sense, the price for nearly nil economic growth is high, namely continuously elevated consumer price inflation.

The press release for the S&P US PMI also lets me suggest that the victory laps of team transitory might have been a little premature (emphasis added):

Although input costs rose at a softer pace, February data signalled a sharper rise in output charges across the private sector. The pace of increase in selling prices was the quickest since last October and steep overall. Firms reportedly passed through hikes in costs to their clients. A faster rise in output prices was seen at both manufacturing and service sector firms.

According to that and a still strong labor market, one can assume that the US economy is still strong, despite the correct notion that the US M2 money supply has shrunk compared to the previous year for the first time in decades. Because of that, it seems unavoidable that the US economy will experience a recession at some point in the future, but if one looks at the two-year growth rate of M2, one will find out that M2 is still up 10 %.

It will indeed take time until the rate hikes of both central banks will cripple the economies, but at the moment, it seems both are surprisingly resilient. The reason behind that might be the strong fiscal support for businesses and households during the pandemic, where governments tried to dampen the consequences of their implemented policies to fight it. As a result, many companies and households could bring their balance sheets in order. Despite the probably correct hint that the savings cushion will be gone in the next few months, there are still enough savings around that help to keep economic activity high.

While most market participants thought the economies were close to falling into recession at the beginning of the year and piled into longer-term bonds because they hoped for a central bank pivot, disillusionment has spread recently. While 10y Treasuries lost all gains from this year, German 10y Bunds will likely follow soon.

While equity markets in Europe and the US are still positive year-to-date, they have chopped sideways (Europe) or started selling off (US) since the beginning of the month. The saying that bonds always lead the way might turn out to be true once again.

Another point for those who support the thesis that the world economy is expanding is the price of copper. Prices for the important industrial metal rose about 10 % year-to-date, suggesting that global demand is increasing because of the Chinese reopening. However, it has to be seen if that turns out to be accurate, as there are several voices, like commodity expert Alexander Stahel (follow him on Twitter!), who believe the rally will be shortlived.

How do all those things affect financial markets in the short term? Since mid of last year, the exchange rate for the US dollar has fallen, as market participants expected that the Fed would be done with hiking interest rates soon. At the same time, the ECB (the euro takes the most significant share in the DXY) was expected to continue to raise interest rates, which pushed EUR/USD back up above parity.

Yet, the strong economic data from the US and the slowing decline of consumer price inflation shows that market participants were too optimistic. Since the beginning of February, the Dollar Index (DXY) has been up around 3 %. If one assumes that the Fed is not done with raising interest rates given the current state of the economy, the thesis would be that the US dollar will continue to appreciate in the coming months, especially against the euro.

Market participants recently started to price in a higher for a bit longer scenario and now expect that the Fed will not cut interest rates as soon as we approach the year's second half and that the ECB will follow shortly afterward. Markets now expect a terminal rate of 3.6 % in the Eurozone and around 5.35 % in the US. While the Fed is expected to cut rates in the last quarter, market participants now think the ECB will not cut rates this year.

However, one can expect that the change in rate expectations will lead to falling equity prices, and if earnings start to come down sharply later that year, the drop could be even more profound. So far, one should be cautious about investments in the stock market.

On the bond market, the situation does not seem much better either. The ongoing development of consumer price inflation could determine future bond price movements. In my opinion, it is not a given that rate hikes and QT will lead to an immediate slowdown of real economic activity.

Economic growth did not rise in Europe and the US during the 2010s, despite extremely low-interest rates and QE. Still, it merely fueled asset bubbles as the new currency units went directly into asset markets, not the real economy.

Now, the effect could turn and lead to a more resilient economy for longer than most expect. Let it be retail investors, who are piling into US stocks at the moment, who could sell their stock or bond holdings at some point to buy real, tangible goods, or businesses who stop using their borrowed money to buy back their stock and start using it for real economic investments again.

If the thesis is correct, producer and consumer price inflation will remain high. They might bring central banks under pressure and force them to hike interest rates even further than currently expected. If market participants adjust their inflation expectations upwards, yields will rise (bonds will fall), and stocks will too.

It was Thomas Sowell who once said that there are no solutions, only trade-offs. In that sense, continuous price deflation in asset markets and elevated price inflation in the real economy might result from years of wreckless ultra-loose monetary policy unfolding upon markets.

So it could be that rate hikes are inflationary for consumer and producer prices until something systemic happens within financial markets. As far as the ongoing labor shortage and expansive service sector PMIs suggest, some who call for another inflationary wave might be proven correct because, as we know, inflation always appears in waves.

At last, one should add that most leading indicators still point to a continuous drop in consumer price inflation in the coming months. The base effect also plays a role here and is arguably helpful because of the high inflation rates from last year. Still, such a scenario would also not benefit asset prices, and yields would still chop sideways or be slightly up, in my opinion.

Do I end this all for the world to see? (in waves, in waves)

Do I take everybody else down (Everbody else down)

Everybody else down with me?Trivium - In Waves

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice)