Nothing is more powerful than an idea whose time has come - Victor Hugo

Throughout civilization, humans have often been skeptical of innovation and technological advancement. The question, "It's a great idea, but who really needs this?" is one of the most common reactions, highlighting how many people initially fail to grasp the monumental changes and opportunities that new innovations can bring.

These innovations are frequently ignored or dismissed as unnecessary at first. As they begin to spread, they encounter resistance, especially from established industries that see them as threatening their profits. Eventually, new businesses rise while some old ones fail and go bankrupt.

Established businesses nearly always resist emerging technologies. In its early days, the internet was often dismissed as a tool for academics or hobbyists. Many scoffed at the idea of using the Internet for shopping, banking, or even communicating beyond email. Yet, traditional companies couldn't stop its rise. When you talk to younger generations today about a time before the internet, they often respond with disbelief, as a world without it is beyond their imagination.

E-commerce, an innovation born from the internet, faced similar skepticism. Initially seen as a niche market, early online retailers were considered impractical and unable to compete with brick-and-mortar stores. Companies like Amazon were ridiculed for thinking people would buy products online without first seeing them in person.

As e-commerce became a dominant force in retail, traditional businesses scrambled to adapt or risk losing their market share. Today debates over how to regulate, tax, and integrate e-commerce into the global economy illustrate the final stage of resistance—where once-disruptive forces become the dominant powers in the business world. These technologies followed a similar path: from obscurity to resistance to eventual triumph, fundamentally reshaping society. This is simply how progress works—through constant change that drives further development.

The evolution of money and currency follows a similar trajectory. People moved from bartering and informal credit systems within small communities to using commodities that both parties in a trade accepted. This shift enabled trade between people who didn’t know each other, regardless of their beliefs or goals.

The development of banking was another step forward. Banks acted as intermediaries, making payments more efficient and secure by issuing fiduciary media that could be redeemed on demand. However, as this system led to double-counting and fractional reserve banking, central banks were established to provide greater stability. The role of central banks like the Federal Reserve is to ensure the system's financial stability and intervene during crises to prevent economic collapse.

Another crucial role of central banks is to control inflation and deflation, as both are seen as harmful to economic growth and prosperity. However, central banks are not infallible. They can make mistakes or misjudge the situation, as they did in 2021 when inflation began to rise.

The resurgence of inflation has prompted many to seek alternatives to diversify their portfolios beyond stocks and bonds. Some have even begun questioning the credibility of central banks, especially after their significant misreading of the inflationary pressures in 2021. As a result, there’s renewed interest in tangible assets like gold, which do not carry third-party risk, although most investors still prefer trading paper assets linked to the underlying commodity.

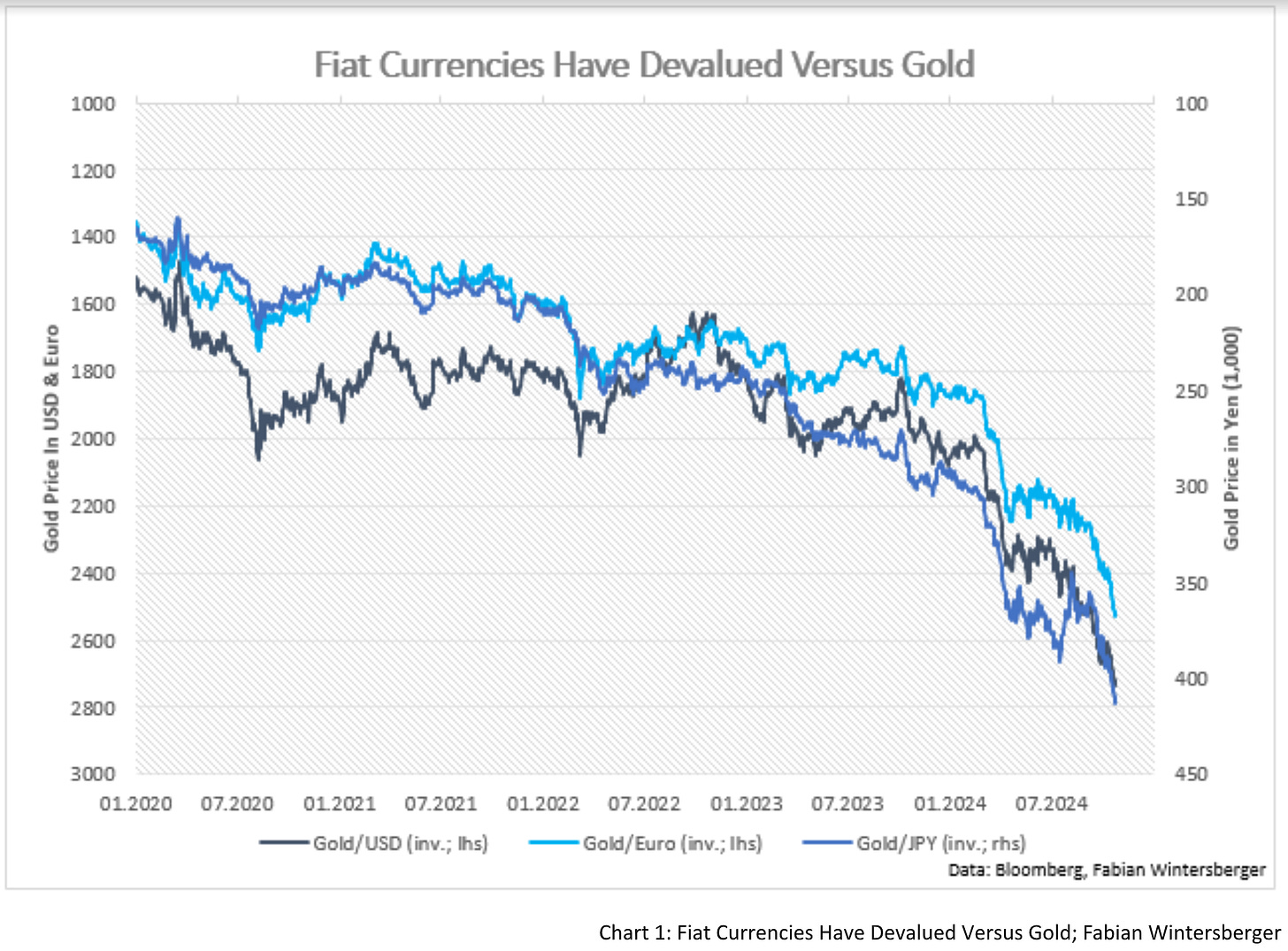

While I wouldn't go so far as to claim we are witnessing the early stages of a global fiat money crisis, it is notable that all major fiat currencies have lost purchasing power in recent years when measured against what J.P. Morgan called “true money,” namely gold. Since early 2020, gold has risen over 70% against the U.S. dollar, more than 80% against the euro, and over 150% against the yen.

While it may seem surprising at first that gold didn't rally during the initial period of rising inflation, it’s important to remember that gold had already surged significantly before inflation took off. In other words, traders had anticipated the rise of inflation before it materialized. When central banks began raising interest rates, it became clear they were committed to combating inflation through higher rates and contracting the money supply.

Still, many seem surprised that gold has continued to rise even as inflation has returned to or neared central banks' preferred 2% target, signaling the end of the tightening cycle. There are several reasons for this. One is the lingering concern that central banks may revert to a monetary policy too loose for the economy, which could boost real economic demand and investment.

Additionally, geopolitical uncertainty is arguably more significant than at any point since the end of the Cold War. Governments are grappling with rising interest rate expenses as a share of their budgets. These factors all indicate the possibility of central banks being forced to intervene again.

Moreover, several financial experts, including Mohamed El-Erian, have advocated for central banks to abandon the 2% inflation target and adopt a higher inflation-tolerance regime. This would also be favorable for gold, so it’s no surprise that it performs well in the current economic environment.

Another critical issue is that, after previously misjudging inflation, central banks are now facing the challenge of maintaining credibility. If they miscommunicate their future interest rate path or mislead market participants, confidence in central bankers—already fragile—could deteriorate even further.

The Federal Reserve is currently facing difficulties with its communication strategy as it starts to express concerns about potential labor market problems that could arise if interest rates remain elevated for too long. As a result, its forward guidance suggests that substantial rate cuts are on the horizon.

However, if unemployment doesn’t rise and nominal growth remains robust despite falling inflation, the Fed risks lowering rates too much or misreading the economic data again. Such a misstep could lead to a loss of confidence in the Fed’s ability to manage monetary policy effectively and, in turn, a devaluation of the dollar against hard assets like gold.

The Fed isn’t the only central bank struggling with its forward guidance. While the Fed risks misinterpreting the current situation, other central banks face even more significant challenges. Take the eurozone, for example, where the situation is quite different from that in the U.S.

In the U.S., the focus is on growth and employment, but the eurozone is grappling with the absence of growth despite low unemployment. Long-term growth expectations in the euro area have fallen to an all-time low of less than 1.3%. This has sparked a debate about whether the European Central Bank (ECB) is once again reacting too late—just as it did when inflation surged.

After cutting rates by 25 basis points in June and September, the ECB reduced rates by another 25 basis points last week. The market is now expecting further rate cuts, with projections showing rates falling to 1.83% by November 2025. Given the eurozone’s bleak growth outlook, the question is whether the ECB is being too cautious in its actions.

As a result, it was not surprising that Christine Lagarde faced numerous questions during the press conference about the outlook of the eurozone's economic growth. In her opening remarks, she acknowledged the bleak situation:

The incoming information suggests that economic activity has been somewhat weaker than expected. While industrial production has been particularly volatile over the summer months, surveys indicate that manufacturing has continued to contract. For services, surveys show an uptick in August, likely supported by a strong summer tourism season, but the latest data point to more sluggish growth.

What’s somewhat amusing to me is that the ECB still seems to believe that wages or profits can magically generate inflation when clearly changes in the money supply and output drive it. Given the ECB’s view that relative price changes lead to inflation, it’s easy to understand why they’re concerned that the recent drop in inflation below the 2% target is just a temporary blip rather than a sustainable trend. However, with real growth nearly stagnant, a continuously falling inflation rate suggests that nominal growth will also decline.

That’s why it seemed odd when Lagarde claimed the ECB still expects a "soft landing" for the eurozone economy. Traders immediately began pricing in a 50 basis point rate cut at the next meeting and looking at the current data; it seems likely they may be right. However, given that only a tiny portion of the eurozone’s economic troubles are due to high interest rates—many are policy-related—rate cuts alone may not be enough to put the eurozone back on track, which could prompt further cuts.

Although the Fed and the ECB’s situations differ, both highlight that while market participants still view them as credible monetary institutions, recent mistakes have eroded trust. Moreover, foreign holders of interest-bearing instruments denominated in dollars and euros have also been negatively affected, which has left its mark. This has likely contributed to the rise in gold prices. Mohamed El-Erian recently wrote:

Consistent foreign central bank purchases have been an important driver of gold’s strength. Such buying seems not just related to the desire of many to gradually diversify their reserve holdings away from significant dollar dominance despite America’s “economic exceptionalism”. There is also interest in exploring possible alternatives to the dollar-based payments system that has been at the core of the international architecture for some 80 years.

Thus, foreign governments are trying to diversify away from Western currencies like the dollar or the euro. Investors are losing trust in central banks' ability to keep their promise of maintaining inflation close to but below 2%. U.S. government debt is at 120% of GDP, and the country runs a budget deficit of 6% even in an expansionary economic environment. In the eurozone, debt-to-GDP ratios are lower but vary widely across countries.

As long as government debt continues to attract demand from investors, one could argue that the debt is manageable. In times of financial turmoil, government debt—particularly U.S. Treasuries—has traditionally been seen as a safe haven alongside gold. After all, government debt, especially U.S. debt, is considered "risk-free" in nominal terms, as it’s assumed the government can always repay it. As long as there’s confidence that government budgets will eventually consolidate, everything remains stable. However, BIS’s Agustin Carstens recently highlighted a potential risk in a speech:

But such confidence may not last forever. Investors will at some point want clarity about fiscal strategies. Failure to deliver fiscal consolidation could pose a material risk to both macroeconomic and financial stability..since fiscal consolidation is not a given, what risks might investors face? High debt levels would imply higher interest payments, and that is even if interest rates were to fall to pre-pandemic levels...Changes in market perceptions of risks may take time to occur and then do so very suddenly, resulting in an abrupt repricing of public debt. Such sharp repricing could put the financial system at risk and, especially in EMEs, reignite inflation through currency depreciation.

Historically, countries have often chosen the easier way out of a debt spiral—reducing the debt burden through inflation. It’s likely that, although they aren’t admitting it now, central banks may eventually choose this option and follow Mohamed El-Erian’s suggestion to abandon the 2% inflation target in favor of a higher inflation regime.

In my view, the recent rise in gold reflects investors' anticipation that such a scenario is getting closer. In this situation, holding government bonds becomes less attractive than the other two classic financial assets: gold and stocks. Moreover, investors are increasingly looking for alternatives. Undoubtedly, Bitcoin has gained popularity as another asset class, regardless of one’s personal opinion of it.

As a new asset/currency/speculative vehicle—whatever one chooses to call it—Bitcoin has gone through phases similar to those of other groundbreaking innovations. When the first Bitcoin was created in 2009, central banks largely ignored it. As it gained popularity, financial professionals and economists dismissed it as laughable, often comparing it to the tulip bubble. Each time Bitcoin’s price dropped sharply, it was hailed as the "final nail in the coffin."

However, the longer Bitcoin has persisted, and the higher its price has climbed, the more it has come under attack from central bankers. Among the most vocal critics have been Ulrich Bindseil and Jürgen Schaaf from the ECB. On November 30, 2022, when Bitcoin fell below $20,000, they published a blog post titled "Bitcoin's Last Stand," arguing that the collapse of FTX had put Bitcoin back on "the road to irrelevance." Ironically, that paper was released just as Bitcoin hit a low, and since then, its price has surged by about 325%.

To provide a more complete picture, it’s worth noting that Schaaf and Bindseil have also advocated for the digital euro, suggesting that their motivations might go beyond pure academic interest. However, as we all know, admitting a mistake is difficult, so both doubled down after the first Bitcoin ETF was approved by the U.S. Securities and Exchange Commission, reiterating their belief that Bitcoin has failed and the ETF’s approval doesn't change their stance.

That mirrors how traditional retailers once ridiculed and downplayed the rise of e-commerce. Schaaf and Bindseil believed they could shape public opinion on Bitcoin by publishing "scientific" work. That might have worked decades ago, but in today’s world, where social media rivals traditional outlets for disseminating news, it's hard to stop once a topic gains traction.

As a result, attempts to ridicule and downplay Bitcoin’s rise no longer worked. Like other industries facing disruption, the tone shifted from dismissiveness to calls for regulation and taxation. This is more concerning because central banks, as monopolists, also shape the financial system's regulatory framework.

In their latest paper, “The Distributional Consequences of Bitcoin,” Bindseil and Schaaf moved beyond warnings and ridicule, portraying Bitcoin as "dangerous for society" and arguing that it benefits early adopters at the expense of others:

Since Bitcoin does not increase the productive potential of the economy, the consequences of the assumed continued increase in value are essentially redistributive, i.e. the wealth effects on consumption of early Bitcoin holders can only come at the expense of consumption of the rest of society. If the price of Bitcoin rises for good, the existence of Bitcoin impoverishes both non-holders and latecomers.

This claim is surprising. After all, the same argument could be made about nearly every financial asset, except perhaps bonds, when the funds are used for real economic investment. Yet, no one argues that buying stocks impoverishes society or increases inequality. Or maybe it's not surprising, considering central banks have inflated financial markets with newly created money.

Their claim about Bitcoin’s "right value" is also amusing. Value is inherently subjective and in the eye of the beholder; in a free-market system, price movements reflect the varying valuations of buyers and sellers. Like any other tangible asset, Bitcoin’s price is driven by a network effect—the higher the demand, the higher the price.

Ironically, Bindseil and Schaaf may have inadvertently achieved the opposite of what they intended. By discussing the potential for Bitcoin’s price to rise, they essentially acknowledged it as an asset that is here to stay. Their suggestion that Bitcoin could rise into the millions might encourage more people to consider it an investment, further boosting demand.

Increased demand for Bitcoin naturally leads to decreased demand for other assets, all else equal. And what assets might be affected? Recall my earlier point about the possibility of abandoning the 2% inflation target as a way for governments to reduce debt-to-GDP ratios through inflation while running deficits. In such a scenario, would you want to hold bonds? Probably not.

That is where another paper from the Minneapolis Fed becomes relevant. It uses "Bitcoin as a metaphor for a private-sector security that is in fixed supply and not a claim on any real resource," which is where Bitcoin mirrors fiat money. The authors correctly identify that such an asset could threaten governments running permanent deficits (which nearly every government does) if considered a risk-free alternative to government bonds.

Monopolists fear nothing more than competition, and it appears that central banks, as monetary monopolists, view Bitcoin as such a competitor. Unsurprisingly, the authors suggest governments could "legally prohibit Bitcoin" to "restore the unique implementation of permanent primary deficits." Such a scenario would place the finance industry in a challenging position, forcing it to choose between siding with regulators and governments or prioritizing the financial well-being of the public. For now, however, Bitcoin’s significance remains in the eye of the beholder.

Independence limited

Freedom of choice is made for you, my friend

Freedom of speech is words that they will bend

Freedom with their exceptionMetallica – Eye Of The Beholder

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. It is strongly recommended to seek independent advice and conduct your own research before making investment decisions.