The Truth

Growing deficits might shake up the bond market and lead to a crack-up boom in stocks

In an era of deceit, telling the truth is a revolutionary act – George Orwell

Politicians often struggle to be honest when delivering bad news. Over the past few decades, it’s been rare to find a politician who hasn’t misled the public during tough times. There are exceptions, of course, like Argentina’s current president or former US Congressman Ron Paul, but such figures are exceedingly rare.

“When things get serious, you have to lie,” former European politician Jean-Claude Juncker once quipped. Yet, most political deception isn’t outright lying but rather a creative spin on the truth.

Consider a ballooning budget deficit that politicians avoid addressing due to fear of backlash. Instead of admitting, “We’re ignoring the rising deficit,” they offer statements like Treasury Secretary Bessent’s:

Our focus is to grow the economy faster than the debt; that’s how we stabilize debt-to-GDP.

This is a clever twist. I assume Bessent genuinely believes this, but if it fails, he can easily shift blame to external factors. At best, he might admit it didn’t work—long after leaving office.

Donald Trump, however, is less subtle in his distortions. This week, he told reporters:

I’m a fiscal hawk. I’m the biggest fiscal hawk. There’s nobody like me.

A glance at his first term reveals this as an outright falsehood. The debt-to-GDP ratio surged by over 20% during that period. While his rhetoric early in his second term suggested a shift, market reactions seem to have softened his stance.

His latest tax-cut plan, costing $3.8 trillion over ten years, is likely understated. Provisions like “no tax on tips” are unlikely to expire after four years, as Congress rarely lets such measures lapse.

As Bessent articulated, the strategy is to spur economic growth to outpace debt. Yet this Keynesian approach has consistently failed. Fiscal hawks warn that deficits are spiraling, while expansionary policy defenders point to Japan, which has managed debt exceeding 200% of GDP since its 1989 crash. However, Japan’s case is unique—its debt is largely held domestically, unlike the US, which relies heavily on foreign investors. Moreover, Japan’s situation is shifting.

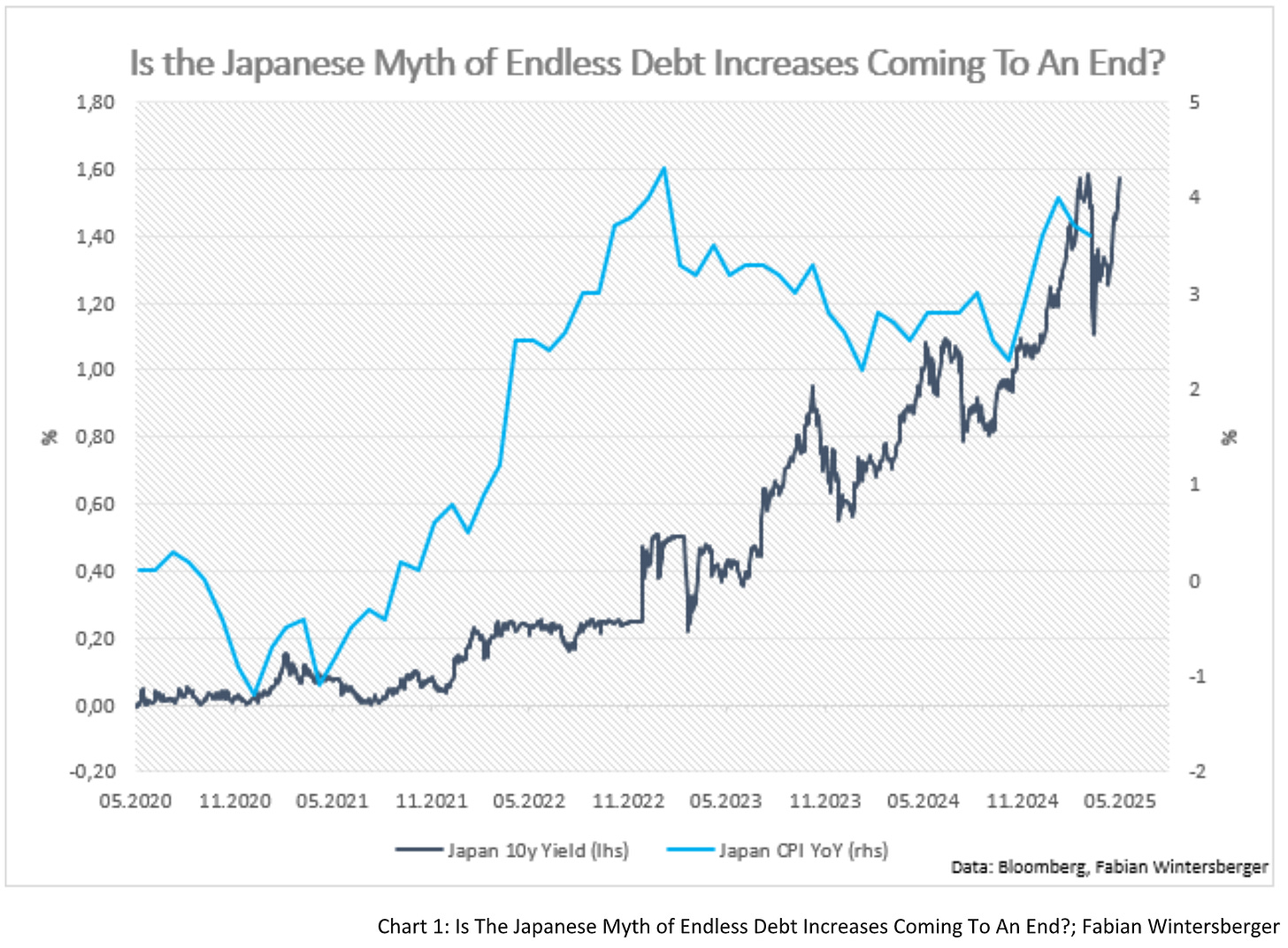

Since late last year, Japan's inflation has crept up, steepening the yield curve. Following a poorly received bond auction this week, Japan’s 10-year yield has surged, nearing 1.60%.

The government cannot comment on interest rates, but our country’s fiscal situation is undeniably dire—worse than Greece’s. – Shigeru Ishiba

With deficits rising globally, long-term bond yields are trending upward. A poorly received 20-year US bond auction this week pushed US yields higher, signaling that the current administration won’t tame the deficit. Meanwhile, Trump’s dominance in global news has diverted attention from Europe, benefiting German Bunds and other European bonds.

German Bund prices haven’t declined as sharply as US Treasuries. With Trump in office, Germany’s plans for significant spending—and signs that other EU nations may follow—have been overshadowed, as has the potential for joint EU bonds, which I expect soon.

Germany’s economic stagnation has created a massive tax revenue shortfall. A push for increased fiscal spending alongside declining government income is a dangerous mix.

For 2026 alone, tax estimators expect a €19 billion reduction. Tax revenues will likely continue to rise – just not as much as expected in October. Finance Minister Lars Klingbeil emphasized: "The results of the tax estimate do not make our start any more difficult."

Thus, fiscal expansion will likely drive deficits higher in both Europe and the US, as I noted last week. However, monetary policy divergence between the US and the Eurozone could spell trouble for German Bunds.

The Federal Reserve is likely to hold rates steady, possibly through 2025, while the European Central Bank may cut rates further, having already reduced them nearly twice as much as the Fed. Trump’s praise for ECB President Lagarde is concerning, as the ECB is easing monetary policy amid fiscal expansion, outside a broader Eurozone recession.

This combination of lower short-term rates and significant fiscal stimulus could steepen yield curves in Germany and other Eurozone countries, potentially fueling future inflation and growth. European long-term bond yields, in my view, are the least prepared for this shift. While rising US and Japanese yields have driven the trend, Europe’s bond market reckoning looms.

A sharp bond market correction could coincide with a rising dollar, creating a double blow. The latest Bank of America Global Fund Manager Survey shows investors are heavily overweight in bonds and underweight in equities, suggesting limited upside for bond prices. Tariff concerns have fueled recession fears, yet investors seem overly cautious.

Ongoing global fiscal expansion, lower short-term rates, and potential growth-driven unwinding all point to higher long-term interest rates. The notion that central banks may lose control of the yield curve’s long end is increasingly plausible.

This week’s weak US bond auction triggered a slight pullback in US stock prices, prompting speculation that worsening deficits will weigh on equities. I disagree. First, investors remain underweight in stocks. Second, global fiscal expansion will loosen financial conditions, likely boosting stocks in both Europe and the US.

However, European stocks’ recent outperformance over US peers, coupled with growing skepticism about US exceptionalism, may signal a contrarian opportunity.

For long-term plays, hard assets like gold or Bitcoin (for those comfortable with volatility) are compelling. Gold appears crowded short-term, but both assets are likely on an upward trajectory given the above dynamics.

Risks remain—a financial crisis could spark a sharp recession, or a rare politician might confront the dire budget situations in advanced economies. However, fiscal expansion makes the former unlikely, and the latter nearly impossible.

Voters, too, seem unprepared for such candor. Argentina needed decades of hardship to elect a truth-teller like Javier Milei, and the Western world isn’t there yet.

Truth

Tell me the truth, the truth motherf*****

Tell me the truth, tell me the truth, tell me the truth

The truth you suckerClawfinger – The Truth

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.