My Apocalypse (?)

The Doomsayers have always had their uses, since they trigger the coping mechanism that often prevents the events they forecast. - Walter Wriston

Whenever economies are at a turning point, many economists, analysts, or other market watchers are on television and claim that they have known it all along. Some of them reach cult status, and their notoriety gains immense.

Sometimes, those people (generally called crash prophets) have called the coming crash for months, or in most cases, for years. And yes, in hindsight, one has to admit that some of them even pointed to the specific areas of the economy where all the troubles started to pull down the economy.

The Terminus crash prophet is mainly used to take legitimacy off of those people. In the economic and fiance branch, two groups are usually critical of them. On the one hand, academics at public institutions or universities and on the other hand, traders and investors.

Academics usually criticize the crash prophets because many of them support their thesis with some heterodox arguments, which are not based on the dominant neoclassical or Keynesian economics schools of thought.

For them, the fact that those people saw the crisis in foresight was nothing more than pure luck, as they, the professional economists, would deny that one could foresee these external shocks that caused the crisis. Thus, the forecasts of those crash prophets should be taken with a grain of salt because the main reason they were right was luck, according to economists.

The other group, critical of such doomsayers, are professional traders and investors. To them, it is not so much because of the heterodox arguments these people often use, as many would even agree with the analysis of those perma bears.

It is a different criticism, namely that the analyses or forecasts of those perma bears are not helpful when it comes to earning money. Those people need to make money. Yet, distinguishing a final turning point in the market is mostly a terrible strategy to achieve that, primarily when the data does not support it.

In the US, Peter Schiff gained much popularity outside the financial industry in 08. Schiff had called for a major crash in his endless TV appearances in the years prior, where he said that the housing boom induced by artificially low-interest rates was not sustainable and that this bubble would pop in the end.

Another was fund manager Michael Burry, who you might know because of The Big Short movie. Burry started to short the housing market in 2005, way too soon, as we know it today. Since then, Burry and Schiff were mostly recognized for their repeated warnings that the US economy might be in for another crash. A joke is circulating that Burry has called 45 of the last two crashes. If one had followed his forecasts, one would have lost much money.

Yet, many investors who have ridiculed Burry and Schiff for their repeated calls are suddenly in the same boat. For at least a year now, many of them are repeatedly calling an imminent recession where central banks would finally have to pivot. They encouraged people to short stocks and buy longer-term bonds the whole time. Similarly to Burry, one would have lost much money if one had followed their advice.

There is a considerable debate now whether a recession is imminent and if stock prices collapse and bond prices rise after they both performed severely last year. Yet, the discussion is not about whether it will happen but more about when it will happen.

Last week, S&P Global PMIs were published for the eurozone and the US. For both currency areas, they showed that economic activity is slowing. In the eurozone, the divergence between manufacturing and services continued to widen. While manufacturing is already contracting, services did slow but are still expansive, at least in most eurozone countries.

Let us start with the eurozone. Besides the PMI numbers, the Ifo Institute published its monthly Ifo Index, which captures current business sentiment. While recent assessments came in slightly better than expected, expectations were missed by a margin. In the past, Ifo expectations have been a very reliable data point to forecast future GDP development.

However, in this cycle, the negative sentiment has not shown up in GDP numbers since it turned south due to the increase in energy prices. On the contrary, Christine Lagarde recently stated that the ECB expects growth to pick up in the year's second half.

Probably, expectations are so bad because of all the planned EU laws, regulations, and energy prices, which are higher than in other economic regions. Yet, all that pessimism does not appear in hard (backward-looking) data.

It might be possible that things are a bit different in this current cycle, heavily messed up by highly expansionary fiscal and monetary policy, and that the current assessment gives a better picture of the overall state of the economy.

At first sight, it might seem strange at first, but there could be a simple explanation for that because current assessments are based on what is, and expectations are based on speculation. Generally, one can say that the environment supports the assumption that businesses might see the situation as more pessimistic than it turns out to be. German comedian Volcker Pispers once described the creation of the Ifo Expectations Index as follows:

Once a month, the scientific staff at the Ifo Institute calls a selected number of entrepreneurs to ask them about their expectations for the next six months of the year... they ask, ‘what do you think, how will it be?’ The academic ‘coffee grounds readers’ call the crystal ball owners.

Of course, it is satirical, but it shows the dilemma of such surveys. Moreover, it is not far-fetched to assume that in a highly pessimistic environment, expectations will be that it will become much worse. As a result, it might be that the actual current assessment consistently exceeds prior expectations. So it might be that the Ifo current Assessment number gives a better picture of the overall economy. Similar to expectations, there is a downtrend, but by far not as strong as it is for expectations.

Currently, the European economies are close to full employment. Overall sentiment in the service sector, the more significant part of the economy, is still positive. While the German economy is already in a technical recession, the mix of too little restrictive monetary policy and excessive fiscal spending keeps the economy alive.

Consumer price inflation is creeping down in the eurozone, just as expected by looking at M2, which has fallen since March 2021. According to studies, tighter monetary policy works with a lag of about 12 - 18 months. Interestingly, the yearly growth rate of M2 was relatively stable between January and September of 2022, between 6 and 7 %.

Because of that, one can assume that disinflationary pressures will grow at the end of the year and that inflation will stay way above the 2 % target until then. Although this will not lead to economic growth, it will help to keep the European economy up and avoid an imminent downturn.

Another point is that consumer sentiment has improved from the lows. Falling inflation leads to higher real wages, improving consumers' situation. This is another point that suggests that a deeper recession is not imminent for the eurozone.

Mainly, the uncertainty around the energy market in the winter and high inflation kept consumer sentiment depressed during the winter. Yet, in the summer, disinflation and lower energy consumption in Northern Europe suggest that consumer sentiment does not face an immediate downside.

Nevertheless, analysts and economists are also repeatedly calling for a recession in the US (while others propagate a soft landing). Therfore, they also point to weak, forward-looking data like the S&P Global PMI or the NFIB Index.

Even though sentiment has been worsening for a while now in the US, hard data is better than one would assume by just looking at soft, forward-looking data. This week, durable goods orders for May were published and vigorously beat estimates. The consensus estimate was a monthly decline of 0.9 %; the reality was a 1.7 % rise. It does not look like the recession is imminent.

Another data point is new home sales, which beat expectations significantly this week. While new home sales were expected to decline 1.2 % month-over-month, they spiked 12.2 %. Median prices were down 7.6 % for new home sales, but housing prices are accelerating overall.

Why was that? In my opinion, Amy Nixon reasonably explained it: Builders are rejecting 7 % mortgage rates. They’re offering incentives and buying down to 5% to get the sales they need. Without much existing inventory for sale, builders are in the driver’s seat—for now. They’re steering the market on their terms.

Rising interest rates and, until then, slightly falling house prices caused a fall in housing supply. Many owners are unwilling to sell at these conditions, as they would have to pay much higher rates to buy another home. This temporarily supports the housing market, which supports the economy.

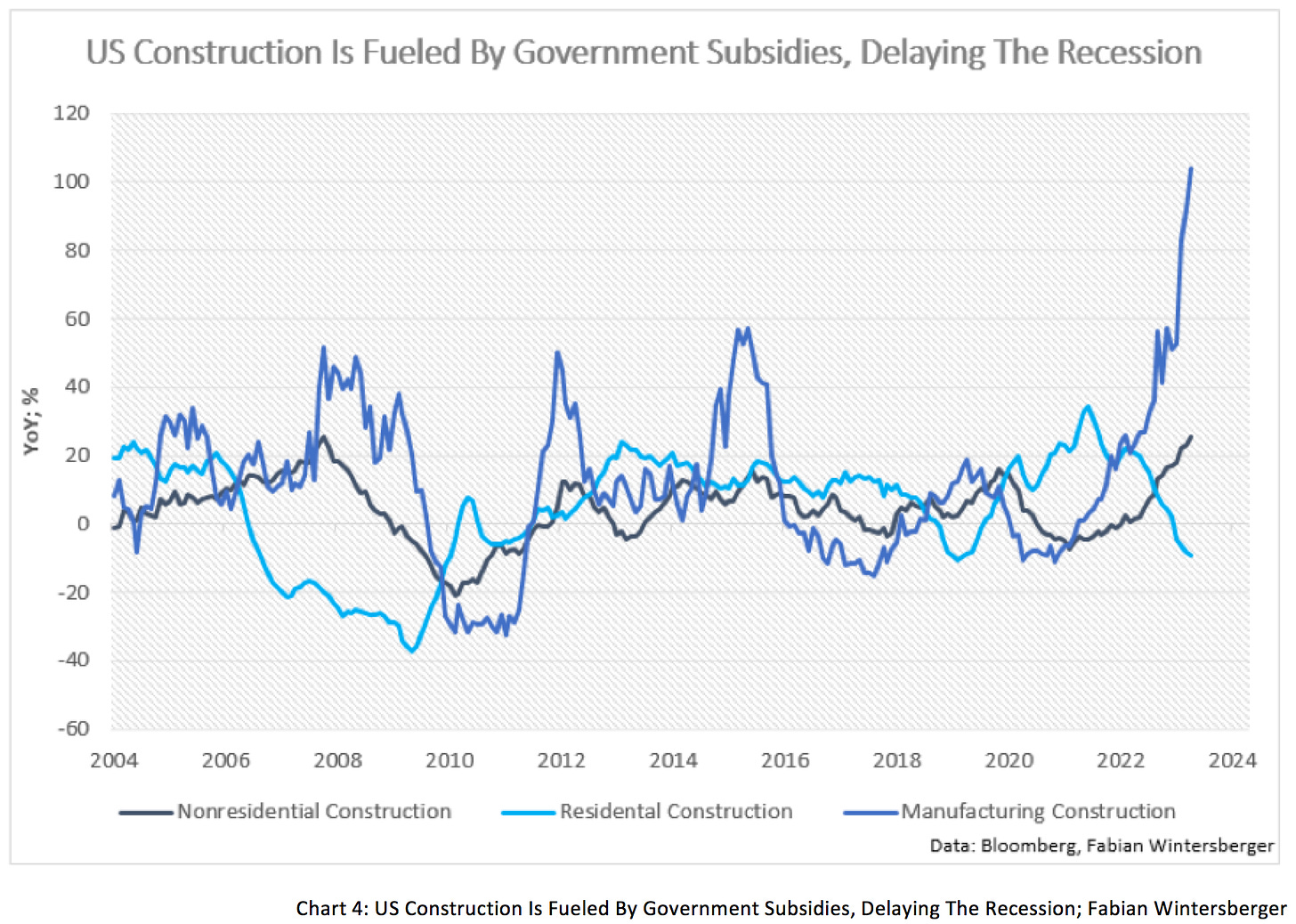

Further, the Biden administration also offered businesses high subsidy payments if they relocated production from other regions into the US. The Inflation Reduction Act is attractive for many companies because of low energy prices combined with high subsidies.

Although residential construction has been falling on a yearly basis since mid-2022, nonresidual construction is still rising, recently more than 20 % year-over-year. Looking at what happened during the GFC in 2008, one can see that year-over-year growth in residential construction already started to fall in 2006, but nonresidential construction continued to grow until 2007. The same can be observed today; therefore, I assume there is no imminent recession. Additionally, the Inflation Reduction Act has caused an enormous boom in manufacturing construction, which could delay the effect even further into the future.

Workers are reallocated from other projects because these subsidies are put in place when the labor market is structurally tight. As a result, businesses will have to compete for workers, keeping wage growth high and consumer prices.

Finally, let me discuss what all those things mean for the economy and financial markets. As we have seen, business sentiment is further darkening; hence, consumer sentiment shows a very mixed picture. Rising real wages due to falling inflation can be interpreted as support for consumer confidence.

Furthermore, consumption in the US and the eurozone is still supported by excess savings or savings above trend. In tandem with continuously elevated fiscal spending, this means a further supportive effect on both economies.

Additionally, the German example shows that a slight recession is not enough to dampen consumer price inflation significantly but needs a severe recession. Technically, Germany is already in recession, but this is still a recession with full employment. The same is true for the US substantially, as economic growth is still positive.

One probably should remember Claudia Sahm, who repeatedly pointed out that a recession does not start before the higher income brackets begin to cut back on consumption. One could say that we are currently in a K-shaped recession.

Equity markets should be supported in such an environment, and buying the dip should be a good strategy for now. For bonds, one should not be blinded by the highest returns in years, as it depends on the future actions of central banks.

When it comes to central banks, it does not depend on what analysts or economists think should be done. It depends on the actual monetary policy. According to the contraction of the money supply, we can assume that there will be a strong disinflationary impulse at the beginning of next year, which would support the thesis that no more rate hikes are needed.

However, at least in my opinion, it is more probable that another rise in consumer prices will pressure central banks to raise rates again. Thus, I still see more rate hikes than market participants currently anticipate. Concerning yields at the long end, it depends on how much short-term yields can push them upwards.

In this environment, gold will continue to struggle as higher real yields put pressure on the gold price. However, because gold prices and real yields have diverged for quite a while now, this could be a sign that gold traders anticipate a pivot. If that is true, we can expect that the divergence will converge.

Summed up, the calls for an imminent recession will stay here for longer. However, I believe many of those should stop laughing about Peter Schiff, Michael Burry, and others, as they have at least called 23 of the 0 turning points in stocks and bonds.

Sudden implosion of silenced emotions,

Buried beneath a scarred heart for too long

Delusions of hope, fading away

Dying like leaves on frozen soil

My apocalypse is near

I can feel the end… coming hereArch Enemy - My Apocalypse

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! If you like my writing, you can subscribe and get every post directly into your inbox. Also, sharing it on social media or liking the position would be fantastic!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice. I may change my view the next day if the facts change)

Well put Fabian. The most widely anticipated recession ever continues to be just over the horizon. and the data refuses to cooperate as per yesterday's GDP number. My take is that we are going to continue to go through a period of soft, but not necessarily negative, economic growth with employment remaining fairly strong as there is a dearth of available workers in many of the G10 economies, but inflation will remain higher than targeted and so will rates. Is that fertile ground for equities? maybe yes. for fixed income? probably not. for commodities? my personal favorite, especially given the decade of underinvestment due to the rise of ESG. good weekend