There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved. - Ludwig von Mises

Given recent events, I thought it was time to quote Ludwig von Mises again. The happenings in the US banking sector and with Credit Suisse exposed how fast monetary tightening can lead to financial instability.

The term financial instability is strongly connected with American economist Hyman Minsky. His theory on financial crises became widely discussed again after the GFC in 2008, very similar to the Austrian Business Cycle Theory.

If one looks at both theories, one finds out that both theories complement each other quite well. It is not far-fetched to assume that expansionary monetary policies have encouraged more speculative financing, and every attempt to normalize interest rates finally led to a Minsky Moment.

As soon as the speculative bubble pops, economic imbalances discharge, and a reallocation of factors of production is set in motion from unprofitable to profitable projects. That is precisely what happened in 1921 when the Federal Reserve did not lower interest rates despite the depression and trusted market forces.

However, as we all know, central banks act differently nowadays. Whenever a crisis hit caused by artificially low-interest rates, central banks reacted by artificially lowering interest rates, pumping liquidity into markets to keep the economy going.

And while central banks encouraged risk-taking by artificially lowering interest rates, governments tried to minimize risk by implementing more regulation. However, it seems apparent that government interventions are not part of the solution but part of the problem, as they cannot suppress risk indefinitely and can lead to unintended consequences.

In my opinion, the fate of Silicon Valley Bank is a good example: the Federal Reserve kept interest rates at zero, which benefited Silicon Valley Start-Ups because they could attract significant sums of capital. Usually, investors assume that it will take years until those businesses become profitable; in reality, only a few achieve that.

Simultaneously, government regulation tried to channel investments into sustainable projects. While the Fed kept interest rates at zero, SVB lent heavily to Start-Ups with a high ESG rating. But a loan portfolio full of debtors, who do not make a profit, can quickly become toxic in a rising interest rate environment.

Additionally, regulations favored SVB investing its deposits in US-Treasuries, the safest investment on the planet. Because interest rates were at zero, the bank bought longer-duration bonds to get some yield. However, as the Fed started its fastest interest rate hiking cycle since 1980, longer-duration bond prices collapsed but did not appear on SVB’s balance sheet. Throw bad risk management in the mix, and you get exactly what happened.

Yet, the Fed ended the panic by implementing a new lending program, where banks could borrow money from it, using their treasuries as collateral, valued at par. That brought the Fed’s balance sheet back up, and a balance sheet reduction of 6.98 % became one of 2.58 %.

While it is true that this is not QE and most likely will not find its way into consumer prices, the question is if banks took advantage of borrowing money for treasuries valued at par to buy financial assets.

As a result, it is not surprising that equity markets have been up since mid-March, the dollar has weakened, and bonds are also a bid. Gold is close to its all-time high, and Bitcoin is far from this year’s lows. Market participants are expecting another soon central bank pivot.

S&P Global published manufacturing PMIs for the US and the Eurozone this week. In both economies, supply chain problems eased further, although manufacturers suffer from weak demand.

In Europe, the strongest PMIs were in Greece, Spain, and Italy, while PMIs in Austria and Germany posted a 34-month low. Additionally, the survey showed another decrease in manufacturers’ order books.

Service sector PMIs in the Eurozone are still in expansionary territory, although slightly weaker than the previous month. Composite PMIs still point to a slight expansion of the Eurozone economy, not signaling a recession.

A considerable tailwind for the European economy has been the rapid fall of energy prices, giving producers room to breathe. Especially the German energy-intensive and chemical industries benefited from falling energy prices. As a result, Germany’s trade balance is back to pre-covid levels.

Headline inflation numbers from last week point to a further weakening of consumer price inflation pressures in the Eurozone. In the euro area, estimated headline inflation for March dropped from 8.5 to 6.9 % year-over-year, while core inflation continued to accelerate from 5.6 to 5.7 % year-over-year.

Yet, energy was the only category where prices fell compared to last year. Prices for food, alcohol, and tobacco rose sharply, 15 % year-over-year. Service inflation also accelerated, while non-energy industrial inflation stagnated at around 6.6 %.

European producer prices rose 0.5 % in February compared to January. Year-over-year, European producer price inflation fell from 15.1 to 13.2 %, mainly because of falling energy prices, which fell 1.6 % compared to the previous month. However, prices for capital goods (+0.4 %), durable- (0.5 %), and non-durable consumer goods (0.6 %) rose monthly.

And while people, as the former ECB-Vice chair Vitor Constancio argues, that interest rates in the Eurozone are close to the terminal rate, because consumers are affected by headline inflation, which is dropping, Chart 2 shows that consumer- and producer prices are still strongly deviated from the trend.

Honestly, I am a bit surprised about Constancio’s claims. In 2016, when Constancio was vice chair of the ECB, he told Reuters that he was worried about core inflation because it does not rise and is too low.

Additionally, a primary reason headline inflation is decreasing is government interventions, mainly in the energy and food markets. Tax cuts for food and price caps for energy have been introduced in nearly all Eurozone countries, not only for consumers but also for producers.

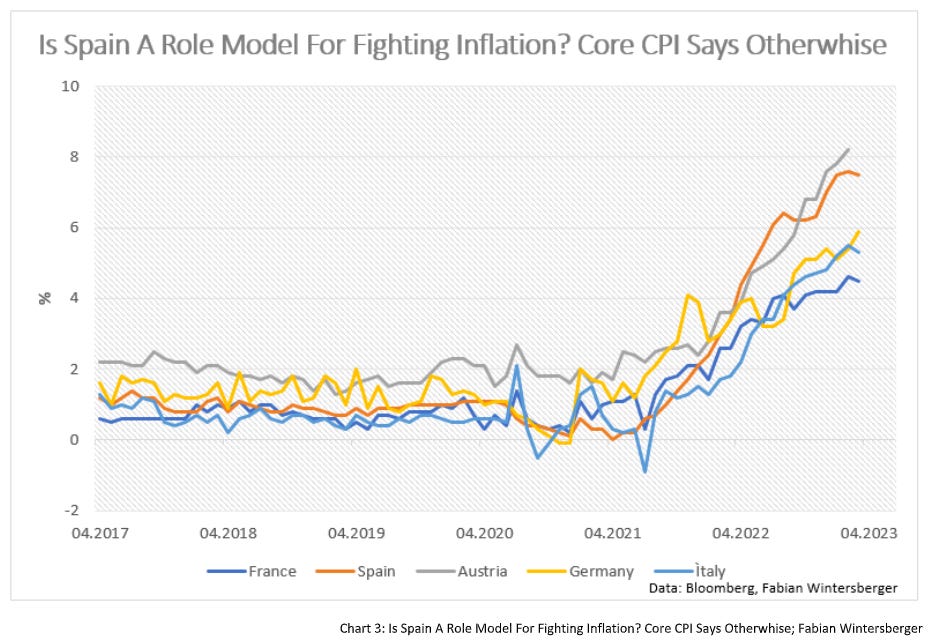

Spain is the poster child for the people who call for more government interventions and (lower) price caps for energy and rents. In the Iberian country, the socialist government quickly intervened in markets while supporting lower-income groups via transfer payments. Apart from these transfer payments, the government decoupled energy prices from gas prices, introduced price controls for energy and rental controls, and lowered taxes for food again in December.

In 2022, Spain spent about 45 billion Euros on these measures. As a result, headline inflation in March dropped to 3.3 %, the lowest headline inflation in the Eurozone. However, apart from the fact that energy prices primarily cause the drop because of the base effect, it is worth digging deeper.

Price caps for energy enabled the Spanish people to spend less on energy and thus can increase their demand for other goods and services. However, as production cannot expand randomly, prices have to rise. Additionally, transfer payments fuel the price increases in these sectors further.

In Austria, the government supported its citizens via one-time transfer payments. However, in contrast to Spain, energy prices are still coupled with gas prices, and an energy price break was implemented not too long ago.

In both countries, transfer payments have increased demand and increased demand for goods and services, raising core inflation. As a result, both countries have one of the highest core inflation numbers in the Eurozone. And as soon as price controls are lifted, inflation for food and energy will experience another boost.

Yet, while consumer prices do not support a pausing ECB, prices in asset markets are still dropping. Apart latest tensions in the banking sector, the ECB is also worried about the commercial real estate market.

For the first time in years, German rent prices grew slower than consumer prices, as WELT reported. The newspaper quotes a study of IW, which shows increasing problems for landlords to find a new rentier for vacant properties. Since mid-2022, German house prices have decreased by about 6 %, according to Eurostat.

Rate hikes decrease real estate prices because they increase financing costs and lower demand. When interest rates trended lower, investments in real estate funds were lucrative because falling rates translated into tailwinds for house prices.

However, the same is true in the other direction, so the ECB is starting to worry about commercial real estate funds, as the Financial Times reported. The sector, with a size of 11 trillion euros, could experience trouble if the troubles in the banking sector spill over to commercial real estate.

If many investors were to withdraw their money from these funds, this could cause a liquidity mismatch, probably forcing funds into fire sales of illiquid property assets. As a result, the ECB proposes additional fees if an investor wants to withdraw his money or pay them out with delay. One could assume this is bad news for those who invested in those funds. Basically, the ECB is proposing that they cannot freely dispose of their money. Let us hope that the ECB was not adding some fuel to the fire with such a statement.

While debt ratios are still high, and the more prolonged monetary tightening is going on, refinancing for states and businesses will become increasingly difficult. There is no doubt, in my opinion, that QT and rate hikes will lead to a liquidity crisis at some point, similar to what we saw in gilts last year, but on a much larger scale.

Nevertheless, the real economy is still going too strong, and inflation is still too high to justify a pause of interest rate hikes. The yield curve is still strongly inverted, and although 2s10s have strongly reverted, 3ms10s show no sign that a recession is imminent.

Usually, the yield curve reverts when the central bank is cutting interest rates for the first time and acknowledges that the economy is in, or close to, recession. I think it pays to wait for that moment instead of trying to anticipate it.

The latest events show that nobody knows how things will play out, but I know that equity prices cannot rise indefinitely and that the first rate hike will start a strong down-move in yields. When the central banks cut rates, it signals that problems in the economy become too obvious to ignore, which drives yields and equity prices down.

Yet, central banks face another problem: inflation is not close to 2 % but about twofold as high. Thus, I am convinced that the Fed and the ECB will fail to deliver their promise to bring inflation back below 2 %. Simultaneously, the coming recession will lead to another increase in fiscal spending, assumably more transfer payments for consumers, which will start the second inflation wave.

Therefore, it does not surprise me that central bankers try to push away the blame for inflation. Fabio Panetta and Gabriel Makhlouf (both ECB) lately said that rising profit margins or a wage-price spiral could drive domestic price pressures and might force tougher action by the ECB.

However, rising profit margins and wages are just symptoms of inflation caused by monetary expansion. Without monetary expansion, it would not take long until profit margins go back down, or businesses would start to cut jobs if workers were unwilling to accept lower wages.

It is like repeating a lie so many times until people believe it. If central banks and governments are expanding the money supply again during the next crisis, they want to be sure that they are not the ones who are blamed for the second inflation wave.

What could make you fade away?

I can’t pretend that there’s nothing left

What could make you fade away?

If there’s something, then I need it to fade awayDiecast – Fade Away -

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! If you like my writing, you can subscribe and get every post directly into your inbox. Also, sharing it on social media or liking the position would be fantastic!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice)

Well written summary, thanks!

The final paragraphs are the key, the central banks most important message is they try to convince us they did nothing wrong as they make the same mistakes over and over again