Everyting comes in time to those who can wait - Francois Rabelais

Markets have remained relatively calm, though participants were eager to hear Jerome Powell and the Federal Reserve’s assessment of the U.S. economy’s current trajectory.

In his FOMC press conference, Powell reaffirmed the Fed’s commitment to its dual mandate of maximum employment and price stability amid heightened economic uncertainty. The economy remains robust, with unemployment at 4.2% and a labor market near full employment, reflecting balanced conditions without significant inflationary pressures.

Inflation has moderated since its 2022 peak but remains above the Fed’s 2% target. Recent PCE inflation is at 2.3%, and core PCE is at 2.6%, partly driven by tariff-related concerns.

The FOMC opted to keep the federal funds rate at 4.25%–4.5% and continue reducing its balance sheet. It positioned monetary policy to adapt flexibly to evolving conditions, particularly with rising unemployment and inflation risks tied to potential policy shifts.

Powell highlighted recent economic trends, noting a slight GDP decline in Q1 due to volatile net exports, though private domestic final purchases grew steadily at 3%. Consumer spending slowed, but equipment and intangible investments rebounded, despite waning sentiment due to trade policy uncertainties.

If one word could summarize the press conference and Q&A, it would be “uncertain.” Powell acknowledged elevated inflation and unemployment risks but noted that the Trump administration’s tariff plans remain unclear. Thus, he argued, the Fed is wise to await further clarity on tariffs and their economic impact.

Regardless of whether the Fed made the right call, the data likely left no alternative but to hold rates steady. Last week’s Nonfarm Payrolls report showed no signs of an economic slowdown, with job growth exceeding expectations. With inflation above target, recent events might typically prompt rate cuts. However, as Powell noted, unlike 2019, inflation remains above the 2% goal.

As I’ve argued elsewhere, post-COVID business dynamics could lead companies to retain workers longer to avoid rehiring challenges if tariff disruptions subside. This differs from periods of abundant labor when firms can easily cut staff without concern about rehiring later.

Thus, I suspect the labor market will stay tight longer, as hiring and firing remain subdued. If tariffs sustain economic uncertainty, this dynamic may shift, but likely at a slower pace than in past cycles.

With the labor market giving the Fed no impetus to cut rates, the focus shifts to short-term inflation trends. Historically, money supply growth and demand changes suggest inflation won’t reaccelerate. However, tariff uncertainty could disrupt disinflation.

Inflation stems from too much money chasing too few goods. If tariffs restrict goods inflows, the money available to purchase scarcer products could temporarily drive prices higher. When supply falls faster than demand, prices rise. Though the Fed views inflation differently, its hesitation to cut rates seems prudent.

Yet, short-term interest rate markets are pricing the opposite—a Fed that holds rates steady. This suggests markets may be mispricing the rate path.

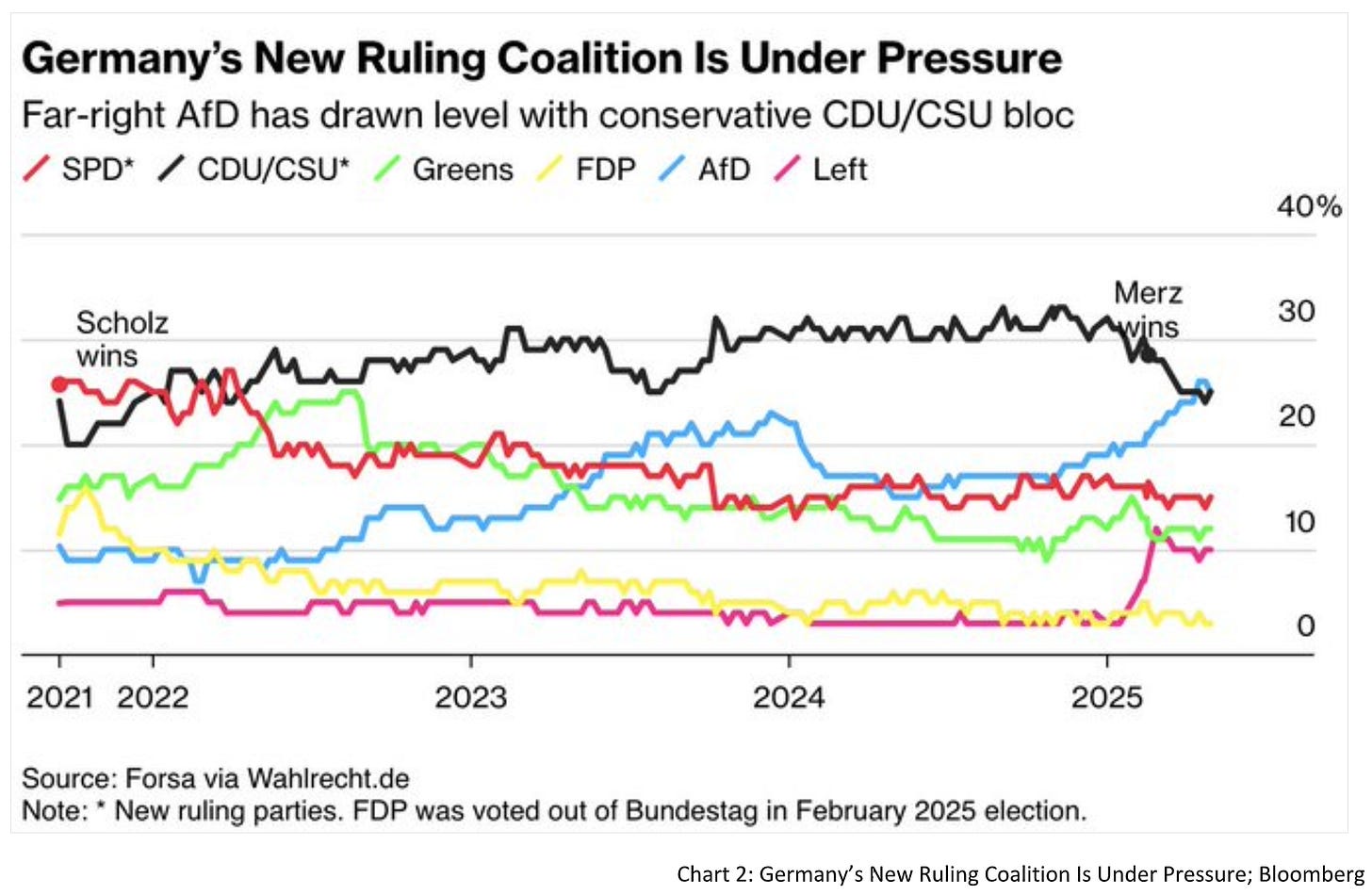

Turning to politics, Germany took center stage this week. After conservatives and social democrats agreed to form a new government, the coalition needed parliamentary approval.

Surprisingly, the Merz government became the first post-World War II German government to fail its initial vote. With support from the far-left Die Linke, however, the coalition secured a second attempt that same day.

In a repeat Bundestag ballot on Tuesday in Berlin, Merz got 325 votes, more than the required 316 out of 630 lawmakers. He had earlier managed only 310 in an initial tally that was meant to rubber stamp him as the head of an alliance of his center-right CDU/CSU bloc and the center-left Social Democrats, even though the coalition partners have 328 seats between them.-BBG

It’s a shaky start for a government whose chancellor already trails the far-right AfD in polls. With the finance ministry led by Social Democrat Lars Klingbeil, signs point to increased deficit spending to “revive growth,” signaling a return to Keynesian policies.

This spending won’t likely remain a German issue. Klingbeil has indicated the government will seek to expand “investment” with European partners, stating:

We have significant funds to invest and drive dynamism.

Markets stayed relatively calm this week. EUR/USD remains range-bound, trading slightly below 1.13. The dollar’s depreciation against the euro has paused, as markets await clarity on tariff discussions.

In equities, U.S. and European markets have recovered from recent lows. The DAX staged a V-shaped rebound, nearing its all-time highs, while the S&P 500 erased losses since “Liberation Day” but hasn’t climbed further. Amid pervasive bearishness, the pain trade leans upward.

Interest rates held steady last week. German bunds are unchanged since the U.S. jobs report, and U.S. Treasuries have nearly erased their losses. I believe bunds have limited upside, while U.S. long-term bonds have more room to rise. Time will tell.

Gold shook out weak hands, rebounding slightly below its recent all-time high after Wednesday’s sell-off. WTI oil remains below $60, with potential for further declines, though risk-reward is limited. Copper continues to trade sideways, and I have no strong view here.

Thus, with tariff uncertainty and shifting European fiscal policies, markets may be entering a phase of “Redesign. Rebuild. Reclaim.”

Scream out, voices loud, weapons of this world

We bow to no one

Burn it down, bring the fire right up to their doors

We are the futureDownstait - Redesign. Rebuild. Reclaim.

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.