Note: The comment was written on June 12

Markets are constantly in a state of uncertainty – George Soros

The US Bureau of Labor Statistics released May’s CPI numbers this week. While CPI data always draws market attention, this week’s release sparked even greater interest. After all, it was the first month expected to reflect the impact of the Trump tariffs.

Let’s briefly recap last Friday’s Nonfarm Payrolls (NFP) Report. Nonfarm Payrolls added 139,000 jobs, slightly above the 126,000 forecast. The unemployment rate held steady at 4.2%, while hourly wages rose 3.9% year-over-year, topping the 3.7% expectation. It was a solid NFP report, though some analysts noted underlying weaknesses. As usual, markets focused on the headline numbers, so we’ll need to see how trends evolve.

The debate over whether tariffs will prove inflationary or disinflationary has been intense. My view? Tariffs are likely disinflationary, as higher prices curb demand. Combine that with tariff front-running, which created an oversupply of goods, and the signs point to a disinflationary impulse.

Indeed, May’s inflation numbers were soft across the board. Prices rose just 0.1% (vs. 0.2% expected) compared to April. Core inflation was also weak at 0.1% (vs. 0.3% expected). Real average weekly earnings dipped 0.1 percentage point, from 1.5% to 1.4% year-over-year.

This supports the disinflationary impact of tariffs, though CPI and Core CPI remain above target. The Fed’s once-favored “Supercore” metric, now sidelined, also exceeds target but has dropped sharply since early 2025.

US stocks rose at Wednesday’s open but closed in the red. Still, they only retreated to Monday’s levels. If the economy were weakening, you’d expect sharper declines.

Before diving into market trajectories, let’s talk interest rates. I remain bearish on US long-term bonds, but the weak CPI report muddles the waters. It’s wise to wait for next week’s FOMC signals.

If the Fed sees May’s soft CPI as a green light for action, it could trigger a relief rally in bonds. Still, I believe long-term interest rates will trend higher. Here’s why.

May’s CPI is old news. Tariff anxiety peaked before the Trump administration softened its stance to prepare for trade negotiations. On Wednesday, Trump announced plans to send letters outlining terms to other countries in ten days. I’d look past the rhetoric.

Inflation’s future path and long-term fiscal deficit trajectory are more critical than tariffs. If tariffs were disinflationary at peak anxiety, scaling them back during negotiations could prove more inflationary than expected.

Another angle on May’s CPI: I’ve likened Trump’s tariffs to a mini-2020 supply-chain disruption. Slowing the supply chain sparked disinflation. Lowering tariffs could have the opposite effect—an inflationary impulse—compared to a high-tariff scenario.

Over the past two months, solid job numbers suggest businesses hold onto workers, positioning them well for improved clarity. Beyond last week’s PMI reports, major US stock indices also signal an accelerating economy.

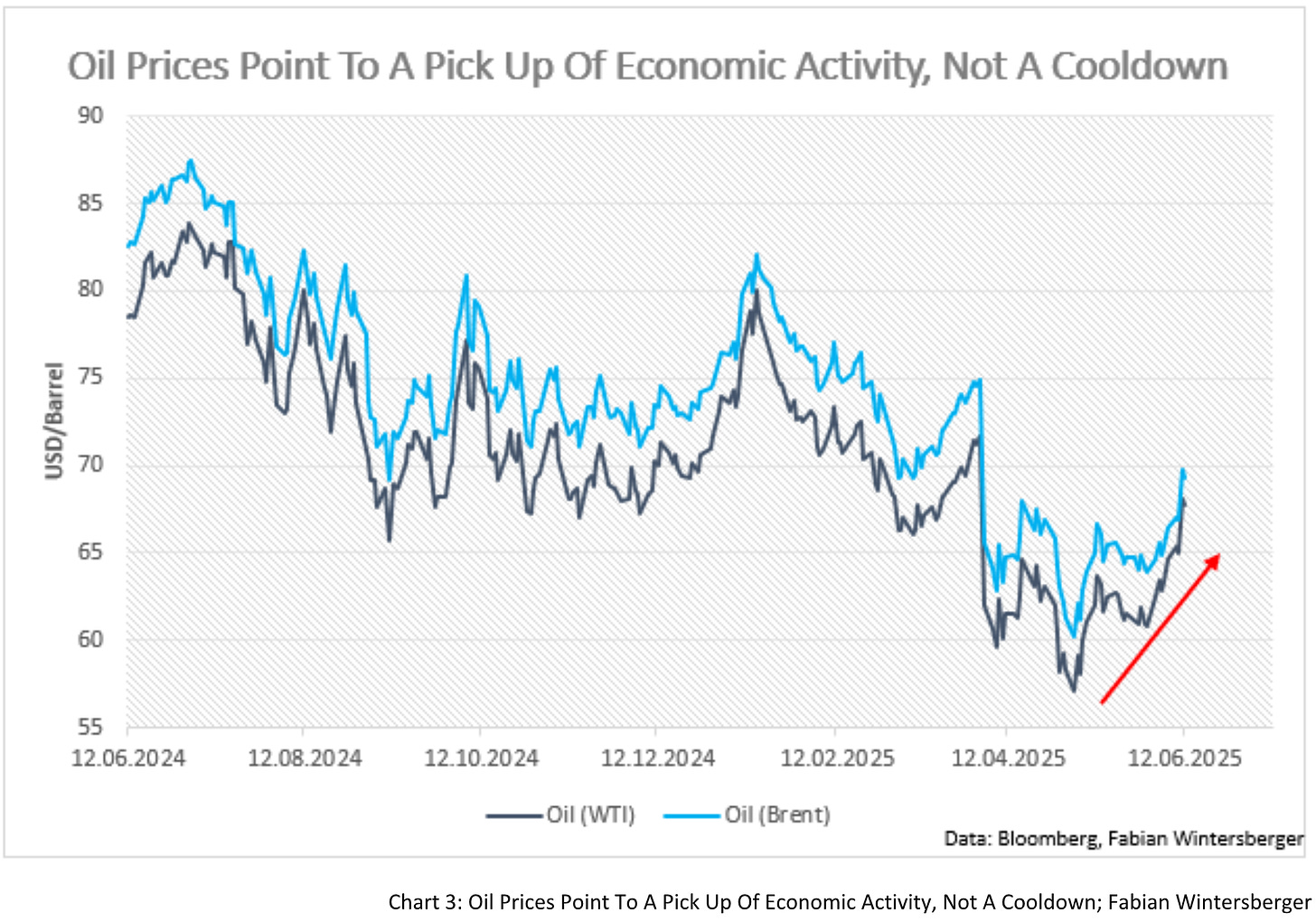

Oil prices have climbed since early May, with gains accelerating in June—a sign of a strengthening, not weakening, economy, as Chart 3 shows. Copper is holding steady, while industrial metals like silver and platinum are surging.

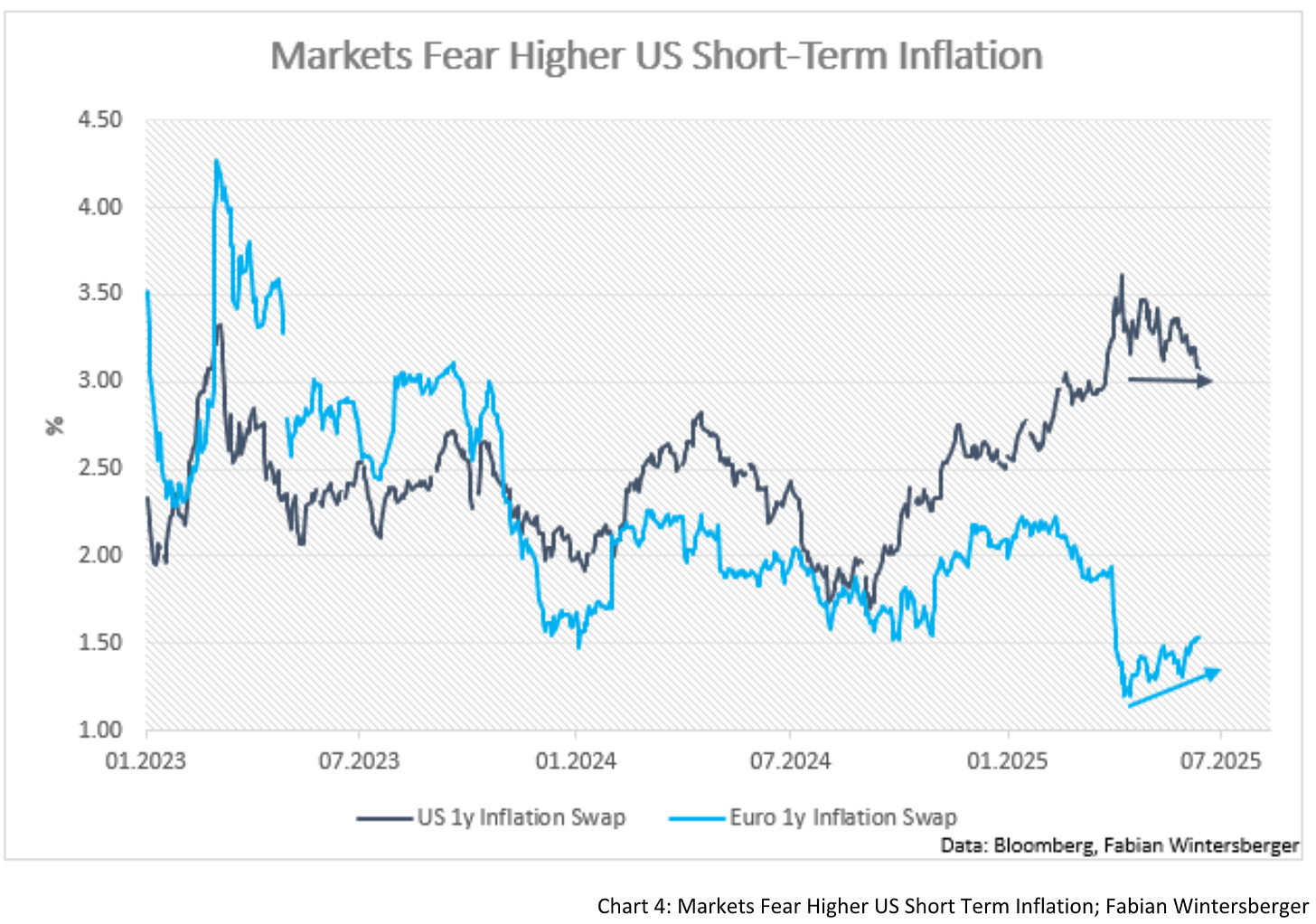

The NFIB Small Business Optimism Index also beat expectations, signaling economic improvement. US Inflation Swaps are at the high end of their 2023-2025 range. Meanwhile, short-term inflation expectations in the eurozone remain subdued.

Notably, eurozone inflation swaps are forming lower highs, hinting at building inflationary pressure, while US swaps have stabilized at “Liberation Day” levels.

Thus, I see limited upside for US bonds, though short-term moves are unclear. The FOMC will provide more clarity.

My view on eurozone bonds, particularly German Bunds, hasn’t changed. Beyond increased fiscal spending to meet NATO’s 5% target, discussions about joint eurozone bonds suggest upward pressure on yields.

If joint bonds replace Bunds as a safe-haven asset or serve as an alternative with a higher supply, yields will rise. Germany’s increasing debt-to-GDP ratio further suggests ultra-low European yields are history.

The strong performance of European banks this year could also be a sign of improving business credit availability. It’s hard to find reasons the eurozone won’t see a fiscal push, which would create a headwind for long-term interest rates.

I remain optimistic about risk assets in the short term. Although the uncertainty regarding interest rates has increased, I still lean toward higher long-term rates, especially in Europe.

Few expect European yields to drive global rates again. While joint debt plans may narrow peripheral bond spreads, they could increase overall yields.

For now, weak eurozone growth drags down long-term rates. But I believe the market’s “jaded” view underestimates the growth pickup brewing. Europe is flying under the radar, but when markets notice, a steepening yield curve, driven by stronger growth prospects, could boost stocks to a point.

Time will tell.

I’ve never found a way to be honest,

All I know is a place where I haunted,

Memories faded,

Blood is jadedSpiritbox – Jaded

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. THEY DO NOT CONSTITUTE INVESTMENT ADVICE, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.