Hypochondria

There is only one side of the market, and it is not the bull side or the bear side, but the right side. ― Jesse Livermore

Over the past few years, more and more people have become aware of conspiracy theories, especially since some appeared to manifest during the pandemic. While one could argue that poorly managed communication by politicians and scientists during the pandemic helped fuel these beliefs, a growing number of individuals now suspect that events such as the Kennedy assassination, the moon landing, or 9/11 were conspiracies.

I won't delve deeply into these conspiracy theories here, but it's important to note that sometimes, the line between reality and fiction can become blurred. Things presented as bearing a lot of truth may actually serve a different agenda altogether. Some theories paint Hollywood as a propaganda tool controlled by those who secretly run society. According to these theories, many elements in Hollywood movies foretell future events.

One example often cited by proponents of these ideas is "The Simpsons," a popular animated sitcom created by Matt Groening that humorously satirizes American culture, politics, and daily life. The show is celebrated for its ability to cleverly address social issues and current events through colorful characters and absurd scenarios.

While some episodes feature real-world celebrities and seemingly predict future events, it's more likely that the show's authors stumbled upon coincidences rather than having foreseen the future. For instance, some believe that a particular episode predicted the pandemic. However, this episode was produced during the swine-flu hysteria, not as a prophecy of the events that unfolded in 2020 but as a satirical take on contemporary fears and events.

The point I want to emphasize here is that the tendency to seek out data that supports one's preconceived beliefs is deeply ingrained in human nature. People gravitate towards news that aligns with their worldview and narrative. This phenomenon is especially prevalent in some sciences, notably the social sciences, particularly financial markets.

Financial markets often react vigorously to various data releases, which are heavily influenced by their underlying methodologies. These data are not mere collections; they are estimations. Many data releases present different perspectives on the same topic. As I mentioned, human nature inclines individuals to prioritize data aligning with their narrative while downplaying contradictory information.

There's an old saying that perception shapes reality, which is especially true in economic and financial market analysis. That's why I always stress that data alone doesn't speak for itself. Data becomes meaningful when interpreted through a valid theory that can explain observed patterns. Analysts must delve deeper to understand the underlying reasons if the data doesn't align with the theory.

When reading financial analyses, one can always find well-crafted reports supporting both bullish and bearish cases for an economy or specific assets. That becomes more apparent in uncertain economic landscapes. The current economic scenario epitomizes this uncertainty, with diverse interpretations stemming from the plethora of published data.

Currently, the prevailing consensus theory regarding the trajectory of the US economy is that we're amidst the beginning of an economic boom. Some argue that we're approaching a speculative mania that will propel stock prices to levels unseen in over 20 years.

Conversely, others caution that these claims lack substance upon closer examination of the data. This debate has persisted for as long as financial analysis has existed. That is the beauty and the beast of financial markets—analysts are occasionally, but never consistently correct, whereas mainstream economists are often consistently wrong.

This dynamic embodies the beauty and the challenge of economics and financial markets. Unexpected events can radically alter the course of history, and sometimes, data fails to present an accurate picture of the economy or requires revision. Consequently, traders and investors frequently find themselves readjusting their assessments.

It's worth noting that despite the influence of consensus on pricing, consensus views on economic trajectories often miss the mark, either underestimating or overestimating outcomes. Recall the consensus at the beginning of the year, which predicted six US interest rate cuts. However, subsequent inflation reports prompted a complete reversal, with markets now anticipating only one rate cut.

The critical question now is whether markets have adequately adjusted to reality or have perhaps overreacted. There's even a possibility that we could end the year with more than six rate cuts, or alternatively, the consensus may prove correct.

Supporters of the bullish case highlight strong consumption, tight labor market data, reaccelerating inflation, and mispriced long-end yield curves. Their forecasts anticipate economic expansion, rising stock prices, declining long-term bond yields, and an appreciating US dollar against other fiat currencies.

Let's address the claim that consumption is robust. Unlike Europe, the US economy heavily relies on robust domestic consumption. This trend is fueled by unprecedented government deficits during an economic expansion comparable in magnitude to those of China or India.

However, this apparent strength in consumption is accompanied by concerning trends. Many US consumers have increased deficit spending, buoyed by the illusion of wealth stemming from rising asset prices. Innovations like "buy now, pay later" have supported household consumption levels, but a significant portion of users—56%, according to Bankrate—struggle with overspending and missed payments. That contradicts the assertion that consumers are in good financial shape.

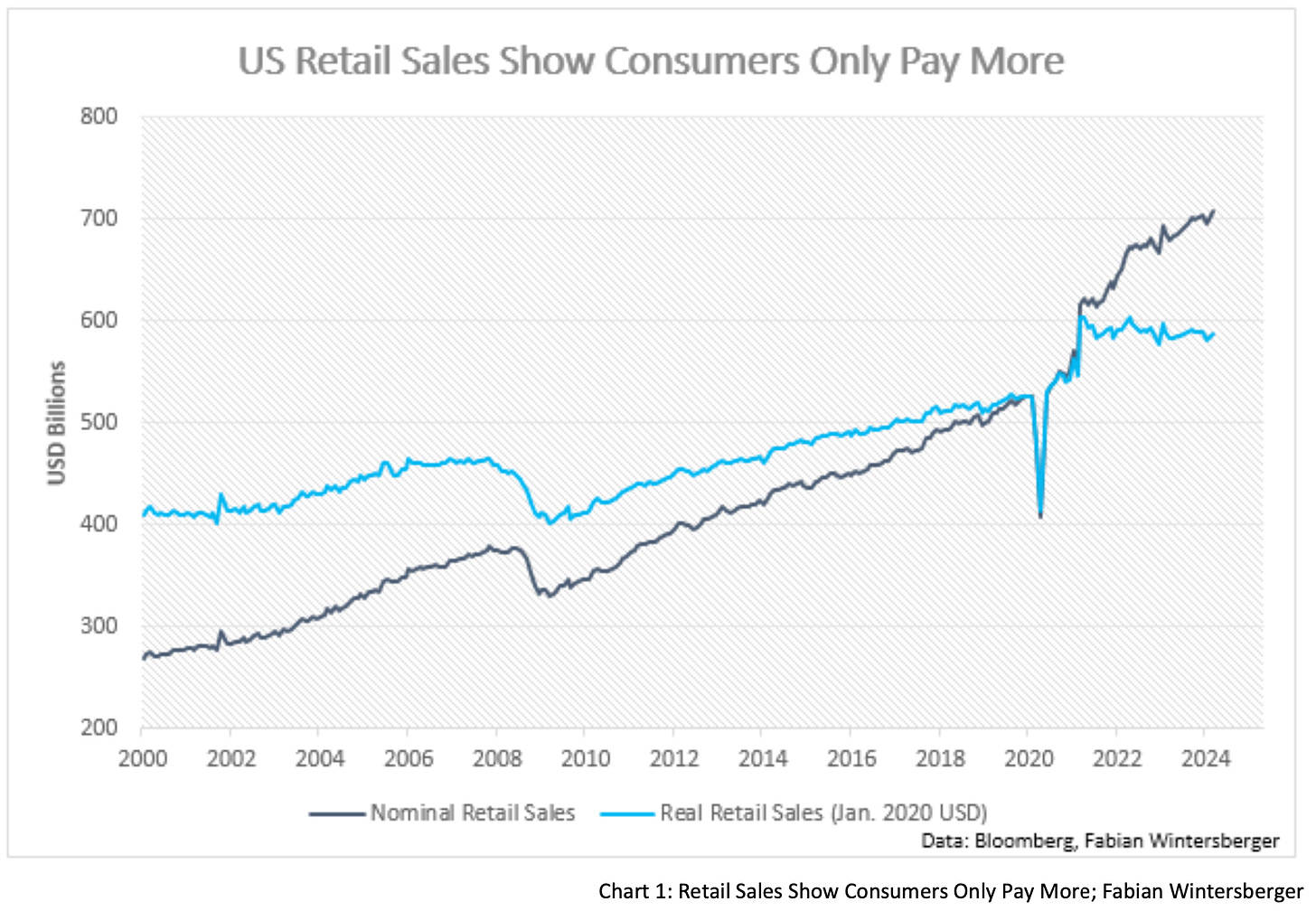

Another point of contention is real retail sales. While nominal retail sales have surged, adjusting for inflation reveals a stagnant trend since late 2021. This divergence from typical economic expansions, where real retail sales tend to rise, challenges the narrative of a strong consumer base.

That being said, it's undeniable that consumption is significantly stronger than most analysts anticipated a year ago. The question arises: is this level of consumption driven by genuine economic strength, or is it merely fueled by increasing consumer debt? While this might seem insignificant in the short term, it's crucial to evaluate its implications for the further, mid-term, and long-term economic trajectory.

When consumption is financed through debt, it entails using anticipated future income to finance current spending, thereby reducing available funds for future consumption, which is inherently tied to future income. Future income is contingent upon employment status—whether one is employed or receiving unemployment benefits. The current pace of aggregate consumption reflects historically low unemployment rates. Therefore, if unemployment rates rise, future income declines, leading to reduced consumption.

This brings me to the second assertion of the "no-landing" crowd—that the labor market remains tight and will likely continue to do so. Labor market conditions are pivotal in assessing the economy's strength. Before discussing other indicators, let's revisit a data point often cited to support this claim: jobless claims and continuing claims.

Presently, the data indicates a robust labor market. Last week, the Department of Labor's Employment and Training Administration (ETA) reported 212,000 seasonally adjusted new jobless claims. However, what appears somewhat peculiar is the absence of fluctuation in five out of the last six reports. This consistency seems statistically improbable, given that the data, including the non-seasonally adjusted figures, typically displays fluctuations.

Moreover, as I've previously emphasized, employment data serves as a lagging indicator, providing a snapshot of current labor market conditions without offering significant predictive value. Therefore, it's imperative to analyze additional employment-related data to understand future labor market conditions better.

Several indicators suggest that the current US economic expansion may reach its conclusion sooner rather than later. The latest US PMI report is a case in point. Despite indicating a slight economic expansion, the PMI largely fell short of expectations, revealing signs of cooling demand across manufacturers and service providers.

Declining demand for goods and services translates into reduced labor demand, particularly evident in the employment sector. Reports indicate a decline in workforce numbers, especially within the service sector—marking the most substantial drop since late 2009, excluding the initial pandemic-related decline.

Similarly, the latest NFIB Small Business Reports highlight significantly reduced hiring plans for the year. In sum, these findings support the assumption that the labor market could face considerable weakness in the coming months unless small business owners reassess their hiring strategies and become more optimistic about prospects.

Falling demand for labor would result in declining wages, even if a substantial influx of immigrants bolsters the supply. Decreasing wages would exacerbate demand weakness, potentially leading to further layoffs and potentially a recession.

Another consequence of this scenario would be a decline in prices as businesses struggle to sell at current prices due to insufficient demand. This brings me to the argument that inflation has bottomed out and will likely remain above 3% due to changes in consumer behavior.

It's true that shifts in consumption patterns can drive inflation levels higher in the short term. Ultimately, prices are determined by producers striving to sell their goods at optimal prices in the market. Rising inflation expectations can lead to a short-term increase in inflation rates. However, in the medium and long term, the relationship between the quantity of currency in circulation and the amount of goods produced determines whether price increases are sustainable or merely reflective of unrealistic expectations.

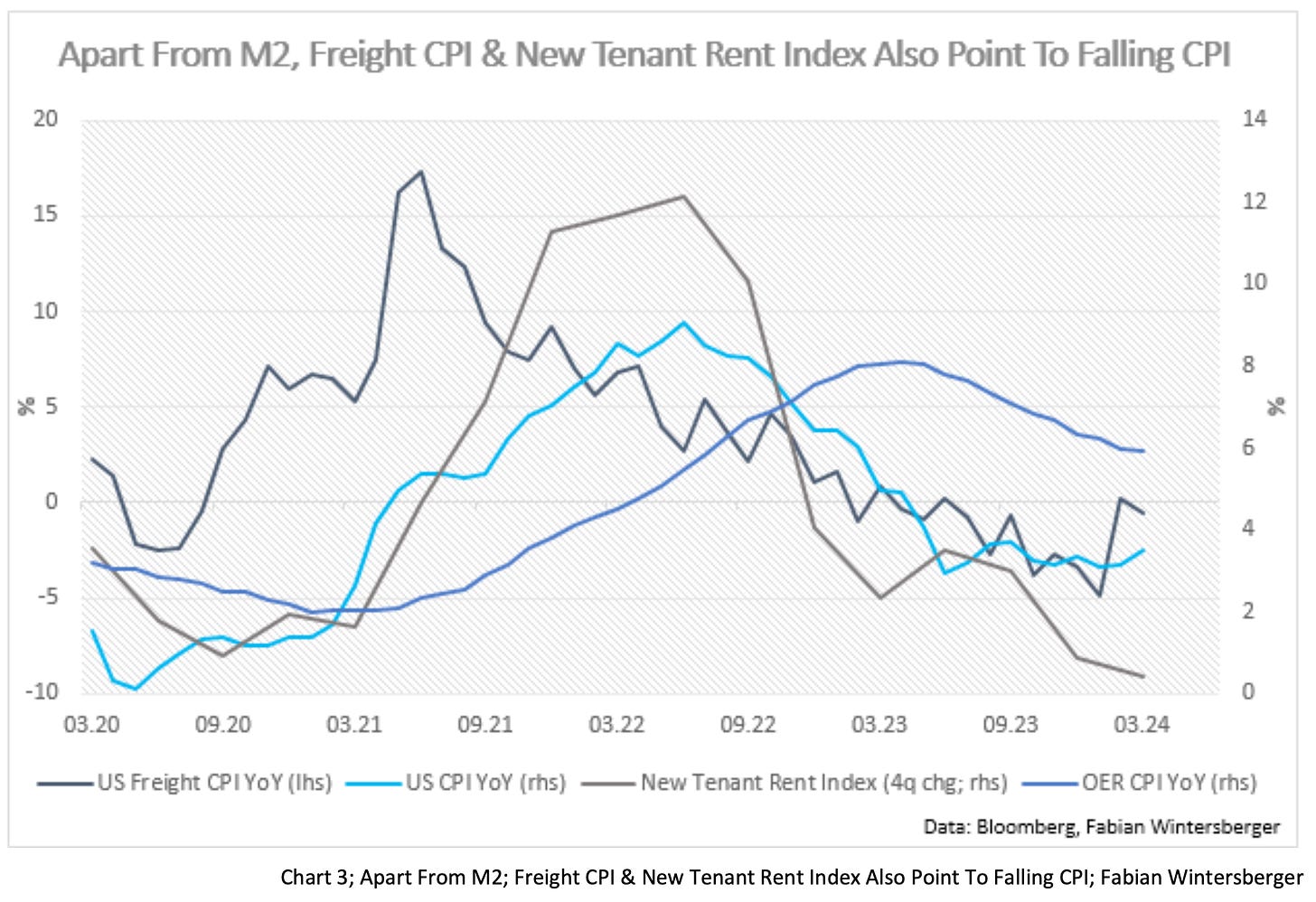

The decline in the M2 money supply throughout 2022, following a ten-month sideways trend in 2021, suggests that price inflation will further decrease in the coming months due to this lag effect.

Despite this insight, economists and analysts now focus on micro-level price changes, extrapolating them to forecast inflation trends while adjusting for quality improvements and other factors. Jerome Powell introduced the "Supercore" metric, which historically has never fallen below 2%, as noted by Danielle DiMartino Booth in a recent TV appearance where she explained this metric.

Examining prices at the micro-level can yield conclusions similar to those drawn from analyzing the money supply. Freight rates serve as an excellent leading indicator, influencing prices across various sectors. Additionally, indications from new tenant rents suggest that the lagging component of the Owners’ Equivalent Rent, which accounts for 25% of the CPI, will continue to decline.

However, understanding that most economists, analysts, and traders do not closely monitor the money supply explains why the recent sideways trend in US inflation prompted a reassessment of the situation. Investors’ expectations for six rate cuts this year were scaled back to just one. People focused on metrics like Supercore and other categories of the CPI, along with rising commodity prices, and concluded that inflation had bottomed out.

Consequently, the yield curve has been repriced at the long end, with rates trending upward. Given the economy's outperformance relative to expectations and the consensus shift toward sustained economic growth, the "higher for longer" stance is becoming more widely acknowledged. Assuming short-term interest rates remain elevated, one can anticipate reduced demand for 10-year bonds, leading to lower bond prices.

Hence, if the US Treasury increased its issuance of long-term bonds, yield increases would accelerate. That might explain why the Treasury has focused on bill issuances, which the market can absorb more easily. Current market positioning suggests that long-term yields could continue rising unless unexpected data, such as weak PMI figures, prompts a reassessment by market participants.

Further, although real GDP came in much cooler than expected in Q1, 1.6% annualized vs. 2.5 expected, it still underscores the US economy's ongoing resilience. With a robust labor market and solid earnings reports, investor expectations lean toward the Federal Reserve implementing only one interest rate cut this year.

In the short term, we might expect a frothy stock market that trades sideways, possibly reaching new highs. That could coincide with further bear steepening and normalization of the yield curve. As the curve steepens, there's mounting pressure on the stock market, as expected earnings must be discounted at higher rates. Investors might rotate into bonds if long-term yields reach a certain level, potentially pushing stock prices lower.

This dynamic is particularly notable given that stocks and bonds exhibit a positive correlation when inflation exceeds 3% and a negative correlation when inflation is lower. After years of low rates, many investors were taken by surprise, although the recent trends are logical.

Higher inflation, resulting from monetary expansion causing increased demand, initially benefits asset prices as well. However, stocks may come under pressure once interest rates reach a certain threshold.

Should the thesis of continuously falling inflation prove correct, decreasing demand could follow, placing pressure on business margins and leading firms to consider layoffs.

In such a scenario, markets could be caught off guard once again. The effectiveness of one or two Federal Reserve rate cuts remains uncertain. Initially, stocks might rally to new all-time highs if investors anticipate only gradual rate reductions by the Fed.

Subsequently, the yield curve could further normalize, with short-term rates declining more sharply than long-term rates. The economy's trajectory will determine whether sentiment remains positive, potentially leading to increased asset purchases, or if deeper rate cuts are required due to economic slowdown, dampening sentiment, and contracting investment.

In this context, the euro could benefit initially from the expected narrowing of the interest rate differential relative to the dollar. However, prolonged US economic weakness could spill over into the eurozone, reducing demand for European exports and potentially halting the region's recent recovery, prompting investors to seek the dollar as a safe haven.

While an immediate shift seems unlikely, the ongoing trend of interpreting and selectively using data to support bullish or bearish views will persist. Optimism remains prevalent, and skepticism from long-term bears, who have been predicting a recession for years, may continue to be dismissed as hypochondria despite the growing possibility that their warnings could materialize over time.

You swear what's wrong is only in my head

It's never justified, I'm terrified

Would I be better off alone instead?

If there's no need for remedyDragged Under – Hypochondria

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. It is strongly recommended to seek independent advice and conduct your own research before making investment decisions.

Two things Fabian, first, the difference between conspiracy and reality is about 6 months these days. at leas that has been the case since Covid.

second, I disagree that we are entering a much slower economic phase. I fear that the 40% increase in money supply that accompanied the Covid stimulus is not nearly worn down and there is still ample liquidity around. add to that the near certainty that Yellen will play with the TGA to support markets and the economy as much as possible heading into the election, and I feel there is little evidence that inflation rates are going to head back anywhere close to 2%, rather 3.5% CPI seems like a base to me. but then, that's what makes markets! hope your weekend was good