I Am Broken Too

When you have trouble at home, go abroad– Niccolò Machiavelli

Everyone has heard the saying that the media is the "fourth pillar of democracy." It's a phrase that has become increasingly common in recent times, especially as social media challenges the media oligopoly, allowing everyone to share their opinions and reports with a broader audience. Critics, particularly traditional journalists, argue that these platforms lead to a rise in misinformation and fake news.

While this criticism is not entirely unfounded, there is a reason why more and more people turn to social media for their news. In principle, as the fourth pillar of democracy, traditional media is expected to fulfill four core responsibilities: to tell the truth, to be unbiased, not to spread propaganda, and to maintain the moral condition of the masses. Ideally, these responsibilities should be equally important.

However, the pandemic took things in a different direction. Many media outlets narrowed the scope of discussion to promote government policies aimed at combating the pandemic. In hindsight, it's clear that much of what the media pushed served as a tool to condition the public into compliance. Instead of encouraging open debate, it was a matter of "do as you're told or face the consequences."

Held to their own standards, the behavior of most European and American media during this time was nothing short of shameful. As a result, it's no surprise that trust in the media to provide unbiased and truthful news has eroded. For instance, Jeff Bezos, in his own Washington Post, admitted, "The hard truth: Americans don’t trust the news media," acknowledging this issue while also vowing not to let the paper "fade into irrelevance, overtaken by unresearched podcasts and social media barbs – not without a fight."

This may seem like a relatively new phenomenon—perhaps because more news outlets are now aligning with a particular viewpoint. But it's important to remember that pushing government narratives has a long history in the Western world, particularly since World War II, especially regarding geopolitical conflicts. The critical difference, however, is that there were always voices questioning the dominant narrative back then.

The movie Wag the Dog, which is almost 30 years old, revolves around a government lie propagated through the media to distract the public. In the film, the president’s reelection team fabricates a story about a fictional war in Albania to shift public opinion away from allegations against the president.

One might recall infamous examples such as the Gulf of Tonkin incident, the fabricated story of babies being thrown from incubators in Kuwait or the false claims about weapons of mass destruction in Iraq. These were all lies pushed by the media that were only exposed after the fact when they simply stopped reporting on them. In today’s world, breaking news fades as quickly as it arrives, and the public's attention span is limited.

In contrast, today, lies can be exposed in real time by vigilant investigators on social media. Traditional media outlets love to fact-check, but they aren't so keen when they are fact-checked. This is one reason social media represents such a threat to the power of traditional media. Social platforms are eroding their ability to control public discourse.

Just as the media shapes political opinion, it also shapes economic expectations and market behavior. Good news tends to generate optimism, driving more investors to act euphoric, while bad news has the opposite effect, leading to a more pessimistic view of the economy. On many occasions, it would have been better to do the opposite of what the media's sentiment suggests. This is why the "magazine cover indicator ” advises taking the opposite position of what the media covers.

In financial markets and economics, people are accustomed to hearing multiple explanations for the same event, with causality varying depending on who you ask. While such debates can go on endlessly in economics, financial markets are different. Ultimately, what matters is whether you made money, regardless of whether your thesis was right or wrong.

In trading and investing, you might start with a hypothesis about what could happen, but you must always be willing to reevaluate the situation and adjust your view. If you stick too rigidly to your original stance when prices move against you, you'll likely lose money—just like most retail traders.

Narratives drive market prices and positioning; everyone knows this. However, when a particular narrative becomes widely accepted, it often means it has already been priced in. Therefore, it always pays off to look beyond the prevailing narratives, searching for anomalies and potential opportunities to profit.

Currently, I would describe the dominant sentiment in the market as one of "optimism"—perhaps even "euphoria." One reason might be that, after Donald Trump's election, people are drawing conclusions from his first term and assuming his next term will benefit stocks. This is almost the opposite of the expectations surrounding his first term.

Further, the number of people expecting a recession a year from now is significantly lower than in 2023 or even 2024. This doesn't mean investors should become outright bearish on stocks, but it does suggest that reckless buying is not advisable, as the risk/reward ratio is skewed to the upside. However, this doesn't mean stocks can't continue to rise.

Economic data this week doesn’t show any signs that the US economy is in trouble. Although consumer assessments from the Conference Board and the University of Michigan fell short, the Conference Board’s Confidence Index reached its highest reading in a year. At the same time, the University of Michigan index shows a solid upward trend. Expectation indices for both surveys came in above median estimates. These numbers do not suggest any concerns from the consumer.

Another noteworthy data point from the Conference Board’s survey is the number of people planning vacations. Vacations are a discretionary spending item, something people want but don’t necessarily need—especially when traveling abroad. Despite lower numbers than in the 2010s, the number of people planning to vacation abroad remains at multi-decade highs, a sign of a healthy consumer.

However, there’s another side to the story, one that highlights a growing disparity. While the overall economic recovery has undoubtedly benefitted some—presumably wealthier Americans—others continue to struggle. CNBC recently reported:

The share of Americans with credit card debt in retirement has jumped considerably — a worrisome financial trend, especially for those with little wiggle room in their budgets, experts said… About 68% of retirees had outstanding credit card debt in 2024, up “substantially” from 40% in 2022 and 43% in 2020, according to a new poll by the Employee Benefit Research Institute… “It’s alarming for retirees living on a fixed income,” said Bridget Bearden, a research strategist at EBRI who analyzed the survey data.

On a broader scale, consumer debt-to-wealth ratios are much lower than before 2020, meaning that households, on the whole, are in a better financial position. This is due to reduced nominal debt (thanks to inflation) and rising asset values. However, it's important to note that those without assets bear the brunt of this recovery, which may explain why the narrative of a booming economy hasn’t resonated with many voters in recent elections.

Recent data on home sales shows signs of trouble, with a 17% drop in monthly sales. However, this figure is distorted by the effects of Hurricane disruptions and shouldn’t be taken at face value. Nevertheless, the housing sector remains one area that doesn’t fully align with the overall positive economic picture. This may be due to higher interest rates and dampening demand from potential homebuyers looking for larger homes.

This week also brought us the annualized GDP figure for Q3, which showed a solid real growth rate of 2.8% or a nominal growth of 5%. Overall, growth remains more robust than during most of the 2010s, further undermining the claim that a recession is imminent. While this could change in the coming year, betting on a recession at this point seems unlikely to be a profitable strategy.

From my perspective, there are two potential headwinds for the stock market, even in the face of continued economic growth: lower-than-expected earnings and interest rates. For instance, markets expect a 14% growth in S&P earnings over the next 12 months. If earnings fail to meet these expectations, it could create a headwind for stocks, though this wouldn’t necessarily indicate weakness in the broader economy.

The second potential headwind involves interest rates—specifically, long-term rates. I’ve written extensively about this in recent weeks, outlining my thesis that interest rates may rise over the medium term. In the short term, I’ve suggested we could see a correction in interest rates based on market sentiment and positioning.

In the past week, we've seen the beginning of an unwind in short-bond positions, which led to a drop in global 10-year yields. Of course, as with all market movements, there are multiple explanations, but the fact that 10-year Bund yields fell more sharply than 10-year Treasuries suggests that this decline was driven by weak economic data from the Eurozone.

If that assumption holds, it could mean that the downside for 10-year Treasury yields is limited, assuming the US economy continues on its growth path. Additionally, the Federal Reserve's upcoming monetary policy decisions in December will play a key role. Currently, market participants expect the Fed to cut rates by 25 basis points again. While this could result in a drop in both short- and long-term yields following the announcement, long-term yields might start rising again if the market interprets the rate cut as stimulative for the economy.

This week's FOMC Minutes from the November meeting revealed growing uncertainty within the Fed about its previous stance, which suggested that interest rates were well above the neutral level and, therefore, restrictive:

Many participants observed that uncertainties concerning the level of the neutral rate of interest complicated the assessment of the degree of restrictiveness of monetary policy and, in their view, made it appropriate to reduce policy restraint gradually.

In my view, this is important because it implies that the Fed is essentially "flying blind" regarding future interest rate policy. This could lead to higher market volatility and an increase in the term premium, as the Fed typically aims to "guide" the market on its future policy path. If the Fed loosens policy too much, long-term yields should rise. Conversely, long-term yields may be too low if the Fed funds rate is already at or near neutral.

Moreover, skepticism about long-term yields falling as much as they did in previous cycles stems from inflation concerns. The PCE data released this week shows that inflation has remained stable above the Fed's 2% target for over a year despite a declining money supply. This may be due to a fall in the demand for money (what monetarists refer to as "velocity"), which leads to higher prices even in the face of a shrinking money supply in 2023.

This year, however, the US money supply has begun to expand again, which could lead to heightened inflationary pressures next year—especially if the demand for money continues to fall towards historical levels. As a result, I believe the thesis that long-term interest rates will fall substantially in the US is unlikely.

In contrast, the situation in the Eurozone is different. Last week's shortfall in PMIs suggests increasing concerns about the Eurozone economy. While many of the Eurozone's problems relate more to economic policy than monetary policy, the European Central Bank will likely be under more significant pressure to lower interest rates more quickly than the Federal Reserve to ease some of the strain on businesses and consumers.

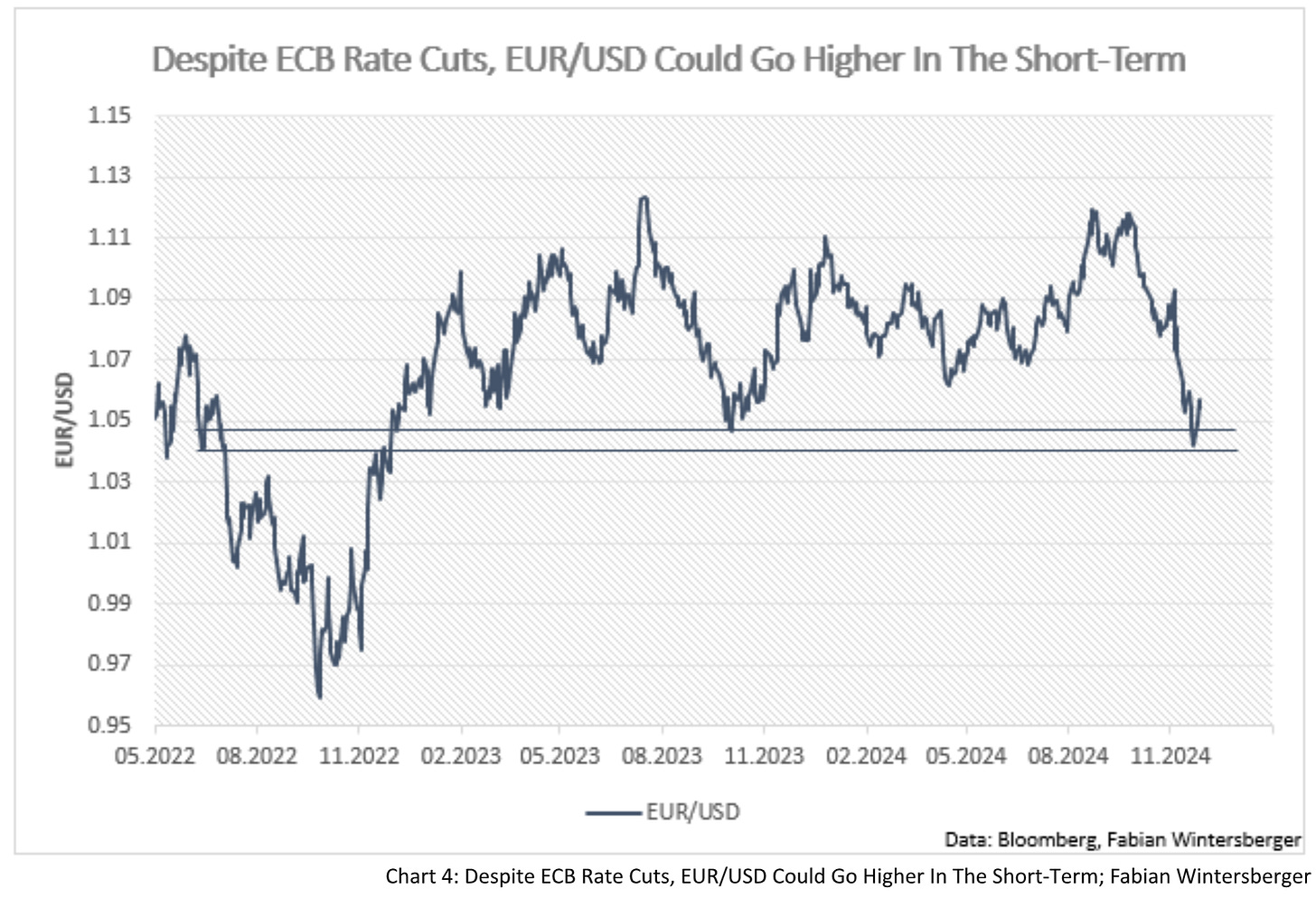

While one might expect this to lead to a lower EUR/USD, the short-term move could be higher. Much like with US yields, long positions in the dollar were crowded, and as I noted two weeks ago, there could be an unwind first. At the moment, the 1.04-1.05 resistance level seems to be holding, which supports the idea that EUR/USD could temporarily rise.

At the moment, the market seems to believe there’s a possibility the ECB could cut rates by 50bps in December. Looking at the economic data, I’d say this is highly plausible. Unlike the US, inflation has fallen below target in most Eurozone countries, and the ongoing economic weakness suggests the ECB may have less to worry about in this regard than the Fed does.

I also think the spread between US 10-year Treasuries and Bunds could widen further due to the growing economic divergence between the Eurozone and the US. The recovery in the US is primarily the result of pandemic-era "helicopter money" trickling up to higher-income brackets, albeit at a slower pace than many had anticipated.

In contrast, the Eurozone's response was markedly different. Helicopter money was only used sparingly to ease the burden of higher energy prices caused by the war in Ukraine. Instead, Europe relied on short-time work subsidies to keep workers employed, which hindered the necessary labor market and economic restructuring. Subsidies to businesses kept them afloat but led to significant malinvestments.

Rising bureaucracy, high wage costs, and soaring electricity prices harm any economy. However, the EU (and the UK, which still mirrors many EU policies despite Brexit) has yet to acknowledge this fully. As a result, it's no surprise that reports of businesses cutting jobs or moving production abroad are becoming more frequent.

This week, the EU Parliament approved the new European Commission under Ursula von der Leyen. While Germany—von der Leyen's home country—should serve as a cautionary tale about the problems created by stubbornly pursuing a green transition that global competitors are avoiding, she remains resolute in her stance:

I want to be clear: We must and will stay the course on the goals of the European Green Deal. But if we want to be successful in this transition, we must be more agile and better accompany people and business along the way. This is why we will put forward the Clean Industrial Deal within the first 100 days of the [commission presidency] mandate.

Given this, my hopes for an economic turnaround in the EU and the Eurozone remain limited as long as EU politicians continue to believe that the strategy of "when in trouble, double" can drive improvement. It risks putting Europe in the crossfire of the ongoing trade war between China and the United States without a straightforward strategy to navigate that conflict.

In the current negotiations between the social democrats, conservatives, and liberals in Austria, the phrase "no more business as usual" is used. Concerning financial markets, it seems there is no longer any "business as usual" like we saw in the 2010s.

The idea that a second term for Trump might be just as beneficial for stocks as his first term could be in doubt. Similarly, the long-term trend of falling interest rates that followed the pandemic appears to have broken, and signs suggest it won’t return anytime soon. The same holds for the era of low inflation over multiple years. The European growth model is also clearly broken too.

If you needed proof, I'll reopen my wounds,

In all the right places for you

So now you see the truth, that you are broken too

I'll reopen my wounds for youKillswitch Engage - I Am Broken Too

Have a great weekend & happy Thanksgiving in the US!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.

Fabian, I think you are spot on here. it is very hard to see how Europe overcomes their green obsession and is able to grow in any significant manner. their collective energy policy has been extremely detrimental to the economic activity across virtually every nation there.

This is simply highlighted by the Trump policies that are expected to be implemented, best described as drill, baby, drill, and the ongoing relative cheapness of energy in the US vs. Europe.

I have said it before and am becoming more convinced that Europe is set to become a historical tourist destination without any serious means of domestically driven business activity. kind of a living museum.