For Whom The Bell Tolls

We all consider the things we perceive as reality and that the people around us perceive reality the same we do. Thus, we often struggle to understand why other draw different conclusions from their observations of specific events than we do.

The philosopher Paul Watzlawick described that fact as follows:

The belief that one’s own view of reality is the only reality is the most dangerous of all delusions.

In his work, the constructivist Watzlawick states that there are two realities. Those that are conveyed to us through our senses, what he calls the first-order reality, and those of second-order, which are only attributions to it, such as meaning and value. According to Watzlawick, those things (meaning and value) are not decisive for the truth because they are based on our subjective interpretations.

Yet, many of us support our assumptions about what we consider to be the reality to a large extent on truths of the second order. As a result, at some point, we often have to realize that the things we considered to be absolutely true were based on false assessments of the situation.

Throughout history, there have been a lot of examples of that, especially when it comes to geopolitics. A recent example is the assessment of many military strategists that the Russian Federation can conquer Ukraine within days and that Ukraine faces a superior power. Those assessments are now about a year old, and the war is still going on because of the brave resistance of the Ukrainian people.

Another example is the fate of Napoleon Bonaparte. After Napoleon was defeated by Russia, Prussia, Austria, and the United Kingdom, he was banished to the island of Elba, which is now a part of Italian Tuscany. As he landed on the island, he decided to take another shot to regain power over France. However, his belief (his reality) that the victorious powers, which debated about a new order on the continent at the famous congress of Vienna, were still too divided to react fast was a fatal misjudgment. As soon as Napoleon returned to France, they formed an international coalition, declared Napoleon a disturber of world peace, and planned their own invasion of France, resulting in Napoleon’s final defeat at the Battle of Waterloo.

Often, our actions are based on our subjective assessments of the truth, which turn out to be untrue later. How often did sports teams lose important games after a comfortable lead because they were too sure of themselves? In the world of economics and finance, misjudgments and false assessments of reality often have led to losses of great fortune.

Let us remember the words of the US economist Irving Fisher, who gave an interview to the press just a few days before the 1929 stock market crash. In the interview, he stated that it looks like stock markets have reached what looks like a permanently high plateau. In the following days, he suffered significant losses in the stock market.

Also, in the new millennium, many economists had to realize that many assessments, based on the results of their econometric models, were haunted by reality much more often than they wished. You, Dear Reader, probably remember the latest winner of the Nobel Prize in economics, Ben Bernanke, who told the public in March 2007 that he did not expect that the problems in the US housing market could lead to severe troubles in other sectors of the economy. In January 2008, he said that the Federal Reserve was not forecasting a recession for the US economy for that year. Many quotes of Ben Bernanke from that years were indeed noble prize-worthy.

Last year, after a brief announcement, the Federal Reserve started quietly shrinking its balance sheet, which had ballooned sharply since 2008. However, this time, it refrained from saying something like the current US treasury Janet Yellen when she was head of the Fed. Back then, Yellen stated that Quantitative Easing would be like watching paint dry.

It remains to be seen if the Fed will succeed and end QT as planned this time without causing market turbulence. Currently, the Fed assumes it will, but as Josh Billings wrote in 1874 in his book Everybody’s Friend: Josh Billing’s Encyclopedia of Humor:

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

Compared to last week, European and US equity and bond markets are essentially unchanged, and so are the expectations of market participants. While European PMIs confirmed an improvement in the economic climate in the EU states, causing hopes that the European economy can avoid a recession in 2023, the latest data from the US points to a cooling of economic activity.

During recent weeks, news about job cuts in the US tech sector continued, let it be Amazon, Meta, or Alphabet. All announced plans to reduce jobs, and market participants reacted positively to this news.

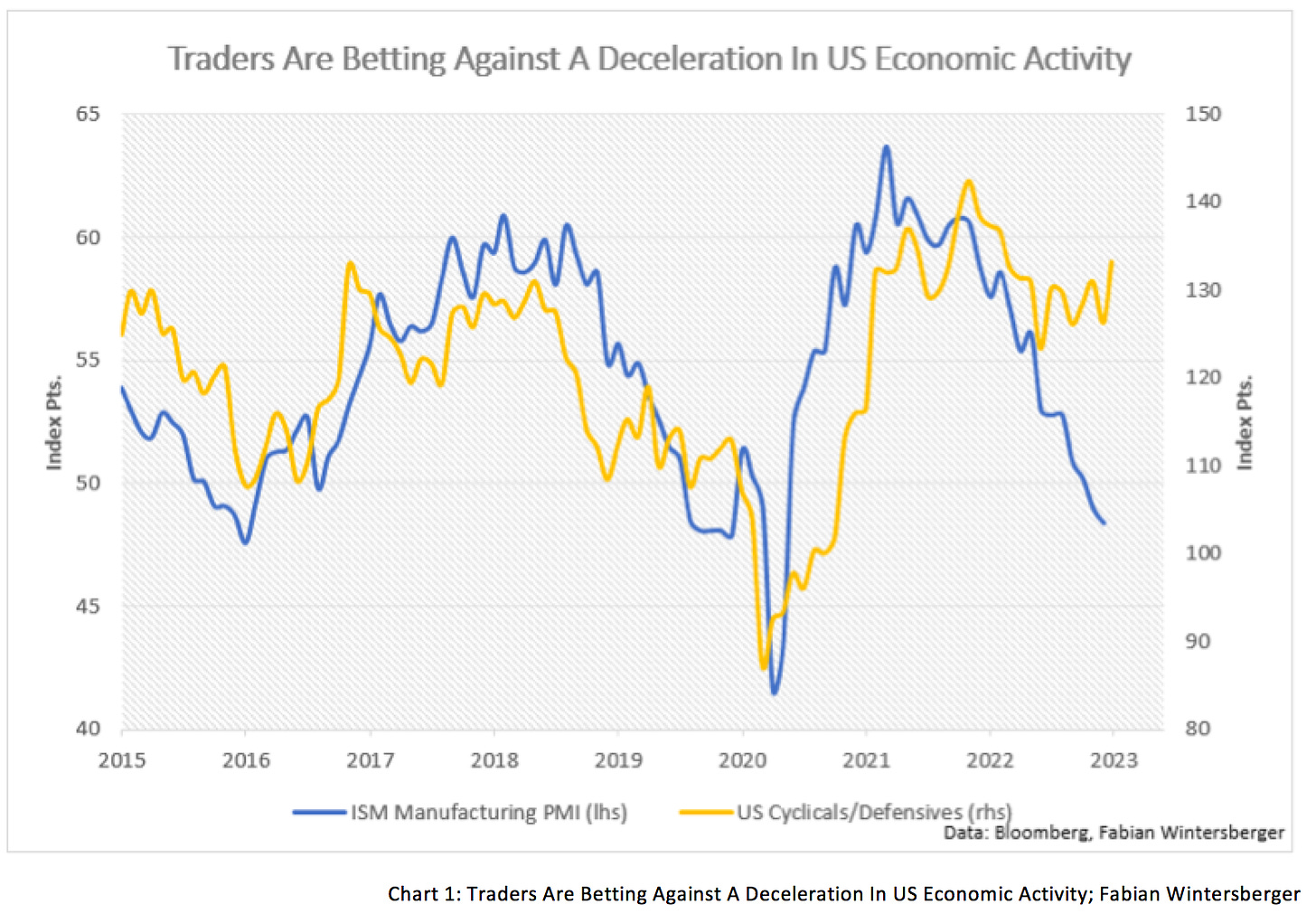

However, market participants are currently calm about the deteriorating US economic data. At this point, many market participants seem to speculate that economic activity in the US might accelerate in the coming months, mainly because the labor market is still robust.

Even though the Federal Reserve’s goal is to take liquidity out of markets via interest rate increases and Quantitative Tightening all, the S&P 500 (+ 4.6 %), the Dow Jones (+1.8 %), and the Nasdaq Composite (+8.1 %) have risen year-to-date. Market participants probably want to front-run the awaited Fed pivot they assume will come later this year. As a result, one can conclude that an actual Fed pivot will lead to a sell-off in the stock market (buy the rumor, sell the fact).

I continue to assume that the current rally is just another bear market rally. Yet, liquidity has improved substantially recently, despite the Fed’s tightening monetary policy.

One driving factor is the US is facing its debt ceiling (again). Hence, the US treasury needs to run off its Treasury General Account, which injects liquidity into markets from which stock markets benefit.

Financial conditions in the United States have also improved noticeably despite the Fed tightening. Currently, financial conditions are where they were in February 2022, when the Federal Funds Rate was still at the Zero lower bound. Nevertheless, one should not forget that monetary policy works with a lag of 8-24 months, depending on the study.

Additionally, the vast amounts of bank reserves in commercial banks' balance sheets induce them to be not dependent on additional deposits. As a result, their deposit rates are still close to 0 %. As the Fed raised interest rates, it basically widened commercial banks’ profit margins and caused them to expand their loan portfolio.

Yet, that situation is not new and holds if one looks at the latest recent interest rate hiking cycles in this millennium. Commercial bank lending and financial conditions improve as the Fed Funds rate increases. Liquidity conditions tighten when the Fed starts to cut interest rates due to economic turbulence, and banks become more reluctant to lend.

Most economists expect a mild recession in the United States because companies’ most recently published earnings may have been mixed but not nearly as bad as some analysts had assumed.

On the other hand, according to the weakening ISM Services Index, one can assume that earnings per share might also fall in the coming months, which contradicts the soft landing narrative for the US economy.

Therefore, one could assume that potential trouble for markets and the world economy will spread out from the US at some point. That assumption is also supported by the fact that European and emerging market stocks outperformed US stocks.

While the outlook for the US economy diminishes and economic data surprises to the downside, European economic data surprises on the upside, as the CITI Economic Surprise Index for both regions shows. Still, it is probably because the better-than-expected data from Europe could cause market participants to underestimate potential risks.

Positive economic data has implications for the ECB’s future path of monetary policy, and it may be forced to tighten further if it wants to reduce consumer price inflation to 2 %. This week, Christine Lagarde assured markets again that the ECB will stay the course.

Fabio Panetta, head of the Banca d’Italia, stated that he is still worried about high consumer price inflation despite recent good readings. It remains his secret why he considers the latest consumer price inflation print to be a good reading, as core CPI came in above expectations and rose to another high.

A 50 basis points rate hike at the ECB meeting next week is almost 100 % certain. Still, the latest statements from various members of the ECB’s governing council suggest that its members are divided about the rate of interest rate hikes after that. While the hawks, like Klaas Knot (Ned) or Joachim Nagel, favor another 50 basis points rate hike in March, doves within the governing council favor a more gradual approach with several 25bps rate hikes.

However, given the current high consumer price inflation, the camp of the hawks has grown, which supports the assumption that the ECB will hike rates by 50 basis points next week and in March. As European economic data continues to surprise upward, the ECB may not have another choice.

Additionally, the situation in European energy markets likely remains tense. Oil (WTI) has risen above 80 dollars/barrel, and the coming ban on Russian diesel from the market might cause another spike in diesel prices. Further, money supply M2 in the euro area is still expansionary and still grows by more than 4 % yearly.

Market participants expect the ECB to hike interest rates slightly above 3 % this year and will let them decrease gradually during the following year. But if consumer price inflation continues to grow stronger as markets assume and force the ECB’s hand, interest rates may increase more than currently priced in.

While it is true that expansionary fiscal policy helped to improve the balance sheets of many European businesses, one should keep in mind that it also put a strain on national budgets. The same goes for current measures to dampen the effects of rising prices. Further, the EU plans to force the green transition via higher government subsidies for those sectors, which also means higher inflation rates.

Remember that it ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. Regarding the United States, market participants expect it will just take a few more months until the Fed pivots and starts loosening again, as the US economy will experience a mild recession, while more and more analysts and economists expect that Europe can avoid one.

The expected weakness of the US economy has increased demand for stocks and bonds, but equity investors favor European and emerging markets stocks over US equities. Given that the scenario is correct, one can assume that US equities will continue to go down. For bond investors, the moment the Fed officially announces a pivot is soon enough to get invested in the bond market.

However, I think that two other scenarios are more probable. First, markets still underestimate the Fed and its aim to stay restrictive for longer. In that case, bonds and stocks will face additional downsizing as long-term rates have to increase, leading to lower EPS as capital costs rise.

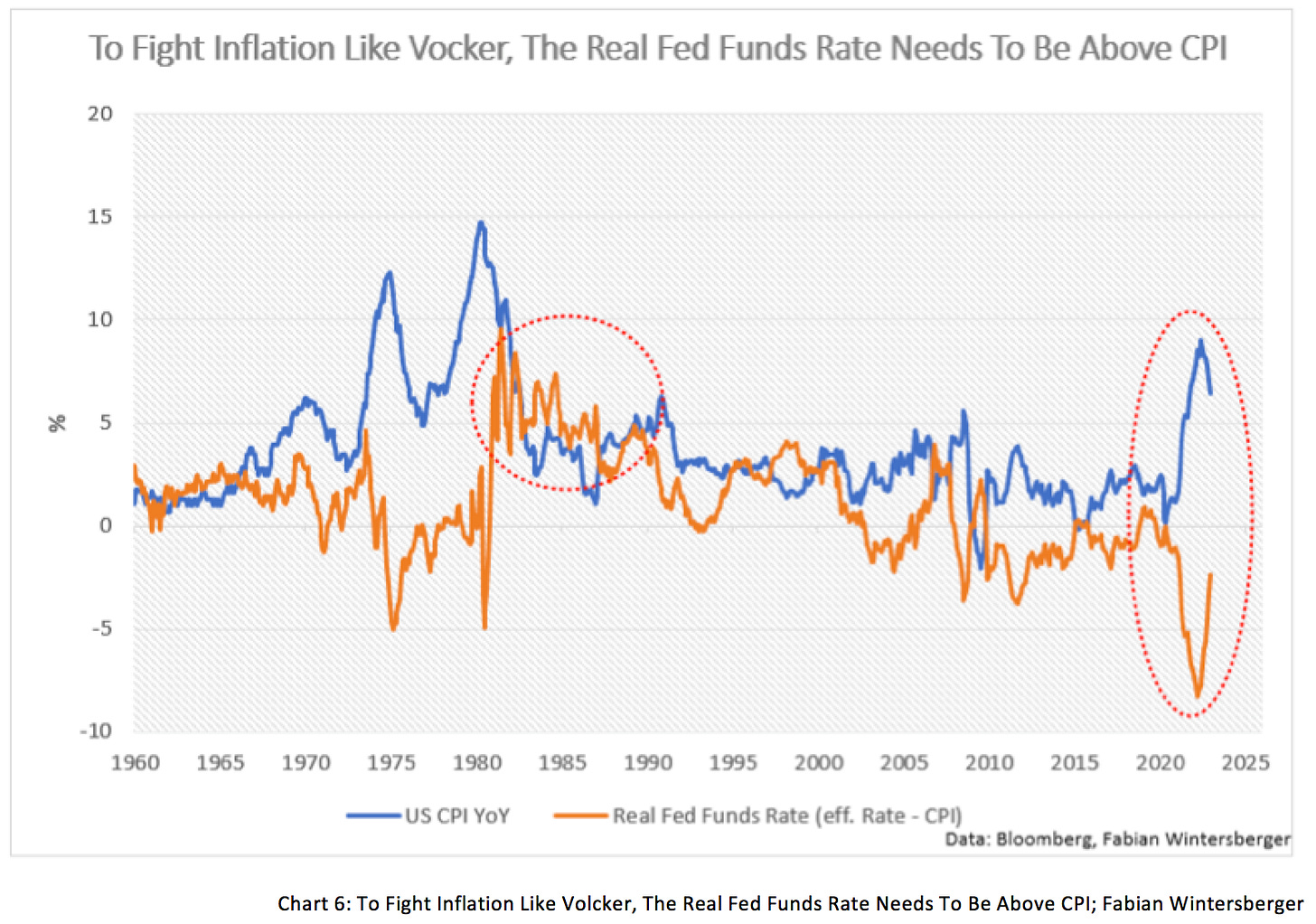

Neither the ECB nor the Fed is restrictive enough to bring inflation back to 2 %. A look at the Volcker era shows that it is necessary to increase real interest rates above the inflation rate for a prolonged period to achieve that.

My other scenario is that a longer-than-expected tightening in the euro area might lead to consequences for the world economy. Many European nations will face a significant increase in their interest rates burden, given the assumption holds, which might cause similar events as what happened last fall in the UK’s sovereign bond market.

Currently, no one pays attention to the budget situations of Eurozone governments, but a longer-than-expected environment of high-interest rates might change that. Even a followed loosening by the ECB might not be enough to bring interest rates down substantially because it also increases inflation expectations.

Although one is tempted to assume that it will be the US where monetary tightening will lead to financial market turmoil, one should not be surprised that things might get sour in Europe first.

For whom the bell tolls (time marches on)

For whom the bell tollsMetallica - For Whom The Bell Tolls

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice)