Shogun

The Pivot that Spooked Duration

Japan never considers time together as time wasted. Rather, it is time invested - Donald Richie

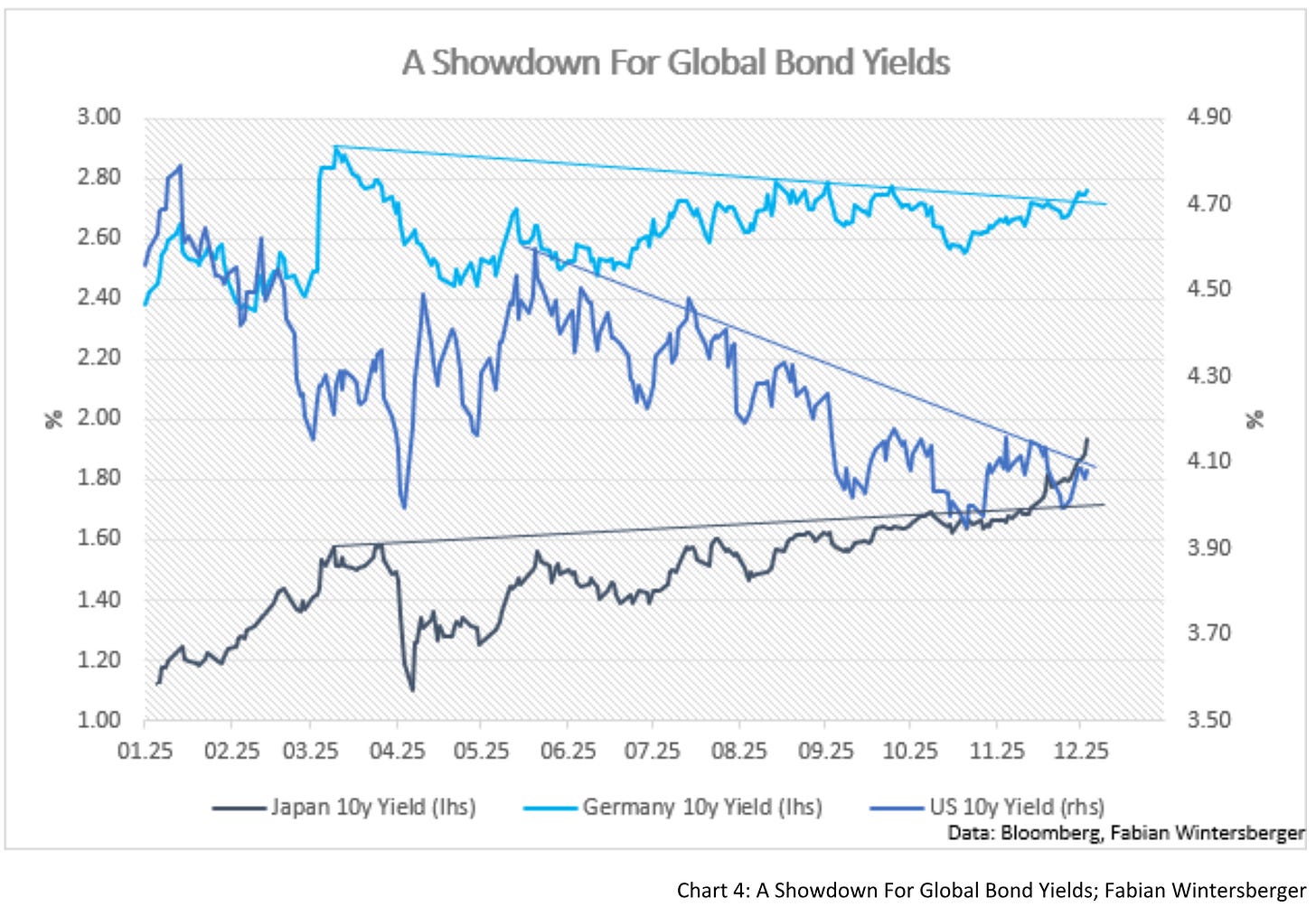

The rhythm of financial markets often resists simplistic prediction. Last week’s commentary suggested a potential breakout in the bond complex toward higher highs. That thesis quickly met a headwind, and the price of German bonds retreated sharply back to a critical support nexus, where it has stayed—for now.

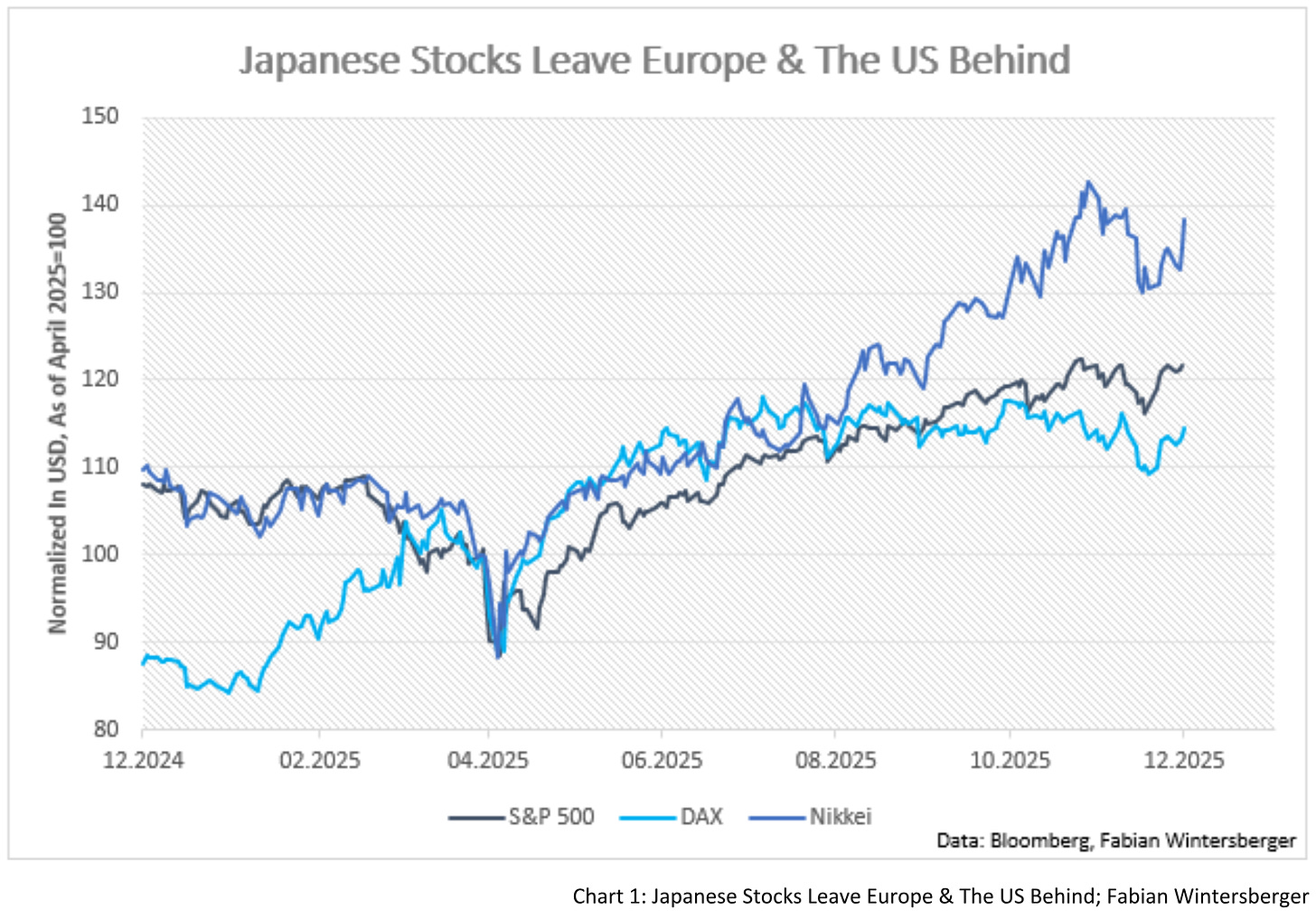

But first, let’s get to the other financial markets. The stock market has recovered from the lows, and more and more people are seeing an increasing probability that the S&P 500 might close the year around 7,000 points (currently, we are at 6,850). America again clearly outperformed Europe from the lows in April.

Obviously, people prefer to buy stocks from an economy that is still in expansionary territory rather than from one that is stagnating. Although the Purchasing Manager’s Indices (PMIs) from this week again showed that businesses are optimistic about the outlook, so far it hasn’t been reflected in European stock prices.

But while European stocks are falling behind, another part of the world has outperformed the US, namely, emerging markets. Japanese stocks are exploding on the upside, and the divergence has widened further since Takaichi Sanae won the election in October, also adjusted in USD terms.

When we look at precious metals, gold is trading only slightly below its September high, clearly in an upward trend. I have emphasized the importance of gold in a portfolio for a few years now, and regardless of what the price does in the short run, the macroeconomic fundamentals likely justify more all-time highs in the long run.

But the main story in precious metals recently has been in silver. Unlike gold, silver has a much higher industrial utility. While gold primarily serves as a form of money, a transfer of purchasing power over time and space, silver is a critical supply input in various industries. It’s used in watches, electric vehicles, batteries, solar panels, and other applications.

That means that the wide-use purpose of silver, historically the money for the masses, manages to squeeze the price higher. If the use of silver for monetary purposes (I include the production of jewelry here, because it’s also a form of saving that can be liquidated in times of crisis) increases, producers of real economic goods need to bid up the price further to acquire it as well. The fact that its exchange rate to fiat is much lower than gold's also makes it more accessible to retail investors, which adds volatility to its price.

As I wrote about Bitcoin last week, it’s worth noting that it recently found a bottom around $85,000. Yet, over shorter time frames, the performance lags behind that of gold and silver. This year, it is down 2% so far, while silver has almost doubled, and gold is up more than 50%. Over the long run, however, it’s likely that Bitcoin still has more upside than both, given that the demand for it increases further.

On the commodity side, EUR/USD has defended its resistance at 1.15 and is now trading back to the high of its recent range, close to 1.17. Oil prices (WTI) are still below $60/barrel, while copper prices have continued to recover, breaking out of its recent sideway trend.

But now, back to global bond markets. As previously mentioned, long-term government bond prices didn’t rise further and were sold off again. While the economic fundamentals in Europe and the US didn’t change, there must be another reason for the sell-off. To be honest, I also underestimated the impact of Japan, so I asked myself this week:

Maybe we should pay more attention to what’s happening in Japan?

The Japanese economy never recovered from the bust of its housing bubble in the late 1980s. Despite being the first to implement Quantitative Easing and the Negative Interest Rate Policy (NIRP), the money never reached the real economy enough to lift growth. Various governments tried to boost growth with stimulus programs, but if anything, they only helped keep GDP from falling. Similar to the Eurozone, Japan is an export-driven economy, and the weak GDP growth back then suggests that profits weren’t reinvested in the real economy but were instead sent abroad.

What made this possible was the Yen Carry Trade, in which Japanese investors borrow yen at low rates, convert them into dollars, and buy USD assets. A strategy that works as long as the dollar keeps appreciating against the yen. That kept money out of the Japanese economy and helped drive up asset prices elsewhere.

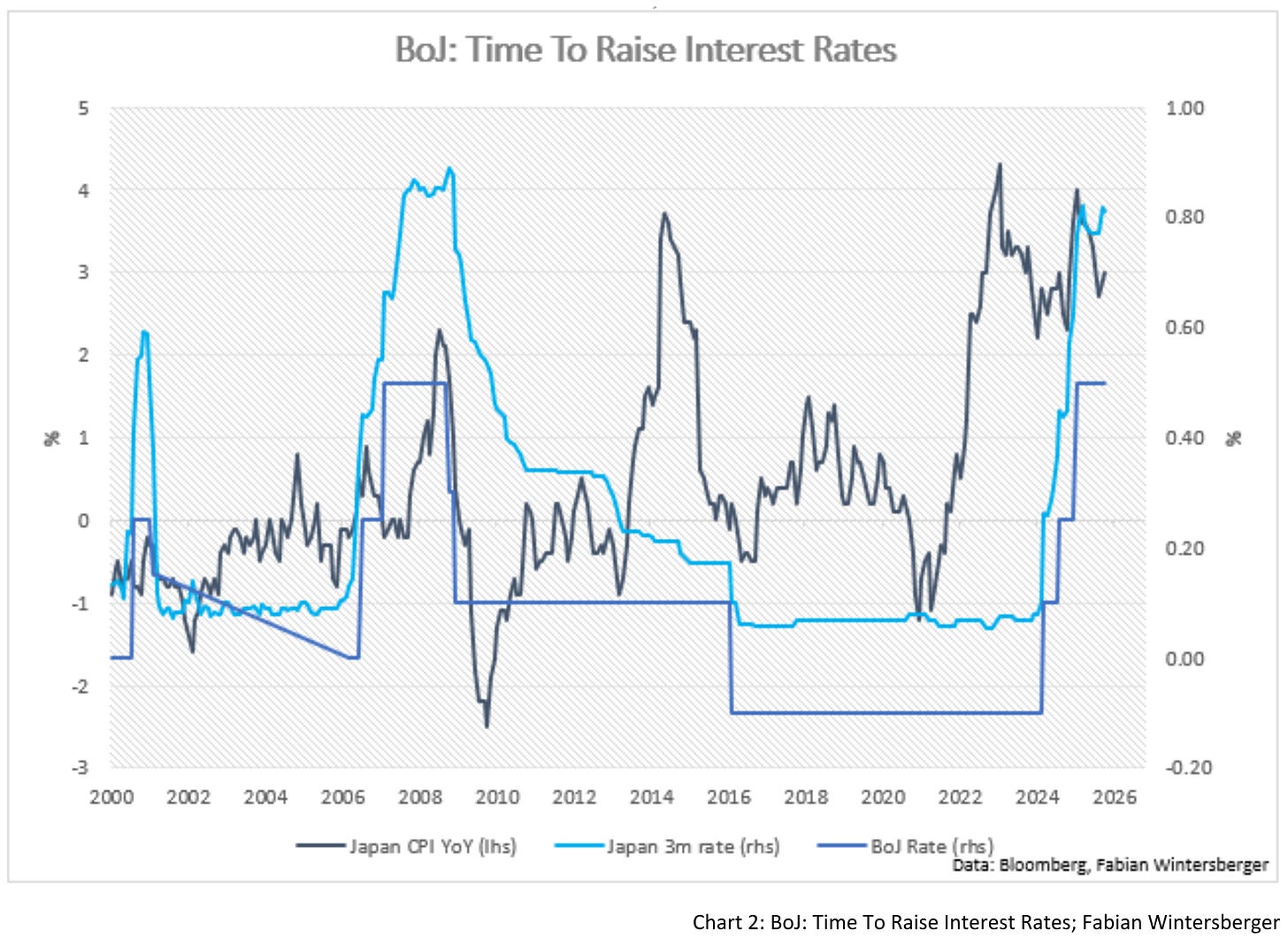

Yet, the COVID policies, the subsequent expansion of the global money supply, and the energy price jump also led to higher inflation in Japan. Since early 2022, the Consumer Price Index (CPI) has remained steadily above 2%, which doesn’t bode well given that interest rates are still close to the zero bound. On Monday, Bank of Japan (BoJ) Governor Ueda hinted that the central bank will raise interest rates in December, despite the government’s high debt-to-GDP ratio.

That move coincides with the new prime minister, who, despite thinking of herself as a Japanese Margaret Thatcher, already announced that she is planning to implement another stimulus program for the Japanese economy. That’s likely one of the reasons for the euphoria in Japanese stocks.

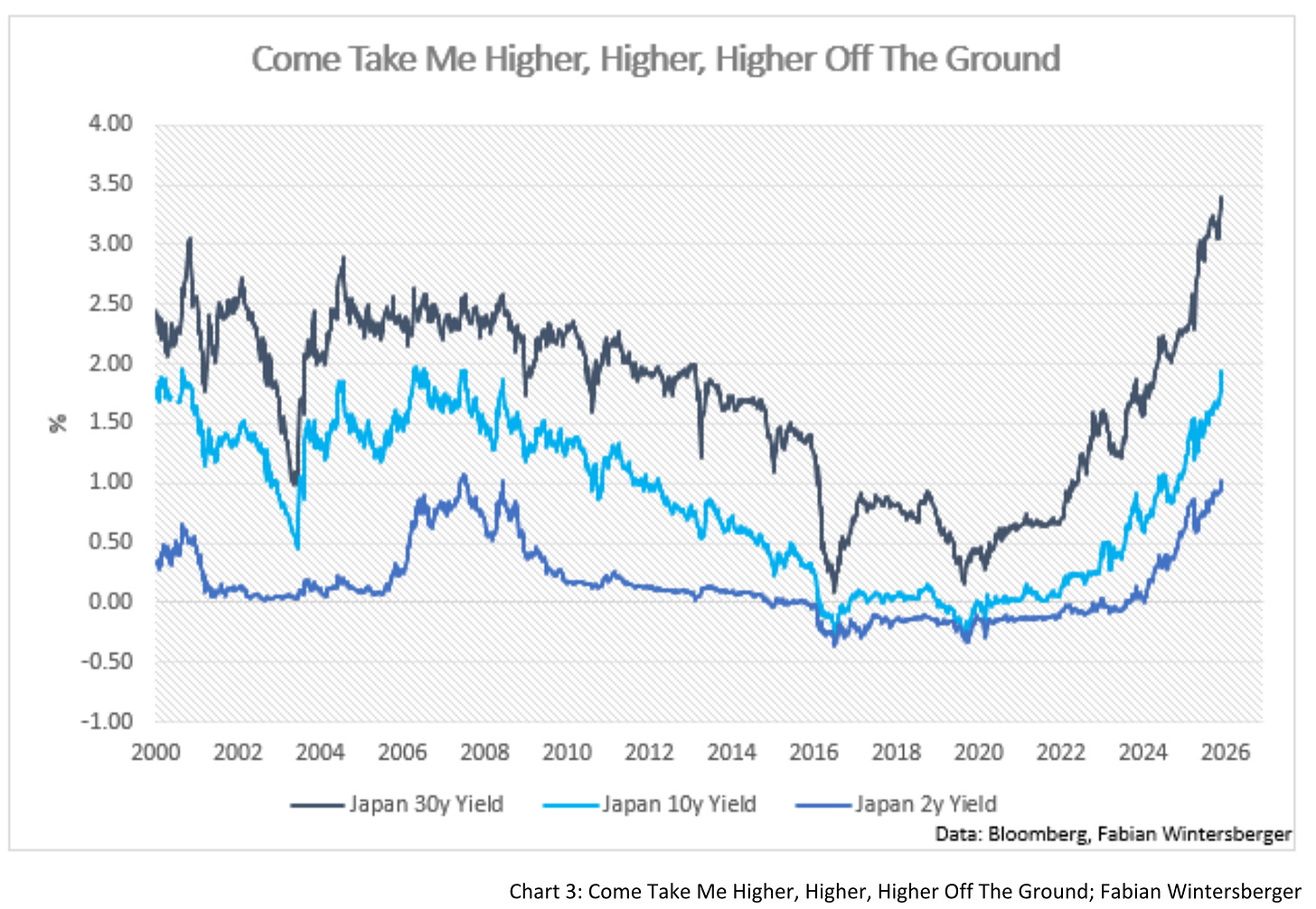

New stimulus programs, high CPI, and higher short-term rates are clearly affecting long-term government bond yields. And therefore, it’s no surprise that Japanese bond yields have increased, bringing the 30y yield to a century high and the 10y yield to 2008 levels. Shorter 2y-yields also increased above 1% for the first time in 17 years.

The effect wasn’t contained within Japan; it spooked bond traders worldwide. European and US bonds also began to sell off. The reason is simply that higher yields in Japan may prompt Japanese investors to reallocate capital. If domestic yields are more attractive than foreign yields, more domestic investors might invest in domestic markets. The demand for long-term bond yields in Japan this week has been pretty solid, supporting this thesis. The rise in Japanese yields has led to a breakout in Bund yields and brought US yields close to the upper trend line of its recent downtrend.

Some market observers have already warned that the Japanese carry trade will blow up financial markets due to the recent move in Japanese interest rates. I don’t think we’re at that stage. For one, even a coming rate hike by the Bank of Japan still keeps interest rates below European and, especially, US policy rates. Second, the USD/JPY exchange rate is still at recent highs, which doesn’t suggest a rush out of the dollar into the yen.

The Bank of Japan is well aware of the financial risks these rate hikes could pose, which is why they’re moving so slowly. Of course, one cannot rule out that there’s a point in time in the future where things might get out of hand. But at the moment, the move reflects only a repositioning of market participants, not financial stress or a looming crisis.

What also goes against this narrative is that US stock markets are trading at all-time highs. If there were an unwind of the carry trade, the market would likely trade at lower levels than it does today. These aspects speak against the fear-mongering of some people, in my opinion.

But how does that impact my view on markets? For the stock market, I still think we'll continue to move higher into year-end, with US stocks leading and European stocks lagging.

When it comes to bonds, the situation has changed, as bond prices have fallen back to key resistance levels. If this resistance holds, we might see prices rise. However, I am not so sure that this will happen. At the moment, things point more to a continued sell-off down to a lower price level. Again, time horizon and risk tolerance become important here if one remains bullish on bonds.

For the US dollar, there are good reasons to believe it will go higher, but also many reasons it could go lower. As my thesis of dollar-appreciation seems to have failed, at least in the short run, it’s probably a good time to wait and see what the price does.

The recent developments in Japan, influenced by both government and central bank policy, represent a notable shift in the global financial landscape. While some narratives focus on a potential market upheaval from the unwinding of the yen carry trade, the current market response suggests a more measured repositioning of capital. For now, the US equity market remains resilient, but the higher yields in Japan could continue to influence global bond markets. Investors are therefore wise to continue observing Japan’s evolving policies and their broader impact, always considering their own risk tolerance and investment horizon.

Time will not heal all of your pain

I cannot wait for it all to come crashing

DownTrivium – Shogun

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you could share it on social media or give the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. THEY DO NOT CONSTITUTE INVESTMENT ADVICE, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.