The reports of my death are greatly exaggerated. - Mark Twain

It’s been a quieter week compared to the last, but don’t mistake calm for stagnation. With Donald Trump in office, the news cycle has shrunk dramatically—every statement, action, or social media post seems to jolt markets. That is the new normal, as it were.

Stock markets have bounced back strongly from last week’s lows, but assuming we’re out of the woods feels premature. The Trump administration’s unpredictability means any day could bring a plot twist for asset prices.

That said, stocks aren’t the asset class to watch right now. Uncertainty sums it up best. It’s unclear whether the Trump administration is following a coherent plan. To me, it looks more like miscommunication within the administration itself.

Before Trump’s inauguration, I thought there was a loose plan to weaken the dollar and lower yields, even at the expense of stocks, by cutting government spending to slow the economy. Yet, current US government expenditures suggest otherwise. Since the inauguration, the government has spent $154 billion more than in the same period in 2024.

If the administration hoped to pressure the Fed into acting sooner, Jerome Powell has pushed back. On Wednesday, he downplayed expectations for early rate cuts, emphasizing the need to monitor the impact of tariffs on inflation. Powell reiterated the Fed’s focus on stable inflation to sustain a strong labor market.

Despite a less frenetic week, plenty happened worth discussing. I’ll focus on one topic: the dollar and interest rates in the US and the Eurozone. Signs of a slowing US economy—some even warn a recession is inevitable—combined with Europe’s push to ramp up spending, point to a broader shift in the global economic landscape.

This shift could narrow a divergence that’s persisted since the 2008 Great Financial Crisis and the European sovereign debt crisis. In Europe, German Bunds are the equivalent of US Treasuries—the safe-haven asset. Everyone assumes (or assumed) Germany will always repay its debt.

Since the sovereign debt crisis and the ECB’s response, however, yields on Bunds and Treasuries have diverged, with US yields consistently higher than those on Bunds. Post-COVID monetary policy narrowed the gap, but it remains significant.

Over the same period, the euro has weakened sharply against the dollar. In late 2009, the EUR/USD rate was 1.50; today, it is around 1.14. One factor was Europe’s weaker fiscal impulse for GDP growth. Germany, in particular, has been far more frugal than the United States, which has consistently relied on higher government spending to counter economic turmoil.

Now, Germany’s new government plans to inject an extra trillion euros into infrastructure and defense over the next 12 years. Meanwhile, the Trump administration, via Treasury Secretary Scott Bessent, is pushing the "3-3-3 Economic Plan": 3% growth, 3% deficits, and 3 million extra barrels of oil output per day.

That implies the US aims to slash its deficit-to-GDP ratio from 7% to roughly half, while European governments expand theirs. Economist Lars Feld from the Eucken Institute projects Germany’s debt-to-GDP ratio will climb from 62% to 90% over the next decade. Many German economists warn that these plans could sharply increase the government's interest payments.

Regardless of the discussions about the sustainability of infrastructure and defense spending, higher government spending boosts nominal GDP, as it’s part of the equation. In the short term, this suggests US GDP growth could slow while Europe’s picks up. Critics argue Bessent’s plan is unrealistic, but I’d say it clearly requires a transition phase with growth below 3%.

For interest rates, this implies US rates may trend lower while Eurozone rates should rise. Consequently, the euro could appreciate against the dollar, aligning with the Trump administration’s apparent goals.

That said, this assumes no loss of confidence in the euro due to external factors. As a European, I’m skeptical things will unfold smoothly in Europe, but I’ll set that aside for now.

The tariff mess and the apparent lack of a clear plan have shaken markets. That brings me to the short-term implications, particularly the odd movements in the dollar, euro, and interest rates.

The dollar index (DXY) dropped sharply after “Liberation Day,” fueling skepticism about the dollar’s strength. Articles predicting the dollar’s demise are everywhere, speculating about a global shift away from it.

Still, while the DXY has weakened, it’s heavily weighted toward the euro and yen. Broader measures of the dollar still show significant strength.

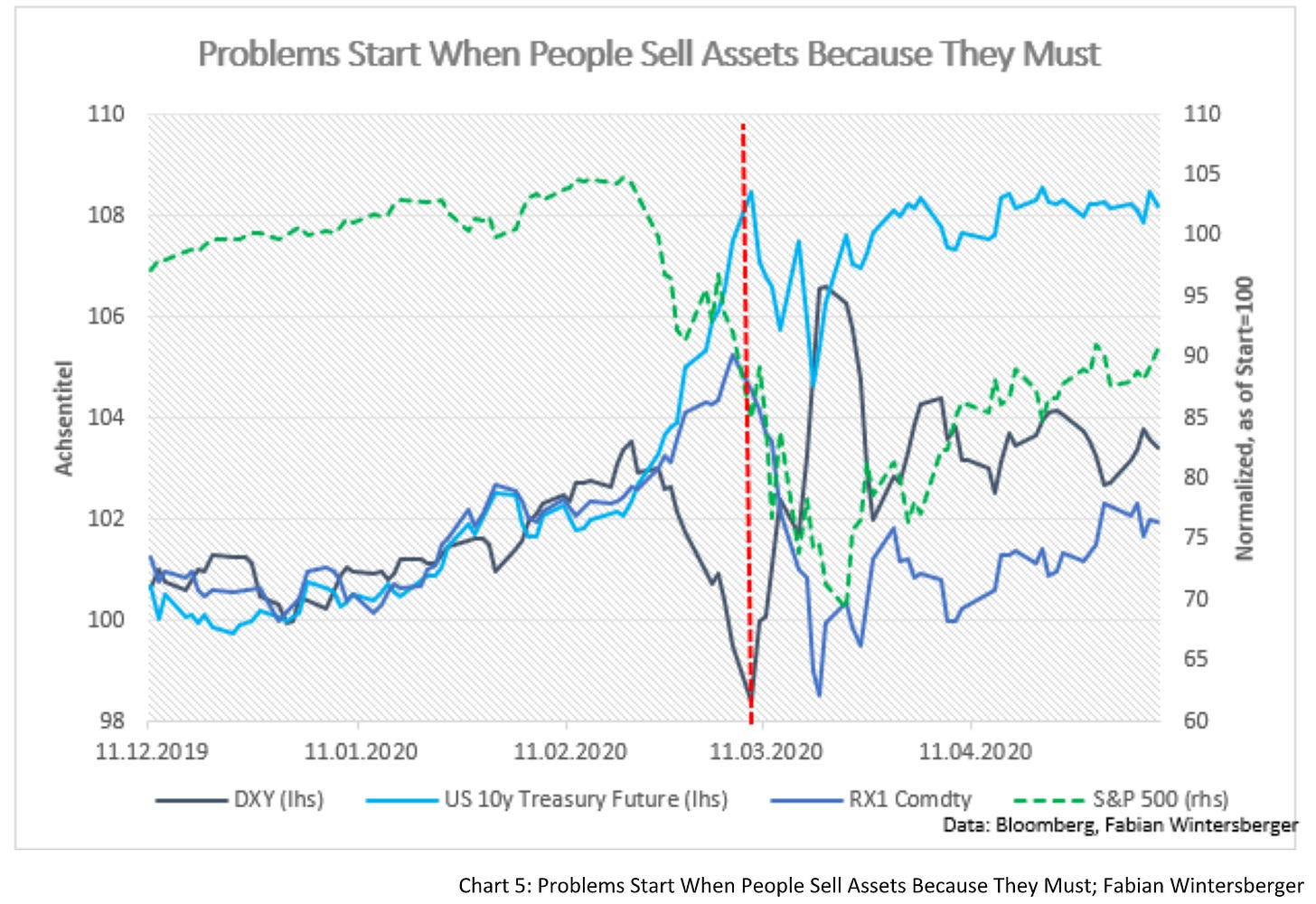

Bonds have also behaved unusually. The tariff announcement triggered a dollar sell-off, sparking a rally in Bunds and Treasuries amid rising global uncertainty, similar to the sell-off in global stock markets. But as confusion grew, US Treasuries sold off again while Bunds rallied.

The widening yield differential, with higher US yields and lower European yields, alongside a weaker dollar, is notable. Such moves typically occur during periods of emerging market turmoil, when a weakening currency causes stress and leads to broad asset sales.

That aligns with growing bearishness on the dollar. One theory is that Europeans sold US Treasuries, exchanged dollars for euros, and bought German Bunds. The latest BofA global fund manager survey, which ended on April 10, showed that respondents were the most bearish on US assets in 30 years.

For now, the DXY has stabilized, struggling to break through the 99–100 resistance range. EUR/USD is a key pair to watch for gauging market direction.

Could the dollar sell-off persist? Sure, but I believe claims of the dollar’s death as the world’s reserve currency are wildly exaggerated. No viable alternative exists. Businesses rely on dollars for global transactions and commodities.

The Trump administration’s policies are likely to slow the US economy, according to soft data from surveys. Yet hard data still shows resilience, possibly because businesses anticipated tariff shocks and stockpiled inventory. Even non-tariff sectors are seeing strong demand.

Since “Liberation Day,” US financial conditions have tightened significantly, signaling a slowdown at best, or a recession at worst. If this materializes, US Treasuries look undervalued, while stocks seem overpriced. I’m not convinced equity markets have bottomed.

So far, investors have sold assets voluntarily, not out of necessity, in response to tariff chaos and uncertainty. Non-US investors have shifted to domestic markets, which has weakened the dollar.

German Bunds, now back to pre-fiscal-stimulus levels, have limited upside. Germany’s spending plans will increase bond supply, and investors will likely demand higher yields. This week’s five-year bund auction had the lowest oversubscription rate in two years, supporting this view. I expect German Bund yields to rise.

What could counter higher Bund yields? A further decline in the DXY is possible if economic actors shift to other currencies. But globally, businesses need dollars to service dollar-denominated debt. During financial stress, these businesses need to sell all their non-essential assets to buy what they need, US dollars, as seen in 2020.

I’ve noted the 2020 analogy before, given the impact of the tariffs on global supply chains. The situation isn’t identical, but if markets darken and equities haven’t bottomed, we could see a repeat of 2020: investors selling what they don’t need to buy what they do—US dollars. That would cap support for Bunds from a falling dollar, while other factors point to rising European yields.

With the rapid pace of market shifts, the best approach is to “kill the noise” and keep a close eye on the dollar.

This rage, I just can't escape

Screamin' at my face

So loud, I can't hear my voice

Breaking through my mistakes

Freefall into grace, I'm not insane

It's time to kill the noise!Papa Roach – Kill The Noise

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.