I have self-doubt. I have insecurity. I have fear of failure. I have nights when I show up at the arena and I'm like, 'My back hurts, my feet hurt, my knees hurt. I don't have it. I just want to chill.' We all have self-doubt. You don't deny it, but you also don't capitulate to it. You embrace it. - Kobe Bryant

"The Truman Show," directed by Peter Weir and released in 1998, is a thought-provoking and satirical film that explores the boundaries of reality, media, and individual freedom. The film's central premise revolves around Truman Burbank, portrayed by Jim Carrey, who unknowingly lives his entire life within a meticulously controlled and broadcasted reality TV show. This cleverly constructed world showcases the intricacies of surveillance, media manipulation, and the ethical dilemmas surrounding Truman's lack of autonomy.

At the core of "The Truman Show" lies the pervasive theme of surveillance and the erosion of privacy. Every aspect of Truman's life, from his birth to his relationships, is meticulously curated and monitored. The omnipresent cameras, hidden in every corner, showcase the insidious nature of surveillance and the ethical concerns it raises. The film serves as a cautionary tale, urging viewers to consider the potential consequences of a society where personal privacy is stripped away in favor of entertainment and control.

The character of Truman Burbank personifies the human longing for authenticity and freedom. As Truman becomes increasingly aware of the artificiality of his world, his quest for truth and genuine experiences becomes a powerful metaphor for the human desire to break free from societal norms and expectations. Jim Carrey's performance in the role is exceptional, demonstrating his versatility as an actor and his ability to blend comedy with introspective depth.

"The Truman Show" masterfully explores the idea of reality and the blurred lines between the scripted and the genuine. The film encourages viewers to reflect on the media's power to shape our perceptions and manipulate our understanding of reality. In doing so, it remains a relevant and thought-provoking piece of cinema that challenges us to question the world around us and the influence of media on our lives.

One of the most intriguing elements of the film is the character of Christof, the creator and director of "The Truman Show," portrayed by Ed Harris. Christof's god-like control over Truman's life and his unwavering belief in the show's importance raises questions about the ethics of entertainment and the responsibilities of those who produce it. His character represents the media's power to shape narratives and manipulate the lives of individuals for the sake of ratings and entertainment.

"The Truman Show" also delves into the concept of the "reality" presented to the public. Truman's world is a carefully crafted facade designed to be an idyllic suburban town. Yet, it's a superficial construct devoid of genuine emotion and spontaneity. This raises questions about the authenticity of the reality presented to us through various media outlets, including television, social media, and even everyday interpersonal interactions. It prompts us to consider the extent to which external forces might influence or manipulate our lives.

The film's ending, where Truman finally breaks free from the constructed world, is a powerful statement on the human spirit's unyielding desire for authenticity and autonomy. As he confronts his fears and the artificiality that has confined him, Truman becomes a symbol of the human capacity to overcome obstacles and seek the truth. This climactic moment leaves viewers with a sense of hope and the belief that individuals have the agency to control their destinies.

In conclusion, "The Truman Show" remains a cinematic masterpiece that continues to captivate audiences by exploring reality, surveillance, and media manipulation. Through its engaging storyline, compelling characters, and thought-provoking themes, the film challenges us to critically examine our world and the media's role in shaping our perceptions. It serves as a lasting reminder of the importance of authenticity, freedom, and the human drive to break free from the constraints placed upon us, making it a timeless classic in the realm of cinema.

I chose "The Truman Show" for the introduction because it has been on my mind a lot recently. Strangely, I've noticed that fragments of the themes explored in the movie are visible in today's global economy and geopolitics. Social media, in particular, plays a significant role in this, and it seems that no matter what stance someone takes on a specific (geo-)political issue, there's always someone on social media supporting that viewpoint.

Similar recurring themes can be found in the financial markets. As I mentioned in last week's note, data doesn't lie but requires interpretation. Sometimes, on the other hand, it's the complete opposite: widely accepted narratives don't align with the data or the consensus among experts in the field. This is what I want to delve into today.

Let's begin with an examination of the US labor market, which, on the whole, appears to be consistently tight. Unemployment claims have remained at a low level, hovering around the 200,000 mark for several weeks. Continuing claims also remain relatively low, although they are gradually creeping higher. However, the chart provided by EPBResearch indicates that continuing claims are trending in an unfavorable direction.

If I had to pinpoint one specific aspect of the economy that was significantly disrupted and transformed by the pandemic, the labor market would undoubtedly be among my top three choices. The situation there is incredibly complex. On one hand, people exited the labor force as the pandemic took hold, and even though some have since re-entered, the numbers are still below the levels seen in 2019.

On the other hand, individuals laid off from various service sectors began seeking employment in industries more resilient to the pandemic's impact. When their former employers eventually sought to rehire them, many were no longer interested in returning. This has led to a peculiar dynamic in the labor market.

As reported by FastCompany magazine:

A recent survey published by Aerotek—a staffing and workforce management company—finds that a whopping 53.8% of job seekers believe current economic conditions and the job market are “the most significant barrier or challenge in their current job search.”

The survey, which was conducted online during August, comprises responses from more than 1,400 job seekers and also finds that the number of workers who’ve been laid off in recent months tallied 6.1%, almost double from this spring. Further, more than 77% say their financial situation has gotten worse or remains unchanged from last year.

In essence, people are struggling to find the desired positions, while companies are doing their utmost to retain their employees, fearing a repeat of the mass departures witnessed during the pandemic. I believe this is one of the reasons why many individuals remain perplexed about the labor market's resilience, even as other economic indicators deteriorate. If we assume that there have been substantial misallocations due to lockdown policies, regulations, and government stimulus payments, the current state of the labor market may be a plausible consequence. Whether this represents a significant misallocation that will resolve itself in due course or a new equilibrium remains to be seen. As we all know, the labor market situation can change rapidly during a downturn.

This leads me to another point often cited as a potential harbinger of a recession in the United States – the yield curve. While many analysts focus on the spread between the 2-year and 10-year yields, I personally prefer to examine the spread between the 3-month and 10-year yields.

It's evident that the inversion of the yield curve has traditionally marked the onset of recessions over the past six decades. Nevertheless, it's important to remember that this inversion typically occurs due to a significant drop in short-term yields. Currently, however, it's the 10-year yields that have started to rise more rapidly than short-term yields. In other words, the cause of the yield curve inversion fundamentally differs from previous instances when it foreshadowed a recession.

It's not that I believe the US economy will manage to avoid a recession. Instead, similar to the way businesses now operate differently compared to, let's say, 2019, I believe that the economic challenges are arising from a different source than in all previous recessions.

The famous Great Depression, the Great Financial Crisis, the Dot-Com Bust, and the European Debt Crisis were all crises triggered by a rapid decline in demand. Supply reacted to the falling demand, not the other way around. This is why Keynesian economic policies appeared effective on the surface – provide people with money, and they'll start consuming again.

However, let's consider the current situation: the US economy is doing reasonably well, yet the US government has spent over 1.2 trillion dollars more than in the previous year.

Hence, my continued argument is that we should refrain from drawing parallels with past recessions. The emerging economic challenges represent an entirely distinct phenomenon – a recession driven by supply-side factors. In the event of a significant misallocation of both workforce and capital, coupled with artificially sustained and increasing demand, the rise in interest rates can hinder investment activity. Consequently, artificially inflated demand intersects with a declining output.

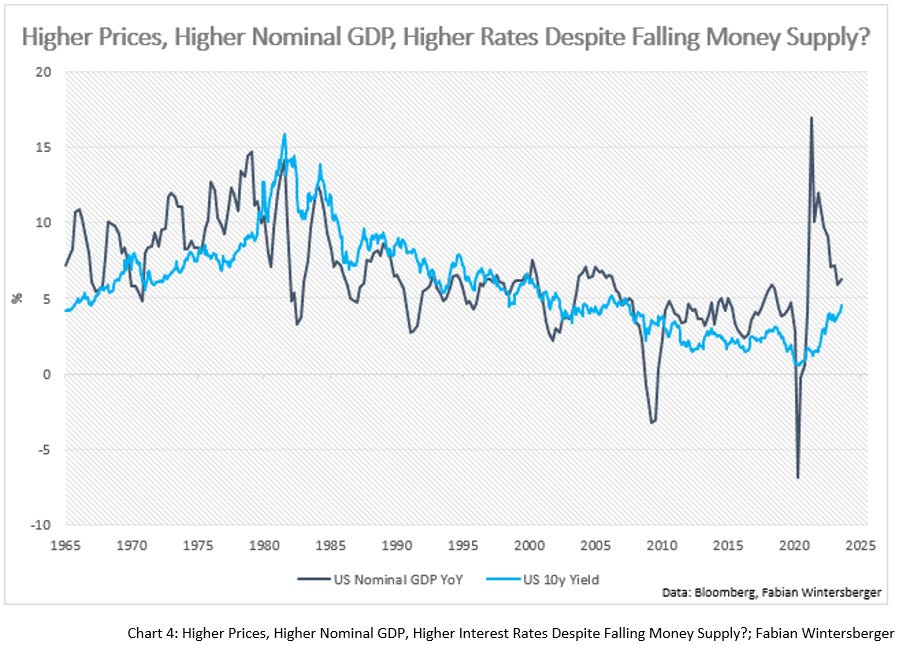

Nonetheless, this transition might be gradual, possibly taking some time. The fiscal situation in the US supports this notion. In this scenario, we might witness a situation in which the diminishing money supply is counterbalanced by higher nominal GDP and elevated interest rates. Interest rates typically follow nominal GDP since market participants consider both real growth and inflation as indicators.

Nevertheless, one can easily interpret the points mentioned above differently and make a case that they are indicators of a booming US economy, suggesting that a recession remains distant. While I may not align with this perspective, I consider it daily when pondering the markets and the economic landscape. Every narrative has valid points, yet the more intriguing question is whether it alters the outlook for price movements in interest rates, the stock market, or commodities.

However, let's now shift our focus to another situation reminiscent of "The Truman Show" that I'm currently observing. Europe is grappling with significant challenges, and yet, politicians seem to be turning a blind eye, seemingly believing they can defy the laws of physics. Since the conflict in Ukraine began, it has served as a convenient scapegoat for European politicians to explain high energy prices. While this argument may resonate with the average voter, it couldn't be further from the truth.

Europe is unquestionably the most ambitious in achieving net-zero emissions among all continents. Germany and Denmark already had the highest energy prices in Europe despite substantial subsidies for green industries and an increasing number of wind turbines and photovoltaic systems. The war has only underscored the critical need for manufacturing to access reliable, affordable energy.

However, not everything was set in stone. In fact, I believe that European politicians could have implemented policies to mitigate the impacts of the economic conflict with Russia. Achieving this, though, would have required a departure from Europe's "Not In My Backyard" (NIMBY) mentality. Unfortunately, European nations didn't embark on initiatives like exploring their own natural gas reserves to bolster domestic energy production, nor did Robert Habeck opt to maintain the nuclear power fleet, as I mentioned last week.

As I highlighted, the Green Industry recently pointed out that European energy prices are too high to support green production. This issue extends beyond just one sector; energy-intensive industries in Germany have been grappling with this challenge for a significant period, partly due to exceptionally high energy costs compared to other global regions. Much of this can be attributed to the policies that Robert Habeck and his party implemented since they entered the German government coalition.

Nevertheless, Robert Habeck remains steadfast in his approach. Instead of reevaluating his policies, he now talks about providing industry subsidies and relaxing Germany's debt limits. He's considering using taxpayers ' money to subsidize industries rather than implementing measures to lower energy costs for German producers and consumers.

However, the feasibility of this approach is questionable. Unfortunately, not a week passes without Robert Habeck facing the consequences of his unwavering policies. This week, even the poster child of Germany's green energy transition, Siemens Energy AG, has requested government support:

The company is seeking backstops over a two-year period after major shareholder and former parent company Siemens AG indicated it was no longer willing to help, according to people familiar with the matter. The company said Thursday it’s also speaking to banks, and the government confirmed the talks.

Siemens Energy needs the guarantees to win new large-scale contracts to build transmission networks and gas turbines. While those units are profitable, they’re now threatened by the strain that the string of losses from the Gamesa wind unit is putting on the company’s balance sheet in what has become one of Germany’s biggest industrial debacles.-BBG

Consequently, its shares plummeted by 40%. In my view, a bailout is now inevitable.

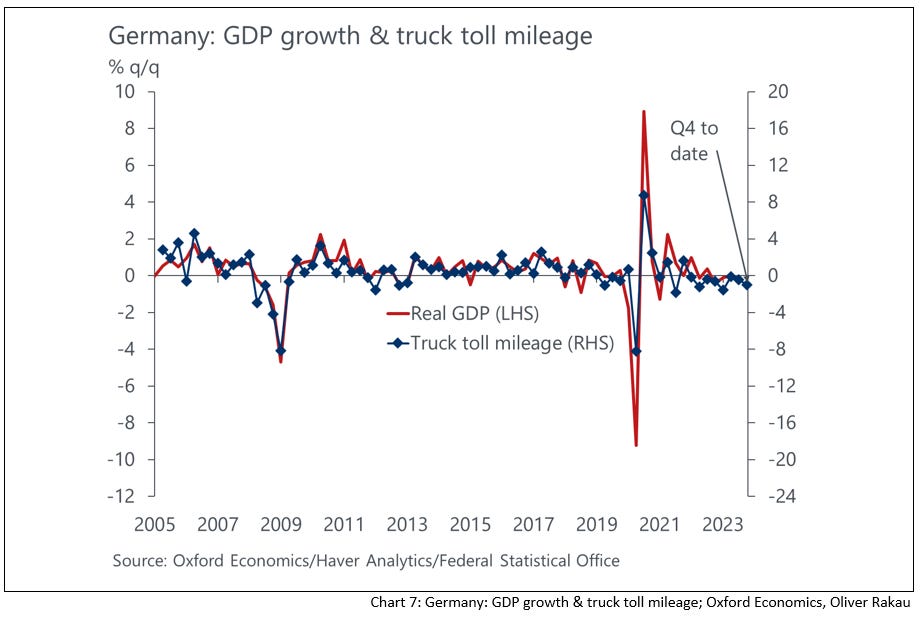

The European economy is already mired in stagnation, and despite the optimistic remarks from politicians and central bankers, the situation doesn't appear any more promising than it did the previous week, even with a minor upturn in the Ifo-Index. Oliver Rakau of Oxford Economics highlights that the trucking data indicators don't point towards an increase in Germany's GDP for the fourth quarter.

The situation continues to be highly uncertain, especially about the US economy and the much-anticipated recession, which has garnered significant attention. As I mentioned last week, the fact that many are beginning to retract their recession predictions may eventually validate my Q4 forecast. Nonetheless, this doesn't significantly alter my perspective on specific assets, such as equities, interest rates, foreign exchange, and commodities.

Effective risk management will be paramount in the weeks ahead. Next week, we'll delve deeper into the insights provided by the ECB in their recent announcement on Thursday!

I can't stand to let you win

I'm just watching you

And I don't know what to do

Feeling like a fool inside

Feeling all the love you hide

Thought you were my friend

Seems it never endsKoRn - Somebody, Someone

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

(Please note that all posts reflect my personal opinions and do not represent the views of any individuals, institutions, or organizations I may or may not be professionally or personally affiliated with. They do not constitute investment advice, and my perspective may change in response to evolving facts.)

Every time I consider the buffoonery that passes for US energy policy I simply look at Germany to help me recognize that there is someone even stupider. To me the real question is with inflation remaining sticky, when recession comes, will the central banks be forced to cut rates in the front end of the curve? I'm guessing that there will be different responses by different central banks, but that the last cuts will come from Powell and the Fed. As such, I foresee another wave higher in the dollar, recession be damned.