Readers of the Weekly Wintersberger know I am very critical of central banks and their monetary policy over the last 40 years. Last week I wrote about the latest winner of the Prize in Economic Sciences in Memory of Alfred Nobel, Ben Bernanke. How the monetary policy he induced as Fed Chair during and after the Great Financial Crisis played paved the way for the approach monetary policy of central banks has taken since then.

However, as it is widely known, it was not Bernanke who started the expansionary monetary policy. He just intensified it, while his predecessor, the Maestro Alan Greenspan, started it during the 1980s. Greenspan’s approach to monetary policy was why investors could be sure that the Fed would come to the rescue whenever markets were in turmoil. Beforehand, they benefited because the Fed artificially lowered the interest rate below the natural rate.

Without the Federal Reserve, the longest bull runs in history would not have been possible. Both lasted about 10 years: the bull market of the 1990s lasted 113 months, and the longest bull market in history lasted more than 10 years. Those who invested in financial markets during that time could hardly lose and could trust central banks that they have got their back.

In the world of finance, everybody won: investment funds had a great run. Especially passive funds enjoyed high inflows because many active fund managers performed worse than the benchmark index (mostly the S&P).

We know that central banks artificially lowered interest rates and killed volatility. Because of that, many bond investors took more risks. Pension funds, whose obligations consist of future pension payments, not only invested the inflows in bonds. Despite the low volatility, they also traded receiver swaps to benefit from falling interest rates, many of them with leverage.

During those days, market participants dismissed the possibility of rising interest rates. If interest rates continued to fall, the pension funds could profit more from the gains they acquired through their receiver swaps. Low volatility suggested that losses would be limited if interest rates rose again. As we know today, at least for the British pension funds, that was a mistake.

Additionally, Wall Street profited too. As Ben Hunt wrote in a brilliant post on Epsilon Theory:

Wall Street has two and only two jobs, to invent new ways to securitize something or new ways to apply leverage to something

For decades, Wall Street and the Fed have worked together. Many employees followed a career on Wall Street after they quit the Fed and vice versa. Ben Bernanke went to Citadel after his second term ended, Neil Kashkari worked for Goldman Sachs before he joined the Fed, and Richard Clarida (you know, the guy who quit this January because he was accused of insider trading in October last year) worked for PIMCO. Even the Maestro, Alan Greenspan himself, consulted Deutsche Bank after his term as Fed chair ended.

The actual chair of the Federal Reserve, Jerome Hayden Powell, is also a guy who worked on Wall Street. In the 80s, he was an employee of Dillon, Read & Co.; in the 90s and early 2000s, he worked at Citadel. Although most Fed Governors are actually trained economists, Jerome Powell is a Lawyer.

In December 2011, Powell, a Republican, was nominated by Barack Obama to join the Federal Reserve Board of Governors. The monetary policies that Powell has supported since then were just in the spirit of his former employers.

Despite some doubts, Powell voted for the 3rd Quantitative Easing program in 2012. As Fed chair, he rescued markets in 2019, ended Quantitative Tightening, and returned to not-QE. Before, in 2018, he had already stopped the interest rate hiking cycle, supposedly because of turbulence within financial markets.

The only positive of Powell during those times was that he consequently opposed the calls of President Donald Trump, who pressured the Fed to lower interest rates again. He always underlined that the Fed is government-independent.

As the pandemic hit in 2020 and markets collapsed, Powell and the Fed came to the rescue again. That also improved his relationship with President Trump. The Fed slashed interest rates to zero after an emergency meeting and started to buy all kinds of bonds and induced direct lending programs. Simultaneously, he supported government stimulus payments for consumers.

The return to ultra-loose monetary policy led to the fastest recovery of financial markets in history. Central banks worldwide fought the crisis in a similar way to the Fed.

In 2020, Wall Street investment banks recorded their best year in history, and Powell received some criticism from economists and analysts. In an opinion piece in the Financial Times, Mohammed El-Erian wrote that the Fed had become a follower of markets when they should lead markets.

In that sense, Fed chair Jerome Powell brought nothing new to the table. The Federal Reserve’s approach to the monetary policy of his predecessors (Greenspan, Bernanke & Yellen) remained in place. The Fed made monetary policy the way investors wanted them to do it.

The result was an increasing mismatch between Main Street (the real economy) and Wall Street (the financial economy). Monetary policy blew up asset prices further, led to rising wealth inequality, and largened the economic imbalances Powell’s predecessors created. Interestingly, in September 2020, Powell denied that recent monetary policy led to asset price bubbles.

Nevertheless, there was an argument that the Fed used endlessly to justify its monetary policy: low consumer price inflation. Before 2020, inflation mainly remained below the Fed’s 2 % target; hence, the Fed saw no argument to change course. However, it also proves that QE never achieved its goal of bringing inflation back to 2 %.

Because of that, in August 2020, Powell announced that the Fed would pursue the approach of Average Inflation Targeting in the future. If inflation got above 2 %, the Fed would tolerate it as long as inflation remained close to 2 % over the medium term. By the time the shift was announced, US consumer price inflation was well below 1 %.

In hindsight, it is possible that Powell was driven, and the shift was not something he believed in. Yet, politics and the public favored loose monetary policy back then, which meant a tailwind for the progressive forces within the Federal Reserve.

For example, FOMC member Lael Brainard was already a big supporter of Average Inflation Targeting in 2019. Brainard, a trained economist who once worked as an associate professor at MIT, possibly enjoyed a much better reputation from other economists within the Fed than (the lawyer) Jerome Powell.

But in 2021, everything changed: inflation started to pick up. In June 2021, it was already above 5 %. However, Powell downplayed the development during his press appearances as transitory. According to him, inflation was only high because of supply chain disruptions, and the Fed’s inflation models pointed to rapid decay.

The fact that Powell’s first term was about to end at the end of 2021 probably played a role. As President Joe Biden took office after he defeated Trump, the progressive forces within the Democratic Party got more standing, and they did not like Jerome Powell. They thought the Fed under Powell was still too restrictive and criticized that topics like climate change and racial and economic injustice did not play a more significant role in monetary policy.

After the summer of 2021, discussions within the Democratic Party broke out about whether Powell should be re-nominated. Progressive party members like Alexandria Ocasio-Cortez (AOC) or Elizabeth Warren favored another candidate: Lael Brainard. Simultaneously, several media outlets began reporting about the insider trading of several Fed Governors, and AOC and Warren used the stories to call for another Fed chair.

In October of last year, I wrote that, despite all of his mistakes, Powell might be the only hope for a tighter, restrictive monetary policy, given the alternatives. Back then, I thought that it was possible that Powell would not be re-nominated and Lael Brainard would become Fed chair. However, the group around Janet Yellen eventually prevailed, and Powell got re-nominated.

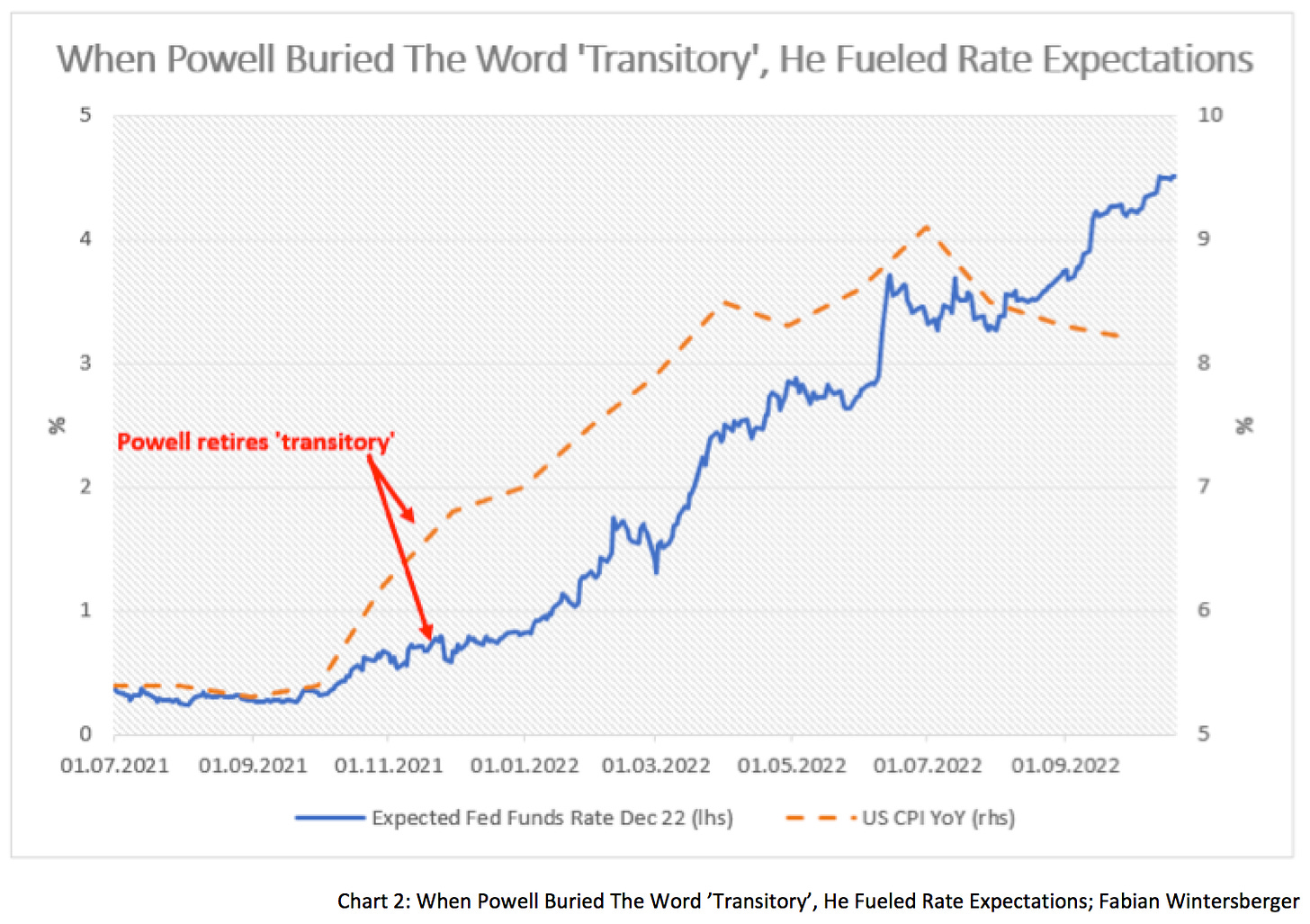

With his re-nomination, it seemed that a lot of pressure fell off Jerome Powell’s shoulders. Suddenly, his tone changed. In a hearing at the Senat’s Central Bank Committee at the end of November, he said that it was probably a good time to retire the word [transitory] and that the Fed needed to accelerate the tapering. While the market expected the Fed Funds Rate in December of 2022 to be below 1 % back then, it expects a 5.5 % rate today.

Yet, despite his re-nomination, the Biden Administration did not seem to be fully committed to Powell. His initial re-nomination was handed back to Joe Biden this January, and Biden had to re-re-nominate him. Finally, the Senate approved his nomination with an 80-19 vote. Lael Brainard, who also applied for Powell’s job, was confirmed as Vice-Chair with a 52-43 vote.

After the confirmation, Powell pushed for more aggressive tightening and higher interest rate hikes. The Fed also started to shrink its balance sheet and stopped to reinvest maturing bonds back into the market. I then thought this was a replay of the Janet Yellen playbook and mostly just talking and bluffing.

In May, I wrote about this in Seasons In The Abyss and discussed some arguments from Danielle DiMartino Booth and Jim Bianco, who disagreed that this was all just a big bluff. While Danielle argued that this was because fighting inflation has become political, Jim pointed to the structural shifts in human action that would lead to sustainable higher inflation. Both of them should be proven right…

I admit I was skeptical back then, but I re-evaluated my opinion during the summer. Currently, I see no argument that supports a Fed pivot. Even though many price developments point to disinflation, it will take some time until this finds its way into the CPI numbers.

The main reason is that shelter inflation makes up one-third of the CPI number. As we all know, shelter inflation is calculated via Owners Equivalent Rent (OER) and moves very slowly through CPI. As a result, shelter inflation will remain stickier than other numbers suggest; hence CPI will remain high.

Danielle, a former Fed employee, was a guest at the Hedgeye Investment Summit last week, where she argued for another time that the Fed pivot is still farther away than most investors would wish for.

In her interview with Hedgeye’s Keith McCullough, she talks about how Powell was left swinging in the wind despite his re-nomination. Because of that, Powell lost his standing inside the Fed, and the other economists would have favored Lael Brainard anyway because she was one of them, while Powell was just some lawyer who worked at some investment banks.

When Powell was confirmed 80-19, and Brainard (according to Danielle, a political nomination) only got a 52-43 vote, Powell (done with politics) regained courage. While back in 2021, all Fed Governors were against Powell and opposed fighting inflation (because, you know, transitory), that should change now. Probably a turning point? Let me quote Danielle:

Can you imagine a president of the New York Fed saying to Wall Street that…it is not his job to look at markets…[but]…to look out for the long-term health of the US economy? Since Volcker’s successor came in and said, ‘it is the stock market’… ‘we are going to make monetary policy based on how investores think how we should make monetary policy. And it had not changed until Powell was put ‘swinging in the wind’

DiMartino Booth also notes that Powell warned about the possible side effects of QE and problems with the balance sheet already back in 2012. And, Danielle states, Powell also said that leaving rates at the zero lower bound for too long was probably not a good idea.

According to her, Powell is on his way to deliver on QT, as one can see if one looks at the Fed balance sheet. She also notes that Powell does not want to talk about it, which is all happening in the background. She thinks (and I agree) that Powell will not stop except some dangerous systemic risk pops up. However, this is not falling stock prices but probably something like no redemptions from dollar-based high-yield grades. Because of that, Danielle suggests that investors should not look at spreads but monitor the most leveraged markets.

Danielle also highlighted something the Weekly Wintersberger wrote for quite a while now. As long as the market rallies again, it gives Powell more ammunition to continue with its Volckerian Path. That could also mean troubles for other central banks, where the ECB has a much stricter job because they do not only have to buy one sovereign bond but a variety of them.

Market participants have been stuck in the investment world for the last four decades since Greenspan became Fed chair. However, this time, Powell will not come to the rescue as long the system is not in danger of collapsing, which includes the stability of the international financial system. The ECB will have to intervene at some point and sacrifice the currency to rescue the highly indebted Eurozone countries. Because of this, I expect that the reign of King Dollar will continue.

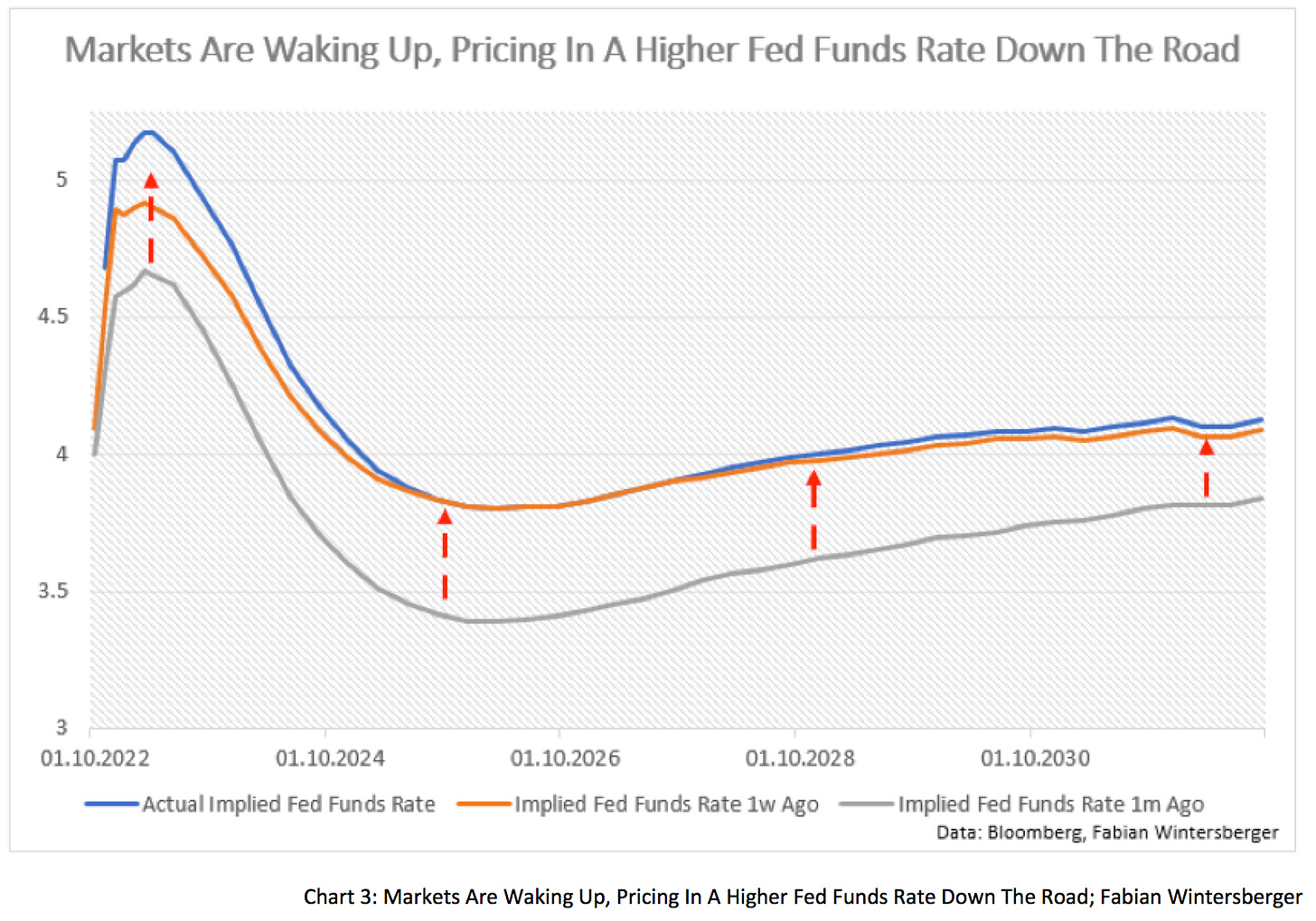

Investors who participate in the US markets slowly realize that the Fed might not lower rates as quickly as expected. During the last several weeks, the Eurodollar yield curve has shifted upwards. Currently, I expect the curve after mid-2023 will also push up further because the Fed will not cut rates back quickly as the market expects (given Powell stays serious).

Further, markets still think inflation will fall back to 2 % quickly down the road. However, suppose Powell uses the sticky shelter inflation to justify a higher for longer policy. In that case, rates will have to move further until the entire curve is above the inflation rate. If that is the rate the market currently expects, it has to be seen.

The Weekly Wintersberger has noted several times now that there are several indications that inflation will not return to 2 %. I have written about government credit guarantees and how governments can influence their money supply. While the US ended those programs (for now) in 2021, they are still in place in Europe. Since February 2020, governments have guaranteed 40 % of loans in Germany, 70 % in France, and (more than) 100 % in Italy, according to Russel Napier.

But credit growth is also picking up in the United States. Low deposit rates and rising interest rates result in higher profit margins for banks that eagerly lend. Former Fed trader Joseph Wang argued in 2021 why rising interest rates might lead to more inflation instead of less. Higher credit growth means more money created out of thin air; hence more ammunition for Powell.

Some investors criticized the Fed for years for doing the wrong thing. Now, as the Fed does what it's supposed to, the same people are literally down on their knees, begging for a Fed pivot to save their portfolios. Yet, I agree with Daniel Lacalle, who wrote that a Fed pivot is not an investment thesis.

It was always a common sense that returning to a solid, sane monetary policy would be painful for financial markets. The warning that kicking the can down the road further would only cause more imbalances (thus pain) is becoming a reality now. If there is another way besides monetizing the debt (more inflation) to dampen the pain, I do not want to judge at this point.

However, I could point to the Forgotten Depression of 1920-1921. Back then, the Fed continued to raise rates while the US government cut spending (something different from today’s government). The economy overcame the crisis quickly. Without a doubt, it could be more painful in such a highly leveraged financial world as ours, but it would be the best decision for the long run.

I do not know if Jerome Powell will put this through until the end. I do not know if Jerome Powell will not pay attention to his former friends, colleagues, and employees on Wall Street who are clamoring for a pivot at some point in the future.

I just want to be heard, loud and clear are my words,

coming from within man, tell ‘em what you heard,

it’s about a revolution, in your heart and in your mind

you can find a conclusion, lifestyle and obsession

- Papa Roach - Between Angels and Insects -

Yet, I think one has to respect Powell for what he put in motion this year. I hope he knows that he is standing Between Angels And Insects, who will be on their knees, begging for a pivot. If Powell can resist those calls, this would be another surprise. Then, he might be the Fed chair for whom proponents for hard money and sane monetary policy have waited such a long time…

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.)

Well laid out description of where we are and where we may be heading.

Big fan of your analysis and insights.