It all comes down to interest rates. – Ray Dalio

Last week’s US GDP figures for Q1 might seem like fuel for stock market bears. The economy contracted by 0.2% annualized, slightly better than the forecasted -0.3%.

The prevailing opinion is that weakening economic data will drag down equities, pressuring the Fed to cut rates faster than expected. This has fueled bullishness in long-term bonds, evident in strong inflows into the TLT ETF, which tracks US Treasuries with maturities of 20+ years.

Unsurprisingly, economists have slashed GDP forecasts. The OECD now projects US GDP growth to drop from 2.8% in 2024 to 1.6% in 2025 and 1.5% in 2026. They also warn that inflation, exacerbated by tariffs, may persist, delaying Fed rate cuts until next year.

While leading indicators signal tougher data ahead, I believe many misread these headlines, missing the forest for the trees.

First, let’s address something that’s commonly overlooked regarding economic forecasts. Economists often rely on econometric time-series analysis, making them trend-followers by nature. Strong data leads to optimistic projections; weak data prompts gloomier outlooks.

This approach works reasonably well in stable times. But in periods of rapid economic or political shifts, when markets are volatile, such models falter. Markets are dynamic information machines, constantly digesting new data to find equilibrium. In calm periods, price discovery is efficient, but during turbulence, misinterpretations can create disequilibria.

Prices ultimately hinge on supply and demand. When supply outstrips demand, prices fall; when demand exceeds supply, they rise. Extreme sentiment—bullish or bearish—often signals exhaustion, halting price movements.

Moreover, asset prices are driven by sentiment, which can diverge from fundamentals. Fundamentals provide a long-term anchor, but prices reflect millions of subjective valuations, often defying “rational” expectations.

The market, as an “information machine,” prioritizes what participants deem valuable. Amid tariff and recession chatter, policy changes drive the market’s increased volatility, which leads people to assume an economic slowdown is imminent.

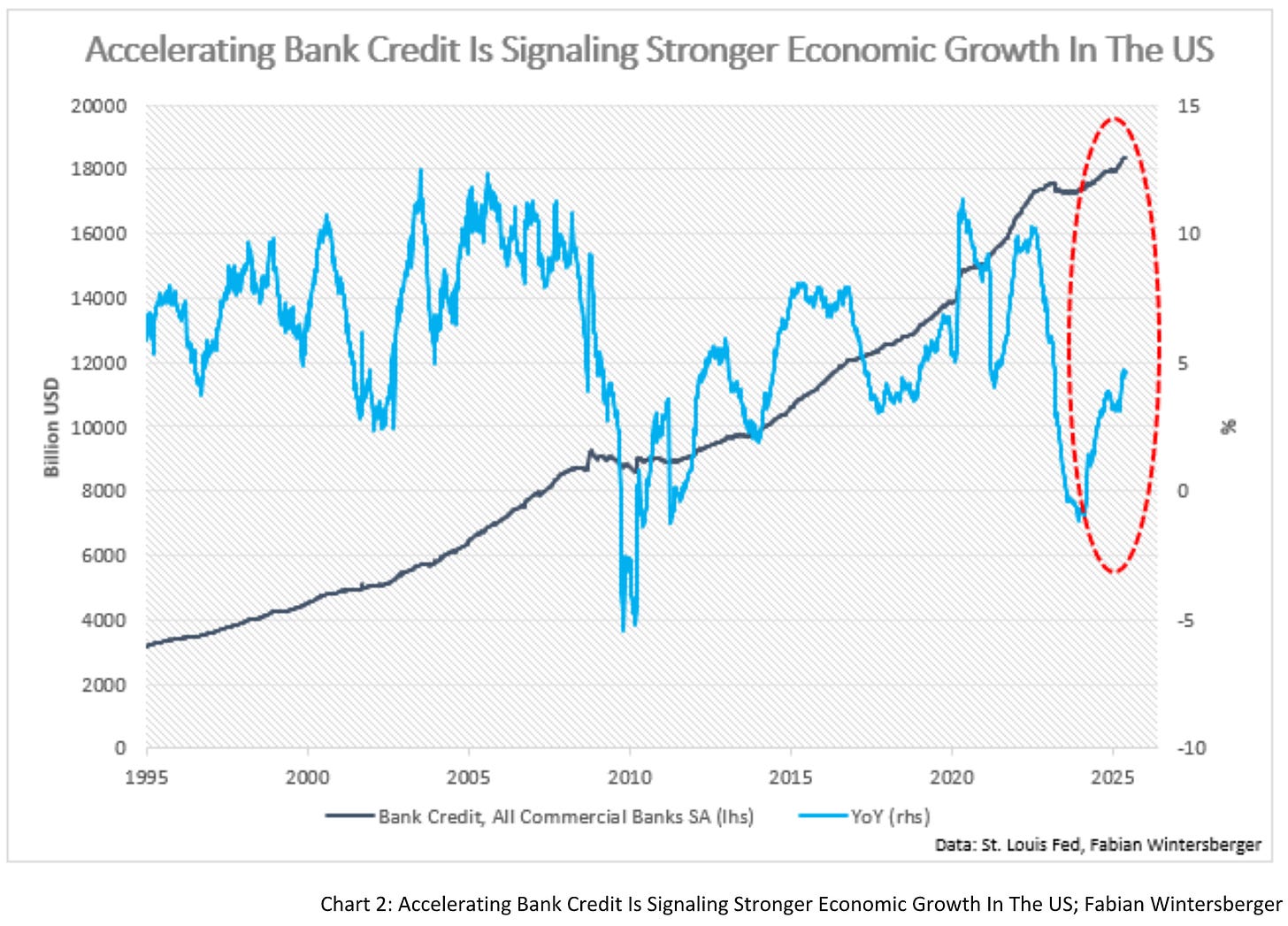

Yet, one overlooked fact stands out: bank credit is surging—a sign inconsistent with an imminent recession.

With accelerating bank credit and sustained government spending, I see a high likelihood of economic reacceleration, despite near-term data disappointments. Most market participants seem unprepared for this scenario.

BCA Research’s Marko Papic recently made a compelling point: markets are already adjusting to Trump’s tariffs, which may not be the dominant factor. He argues that hard data isn’t the key driver of stock market performance—policy is. In Q2 2020, despite a sharp GDP contraction, stocks rallied, buoyed by massive fiscal stimulus and market adaptation to a new environment.

Papic likens hard data to a canyon with a bridge already built. Once markets adjust to tariffs, they’ll move on.

Another overlooked factor is that Q1’s tariff-driven import surge will likely reverse in Q2, narrowing the trade deficit and boosting GDP. The Atlanta Fed’s GDPNow model currently projects 4.6% annualized growth.

Critics may downplay the “Big Beautiful Bill,” but combined with robust bank credit growth, it’s a significant catalyst. Sentiment and positioning suggest a perfect storm is brewing, with stocks and long-term yields poised to climb. My view remains unchanged.

In Europe, the picture is similar but with a twist. As I write, the ECB’s interest rate decision looms, likely bringing another cut, loosening monetary policy. Amid tariff uncertainty, this could be a misstep. Recent PMI data paints a mixed picture: most eurozone economies are expanding, but Germany remains in contraction. Still, the eurozone is growing, albeit marginally.

The eurozone’s struggles may stem less from tight policy and more from tariff-related uncertainty. If monetary policy is already neutral, further cuts could overstimulate as uncertainty fades. Economic activity might accelerate even without additional easing.

Moreover, eurozone countries, including NATO members, are set to ramp up defense spending—a fiscal stimulus. Germany plans to increase spending and cut corporate taxes to spur growth.

These moves favor the private sector and European stocks but spell trouble for German Bund yields. Finance Minister Klingbeil recently noted expected declines in tax revenue, yet spending and tax cuts continue. This points to higher long-term Bund yields.

Markets haven’t fully priced this in, but it’s only a matter of time. With participants braced for persistent weakness, hesitant to bet on equities, and overweight in bonds, a shift is brewing.

The bearish narrative feels certain, but I suspect the stock market won’t falter. Instead, the bears’ tears will crash around them.

Your tears don’t fall, they crash around me

Her conscience calls the guilty to come home

Your tears don’t fall, they crash around me

Her conscience calls the guilty to come homeBullet For My Valentine - Tears Don’t Fall

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.