If it trades like a bull market, it’s a bull market. – Colm O'Shea

This week was a busy week for financial markets. Market participants awaited the FOMC decision on Wednesday and the ECB governing council's decision (I will discuss the ECB's decision next week). Last week on Friday, we also got various PMI surveys for France, Germany, the Eurozone, and the US. European PMIs surprised to the upside, with composite PMIs rising back to expansion territory. US PMIs, on the other hand, remained subdued and came in lower.

However, arguably, the biggest news this week wasn't the FOMC or the ECB but the news from China and DeepSeek AI. The Chinese ChatGPT rival released a new open-source AI model called R1, outperforming leading US developers, allegedly at a much lower cost. While the news was out on Friday already, it took a little while to trickle into the minds of market participants.

On Monday, the news finally sent shockwaves throughout the West, and all stock markets opened lower. The S&P 500 opened 2% lower, the Nasdaq was down more than 3%, and NVIDIA opened 10% lower. Due to NVIDIA's high weight within the Nasdaq and the S&P and the significant concentration among the Mag7, there was nervousness that the lower cost might translate into lower earnings for these stocks.

Since I'm no expert in AI, I contacted a computer science professor at an Austrian university on Monday to ask him about the significance of DeepSeek AI. Here's what he told me:

There are definitely some good improvements as far as I can see, especially less memory usage during computation and the resulting lower energy consumption. But in the end, it’s not that much different from the other models. I’d say it’s definitely a breakthrough, but not a huge leap, like it would be with a completely new architecture.

Therefore, I thought the stock market drop might not last, and the indices recovered in the following days. Most of the Mag7 stocks erased about half of their Monday losses, except for NVIDIA, which is still struggling to recover, although it has also erased some losses.

Government bonds rose on Monday due to some sort of flight to safety. US 10-year treasury futures are still trading around the top at significant resistance around the 109-10 area, while bund futures have dropped 50 points from above 132 to about 131.50 again.

Overall, bonds went nowhere during the month and stayed within a tight range. Bunds stopped moving around January 10. Treasuries erased their early-year losses and traded around the same levels they did at the beginning of the year.

Commodities also sold off on Monday, indicating nervousness. Nevertheless, while gold and copper have recovered from these losses, oil prices have not and continue to drop. That underlines my thesis from last week, in which I wrote that oil (WTI) will likely continue moving towards 70.

EUR/USD also pared its gains from Friday and Monday and is now down from 1.05 to 1.04 again. The move in FX was again highly influenced by the Trump administration and the back-and-forth about tariffs. Again, Treasury Secretary Bessent formulated a plan to implement a gradual 2.5% tariff plan, where levies rise month by month.

The rate differential between the Eurozone and the US could also probably play a role here. The Fed still has to remain hesitant about cutting rates, while the ECB needs to cut to give the economy at least some relief. That is especially true since the EU's flip-flopping on implementing growth-friendly policies just leads to more uncertainty.

As I mentioned interest rates, it's time to discuss Wednesday's FOMC decision. As expected, the Fed kept interest rates steady, something everyone had already expected. In his opening statement, Powell repeated that the labor market is still solid, and inflation remains somewhat elevated. Notably, the FOMC downplayed the progress on inflation and changed the wording regarding the labor market from "eased" to "stabilized."

One of the more interesting questions during a mostly meaningful press conference was asked by WSJ's Nick Timiraos whether Powell considers the policy rate restrictive and has changed his mind. Powell answered that his opinion hasn't changed, although he pointed out that rates are less restrictive than before the rate cuts were implemented.

What to make of this? As he answered another question about the same topic in the same way and said that the Fed is "well positioned," I think that as long as the data remains strong, the market is probably right to expect only one to two more rate cuts this year.

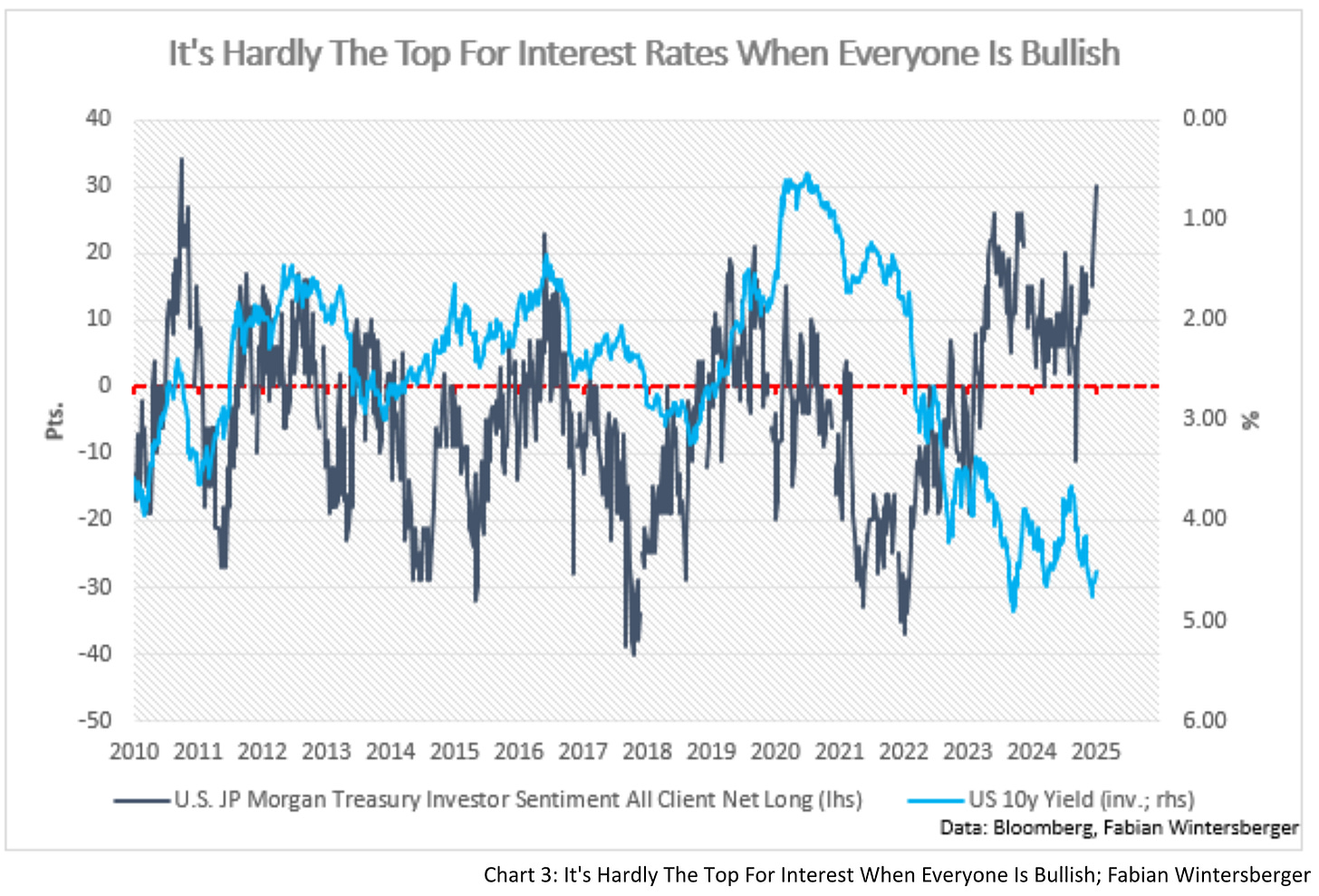

On the other hand, I think there's a lot of uncertainty, which could lead to various mispricings down the road. Many seem to believe that the 5% threshold for the US 10y will hold and that long-term interest rates are poised to fall from here. At least, that's what the JP Morgan Treasury Investor Sentiment suggests.

Nevertheless, Bank of America stated in their survey that small retail investors are extremely bearish on bonds, which generally indicates the exact opposite of JP Morgan. On the other hand, the variance in positioning between big and small money could also suggest that the jury is still out to judge. If one takes the rule of thumb that small traders are mostly more wrong than large traders, one could formulate the thesis that there's a further drop in bond yields that unwinds the positioning of small speculators before things like stronger-for-longer economic data push yields back up.

Currently, the market seems primarily focused on inflation, so a softer-than-expected PCE on Friday could push yields lower. GDP Nowcasts sharply went lower this week, so I don't know whether strong GDP growth will be enough for bonds to serve as a headwind.

Other indicators don't suggest any weakness for the US economy. The Redbook Index shows retail sales are still growing at a 5% rate year-over-year, which is totally inconsistent with times of a slowing economy or recession. That's in line with data from American Express, which reported that consumer spending grew nine percent in the fourth quarter.

Of course, there's also another side to the story, namely that these average increases are primarily reserved for the wealthy while many others are left behind:

A recent survey by Resume Now reveals that financial stress has reached a breaking point for American workers, with 73% of employees struggling to afford anything beyond their basic living expenses.

From a distributional view, that sounds worrying, but from a macroeconomic perspective, the increase in consumption of the wealthy makes up for it, and that's the data the market looks at. The bottom line is that, although some groups have a very hard time, the overall economy is performing well, and these numbers drive the market sentiment.

Monday's drop in the stock market can mean two things: either the market shakes this off and goes on with business as usual, with the big names in the S&P 500 & Nasdaq leading, or the worries about DeepSeek turn out to be true. In that case, the reading would be lower profit for all these AI companies but higher revenue for all businesses implementing AI. Although the air is getting thinner in both cases, stocks could climb to another all-time high soon. It's never wrong to be invested in a bull market until the music stops. Just like the economy, the bull market remains the speculator's lionheart.

With a heart so big and stars so bright

You're the light in my day and the dark in my night

You pulled out the best in me, close to my chest you'll be

End to start, you're my lionheartBuried In Verona – Lionheart

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.