The benefits of a tariff are visible. Union workers can see they are “protected”. The harm which a tariff does is invisible. It’s spread widely. There are people that don’t have jobs because of tariffs but they don’t know it. – Milton Friedman

The global landscape of financial markets, economics, and geopolitics is anything but dull these days. Since Donald Trump began his second presidency, there's rarely a day when he doesn't baffle or excite observers, depending on one's stance on his policies. However, before delving into the weekend's events and current market developments, let's discuss last week's ECB rate decision.

The ECB's governing council made no surprising decisions regarding interest rates. As expected, they cut all three key interest rates (Deposit Facility Rate, Main Refinancing Rate, and Marginal Lending Facility Rate) by 25 basis points. These decisions were already priced into the market, so there were no unexpected movements in European rate markets, and rates remained broadly stable post-announcement.

Watching Christine Lagarde's Q&A sessions is always a challenge because her answers tend to be more political rhetoric than informative. One notable point was her response regarding the "neutral rate." Here's what she said:

We are not at the neutral rate [policy is restricitve]. This is a debate that is entirely premature. When we get closer to that, we will operate on the basis of a staff research paper, on the basis of the analysis provided by staff, and then that will help us determine how close we are and what our monetary policy stance should be.

I get really worried when I hear that the staff will estimate the neutral rate in due time. After all, Lagarde’s staff doesn't have a good track record in assessing the future trajectory of monetary policy. We all remember the "it's just a hump" claim, possibly a result of the ECB's reliance on New-Keynesian models that fail to use critical variables for inflation like money supply and money demand (inverse velocity).

The neutral rate concept has entered the central bank's Neo-Keynesian framework because it is essentially a theoretical construct used to justify current monetary policy, not to guide it. I doubt Knut Wicksell, who invented the concept more than a hundred years ago, would support using it for monetary policy. Wicksell's idea was about a theoretical level of interest rates that would bring equilibrium to the economy, not a practical policy tool.

I strongly argue that a central bank, as a "central agency," cannot possibly gather nuanced information from millions of market participants who engage in transactions based on their preferences and desires. Given that preferences and equilibria are constantly changing, central banks can never accurately pinpoint the neutral rate, setting it either too high or too low compared to the natural rate. The only way to determine where the "natural rate" lies is to allow the market to define it.

The ECB knows it needs to lower rates, but it must be careful about the difference in interest rates with the US. Further, it will remain cautious because it assesses short-term inflation using relative prices. As a result, it will always believe that inflation isn't contained as long as it doesn't stay around its 2% target for a sustainable period. Given that approach, the ECB will remain reactive instead of proactive.

With Donald Trump in the White House, the only certainty about global markets and the economy is the high uncertainty about his geopolitical and economic moves. Over the weekend, Trump again proved this by suddenly announcing tariffs on Canada and Mexico and that some on China and the European Union may follow.

Markets reacted immediately, with stocks selling off while long-term interest rates fell. However, the effect on interest rates remained contained for US 10-year yields. At the same time, European bonds got a strong bid, which makes sense given the rising uncertainty and the potential of tariffs against European Union countries dampening future economic growth.

The news kept coming, one after the other. First, the Mexican government wanted to retaliate against the US through tariffs. Canada followed suit, but by the end of the weekend, both had reached an agreement. Trump claimed that both countries weren't doing enough to prevent drugs from entering the US through their borders, leading to commitments from both to strengthen border controls. Interestingly, this outcome doesn't really differ from an agreement from Trump's first presidency.

One can see a pattern of Trump announcing extreme measures and then being satisfied with minor concessions. It doesn't mean he'll be happy forever, though. Hence, the uncertainty remains, likely supporting bond prices in the short term. As I mentioned last week, the recent move could be an unwinding of positions, noting that small traders had been extremely short on long-term bonds. I doubt that lower long-term inflation expectations drove the move because 5y5y inflation swaps remained relatively stable compared to the move in the 10y yield.

What stood out was a comment by Scott Bessent, Trump's treasury secretary. After Trump said the Fed did the right thing by keeping rates steady, Bessent underscored this with another statement:

“He and I are focused on the 10-year Treasury,” Bessent said in an interview with Fox Business Wednesday when asked about whether President Donald Trump wants lower interest rates. “He is not calling for the Fed to lower rates.”

Bessent also reiterated the Trump administration's aim to bring energy prices down, as they see it as a "main driver" of inflation. While many economists and financial professionals might agree, from an Austrian perspective, this isn't clear-cut. If the aim is to bring prices down by increasing supply, then it might work, even with an expansionary money supply.

However, I believe Bessent's comments suggest that the Trump administration – unexpectedly – might be willing to endure short-term pain for long-term gain. Think about it this way: let the Fed fight inflation by keeping short-term rates high while implementing policies that lower growth expectations on the long end. Falling inflation could bring down long-term rates, enabling business investments that rely more on these long-term rates.

On paper, that sounds great for the US: implement tariffs to bring production back home and lower the 10-year yield by influencing growth and inflation expectations while working to increase energy supply. Plus, Elon Musk's involvement could cut government spending and free up workers for the private sector.

However, this might be too good to be true. My main concern is that it could turn the global economy upside down. After all, the US enjoys being the world's reserve currency because it issues dollar-denominated debt that foreigners buy to save their acquired dollars from trade.

If you relocate production to the US, the influx of dollars into the real economy could increase inflation if productivity doesn't match the increase in money supply chasing goods. That would push rates back up while the dollar appreciates due to increased demand. Other central banks would need to counteract the falling demand for their economies by selling US assets to prevent their currencies from depreciating against the dollar.

I'm skeptical that the short-term economic pain can be managed smoothly enough to be bearable for a significant portion of the US population.

Perhaps this is where the trade war suddenly makes sense. US producers and labor unions immediately supported Trump’s announcement to implement tariffs because they subsidize their businesses and wages; he might think he can balance the economic disruptions from a system overhaul. It could work, but it might also lead to significant backlash since centrally navigating such changes is challenging. We'll see.

The stock market quickly overcame its initial fears and has continued to rise on both sides of the Atlantic. Though the S&P still lags behind the DAX, it benefits from US economic strength. The Chicago Fed's National Financial Conditions index shows that conditions have continued to loosen, which should support stocks. However, this could eventually pose headwinds for bonds, though other factors currently keep bonds from falling, as discussed.

Oil (WTI) prices continued marching towards $70/barrel this week, as I assumed last week. Once they hit $70, we'll see if the resistance holds or if they break through immediately.

On the other hand, copper rose again to another all-time high, likely due to the tariff talks Trump initiated. It managed to break out of its downtrend and could trend towards $460 if it stays above the trend line. Rising commodity prices could hinder the progress on inflation control in both the US and Europe.

Ultimately, the increased uncertainty associated with the Trump administration's unforeseeable actions means movements in either direction are possible. Yet, my base thesis remains that stocks will continue to be supported. Long-term interest rates could have more downsides, especially since US job openings were below expectations this week, but rates continued to decline. We'll see if the new NFP report on Friday can change the yield trajectory.

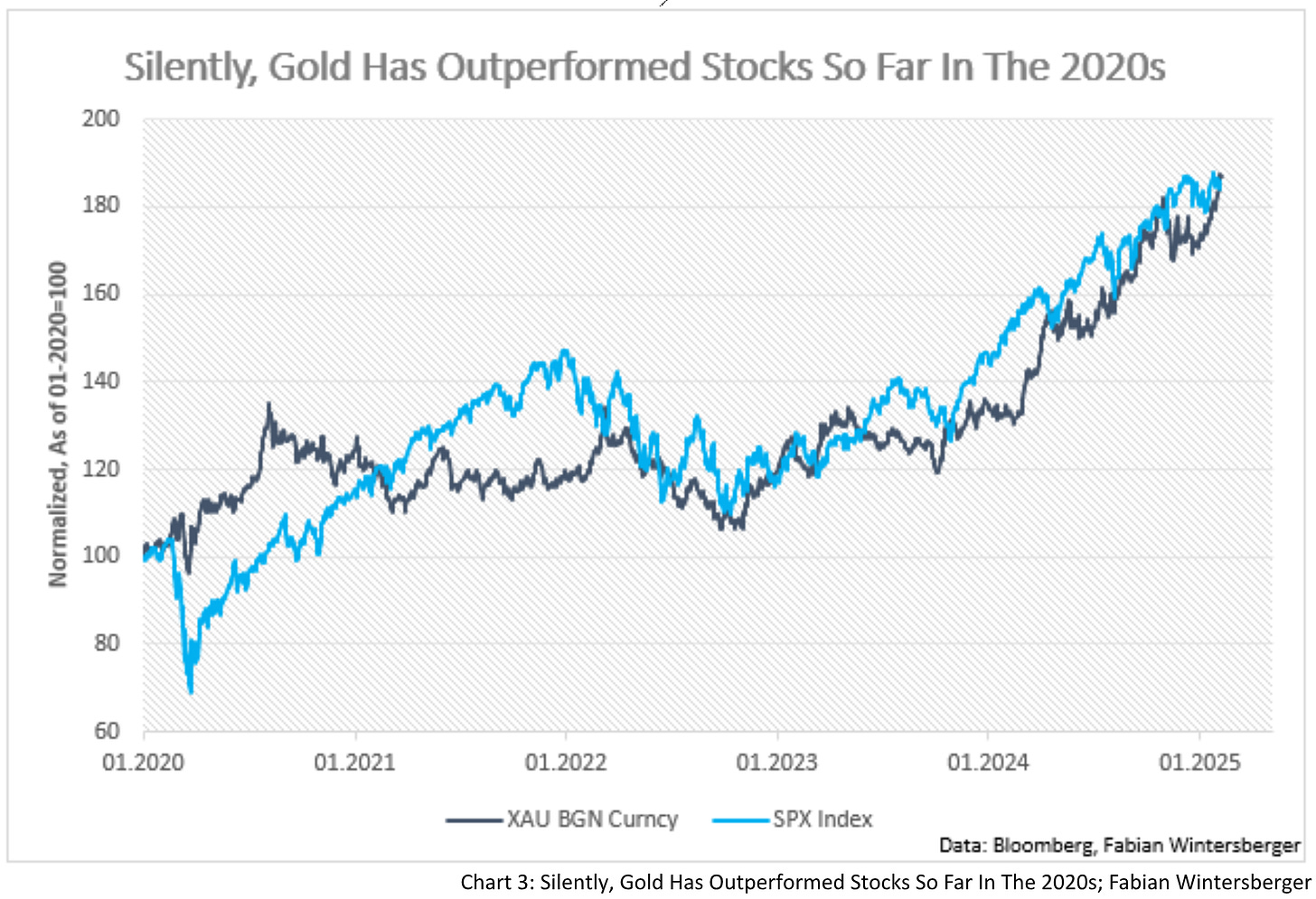

Amidst all this uncertainty, one clear winner emerges: gold. In 2020, I predicted that gold would outperform stocks in this decade. The race remains close, but gold has recently taken the lead. So far, gold has outperformed the S&P 500 in the 2020s.

Financial markets won't have a calm quarter, as uncertainty around geopolitical economics helps keep volatility elevated. That is especially true since Trump has declared to other countries that “this is war” on trade.

This is war

And I swear that Im not giving up or giving in

This is war

Then I swear that Im not giving up or giving inIll Nino - This Is War

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.