Note: The text was written before the NFP report

Some events are so unforeseen that no one is ready for them – Leo Rosten

Recently, I’ve been reflecting on this quote by Ludwig von Mises:

But then, finally, the masses wake up. They become suddenly aware that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap their money for “real” goods, no matter whether they need them or not, no matter how much they have to pay. Within a very short time—weeks or even days—the things used as money cease to function as media of exchange. They become worthless paper. Nobody will trade anything for them.

This got me thinking: Are financial markets nearing a point of rapid acceleration? To be clear, I’m not interpreting Mises’ words literally, as if hyperinflation is imminent in the real economy. Instead, I’m applying the economic logic behind his statement to today’s financial markets.

Every economic decision-or indecision—mirrors trading in financial markets. When someone buys something, they’re effectively “going long,” betting that the good or asset is worth its price. Conversely, choosing not to buy is akin to “shorting” it, implying the economic actor values the asset below its market price.

This boils down to opportunity costs. You can buy asset A or invest elsewhere. Mises’ quote comes into play when people realize prices are likely to rise further or see profit in buying now. They shift from “not buying” to “buying,” and as more people pile in, refusing to sell, price gains accelerate.

I firmly believe short-term prices are driven more by expectations and emotions than by so-called fundamentals used to determine an asset’s “true value.” If you assume prices are moving correctly, you can profit handsomely—or lose big by betting against the trend or missing out on gains relative to other assets.

Investors hate losing, so they chase gains, often fueled by greed and euphoria. When they see others profiting, they jump in, buying at elevated prices and pushing them higher. Pessimistic “shorts” are forced to cover their positions, further driving prices up.

Looking at the current landscape, US economic data has disappointed chiefly, while the Eurozone has surprised to the upside. Yet, the mid-term trend in data surprises is improving in both regions, and Trump’s tariffs haven’t derailed this trajectory.

Despite the US remaining in negative surprise territory—likely due to tariff uncertainty—these disappointments are softening. While hard data may stay weak as a result, markets are forward-looking. They see governments in both the US and the Eurozone continuing to spend heavily.

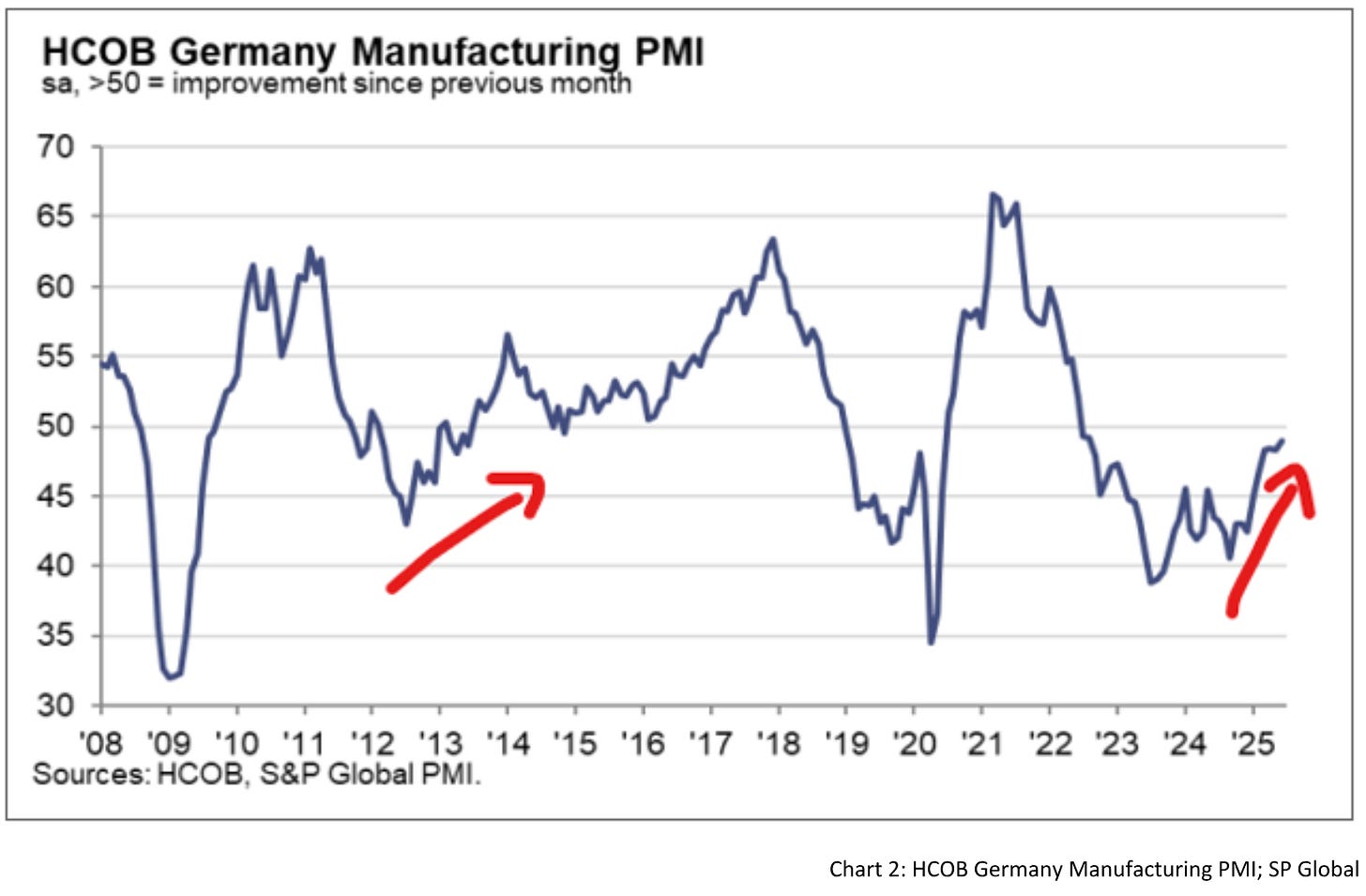

This explains why recent PMIs in the US, Germany, and France point to improving economic conditions. Germany, mired in a slump since the Russia-Ukraine war and hampered by misguided policies under its former left-wing government, is showing signs of recovery.

Anecdotal evidence supports this: friends in various industrial sectors told me a month ago that conditions were dire, but now they report that orders are picking up and sentiment is improving. For instance, automotive suppliers are pivoting to produce military equipment. Discussions from May 2025, like Rheinmetall’s potential use of VW facilities for tank production, reinforce this shift.

Germany’s manufacturing PMI reflects this upward trend, reminiscent of the recovery after the European sovereign debt crisis. As expected, government spending plans are reigniting economic activity.

Meanwhile, the ECB and EU are pushing for a European Savings and Investment Union (SIU) to redirect European savings toward domestic businesses. Currently, a significant portion of this capital flows to US equity markets. Calls for an SIU are growing louder, and its implementation seems likely soon, which could pose a short- to medium-term tailwind for European stocks.

However, the ECB’s proposal to tie investments to “EU objectives” raises concerns about politically driven allocation, which could lead to malinvestment over the long term.

Monetary policy in the Eurozone remains accommodative. With inflation back at the ECB’s 2% target, victory is near, but the economy’s growing momentum suggests policy might be too loose. Record-high junk bond issuances in June signal abundant liquidity in financial markets, yet markets still expect one more ECB rate cut this year.

Turning to the US, recent data has underperformed but not as severely as feared. If Trump’s “Big Beautiful Bill” passes the Senate, government spending will surge. While tariffs have dented the labor market, I expect strength to return as trade agreements stabilize. This should boost confidence, and a weaker dollar could aid exports.

Though Jerome Powell urges caution on rate cuts, some FOMC members, eyeing his seat, are advocating for looser policy. Markets anticipate nearly three additional rate cuts this year, assuming the economy doesn’t accelerate in Q3. Yet, the divergence between forward interest rates and cyclical versus defensive stocks suggests reacceleration is possible. Markets will likely overlook past weak data tied to Trump’s tariff experiment.

Oil prices (despite retreating from geopolitical spikes tied to Israel/Iran tensions) have maintained their upward trend since early May, signaling no significant economic slowdown.

In summary, I believe the equity rally in both Europe and the US has room to run. The ECB and Fed have signaled excessive easing, but with markets still expecting economic weakness, the surge in stocks to all-time highs hasn’t significantly lifted bond yields.

When sentiment shifts and markets recognize a reacceleration of economies, many will be caught off guard. Equity exposure isn’t overstretched, setting the stage for a potential squeeze higher—a rally akin to Mises’ crack-up boom, though confined to financial markets, not hyperinflation.

Long-term interest rates don’t yet reflect this reality and are poised for a sharp rise. In Germany, an influx of bond supply will amplify this. My view remains unchanged: we’re on the cusp of a significant acceleration, and few are positioned for “when darkness falls.”

When darkness falls,

We are reborn.

Our dream since the fall of man,

We are reborn.Killswitch Engage – When Darkness Falls

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. THEY DO NOT CONSTITUTE INVESTMENT ADVICE, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.