Seasons In The Abyss

In 1990, the upheaval in the world was already in full swing. The End of World War II divided the world into two camps after World War II (west and east), the fall of the iron curtain in 1989 was to herald a turning point. The USSR was on the edge of collapsing and marked the failure of another try to implement socialism.

The western corporatist system (commonly described as capitalism) spread worldwide, with millions of people in the former eastern block eager to participate. Eastern countries got integrated into that economic order, and the victorious western ‘capitalism’ was unstoppable after the Sowjet Union collapsed in 1991.

Simultaneously, 1990 marked the end of the Japanese economic miracle. The Nikkei Index lost more than 40 % that year, and the country had to experience what would happen if the flow of liquidity to fund debt-based growth suddenly halted.

In the years prior, the Japanese housing sector climbed to extraordinary highs. At one point, the site of the Japanese imperial palace alone was valued higher than all property within the State of California. Although it is always just a question of when a house of cards like that collapses, it caught many investors on the wrong foot. However, financial capital moved on to other Asian countries. It continued to fuel another boom that, again, abruptly ended at the end of the 20th century, but I want to write about that on another occasion.

Recently, it seems that the clock of history has been turning backward, and the world is on the edge of another turning point. The war in Ukraine causes the world to split into two camps again: the west who tries to hurt Russia with severe sanctions on the one hand, and emerging economies like Brazil, China, India, Russia, and other African countries on the other side who own many of the resources the West so desperately needs to push the green transition forward.

The United States and Europe are still the most vital economic forces. Thus their economic sanctions are hitting Russia hard and cutting off Russia from its dollar and euro reserves works, putting Russia on the brink of technical default because it cannot pay its debt obligations in those currencies.

Nevertheless, the consequences of the war can be felt globally, mainly because the two fighting parties are big exporters of agricultural products. The UN Global Food Index climbs from one all-time high to another, which does not only mean higher inflation in the advanced economies but also means potential danger in regions that are heavily dependent on those exports, like the Middle East and North Africa, and thus Europe because of a possible rise in the number of refugees from those regions.

Additionally, Europe is also feeling the pain in the form of more fuel to already existing price pressures. There is a reason why Marine Le Pen is so close in the polls to current president Emmanuel Macron, although I expect a clear win by Macron because he is now up to 9 percent ahead in the polls.

Nevertheless, there is no sign that high price inflation is over soon. This Wednesday, German foreign minister Annalena Baerbock announced that Germany plans to stop coal imports from Russia until summer. Additionally, the country plans to cut oil imports from there by half until then. At the latest year-end, Germany wants to stop importing Russian oil, and gas should follow, too, Baerbock said.

While it is a good thing to look for additional other suppliers because that is what proper risk management is and what has been neglected so far by countries like Germany, which abandoned nuclear power and coal to become a pioneer of renewable energy. However, I see no scenario of achieving that goal without having sustainable high energy prices.

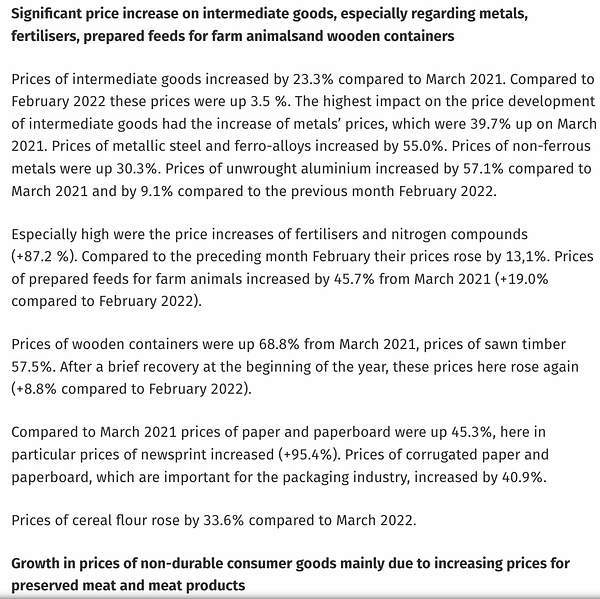

The new head of the German Bundesbank, Joachim Nagel, said on Wednesday that an immediate import ban on Russian gas could push consumer price inflation into double digits. However, if one looks at producer prices, inflation is already way off the charts. In March, the German PPI climbed above 30 % YoY, and in some areas, price increases were even higher.

Firms will feel the pain of the enormous increase in producer prices because their margins will suffer if they do not pass them to consumers. Especially the scale of this divergence is extraordinary and is way above the level it was during the GFC or the sovereign debt crisis. After Asia and the United States, I expect a high probability that the next big economic crisis will start in Europe. It is not a good sign that there is no sign of a relaxation of the situation in areas where the economy is in trouble.

Additionally, the devaluation of the Euro has put even more pressure on inflation because a falling euro leads to a rise in import prices. This is also a bad sign for the big European exporters because they mainly import input goods which they further process and export.

Meanwhile, the European Central Bank is still hesitant to normalize monetary policy, while the Fed is at least signaling that its primary goal is to fight inflation. Therefore, I expect that the euro's devaluation against the dollar will continue. Bloomberg columnist Marcus Ashworth warns that the ECB must act soon to avoid a currency crisis.

Another problem for the world economy is that the supply chain problems will intensify even more the longer the Chinese government keeps a considerable amount of its population in lockdowns. Especially the situation in Shanghai is posing the risk of another supply chain shockwave, as freightwaves.com writes:

Shanghai is one of the largest manufacturing centers in China, with heavy concentrations of automotive and electronics suppliers. It is home to the largest container port in the world and a major airport that serves inbound and outbound air cargo. Exports produced in Shanghai account for 7.2% of China’s total volume and about 20% of China’s export container throughput moves through the port there, according to the BBVA report.

The article then continues and gives a terrific metaphor:

The supply chain is backing up like water behind a dam. When water is released, the landscape gets flooded.

China is the biggest trade partner for the European Union, and thus a more intense problem with the supply chain poses more additional risk for the European economy. Additionally, rising rates might also become a problem very soon.

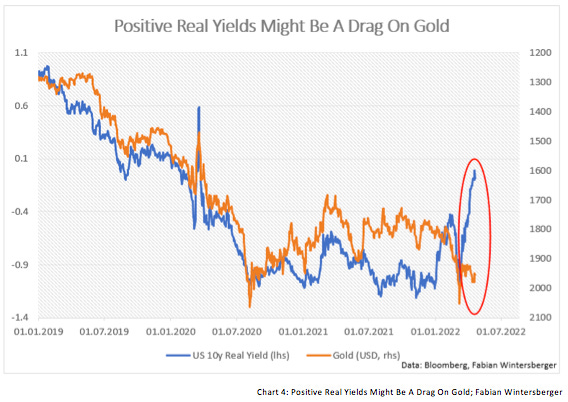

In the United States, real yields are on the edge of becoming positive again after another vast rally in nominal bond yields. I urge you to notice the gap between real yields and the gold price. If real yields become positive again, gold might sell off and fall below 1,700 dollars.

Now, let me talk about the Fed’s monetary policy path. Recently, I have written on several occasions about why I think that the Fed is just bluffing and that there is no way that they hike as much as the market expects because it failed to deliver in the past.

It is pretty apparent that the market does not agree with me at the moment, and there is a reason for that. Most people argue that the situation differs from the past because there was no inflation last time. Now, the argument goes, inflation is a real threat, and therefore the Fed will do anything to fight it.

Market participants are still expecting a very aggressive tightening cycle and think the Fed will hike rates nine more times (one hike equals a 25bps hike) this year.

So, is the Fed serious this time? While I think it is not, some brilliant people argue that the Fed indeed is profound. I want to discuss the arguments of two persons briefly here, namely the explanations of Danielle DiMartino Booth (Quill Intelligence LLC) and Jim Bianco (Bianco Research LLC).

Both of them were interviewed by Hedgeye CEO Keith McCollough at the latest Hedgeye Investment Summit, where they explained why they think that the Fed will be aggressive.

Danielle pointed out that the difference is that the Fed’s actions this time became political. Inflation has become the leading political topic in the United States, and the Biden administration wants to Fed to act because of this year’s mid-term elections.

According to Danielle, the US government urges the Fed to act and that it should not think about the consequences for investors because of a potential fall in equity prices. The American public, which recently suffered hard from high inflation, wants the government and the Fed to bring inflation back down. She guesses that Jerome Powell is now trying to save the capitalist system (Annotation: the American system of corporatism). Therefore, she thinks that Powell will also not stop a significant potential drawdown in the corporate debt market.

It will be interesting to see if Danielle is correct and Powell’s actions try to keep the progressives away from the treasury and the Fed. While I am not sure that the Fed is determined to go as far as Danielle thinks, she is definitely correct that the Fed will change course if systemic risk pops up. We will see how long it takes.

Corporate bond spreads already are back where the Fed halted its last tightening cycle. An aggressive Fed like the market expects will widen spreads more, which might become a considerable risk for the corporate bond market. I do not think that the Fed will stay on the sideline and watch it implode, although I favor that because it would diminish economic imbalances and lead to a more robust US economy.

Jim Bianco agrees with Danielle in her analysis, saying that the Fed will be restrictive, but not until something breaks, but until prices come down. Further, he argues why he thinks inflation has become more sticky than others (myself included) think.

According to Jim, the pandemic has fastened a trend that will lead to more structural inflation. As it is helpful to think about the counterargument from one’s standpoint, let us think this through.

The trend that Jim is referring to is work from home. He thinks that work-life will not return to what it was before the pandemic and hence says that the recent change in consumption habits is permanent.

Because now many people have experienced that they can work from home s good as they can in the office, and will not accept to return to the office and instead look for a job where they are allowed to work from home. As a result of that trend, Bianco argues, people do not want services; they want more stuff.

More demand for durable goods and less for services means that the prices for durables rise. As it is harder to expand the production of durable goods overnight, this means higher prices. Therefore the Fed has to act aggressively if it wants to bring inflation down.

Chart 7 shows that consumption habits have changed, and demand has shifted from services to durables. While personal consumption expenditures for durable goods are above the pre-covid trend, service expenditures are running below the trend now.

Jim’s argument about why consumption patterns might shift permanently is compelling. However, I still do not see that this will lead to more structural inflation over the medium or long term. The only way to get structural inflation is either a) a rise in the quantity of money in the real economy or b) a fall in demand for money. Therefore I stand with my argument from last week that we need to see more credit creation, hence more money in the real economy. This would be a sign that inflation pressures might become permanent.

Regarding the argument, I agree that this can lead to a rise in the general price level because service sector prices need some time to adjust to new consumption patterns. Nevertheless, over the medium and long term (and if there is no substantial money expansion via credit), prices for service sector goods need to fall, or the demand for durables needs to normalize.

Hence, I agree with Jim that inflation will stay higher in the short term, whereby I mean that it will remain above the Fed’s 2 % target if the economy slows. However, either prices (disinflation) or the supply of money (inflation) would need to adjust over the long term.

I might add that another possibility might unfold, which is related to the Fed’s actions over the last ten years. If money flows out of financial markets and into the real economy, that is to say. If that were the case, asset prices would take a hard hit while consumer price inflation would rise simultaneously. In my opinion, this would be the indefinite endgame.

Finally, I want to share a chart by Bank of America to show that market participants usually overestimate the Fed’s hiking path, which to me is another argument that the market is expecting too much of the Fed.

However, all current events point to more Seasons In The Abyss for the world economy.

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.)

Great piece Fabian (just getting around to reading it now). I am with you on the Fed's ultimate ability to tighten as my take is the economy is starting to slow more rapidly than the Fed is letting on. in addition, we are seeing Chinese growth start to slow dramatically which is going to feed an overall global slowdown. didn't the IMF just cut their forecasts for the year? however, another issue for the Fed is going to be the ability of the Treasury to afford its debt as it has to roll over existing debt as well as add new debt to the pile given the budget deficits. over the past years the maturity of US debt has continued to shrink meaning it needs to roll over more frequently. if the Fed truly does allow the balance sheet to shrink, who is going to buy that debt? I think we could well see a much steeper yield curve as the Fed addresses slowing growth (as much as the Biden Administration hates inflation, they will hate a recession even more) but the lack of a price insensitive buyer of debt will see the back end yields rise. also, I would take the real rate story with a grain of salt as the Fed has massively distorted the TIPs market by purchasing so many as part of QE. Is that a viable "market" measure, or just another manipulated number. in the end, I think they hike probably another 100 in total before the wheels fall off and they stop both hiking and QT

Hi Fabian, interesting stuff to think about. Want to clarify - last para: If that were the case, (financial ? ) asset prices would take a hard hit ....and why CPI in such case is going to rise ten?