Take A Look Around

As the weeks pass, more and more evidence points to the fact that the European Union will enact an embargo on Russian oil (the EU already proposed the boycott this week, but the details remain unclear for now). Numerous economists, journalists, and politicians have called for an embargo recently. Lately, Robert Habeck, the German economic minister, stated that Germany would not oppose such a proposal.

According to his statement, an embargo would cause a lot of harm to the European economy due to supply shortages and price increases. On the other hand, Habeck also stated that a ban would not cause a national catastrophe and that Germany has made a lot of progress on that side and thus would vote for an embargo.

Nevertheless, Habeck also said he is skeptical about an embargo and warned that it might be counterproductive if oil prices rise further until only the West can afford it. Habeck noted a discussion about other possibilities within the western coalition. The EU plans to propose an import ban on Russian energy that is supposed to occur at year-end. In the meantime, the EU announced further sanctions on Russia on Wednesday and said that Russia’s biggest bank, Sberbank, will be excluded from the SWIFT system.

Additionally, it calls for an embargo on Russian gas increase too. On April 6th, Politico published an article that the EU can afford to ban Russian gas completely, as it has already done with coal. As I noted last week, Russia’s step to deliver gas only if it is paid with rubles supported the currency and helped push the exchange rate down to pre-war levels.

Indeed, oil imports from Russia to Europe have declined enormously since the war started, as Bloomberg notes (link only available for users of the Terminal). Chart 1 shows that oil imports from Russia have declined by 37 % from their January levels.

As many sides want the EU to ban Russian energy entirely from the market, I assume that this will only be a matter of time. The repeated argument is that an embargo would hurt the weak Russian economy much harder than the European economy. However, let us Take A Look Around!

But can the West afford such an embargo? This week, I want to discuss several risks that (in my opinion) are too easily brushed aside by the proponents. Additionally, there is some other aspect of the war in Ukraine that is often overlooked, namely that the war is not only about defending freedom but also about future possessions of commodities and industrial facilities.

European governments are already aware that an embargo on Russian energy would hurt a lot of firms hard. The German government has already decided on a package to support affected businesses. According to Bloomberg, the package is supposed to help those with loan guarantees of around 100 billion Euros.

Additionally, the coalition agreed on another program of another 7 billion Euros to support companies in danger of liquidity problems due to the sanctions. Consequently, one tries to solve economic problems as usual by providing additional liquidity.

Here it becomes evident that an environment of rising rates might turn out to be disturbing at least. 10y Bunds rose above 1 % for the first time since 2014 this week, and US treasuries note near their highs of 2018 at around 3 %. Let us keep that in mind while we continue with our analysis.

Although the Chinese lockdowns damper global energy demand, the energy market is already very tight. Reuters quoted Phil Flynn, senior analyst at Price Futures Group, on Wednesday, who says

Inventories are so tight, so against this backdrop, when you’re talking about this ban, there are a lot of questions on how (Europe) is going to make up for this.

Reuters continued that

in the United States, petroleum reserves fell last week, according to market sources, citing numbers from the American Petroleum Institute. They said that crude oil reserves fell in the week of April 29 by 3.5 million barrels. This was a higher than the expected drawdown of 800 thousand barrels from a Reuters poll.

This is happening in an environment where the US has released parts of its SPR to fight the Putin price hike. According to the White House, the release is

the largest release from reserves from both the United States and the rest of the world in history.

However, the market is not only getting tighter because of a possible lockout of Russian oil but ongoing fights in Libya also lower supply. Two oil fields are already halted and caused a drawdown in daily oil exports of the country of 34.6 million US dollars.

According to the proponents, an oil embargo would hurt Russia hard but would be manageable for the EU because it can simply switch suppliers. However, the EU is still highly dependent on Russian oil, and in 2021 Russia accounted for about 25 % of all oil imports into the EU.

This means that Europe will have to replace 25 % of its oil imports if it imposes an embargo on Russian oil. As a result, the demand for Russian oil would fall drastically at first, while the demand for oil from other suppliers would rise.

If rising demands meet an (at least) inelastic supply, the oil price from those suppliers will go up. As Russian oil is banned entirely from the (western) market, buyers cannot switch to a cheaper alternative (Russian oil) and have to buy at the given price.

This would only affect the exporters because (if the total oil supply remains more or less fixed), it would lead to less supply on the domestic market. Thus, domestic prices rise if production is running at total capacity. So, more exports result in higher domestic prices.

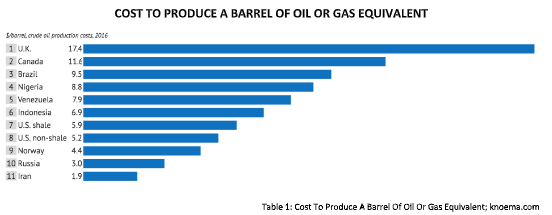

It is evident that oil prices will have to rise in case of an embargo. Nevertheless, it is not only because supply is falling but also because Russia is not only a prominent commodity exporter. It is also a low-cost producer. Only Iran produces more cheaply. However, The sword of Damocles is constantly hanging over the country from possible renewed sanctions.

As I wrote last week, there will be a demand for Russian oil. Some countries will buy their oil at a discount, for example, China, India, and possibly other commodity-rich emerging economies. India is already buying more Russian oil than in 2021, supposedly at a reasonable price.

Even if the west achieved a global ban on Russian oil, the effects on oil prices and markets would be enormous because the drilling cannot simply be switched off and later switched on. An embargo would lead to a fall in the Russian oil supply by 8 million barrels per day (that is what Russia exports), and I do not think that the market has priced such a scenario.

If only the west cuts off Russian oil from the market, this could lead to problems because of oil supply chains. If oil is not delivered via pipelines, it is shipped. As the biggest operator of tankers, Euronav, already announced not to ship Russian crude anymore, there are not enough vessels to ship the oil and thus to keep the Russian oil supply constant. The result would be a lower total supply as well.

Finally, there are problems with the shipment routes. Most of the oil from Arab countries is transported through the Strait of Hormuz. If we consider current developments, joint military drills of China, Iran, and Russia in the Gulf of Oman (that leads to the Strait of Hormuz) appear in one new light.

Considering all these points, one may conclude that an embargo on Russian oil by the west could have a lot of possible harmful consequences. And as I mentioned the Strait of Hormuz already, you possibly remember that many European leaders have traveled to Qatar to negotiate on potential LNG supply since the war began. LNG is shipped by vessels, and the delivery way to Europe leads through - yes, exactly - the Strait of Hormuz.

That brings us to gas, where the European dependence on Russia is higher than on oil, as 40 % of total gas imports into the EU come from Russia.

Let me remind you that Russia is a low-cost commodity producer. A switch from Russian gas supply to LNG suppliers like Qatar and the United States means higher natural gas prices because LNG needs to be liquified, shipped, and stored in terminals. Higher energy prices would drive up production costs for European companies and harm their global competitiveness. Thus we may conclude that a switch from Russian gas to LNG might lead to lower European production because the continent loses competitiveness as it cannot continue to purchase cheap Russian energy.

Further, most European countries do not have LNG terminals to store it. Even if German LNG terminals will be ready in 2024 (neglect the fact that it took 14 years instead of two to build an airport), that means that until then, there is still the danger that Russia will cut Europe off from natural gas. OMV-CEO Alfred Stern told CNBC

If you look at the total European picture, the quantities work out in such a way that we will not be able to substitute in the short run the full quantity with European production or imports from other sources. The capacity currently is not here, it can be built up over time, but in the short run, this is not possible. I just want to highlight it will be critical because it could have significant impact on our ecnomy, on the running of industry because we depend on the availability of energy for this

Hence, it is understandable that European politicians are hesitant to impose an embargo on Russian gas, and some, like Hungary’s Viktor Orban, oppose it. All the options on the table will result in higher prices, lower international competitiveness, and thus an enormous burden for the European people that possibly cause a change in Europe’s political landscape for years.

Most wars are fights about commodities, and the war in Ukraine is no exception. However, in the media, the (highly understandable) moral argument dominates in the same way as it did back in the days when the west defended freedom at Hindukush. However, the current war has another aspect that I would like to highlight here.

Recently, the Russians seem to concentrate on the southern part of Ukraine to cut it off from the access to the Black Sea, but apparently, the south is not only about the entrance to the sea. It is also about semiconductors.

Heavy fighting rages around Mariupol’s Azovstal steel plant, with the Russian invaders gaining ground. Azovstal and another steel plant in the south, Zaporizhstal, are two of the largest steel plants in the world and were built back in the days when the USSR was still a thing.

Because of their enormous size, both plants produce industrial amounts of neon gas, which is needed to make semiconductors. Ukraine is the biggest producer of neon gas and exports about half of all the neon required to produce semiconductors. The second-largest producer of neon is China.

Thus, if Russia can secure the southern part of the country, this will mean that Russia will own half of the neon needed for semiconductors production. So, apart from the troubles in energy markets, an additional danger is more severe problems in the market for semiconductors.

Troubles on the market for semiconductors mean problems for the production of computer chips, cars, and…

…precision-guided weapons.

Precision-guided weapons that the West wants to deliver to Ukraine to fight the Russian aggressors. Because of the war, a variety of western states have decided to ramp up defensive spending to be able to protect themselves. Germany alone plans additional expenditures of 100 billion Euros.

While this has not even started yet, the semiconductors market is already struggling, as a Bloomberg article from April 21st shows. The article quotes a CEO from a leading company in the US chipmaking industry, who said that

A major industrial conglomerate has resorted to buying washing machines and tearing out the semiconductors inside for use in its own chip modules

The industry has been suffering since the start of the pandemic, partly because stimulus programs drove up demand for computer electronics and thus the demand for semiconductors for this branch. However, as the industrial demand for chips is still there, this caused an enormous price spike. As governments are planning to ramp up defense spending, this might have a similar effect and probably pushes up prices further or keeps them elevated.

One can conclude that the ongoing war, the possible gains of land by the Russians in the south, and the nearing embargo of Russian energy might cause enormous economic and political problems because of a potential fall in the western standard of living.

All this happens when inflation is already at forty-year highs. According to their mandates, the Federal Reserve, The Bank of England, and the European Central Bank are obligated to tighten monetary policy to fight inflation.

However, falling margins because of highly elevated producer prices combined with a rising interest rate environment may prove an explosive mixture for economies with debt/GDP levels of around 100 %. Years of zero- or negative interest rate policies put a lifeline to businesses that could only survive because of artificially low rates, and this effect now seems to be reversed.

Rising interest expenditures might mean trouble for many firms and hence could lead to a rise in bankruptcies and, therefore, lower supply. At a certain point, this could mean risk for some banks. If banks are in trouble, this means that there is some systemic risk, and that would exactly be the case where (according to Danielle DiMartino Booth) the Fed might reverse course.

All these troubles loom in times when the Fed plans to shrink its balance sheet and raise rates. If the banks get into trouble because of regulation, the Fed might be forced to relax those as it did during the first year of the pandemic.

As we can see already, with the planned measures to subdue the effects of an oil embargo, countries will likely ramp up expenditures in this environment and do what they always do: cover up problems with additional liquidity.

But if the government needs more money, it is interesting that rates will not go up, and this brings me to the topic of last week if the West even could afford a total ban on Russian energy. If it wants to be able to afford it, then governments need a shitload of money, and thus I expect that QT will become QE again soon. Probably already in Q4.

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.)

Let's wait which CB will blink first and how. I'm observing currency valve proactively hedging cash position having EUR as primary CCY to hedge.