While central banks have been the most discussed topic in financial markets for the last few months/weeks, it is replaced by geopolitics now.

The conflict about Ukraine has gone on for quite some time now, as Russia opposes that the country joins the North Atlantic Treaty Organisation (NATO). The Kremlin points to assurances made by western politicians after the fall of the iron curtain that Russia’s western neighbors will not be considered candidates for NATO memberships while the US is arguing that free countries can make their own choices.

Here is a brief summary of the conflict first:

Russia occupied the Crimean province in the east of Ukraine in 2014 to keep the Russian minority in Ukraine safe. Or at least that was Russias argument. In the same year, the Crimean Region was annexed by Russia, although most countries do not acknowledge that.

More NATO missiles stationed near the Russian border are not acceptable for the Kremlin, especially when considering the assurances I mentioned above. However, over the years, the conflict has never gotten more intense, despite some violations of several agreements of an armistice.

In 2021 the conflict got more intense, and so did the disagreements between the United States and Russia about Ukraine. The discussions got more serious when Ukraine asked NATO to speed up the joining process. News agencies reported that Russia is gathering more and more troops near the Ukrainian border.

In December of 2021, the Biden administration claimed that Russia could invade Ukraine early in 2022. Moscow denied that, but the United States made clear that there will be a reaction in case of an invasion.

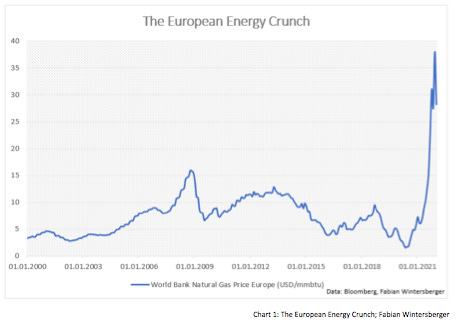

Biden pressured Europe, especially regarding the Russian-German natural gas pipeline Nordstream 2. If there was an attack, Biden wanted Germany to agree that there would be no Nordstream 2. Europe already suffers from high elevated gas prices, partly because of the conflict and partly because of lower-than-usual natural gas shipments from Russia.

Last Friday, the situation intensified, and the US warned that there would be a Russian invasion of Ukraine next week (=this week). Markets tumbled upon the news, with 10y yields dropping sharply after a significant rise on Thursday because of higher than expected US CPI data. However, as is always the case with extreme moves on geopolitical news, the move reversed on Monday.

Nevertheless, it seems that the rise in yields is on pause, at least for now. Equity markets fell sharply on Friday and have not rallied back to their February highs until now. Risky assets suffer from higher uncertainty and inflation fears and expectations of a tighter monetary policy. The MOVE index reached its highest level in March 2020.

As long as the conflict is not solved, volatility will likely remain elevated, mainly because there is a lot of uncertainty within markets even without the conflict.

On Monday, the situation got almost ridiculous: President Zelensky stated that Russia would attack on February 16, which again caused equity markets to tumble and bond markets to rally…

…just to reverse shortly afterward because it was just a joke. Seriously?

I think the Russian interests are apparent: On the one hand, the Kremlin does not want another NATO-member state as its neighbor as five other neighbors already are part of the organization. On the other hand, Russia wants to be seen as a global player again.

Undoubtedly, more sanctions on Russia would dampen economic development, but after years of sanctions, the assumption that Russia got used to them is not that far-fetched.

Crypto-Currencies might also play a role: The Kremlin has a much different view than the Russian central bank on crypto, which proposed that cryptocurrencies should be abolished totally within the country. At the same time, the Bank of Russia wants to proceed further to develop its own digital currency.

Maybe Putin sees crypto/Bitcoin as an option to bypass sanctions, although - to be honest - this is a very speculative assumption. The Bank of Russia has repeated its proposal to ban crypto this week.

The Russian ruble will undoubtedly suffer from a further escalation of the conflict. Further, gas prices came down from their highs during the last months, which led to an appreciation of the Euro against the Russian ruble.

Russia will do ok with sanctions, I suppose. At least they are used to them. My view is that they may be happy to pay the price to reclaim a seat at the top level of geopolitics.

Regarding the US, my sentiment is that Joseph Biden and his administration are fueling the conflict verbally. Maybe he uses the classical method of American presidents when approval ratings are low?

Since the Democratic party has to survive this year’s mid-term elections, the conflict may help to cover up the problems of high inflation and, hence, falling real wages.

On the other hand, there is probably another reason: China is watching the reaction of the United States with a lot of interest. How would the US react in case of a Russian invasion? If the US is not responding harshly, would this also be the case if China invaded Taiwan?

I can highly recommend you to read the text from Pippa Malmgren (former presidential advisor of George W. Bush) about where she puts the whole conflict into further context:

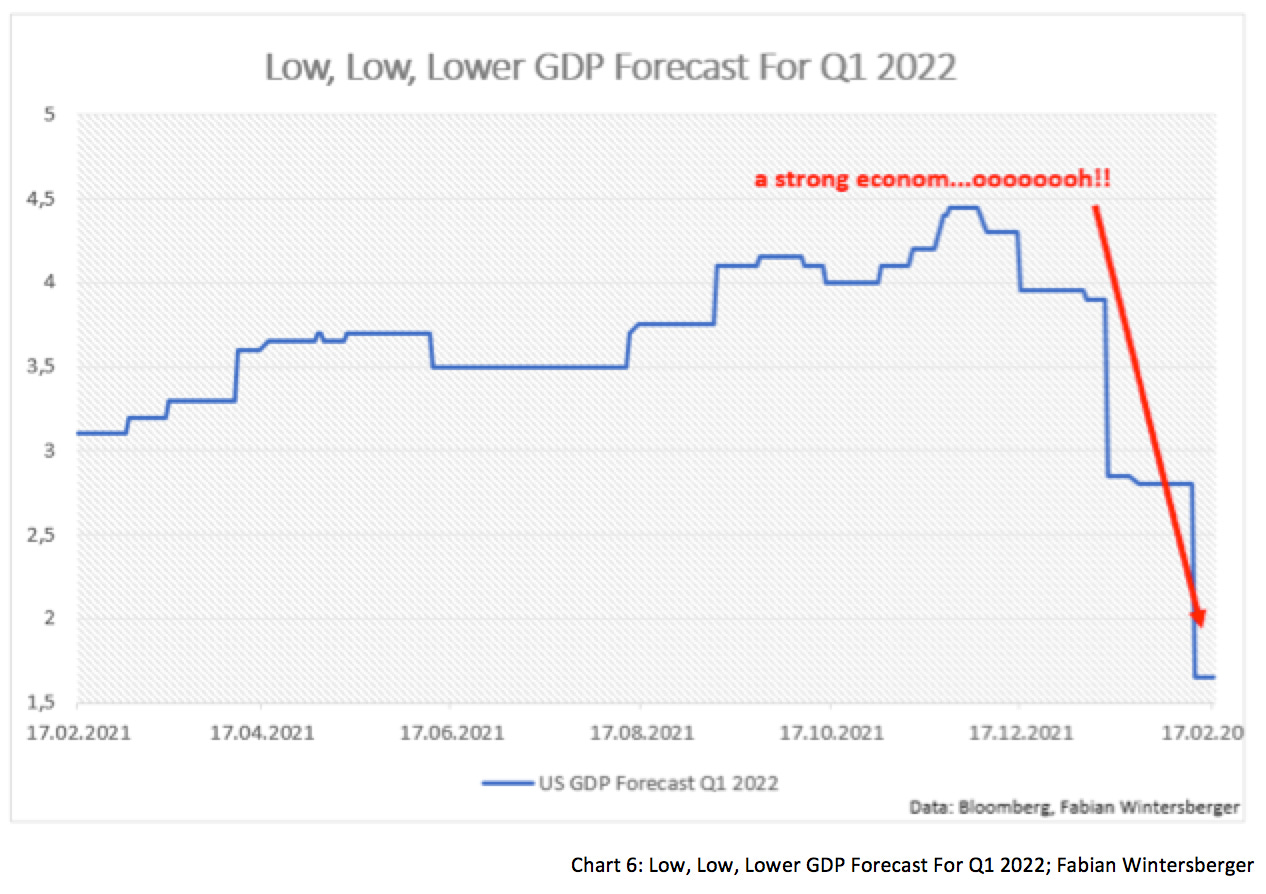

From a monetary policy standpoint, the geopolitical tension may lead to a looser tightening process than the market currently anticipates, as it would be an even worse decision under more uncertainty. I have written about this intensely for the last few weeks, and I think the market got way ahead of itself regarding rate hikes and tightening. The coming (already noticeable) economic slowdown indicates that the interest rate hiking-cycle will indeed be a very short-lived one.

On the other hand, if the intensification of the conflict leads to higher oil and gas prices, US companies may benefit because their production facilities rely on high oil and gas prices to become profitable. However, one must keep in mind that rising labor and capital costs also play a role in the equation. However, if more sanctions on Russia are implemented, those companies will have a willing demander: Europe.

The US (and Biden was very clear about that recently) wants Germany to bury Nordstream 2 before it is even put into operation. However, wanting Europe to stop importing (needed) natural gas while heavily importing Russian gas to lower domestic energy prices seems hypocritical.

Nevertheless, the big loser of the conflict will be Europe, or respectively, the European Union. On the one hand, the EU lacks an independent foreign policy standpoint. On the other hand, the EU still denies that its energy policy is still bonkers, despite considering nuclear power as green.

Ursula von der Leyen (Head of the EU-commission) tweeted on Wednesday:

The first question that comes to my mind is the following: Does the replacement of the Russian gas supply even work short-term by importing it from other countries (yes, the US LNG is part of the solution)?

According to a comment by Clark Williams-Derry and Ana Maria Jaller-Makarewicz (Institute for Energy, Economics and Financial Analysis),

By 2020, 44% [of the EU’s gas imports came from Russia]—and liquefied natural gas shipments added a few percent more. For some EU countries, dependence on Russian gas is even higher: Germany, for example, relies on Russian gas for up to 75% of its imports.

This makes those countries vulnerable to Russia, and I suspect that the latest EU sanctions against Russia did not change the better.

Further, the authors argue that some pipelines are also from North Africa to Europe. Still, Russia is already partly involved there (Chalous pipeline) or, the political situation is equally unstable. So, there is only Liquid Natural Gas (LNG) left. As correctly noted by Williams-Derry and Jaller-Makareqicz.

U.S. LNG will always be more expensive than pipeline shipments, since it costs so much to liquefy and transport gas across the Atlantic.

The authors suggest that the EU should invest heavily in renewable energies to break the dependency on Russia. While this is a good solution theoretically, there is a problem too: the EU economy is already suffering from strict regulations and has relocated many parts of production to Asia over the years, especially to Russia's ally China.

Because of Net-Zero, domestic production of renewables is almost impossible for Europe because of a lack of competitiveness. Additionally, solar panels need steel and rare earth. Further, wind and solar do not work well with no sun or wind. Europe would need to depend heavily on China, another Russian ally within the current situation.

It is good that German chancellor Olaf Scholz could deescalate the situation a little bit when he met with Putin this week. Gas prices remained down from 2021 highs, and, additionally, Putin promised to continue to supply natural gas.

Although the US and Nato have not confirmed it yet, allegedly, Russian troops have withdrawn from the Ukrainian border.

Investors should keep an eye on the situation in Ukraine, especially when they are holding risky assets. My impression that the US is escalating instead of deescalating the problem hardens my assumption that the interest rate hiking cycle from the Fed will be short-lived and that Christine Lagarde and the ECB probably are rightfully hesitant to tighten at the moment (both are far too late anyway)

Economically and geopolitically, Europe will be the loser of an intensifying conflict. The EU is between a rock (Russia) and a hard place (US) regarding natural gas imports and the lack of its foreign policy. It is not very likely that the EU could replace Russian gas imports in the short term.

The United States, on the other hand, probably benefit via higher LNG exports to Europe while Biden, on the other hand, could regain some approval.

Russia is used to sanctions and may deal with additional ones. Probably this is the price for Putin’s wish: Being treated equally as a significant global player in geopolitics.

Have a great weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.)