The desire of gold is not for gold. It is for the means of freedom and benefit. ― Ralph Waldo Emerson

Executive Order 6102, signed by US President Franklin D. Roosevelt on April 5, 1933, was a pivotal measure during the Great Depression to stabilize the US economy. The order mandated that all individuals and entities possessing significant amounts of gold coins, gold bullion, or gold certificates were required to deliver them to the Federal Reserve in exchange for US dollars. This effectively prohibited the private ownership of gold and sought to centralize gold reserves to combat deflation and stimulate economic recovery.

At the time of Executive Order 6102, the United States was in the midst of severe economic turmoil. The Great Depression caused widespread unemployment, bank failures, and a contraction in industrial production. The government sought ways to restore confidence in the financial system and inject liquidity into the economy. By confiscating privately held gold, the Roosevelt administration aimed to increase the money supply and boost consumer spending, which was crucial for reviving economic activity.

The executive order was met with mixed reactions from the public. Some saw it as necessary to stabilize the economy and prevent gold hoarding that could worsen deflationary pressures. Others viewed it as a government overreach infringing on individual property rights and personal freedoms. Many Americans complied with the order and surrendered their gold holdings, fearing legal repercussions or believing in the government's efforts to combat the economic crisis.

Executive Order 6102 had far-reaching implications for the US monetary system and the role of gold in the economy. It effectively ended the gold standard for private individuals and strengthened the government's control over monetary policy. The Federal Reserve became the sole holder of gold reserves, allowing it to expand the money supply by issuing more currency backed by gold reserves.

One of the executive order's immediate effects was the devaluation of the US dollar against gold. Shortly after the order was issued, the government raised the official price of gold from $20.67 to $35 per ounce. This devaluation aimed to stimulate exports and increase the competitiveness of American goods in international markets. However, it also fueled concerns about inflation and the dollar's long-term stability.

Executive Order 6102 had implications beyond domestic economic policy. It signaled a shift towards more significant government intervention and laid the groundwork for expanding monetary and fiscal policies to combat economic downturns. The order set a precedent for future government actions during times of crisis, highlighting the tension between individual liberties and the need for collective economic stability.

In retrospect, Executive Order 6102 remains a controversial and consequential chapter in US economic history. It represented a significant departure from traditional monetary policies and underscored governments' challenges in balancing economic stability with individual freedoms. The order's impact extended well beyond its immediate economic objectives, shaping public perception of government intervention in financial matters and influencing subsequent policy decisions during periods of economic uncertainty.

Today, 91 years later, gold is once again making headlines. Year-to-date, the gold price has risen by about 14% to around $3,337. Interestingly, this increase has occurred amid rising real interest rates. US 10-year real yields have also climbed by 25% for the year, typically suggesting a decline in gold prices. Gold, a non-interest-bearing asset, would generally experience reduced demand as investors shift towards interest-bearing assets like bills or bonds in response to higher yields.

However, in this cycle, this conventional rule appears to have been broken. The gold price has traded sideways throughout the period of rising real yield, which is attributed to actions by the Federal Reserve and other central banks to raise interest rates.

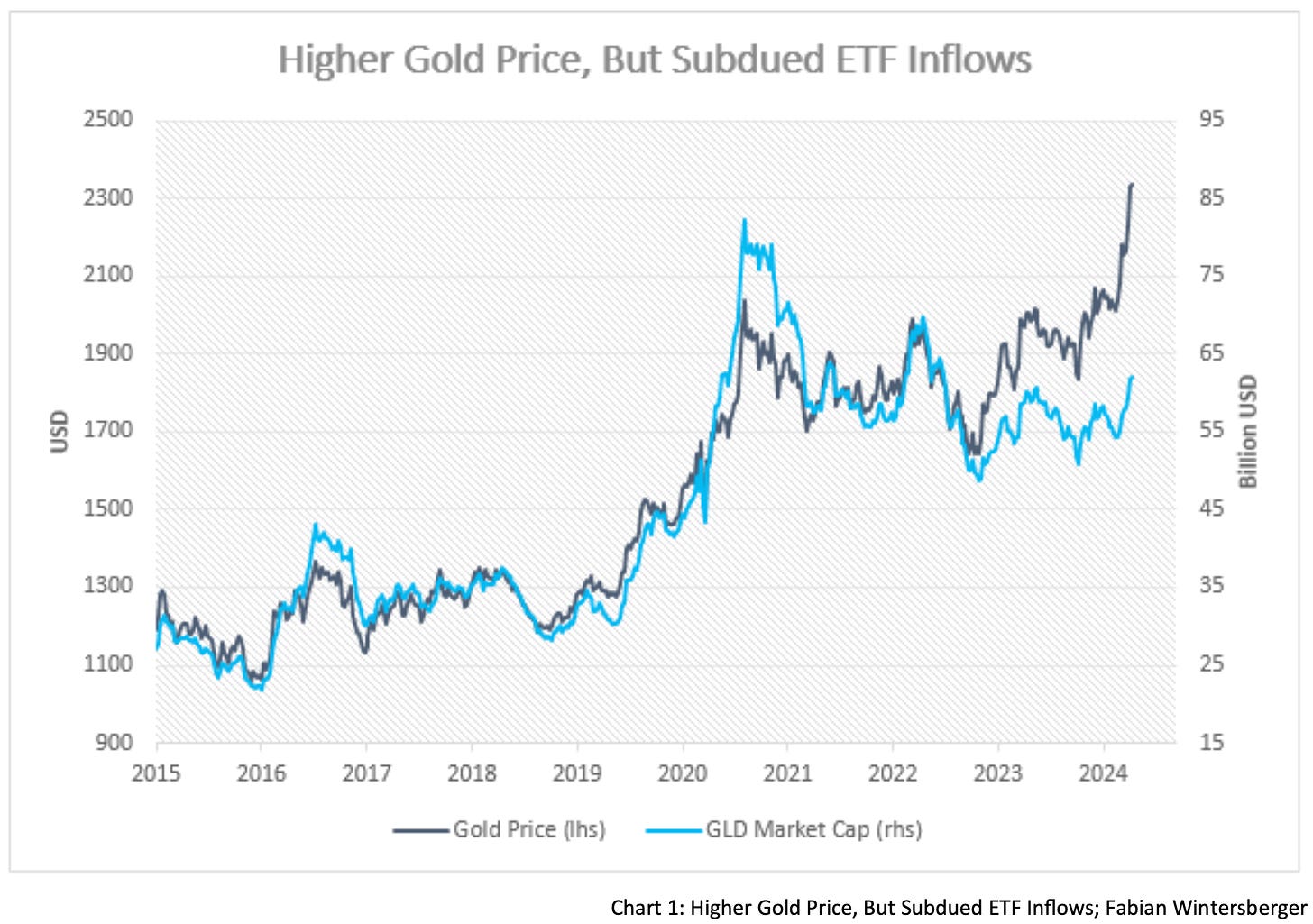

Notably, the demand for gold does not seem to be driven by Western markets. Examination of the market capitalization of Western gold ETFs reveals that despite gold prices reaching all-time highs, the market cap of GLD, the largest gold ETF in the US, is now only marginally higher than in March 2023.

Where does the demand come from when investors in the West are not buying gold? The answer lies in the East. Central banks worldwide, particularly in the Eastern regions, have significantly increased their gold holdings since 2020. Notably, countries like China, India, and Turkey have been actively accumulating gold reserves.

Another significant factor contributing to this trend is the geopolitical divide between the West and the East, often called the "new cold war" by geopolitical analysts. Freezing Russian FX reserves in response to Russia's actions in Ukraine has prompted countries to reassess their use of accumulated trade dollars.

However, the theory of geopolitical tensions alone does not fully explain the surge in gold prices. Simultaneously with the increase in the gold price, foreign treasury holdings also rose by $766 billion in 2023. This suggests a speculative aspect to the recent rise in gold prices, with gold investors possibly anticipating a return to more expansionary monetary policy.

That brings me to Wednesday’s inflation numbers from the US, which shook up the market again for the second time in a few days after the shockingly strong NFP report.

Consumer prices rose by 0.4% instead of the expected 0.3% increase from February, maintaining a steady month-over-month inflation rate. Annualized inflation remained 4.8%, well above the Fed's 2% target. Consequently, the bond market reacted by selling off, with futures markets adjusting expectations and pricing out the possibility of a third-rate cut by the Federal Reserve.

The CPI report highlights concerning trends, with the newly introduced "Supercore" measure of CPI registering a 4.8% year-over-year increase. Notable price increases include transportation services (10.7%), services excluding energy (5.4%), and car insurance (22.2%) compared to the previous 12 months.

The Federal Reserve's data-dependent approach has heightened market sensitivity to inflation reports as investors gauge the Fed's future policy moves. The Fed's lack of clear communication on its next steps has contributed to market volatility around such events.

Furthermore, the US Treasury's decision to conduct a 10-year bond auction on the same day as the inflation report resulted in a disastrous outcome, exacerbated by the alarming inflation figures. That led to a spike in yields, pushing US 10-year yields to 4.56%. From a chart perspective, there is now potential for yields to rise further towards 5%.

While a modest yield increase remains plausible, a 50-basis-point rise in the 10-year yield is less convincing. Many analysts argue that the second wave of inflation has just begun and that current interest rates are insufficient to curb inflation back down to the Fed's 2% target.

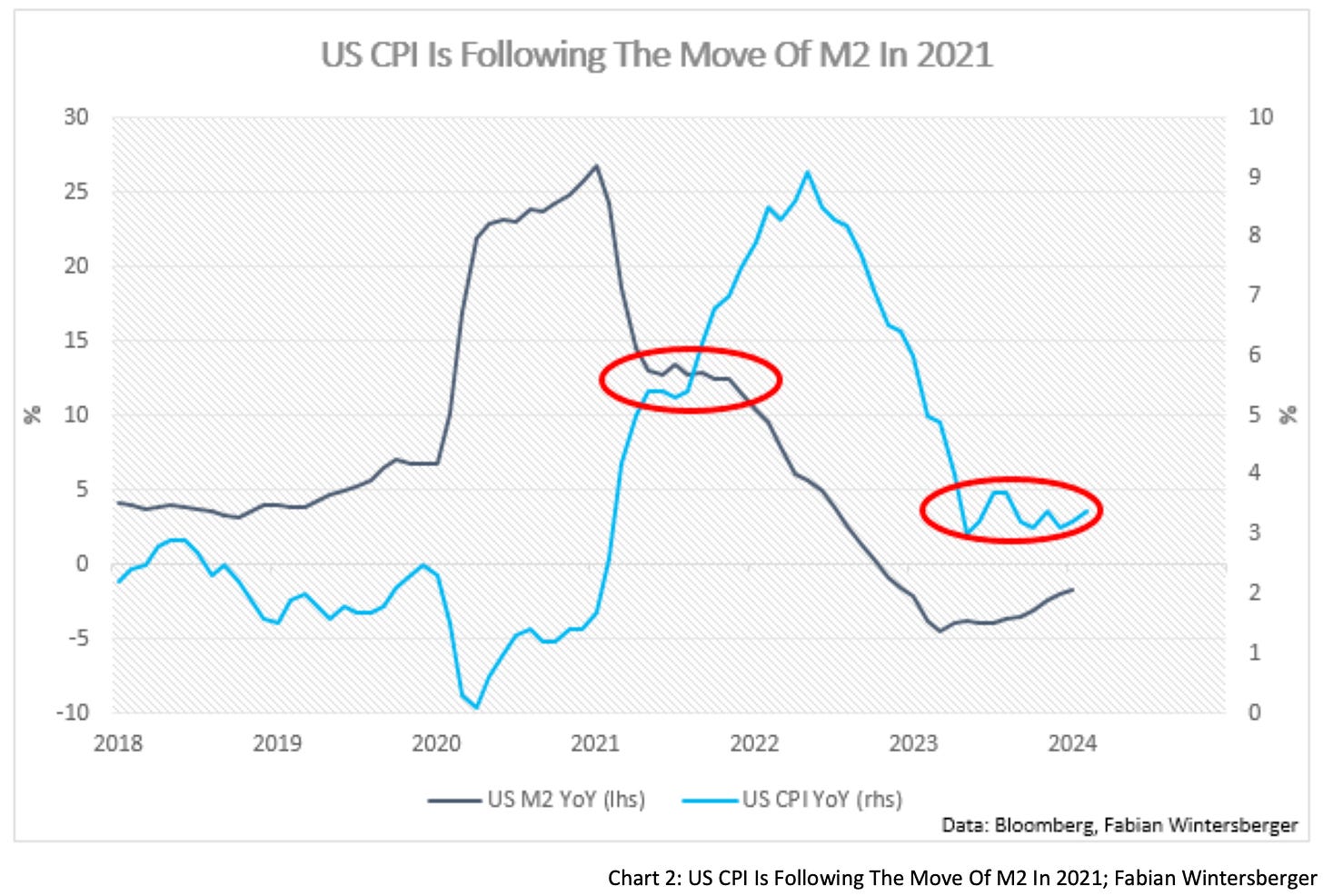

Many analysts primarily attribute inflation to recent price movements, assuming that these movements will persist into the future. However, this approach often overlooks the significance of monetary developments from previous periods.

A more comprehensive assessment, considering changes in the quantity of money over time, presents a notably optimistic outlook when evaluating future consumer price trends. Analyzing monetary aggregates reveals that the recent modest upward trend in consumer prices closely aligns with shifts in the money supply during 2021.

Between May 2021 and February 2022, the growth rate of the money supply plateaued, indicating that consumer price deflation would eventually stabilize and transition into a sideways movement. This prediction materialized around July 2023, as inflation settled around 3%. Looking ahead, projections based on the money supply suggest that inflation may decrease in the second quarter and potentially reach the Fed's target of 2% by the third or fourth quarter of this year.

Somehow, there's a widespread belief that slightly higher inflation reflects a well-running economy, driven by the assumption that a tight labor market boosts wages and, subsequently, inflation. However, while this might seem intuitive, the reality is far from clear.

Firstly, rising wage costs influence business behavior, prompting consideration of reducing workforces to allocate resources toward capital goods spending and decrease reliance on labor. Consider the example from last week regarding California's minimum wage, where businesses began installing self-service order terminals to mitigate wage expenses.

Secondly, the fear that rising wages will drive inflation is a misconception that holds true only with a constant influx of money into the real economy. Higher wages necessitate price adjustments for other production factors without additional currency, encouraging businesses to shift from labor to capital.

Examining wage growth trends reveals no wage-price spiral in progress, as wage growth is slowing down. That aligns with the typical money supply trajectory: initial increase, followed by inflation and then wage growth.

The latest Nonfarm Payrolls significantly exceeded expectations, with 303,000 jobs added against an expected 214,000. The unemployment rate dropped to 3.8%, and average hourly earnings growth slowed to 4.1% year over year.

Despite positive job numbers, concerns persist, notably the gain in part-time employment while full-time jobs decreased by 6,000. Since November, the US economy has lost 1.8 million full-time positions.

The NFIB Small Business Optimism Index, reflecting the state of small US businesses, unexpectedly dropped to 88.5, the lowest since December 2012, indicating continued subdued confidence among owners.

In the labor market, job openings remain significant, but overall, difficulty in filling positions has slightly eased, particularly in the transportation, construction, and services sectors. Plans to create new jobs in the next three months have slowed, reflecting decreased small business optimism.

Capital spending remains notable, with recent outlays on equipment and facilities, but future investment plans have decreased slightly amid economic and policy uncertainties. High financing costs hinder longer-term investment decisions, affecting labor supply chain issues.

Increasing costs, followed by sales volume, pose the most significant challenges for small businesses, with current inflation strength likely to further dampen optimism and potentially impact the broader economy, given small businesses' role as its backbone.

Historically, declining small business optimism often signals impending nominal GDP growth contraction. The current significant divergence between optimism and nominal GDP suggests a potential decline in coming quarters, raising concerns about its severity.

Obviously, the current economic landscape seems to favor large businesses over small ones. That raises the question of whether this support will sustain the economy going forward. It appears to be sufficient for now, though, suggesting short-term strength in the stock market.

However, the recent rise in yields hints at a potentially rocky road ahead. Since April, the VIX has climbed by about 24%, from 13.65 to 16.37, while the MOVE has surged by 16%, reaching levels not seen in the past decade, where bond market volatility was significantly lower.

Could this signal impending economic turmoil? It's hard to say. Despite recent volatility spikes, high-yield and corporate bond spreads are nearing record lows, suggesting the opposite. With the consensus leaning towards a "higher-for-longer" scenario, the outlook is that the US economy will continue to perform well in the coming quarters.

This outlook contradicts what the gold price typically indicates, as gold usually rises in times of economic uncertainty. However, the Keynesian policies of the Biden administration have proven successful so far, driving economic activity. Yet, the European experience in the early 2000s suggests that this success may be short-term gain at the expense of longer-term consequences.

In the short term, the US treasury market remains subdued, with market participants anticipating continued inflationary pressures in the months ahead. While this may weigh on sovereign bonds globally, the current situation hints at a developing divergence.

While US CPI appears to be accelerating, Eurozone CPI figures give the ECB room to consider interest rate cuts. This comment predates the ECB decision on Wednesday, but I wouldn't be surprised if we receive guidance on potential upcoming cuts. I firmly believe the ECB will act before the Federal Reserve in this easing cycle.

Consequently, we might see European sovereign bond prices diverge from treasuries, potentially rising while US bonds hold steady or even decline. Although this could impact European government bonds, the ECB's interest rate cuts are expected to have a more substantial effect, limiting the downside.

The stock market isn't likely to experience significant downside in the short term, although rising volatility remains a possibility. The short-term outlook for the stock market remains positive, suggesting either further upside or a sideway movement, although rate-sensitive indices like the Russell 2000 could face some downward pressure in case yields continue to rise.

Furthermore, ongoing expectations of minimal interest rate cuts this year could weigh on the gold price in the short term, prompting a correction or consolidation. However, the shadows inside the data regarding the real economy could serve as a tailwind for gold due to the monetary and economic policies that would follow in such a case.

Caught in the flames, there's nowhere to hide

New light will break the shadows inside

Embrace the change and then you will find

New light will break the shadows insideMiss May I – Shadows Inside

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. It is strongly recommended to seek independent advice and conduct your own research before making investment decisions.