I'm Not Right

The Year In Review And Unintended Consequences Of Tariffs

Tariff is the most beautiful word in the dictionary. – Donald J. Trump

As we move into year-end, and half of Europe is packed into Christmas markets, downing hot punch and bratwurst, the research community traditionally uses December to unload its forecasts for the coming year.

The Weekly Wintersberger will keep to its habit and save that ritual for the very last edition of the year – one more week of patience, dear reader. Today’s note will stay short, but I still want to briefly look back at 2025 and then touch on a favourite topic: the unintended consequences of economic policy.

In my final 2024 piece I sketched out the usual set of scenarios. As always, some came true, some didn’t, and some were right for a while before flipping completely.

The broad consensus for 2025 called for decent but unspectacular stock market gains. In the end equities did slightly better than most had expected. Once again the majority got the magnitude wrong. And while virtually everyone assumed Trump would deliver on his campaign promises, the tougher truth of 2025 is that he turned around on a number of issues far quicker than many thought possible.

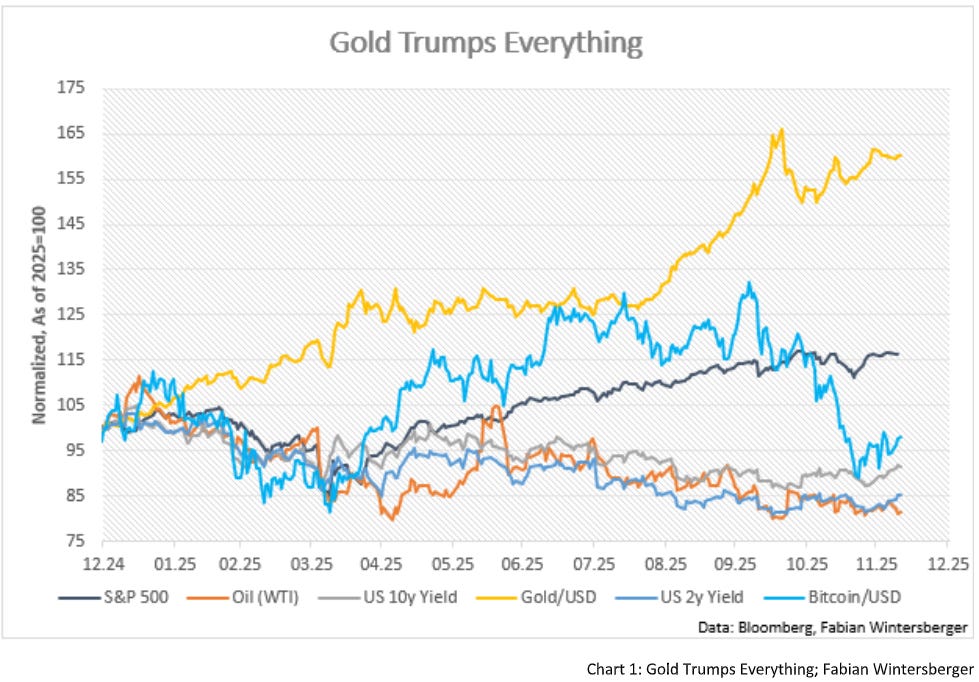

What absolutely nobody saw coming was that 2025 would turn into a golden year – literally. Gold is up roughly 60 % year-to-date and has been the best-performing asset by a country mile, leaving its digital cousin Bitcoin far behind. Bitcoin is actually down for the year, and so are oil (WTI) and longer-dated US interest rates.

I also pointed out a year ago that sentiment towards Europe was at absolute rock bottom. The strong outperformance of European stocks in the first quarter therefore wasn’t particularly surprising. What was surprising was how fast it vanished after President Trump’s tariff shock in April.

After that announcement Europe’s lead evaporated almost overnight, and the widespread fear that capital would flee the United States proved completely unfounded. As usual, reality looked nothing like the herd had expected.

Looking at price action since last Friday, stocks continue to look constructive and a Santa Claus Claus rally into Christmas remains very much on the table. The bond-market dynamics I described last week have played out exactly as outlined, with bearish sentiment still dominant. Nothing in the price action points to a major shift ahead of this week’s FOMC decision or next week’s ECB meeting.

Yet despite the solid year for equities, Trump’s economic agenda is not delivering the promised results. The tariffs, above all, are not working as intended.

Recall the core pledge: tariffs would spark a manufacturing boom and bring production back to American soil. So far we are getting the exact opposite. As the Wall Street Journal recently summed it up:

President Trump retook the White House almost a year ago promising a manufacturing boom.

He got one – in China.

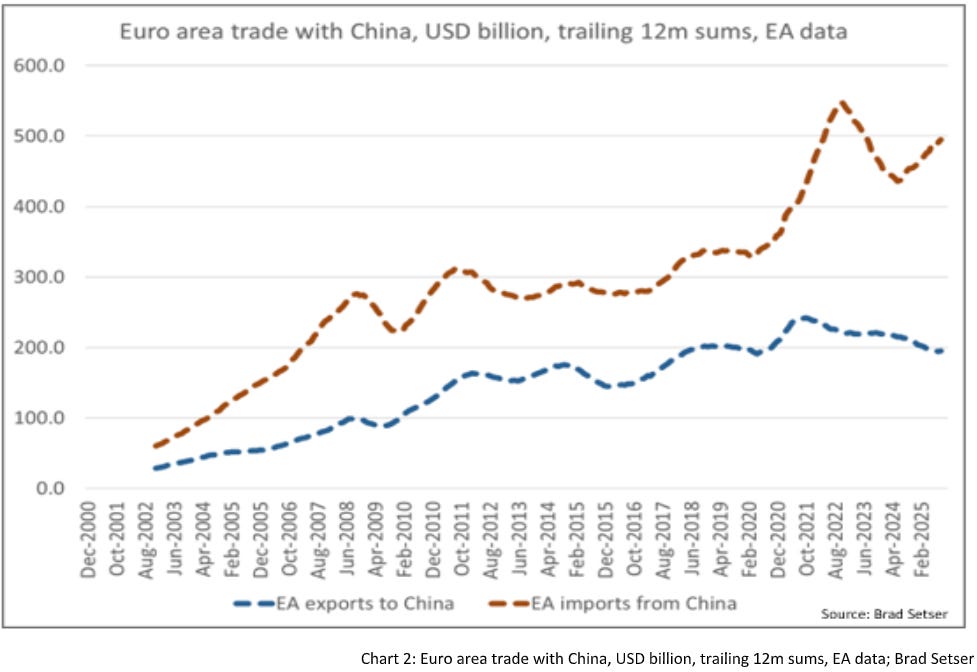

Brad Setser dissected the story in a long thread on X. China is on course for a manufactured-goods surplus of roughly $2 trillion this year – exports are carrying a weak domestic economy single-handedly. The Trump tariffs clearly haven’t slowed China’s ability to supply the world.

What happened? At first, a lot of the usual exports from China to the US were just redirected to Europe, despite European goods getting squeezed out of China.

Besides that, Chinese exporters also got around the tariffs by installing middlemen for exports into the US, namely Vietnam, Mexico and other neighbouring countries. And finally, Setser emphasises that the weakening of China’s real exchange rate has also been supportive for exports. His view is that Trump will not be able to reverse the trend without some serious concessions to China.

Of course things could still turn around in the years ahead, but the early evidence is clear: tariffs always create unintended consequences. The manufacturing boom in China is only the most obvious one.

Another classic side-effect is the damage done to American farmers. Instead of rethinking the policy, the administration is doing what every administration before it has done: it announced a $12 billion farm-aid package. Trump supporters still claim foreign countries pay the tariffs. The simpler truth is that American consumers and businesses pay them, and the aid package is nothing more than a transfer from one group of Americans to another. It papers over the problem until the next package is needed.

In short, tariffs are a tax – and the spending required to offset their collateral damage will likely exceed the revenue they generate by a wide margin.

Someone would need to prove that “I’m Not Right.”

I can be strong other times I cry

I close my eyes, try to clear my mind

Something’s missing, I’m not right

My reflection lies to me, I’ve lost myselfTetrarch - I’m Not Right

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you could share it on social media or give the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. THEY DO NOT CONSTITUTE INVESTMENT ADVICE, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.

my hope for 2026 is that the OBBB, which will reduce tax burdens on a large portion of the US population, will offset some, if not much, of the tariff impact. after all, wouldn't we want a consumption tax rather than an income tax? much more efficient.

but it remains to be seen.