Savior

Policy Revaluation: The Structural Decoupling of Bitcoin's Risk Correlation and Central Banks' Fiduciary Role as Market Arbiters.

It’s sort of like a teeter-totter; when interest rates go down, prices go up - Bill Gross

I’ve spent the week analyzing the price action in financial markets, leading to one recurring thought:

The signs were there – although the jury is still out.

Since the US government ended its shutdown, some of the missing data points began to be published. Thursday, after I finished “Do or Die,” the Bureau of Labor Statistics (BLS) released the September NFP report, which showed an increase of 119,000 jobs, rather than the expected 52,000. That was the moment the price action in the bond market became interesting.

Usually, one would expect that a beat in NFPs (accompanied by continuously solid jobless claims) would translate into spiking long-term rates due to higher expected growth and the assumption that interest rates will stay higher for longer. However, the initial sell-off, although strong at first, was quickly erased. That was the time one should have raised an eyebrow.

Then, on Friday, the price action in US Treasuries and German Bunds got even more intriguing. Long-term bonds started to rally, and 10y Treasury Futures broke out of their sideways channel from November. Bunds and 30y Buxl Futures of Germany also rallied. Although yields are only slightly lower today (Thursday), the short-term price action suggests that bonds might rally further from here.

Remember last week, when I wrote about the diminishing probability of a Fed cut in December? Well, that has completely reversed after several FOMC members came out and declared that they support cutting rates in December. As I wrote last week, risk management played a crucial role. The bull thesis for bonds into year-end remains intact.

And also, my hunch from a month ago now faces an increasing likelihood of becoming a reality:

Clearly, markets got a bit spooked by Powell, but in the end, the wording (albeit hawkish-sounding) isn’t much different from “we decide meeting by meeting.” In my opinion, these hawkish comments will be eradicated by other members, and the market will price in a higher probability of a rate cut in December.

The news flow since the NFP release has conclusively shifted the rate-cut sentiment back to a December cut. The influential New York and San Francisco Fed Presidents, John Williams and Mary Daly, now declared they will support a cut in December. While others seem to favor holding rates steady, rumors that Trump’s White House National Economic Council Director Kevin Hassett has a good chance of becoming the next Fed Chairman served as another policy tailwind for bonds.

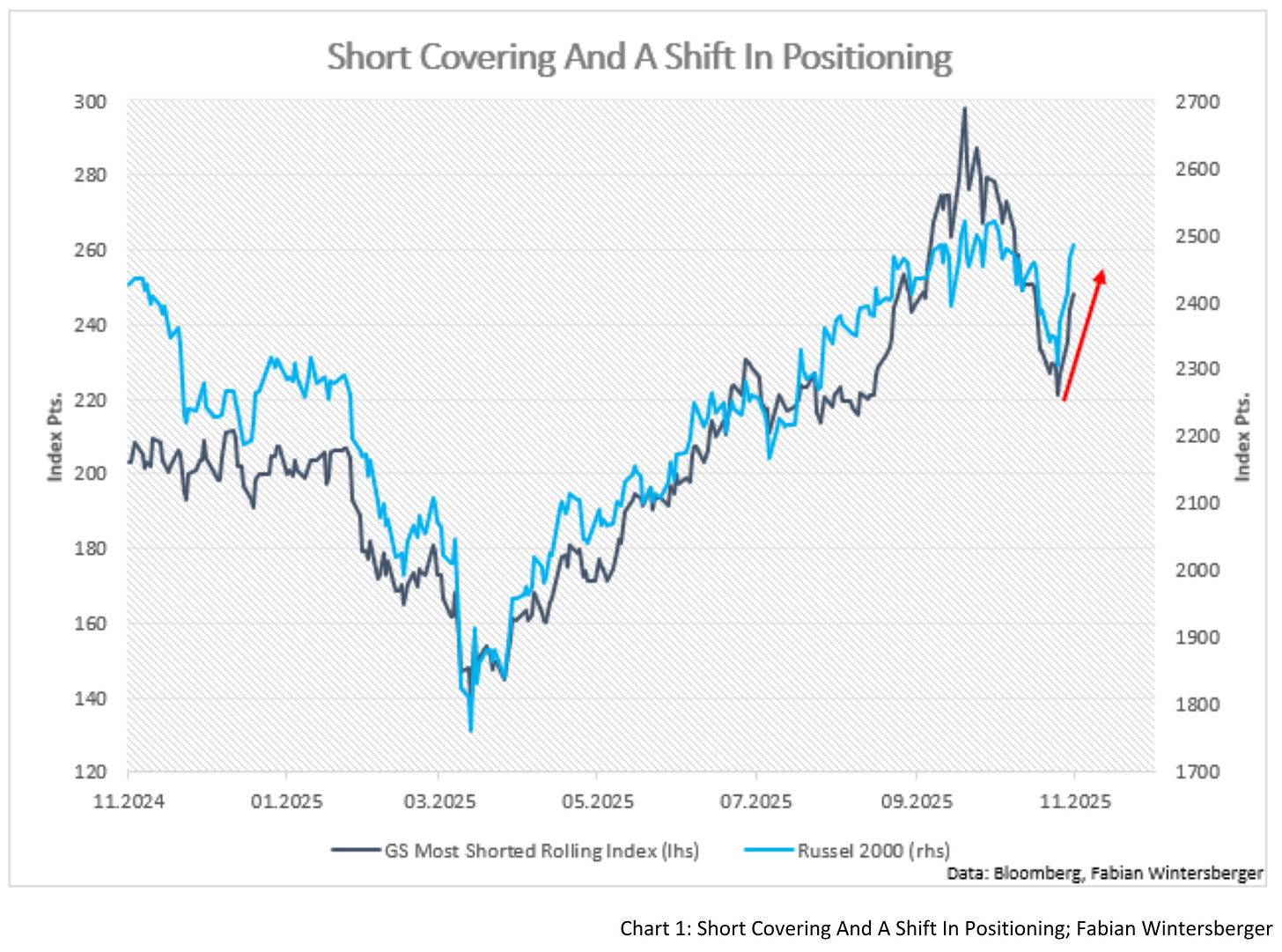

Stocks also benefited from these developments. After selling off on Thursday following the NFP release, they recovered on Friday. What’s notable is that the Magnificent Seven cohort has been flat since the November 20 opening (NVIDIA is down 7%) while the Russell 2,000 is up almost 4%. Is this a definitive sign of capital rotation out of mega-cap growth and into smaller stocks? I don’t know, but the coming price action will tell us, for sure. The Goldman Sachs most-shorted-stocks basket suggests a short-covering dynamic is pushing the price higher.

The dollar also hit its low last week and has since appreciated, which can only be interpreted as tacit support for asset prices. However, the mid-term trend shows that the dollar has been up since the beginning of September, and so have US bonds and equities. I suspect that the dollar's strength is more a reflection of the systemic weakness of the Euro, the Pound, and the Yen, rather than a sign of domestic dollar strength.

My reasoning here is that the gold price has remained remarkably resilient so far and is still above $4,000. Therefore, my view remains that we might see a continuation of the rally in stocks, bonds, and the dollar. The seeds are sown, but the jury is still out, especially for German long-term yields, which have yet to break their short-term uptrend.

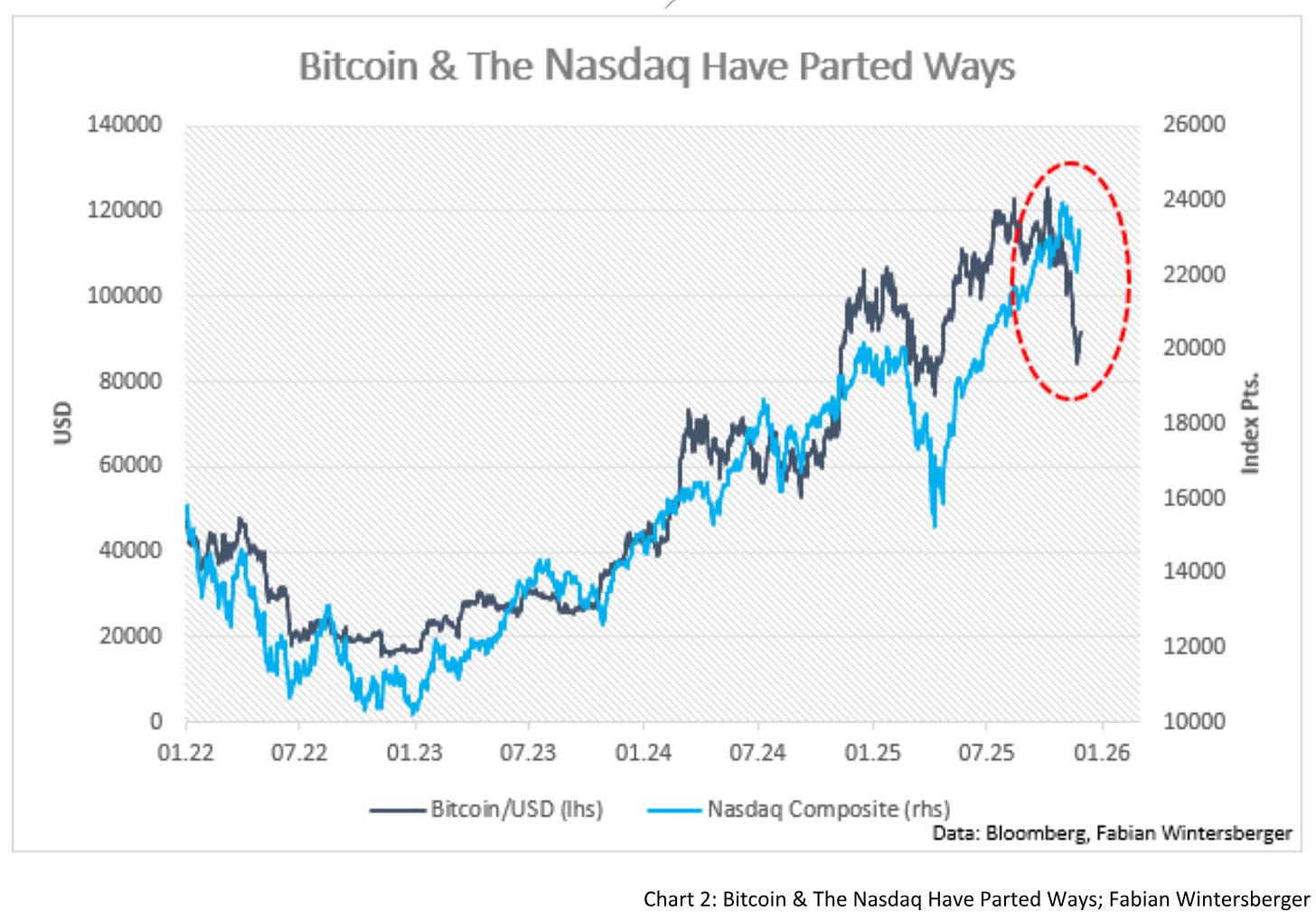

One other interesting thing, though, is the latest price action in Bitcoin. Bitcoin has been called a proxy for risk assets for quite some time now due to its correlation. Yet, unlike stocks, the Bitcoin price didn’t recover, and the script has flipped from bullish to bearish.

If one assumes the correlation still holds, one should either expect Bitcoin to resume its upward trend or the Nasdaq to have more downside. Bitcoin is usually considered an asset farther out on the risk curve, so a drop in its price could signal that market participants are moving toward safer assets. Considering the drop in bond yields, that seems reasonable. However, the question is why small caps rallied, as they’re usually considered riskier than larger companies.

However, as a long-time observer of Bitcoin, one should note that the correlation between Bitcoin and other assets comes and goes over time. Therefore, I don’t think one should abandon the view that the correlation pattern of the last few years is starting to break down. Maybe the market environment is changing, with Bitcoin prices steady or falling and further upside for stocks.

Albeit no one knows for sure, let’s just assess what such a scenario could look like. Since all prices result from supply and demand in the marketplace, a falling price of Bitcoin simply reflects that supply increases while demand does not. Since the price of Bitcoin has appreciated significantly over the last decade, some people may consider cashing out their positions to buy a home, less volatile assets, or something else.

Such a scenario isn’t implausible, in my opinion. While there might be a continuously growing demand from institutions, it’s unclear how sufficient it is at the moment. The latest correlation with risky assets suggests it’s seen more as a vehicle for leveraged upside than as a diversification asset. If these buyers switch back to “normal” risk assets, prices suffer. If some retail buyers also opt out, the short-term trajectory points down unless demand comes from elsewhere. The obvious next marginal buyer would be governments or central banks, but I don’t expect it to happen on a large scale anytime soon (if ever). Hence, I conclude that the divergence in the correlation between Bitcoin and risk assets is the beginning of a structural rotation and that it won’t return anytime soon. Bitcoin prices might struggle in the coming months until a bottom is found.

To sum it up, the price action in bonds and stocks could indicate that the year-end rally is still a possibility, albeit probably not for Bitcoin. Regarding the dollar, it’s not yet clear, but if its strength continues, it might not be a substantial drag on risk assets, since it would stem from the weakening of other currencies.

Since a FOMC rate cut in December is becoming increasingly likely, the situation in Europe remains that the market doesn’t expect one. I think this could turn out to be correct, but the further weakening of the German economy might lead to a less hawkish stance than in October. I think one should be aware that 2026 could be a year with many more rate cuts than are currently priced in. In the short term, central banks will be the savior of markets. In the long run, we have to see...

That’s when she said

“I don’t hate you boy

I just want to save you

While there’s still something left to save”Rise Against – Savior

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you could share it on social media or give the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. THEY DO NOT CONSTITUTE INVESTMENT ADVICE, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.