Keep Rollin' (in 2025)

The future is uncertain, but the end is always near – Jim Morrison

Financial markets and economics wouldn’t be nearly as intriguing without the element of forecasting. Not because forecasts have a stellar track record—they often don’t. Most forecasts simply extrapolate existing trends into the future. Yet, when goals and intentions drive human behavior, these goals can shift quickly, rendering past patterns unreliable. The more people involved, the more complex predictions become.

Take the 1950s and 60s, for example. The Soviet Union experienced rapid industrial growth, launched Sputnik into orbit, and showcased remarkable state-driven progress. The perceived efficiency of central planning, coupled with large-scale mobilization of labor and resources, led many to predict that the Soviet model would dominate global economic leadership.

However, cracks in the system gradually emerged. While central planning enabled impressive short-term industrial achievements, it lacked flexibility, innovation, and efficiency. Resource misallocation, widespread corruption, and weak incentives for productivity eventually led to stagnation. By the 1980s, the Soviet Union faced economic paralysis, and its collapse in 1991 cemented the failure of those earlier predictions.

Another example comes from the 1990s, when oil prices were historically low due to geopolitical stability, advancements in extraction technology, and subdued global demand. Many analysts and policymakers confidently forecast that oil prices would remain low indefinitely, dismissing the possibility of future energy shocks. They based their outlook on the assumption that innovations like improved drilling techniques and expanded reserves would maintain supply while demand growth remained moderate.

This view unraveled dramatically in the early 2000s. Rapid industrialization in emerging markets, especially China and India, drove a surge in energy demand that few had anticipated. At the same time, geopolitical disruptions in the Middle East, including the Iraq War and regional instability, constrained oil supplies. By 2008, oil prices soared to an all-time high of $147 per barrel, shocking markets and fueling fears of global economic stagnation. This episode highlighted just how fallible even the most confident predictions can be.

As each year comes to a close, market commentators, analysts, and economists rush to their keyboards to craft their outlooks for the year ahead. These forecasts range from highly technical analyses to imaginative narratives about what the future might hold.

In hindsight, many of these predictions are shattered by unforeseen events. In 2019, no one anticipated a global pandemic; in 2021, few foresaw a major invasion in Europe. As Mark Twain famously quipped, “Prediction is difficult—especially when it involves the future.” Yet, as I mentioned at the outset, we continue to read these forecasts, if only for their entertainment value.

My 2024 forecast was, unsurprisingly, full of things that didn’t come to fruition (mea culpa!). Few would have expected the USD/JPY to climb steadily higher or the US economy to hold up as firmly as it did throughout the year. However, forecasting isn’t just about making accurate predictions—it’s about managing risks and adapting to unexpected changes.

With that in mind, I’ll humbly admit that I have no idea where stocks, interest rates, or commodities will stand this time next year. Nonetheless, I’ll attempt to outline a few scenarios and assess how they might unfold over the course of the year. That said, I’ll revisit these predictions a year from now, likely surprised at how little of them turned out to be accurate.

As we approach 2025, the range of possible outcomes seems particularly wide, mainly depending on how global events and economic trends evolve. Some analysts—Bank of America, for instance—predict that 2025 could be another strong year for stocks, with the US economy continuing to outperform, even “amid geopolitical tensions.”

Investor sentiment in the US stock market has been euphoric since Trump regained the presidency. His first term was generally positive for stocks despite the significant drawdown in 2020. In fact, Trump’s first term ranked fifth best for stock market performance among all presidential terms since 1981.

Although past performance is never a guarantee of future success, many traders and investors believe the stock market could deliver similar or even better returns during Trump’s second term. But what are the potential risks to this outlook?

One perspective is that market participants may underestimate the impact of policies Trump might implement to spur an unprecedented economic boom. The argument is that Trump’s plans for deregulation and reduced government spending could unlock significant capital, providing the private sector more benefits than anticipated. If this is the prevailing expectation, one might argue that investors should buy stocks aggressively.

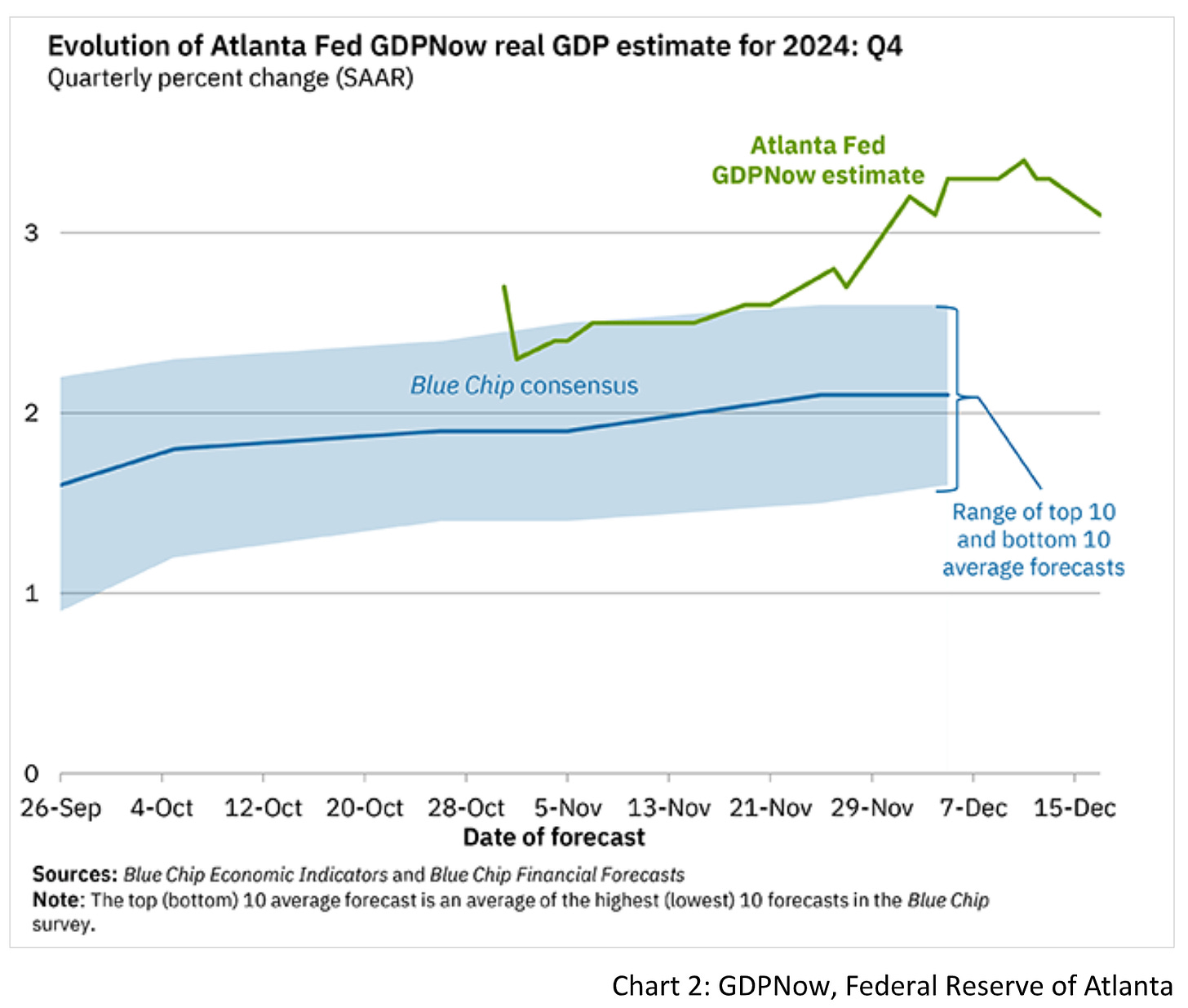

Since September, the Federal Reserve has cut interest rates by 100 basis points. Before the most recent Federal Open Market Committee (FOMC) meeting, the expectation was that the Fed would continue to cut rates gradually next year, likely by 25 basis points per quarter. Meanwhile, the current estimate for Q4 economic growth remains strong, sitting comfortably at an annualized 3.1%.

Lower short-term interest rates benefit businesses refinance using short-term debt, particularly small and medium-sized enterprises (SMEs). The latest NFIB report showed that small business optimism surged to 101.7 in November, marking its highest reading since June 2021. This jump also ended a 34-month streak below its 50-year average of 98.

SMEs traditionally lean Republican, so their future expectations rose significantly following Donald Trump's presidential election win. Despite this, the Russell 2000 index has erased almost all post-election gains and is now consolidating around its pre-November highs. Small businesses are hopeful that Trump will deliver on his promises of deregulation, which could reduce administrative costs and make them more competitive against larger corporations.

Trump has already committed to prioritizing US oil and gas production and has expressed his intent to withdraw from the Paris Climate Agreement. Theoretically, this could lower the energy price differential between the US and Europe, potentially incentivizing production shifts to the United States.

These factors support the stock market's optimistic outlook. If Trump's promises materialize, what could go wrong? Given this dominant sentiment, one might expect the stock market to rally in the early months of the year, assuming the current consolidation phase gives way to more all-time highs.

However, other critical considerations are inflation and interest rates. In 2024, the pace of disinflation slowed dramatically compared to 2023. In 2023, the CPI fell from 6.5% to 3.4%, and the PCE index dropped from 5.5% to 2.7%. By the end of 2024, however, PCE stands at 2.3%, while CPI is at 2.7%.

This slowdown in disinflation can be attributed to an increase in the money supply during the year while money demand continued to fall. As a result, the velocity of money—how quickly money circulates in the economy—has been rising.

The yearly growth rate of M2 turned positive in the second half of 2024. As a result, I’d argue that the impact of M2 growth on inflation remains somewhat subdued. Money velocity continues to grow year-over-year, though the pace is slowing. How long this dynamic can sustain higher inflation, driven by lower money demand, remains uncertain.

According to inflation swaps, market expectations for long-term inflation have remained relatively stable. However, short-term expectations (one year ahead) have been highly volatile. Recently, one-year inflation swaps in the US returned to their 2024 highs.

I’m skeptical about using inflation expectations to predict the future path of consumer price inflation. However, these expectations heavily influence financial market pricing. Many also associate high inflation with a vibrant economy, where rising prices signal increasing demand. If the productivity boom envisioned for Trump’s second term materializes, inflation could remain above target—especially if the Fed continues gradual rate cuts into an economy with sustained high growth.

If you’re bullish on the stock market heading into 2025, you must closely monitor inflation and its impact on interest rates. Currently, the Fed is maintaining quantitative tightening (QT), which seems to involve not replacing maturing bonds with new purchases. This approach prevents adding new supply to the market, which could push interest rates higher (and bond prices lower).

If inflation is nearing its bottom and poised to rise again, long-term interest rates may also increase. This thesis supports the idea that falling short-term interest rates stimulate economic activity, which can create upward pressure on long-term rates. Recently, US 10-year yields rose by 20 basis points in December, potentially reflecting these expectations.

Still, one could argue that this upward movement in yields is nearing its short-term peak. Yes, growth remains robust, but it is gradually slowing. According to swaps, inflation is expected to stay flat through the next year. Does this mean higher long-term rates, lower short-term rates, and a stock market rally—until long-term yields rise too much? That seems to be the prevailing narrative for next year and what most investors expect.

Before this week’s Fed meeting, markets had already priced in a more hawkish interest rate path than the September Fed dot plot suggested. As such, it was unlikely the Fed could deliver anything even more hawkish. Indeed, the Fed cut interest rates by 25 basis points on Wednesday.

However, the Fed revised its 2025 rate cut projections from four to two cuts. Following this shift, the 10-year yield climbed back to 4.5%. Powell also stressed that the Fed would adopt a more cautious approach to rate cuts, emphasizing the need to see further progress on inflation. This notably more hawkish tone spooked markets, pushing interest rates higher and stock prices lower.

It remains to be seen how stocks and bonds will behave for the rest of the year. Personally, I feel the Fed and Powell may have turned more hawkish at the wrong time, though the final verdict is still out. Interest rates could continue increasing while stocks consolidate if current data trends hold.

Nevertheless, I maintain that the bond market may rally at some point if economic data softens. While economic growth is strong, the overall direction of inflation and growth appears to be downward, with unemployment slowly ticking up. While this isn’t a significant concern for the broader economy, it could indicate that interest rates are nearing levels that are too high for the stock market to sustain.

What are my potential outcomes for the US economy and stocks next year? I believe the widely anticipated scenario of “average returns” and a “good economy” is the least likely. My thesis is that we’ll either see an exceptionally strong year or a weak to extremely weak one. At present, the signs lean toward strength, but it’s crucial to monitor how data evolves at the start of the year. As of now, the outcome could swing either way.

Following the Fed meeting, the dollar rose, pushing EUR/USD below 1.04 again. Currently, the pair is wrestling with the 1.04 support level. As long as it doesn’t break decisively below this level, EUR/USD might still consolidate. If my thesis holds that the Fed cannot become more hawkish after this week, then further downside for EUR/USD would likely have to stem from the eurozone or the ECB.

Meanwhile, Europe seems headed for another year of stagnation, with inflation hovering near the 2% target. The German automotive sector, in particular, is struggling due to a combination of problematic economic policies and a challenging geopolitical environment. Trump’s tariff plans have further darkened the outlook for German automakers. Major car companies in Germany are planning workforce reductions, and their stock valuations are plummeting.

That said, a contrarian view worth considering is that Europe will outperform the US in 2025. The following chart by TS Lombard’s Dario Perkins highlights the significant divergence between US GDP and the rest of the world’s GDP, a trend that historically hasn’t lasted.

The most apparent catalyst for European recovery would be a peace deal in Ukraine, which could ease economic pressures. This would be coupled with a victory for a conservative/liberal government in Germany after the elections. While a peace deal seems plausible, the latter remains highly speculative. The liberal FDP is on the brink of losing all its parliamentary seats, and the conservatives have ruled out forming a coalition with the far-right AfD.

While the AfD poses undeniable challenges, the conservatives’ refusal to cooperate with them limits their options. If the conservatives cannot secure a majority with the FDP, forming a coalition with the Greens or Social Democrats would likely lead to a “more of the same” scenario—continuing current policies without significant change.

Given these dynamics, I believe caution is warranted when considering the contrarian position that Europe will outperform the US next year. For that scenario to materialize, more concrete signs of improvement are needed. That said, in terms of sentiment, it’s hard to imagine how it could deteriorate much further from current levels.

Beyond Germany, France faces significant challenges as well. Although the government was recently restructured, the fundamental issues persist. Business investment declined throughout 2024, and the government is running deficits similar to the US—but without achieving comparable economic growth. The EU’s failure to penalize France for its budgetary breaches highlights ongoing inconsistencies in how the union treats its member states.

Despite this, predictions that France will descend into a crisis akin to Greece’s are likely exaggerated. While some fear France could trigger a more significant eurozone crisis, the comparison is premature. During the Greek debt crisis (2009–2013), deficits ranged between 12% and 14% of GDP. France’s current deficit, by contrast, is around 6%. Although the situation is far from ideal, it is not nearly as severe as Greece’s was during its peak crisis years.

As I’ve already noted, sentiment in the eurozone is already at rock bottom, which suggests that the region might not perform as poorly in 2025 as many expect. However, this is far from certain. At some point, it might be justified to give Europe a chance, but the timing and justification require careful evaluation.

Regarding inflation, I don’t foresee the eurozone facing the same challenges as the US. This is primarily because the demand for money in the eurozone remains high while the money supply is growing at a subdued rate. Furthermore, the additional liquidity isn’t driving significant economic growth; the region seems to mirror Japan’s prolonged stagnation following its 1987 stock market crash.

Oil prices have remained tightly range-bound between $65 and $70. Planned Trump policies suggest the potential for further declines. However, a contrarian perspective might argue that deregulation could increase oil demand, outpacing supply and pushing prices upward. That is a risk worth considering, especially given the decade-long underinvestment in the energy sector. It might not be as unlikely as it seems.

Gold and bitcoin have both had stellar years, raising questions about whether their upward trends will persist in 2025. Historical bitcoin cycles suggest there’s still considerable room for new all-time highs. However, this cycle could play out differently if the US economy slows and the stock market declines. Gold may also face downward pressure in such a scenario. Nevertheless, I believe the long-term outlook for both assets remains strong, particularly as fiat currencies continue to face debasement over time.

To conclude, investors should not take anything for granted in 2025. Predictions for an “average” year of stock market returns are cautious forecasts at best. Far better outcomes, possibly an unprecedented economic boom, are possible. However, I lean toward the more surprising scenario of an economic slowdown, lower stock prices, and a short-term bond rally.

The US is currently priced for a Goldilocks economy in 2025, but it remains to be seen if this materializes. Conversely, the European economic outlook is so bleak that it could be a positive surprise. However, such contrarian takes require waiting for clear signals—be it worsening US data or unexpected positive shifts in Europe.

While there are few reasons to doubt that gold and bitcoin can move higher, it’s worth considering the possibility that things might not turn out as widely expected. Similarly, while oil appears poised to edge lower, various dynamics could also push prices upward. Ultimately, that’s the beauty of human action and financial markets: no matter your beliefs, they just keep rolling—unpredictable as ever.

I hope you had a great 2024 and wish you an even more fantastic 2025. While I hope you find this final piece of the year insightful, I urge you not to take my outlook as gospel. Human behavior and market dynamics are so complex that accurate forecasting remains elusive. No matter how convincing a forecast may sound, there are always countless ways it could go awry. But regardless of what happens, let’s embrace the unpredictability of the year ahead—just like Limp Bizkit said: Keep Rollin’ in 2025!

Merry Christmas & a Happy New Year!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.

while I sit in the US, it remains difficult for me to observe Europe and the ongoing dysfunction in governments all around and conclude a positive economic surprise. Here at home, though, I can see the case for both a great or terrible outcome in the economy and equity markets as unpredictability is Trump's strong suit. perhaps the best investment is long volatility!

Merry Christmas