We cannot solve our problems with the same thinking we used to create them

– Albert Einstein

Throughout history, we've witnessed people making foolish decisions. However, this isn't necessarily a negative phenomenon, as human progress often hinges on trial and error. The key, though, is acknowledging and rectifying one's blunders, as wise individuals tend to do.

The real problem arises when individuals fail to correct their mistakes or, worse yet, persist in their errors. Take Mao Zedong's attempt to industrialize China, for instance. He and those around him initially believed it to be a brilliant idea. However, the issue lies in their failure to abandon this approach when it became evident that collectivization and agricultural reforms were causing more harm than good.

In essence, a careful examination of the Soviet experiment should have dissuaded the Chinese communists from pursuing such a path in the first place. Unfortunately, like many politicians faced with historical examples that challenge their proposals, they tended to believe that it wasn't the concept itself flawed but its execution.

It didn't take long for it to become abundantly clear that the ambitious goals the Chinese politburo set were unattainable and led to a significant misallocation of resources.

One of the most infamous innovations of the Great Leap involved an industrial revolution in the countryside, where farmers constructed millions of backyard furnaces and then divided their time between tending crops and smelting steel. Gathering fuel to stoke all these furnaces resulted in the loss of at least 10 percent of China’s forests, and when wood became increasingly scarce, peasants resorted to burning their doors, furniture, and even raiding cemeteries for coffins. Rather than mining the ore to be smelted, everyone contributed iron implements, including tools, utensils, woks, doorknobs, shovels, window frames, and other everyday items, while children scoured the ground for iron nails and other scraps. Farmers had no technical expertise in smelting steel, of course, but these skills were derided as bourgeoisie and rightist anyway. Unsurprisingly, the campaign essentially converted practical items into useless lumps of pig iron good only for clogging railroad yards. - Association for Asian Studies

Indeed, the Great Leap Forward proved an absolute catastrophe, mainly because the politicians in charge refused to admit their policy mistakes. Instead, they shifted blame onto the people, or as they referred to them at the time, the bourgeoisie, accusing them of contradicting the people's objectives. Mao's experiment evolved into one of the most tragic episodes in human history, resulting in millions of deaths and a devastating impact on the Chinese economy.

It's worth noting that while this is an extreme example, there are less dramatic instances that fall into the same category as the Great Leap Forward. In these cases, the absence of success only seemed to encourage decision-makers to double down and intensify their efforts.

For instance, when Mario Draghi assumed leadership of the ECB in 2011, succeeding Jean-Claude Trichet, he was widely regarded as the ideal candidate for the role. Silvio Berlusconi, Italy's prime minister, strongly endorsed him at the time, and Draghi's actions justified the support. By the end of his term in 2019, the ECB had slashed interest rates to zero and purchased substantial quantities of government debt, particularly from struggling Eurozone countries, to provide support.

However, despite all the efforts, such as ZIRP and QE by the ECB, structural reforms in the struggling member states did not materialize, nor did inflation return to the desired 2%. This failure became apparent rather swiftly. Nevertheless, much like Mao, the ECB persisted in doubling down on its approach, buying even more government debt and keeping interest rates at rock bottom for years, all without achieving the intended results.

Just this week, Mario Draghi met with Ursula von der Leyen to discuss strategies for maintaining Europe's competitive advantage, as she highlighted in a post on X (formerly known as Twitter). Von der Leyen's assessment is accurate as the EU and the Eurozone navigate an uncertain economic future. Paradoxically, despite these challenges, there appears to be a reluctance within the EU to reflect on past errors and take corrective action. It seems that, in the world of politics and central banking, admitting mistakes has fallen out of favor, with a prevailing tendency to double down on existing strategies.

The current economic landscape presents an exceptionally daunting set of circumstances, markedly distinct from the conditions of the 2010s. In 2020, when the COVID-19 pandemic struck, the ECB and the Fed made a similar misstep. They held interest rates at rock bottom and initiated extensive QE programs while governments piled on debt to buoy their economies.

With a few exceptions, most economists and analysts concluded that these measures would not lead to a surge in consumer prices, much like what had occurred after the Global Financial Crisis. However, they failed to recognize that 2008 differed in two critical ways. Firstly, the drop in demand outpaced the decline in supply. Secondly, most of the funds raised by governments were directed toward rescuing banks, effectively containing a significant portion of the problem within financial markets.

The scenario in 2020 unfolded quite differently. Initially, government-imposed shutdowns halted production in various sectors of the Eurozone economy, particularly in the service industry. Nevertheless, governments swiftly implemented Kurzarbeit schemes to subsidize wages and maintain employment, resulting in a more pronounced drop in supply than demand.

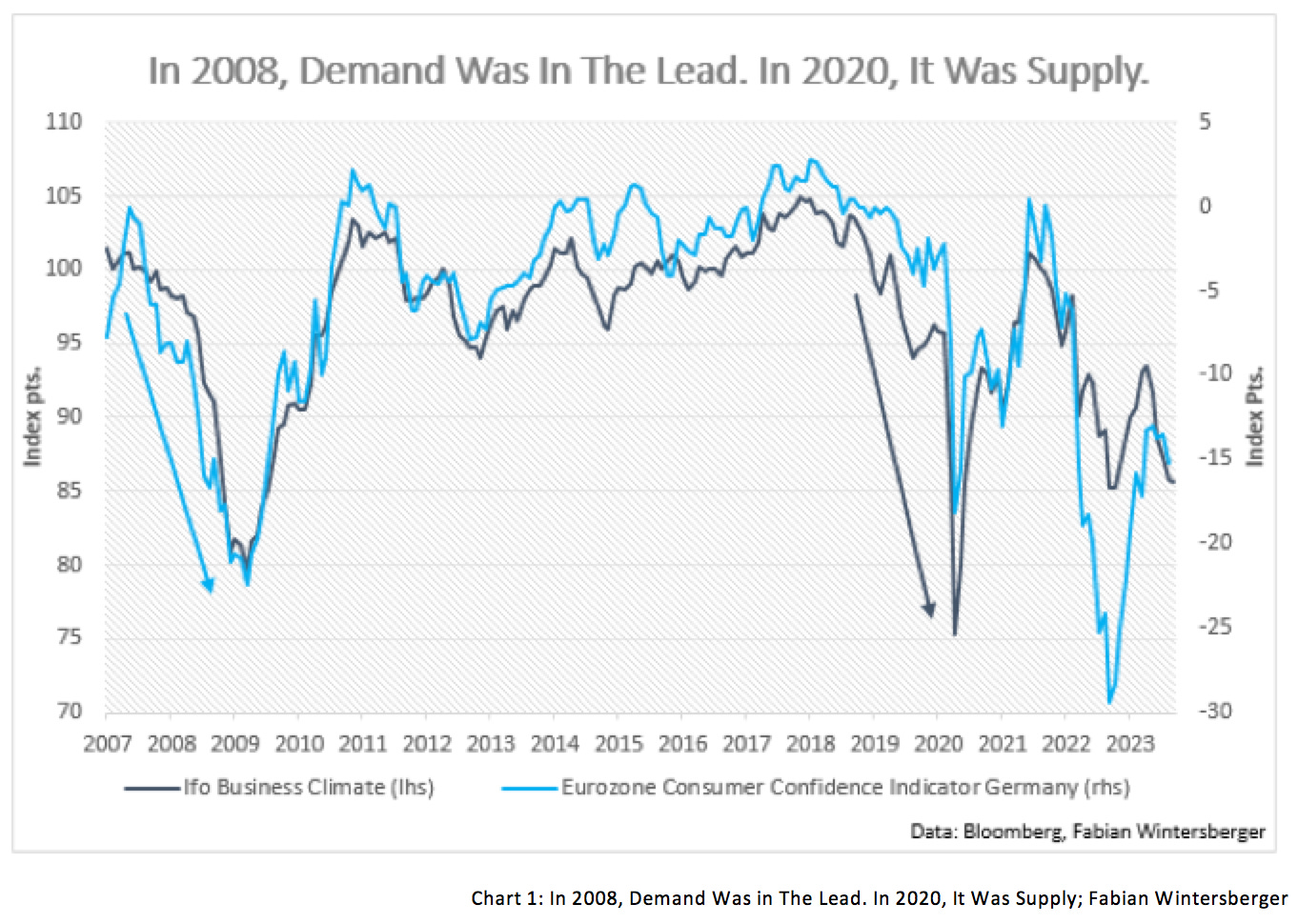

Chart 1, which presents the German Ifo Business Climate Index alongside the Eurozone Consumer Confidence Index for Germany, visually represents this phenomenon. As depicted, in 2008, Consumer Confidence began declining before the Business Climate, indicating that businesses faced a diminishing demand that cast a shadow over their current business sentiment. In 2020, the situation reversed: the economy had already been grappling with challenges in 2019, but the advent of the coronavirus and the rollout of lockdowns on a country-by-country basis led to an initial decline in business sentiment, followed by a decrease in consumer confidence as people encountered limitations in their ability to purchase goods and services.

What's also evident is that the upturn in economic sentiment was driven by demand in both directions, signifying that consumers were the driving force behind the recovery. However, a notable imbalance between consumer well-being and supply still grappled with supply chain disruptions. China continued to experience shutdowns while European economies were reopening, and vice versa.

Interestingly, during the early stages of the pandemic, many comments and analyses argued that Europe had outperformed the United States. In contrast to the US, where the government opted to distribute stimulus funds directly to individuals, European governments subsidized wages (Kurzarbeit), while the ECB and the Fed purchased bonds to bolster the financial health of businesses. Concurrently, governments extended credit guarantees to support bank lending to these businesses.

When you shut down the economy but continue to provide cash to people, it creates imbalances. People unable to patronize restaurants, bars, or travel will divert their spending elsewhere. Some may save a portion, with wealthier individuals more likely to do so, but it's almost certain that demand for certain goods will surge.

Additionally, travel restrictions caused some sectors to struggle in recruiting workers. For instance, in the summer of 2020, Austrian strawberry farmers had difficulty finding foreign labor due to these constraints. The government intervened by organizing flights and assisting unskilled citizens willing to help. However, this introduced a new challenge – after years of employing experienced individuals, businesses had to hire people with limited expertise.

The fundamental point is that the economy underwent numerous structural changes that required adaptation, a process that unfolds gradually. Just-in-time supply chains no longer functioned as they once did, leading to increased demand for goods. People sought to move from cities to the countryside, further altering demand by raising it for goods and reducing it for services, effectively reshaping the economy.

In addition to this disequilibrium and economic restructuring, the EU initiated its green transition, another artificial transformation of the economic landscape. For the first time, the EU issued joint bonds to finance this transition and provide funds to member states, injecting more money into the real economy.

Any economist or analyst familiar with the quantity theory of money and the Cantillon Effect should have recognized that these policies were inflationary, particularly in a rapidly evolving economic environment. Eurozone consumer prices surged from -0.3% to 5% year-over-year between the end of 2020 and January 2022, while the exchange rate against the dollar dropped from 1.22 to 1.13, a decline of approximately 7%.

During this period, tensions between NATO and Russia escalated over Ukraine's status, with Russia reducing natural gas deliveries to Europe. Europe, especially German-speaking countries and Northern member states, has been among the most ambitious in pursuing green energy policies. This posed a dilemma for Germany, as it heavily expanded renewable energy production but still relied on Russian gas as a cost-effective backup source due to the intermittent nature of wind and solar power.

Despite assertions to the contrary by ECB officials like Christine Lagarde and Isabel Schnabel, it became evident that inflation was not a passing phase. In 2022, inflation continued to rise, aided by increasing energy prices. The outbreak of the first war on European soil since World War II exacerbated the energy dilemma. The ECB had no choice but to abandon its zero-interest-rate policy to combat inflation, raising the ECB Main Refinancing Operations Announcement Rate from -0.5% to 4.5% since June 2022.

Nevertheless, the battle against inflation proved more challenging than anticipated, given that European governments increased spending to help citizens cope with soaring energy costs. Essentially, EU governments countered the ECB's policy of raising interest rates by providing financial assistance to their citizens. Without these monetary aids, the ECB might not have needed to raise interest rates to their current levels, and consumer price inflation might have abated more swiftly.

The consequence of these rate hikes is gradually being felt in the European economy. Bank lending to businesses has significantly slowed, and the growth in household lending for home purchases has also decreased. Both the services and manufacturing PMIs have dipped into contraction territory, underscoring businesses' grim prospects. They are grappling with the twin challenges of elevated energy costs and a volatile geopolitical climate.

Numerous energy-intensive enterprises have either decided or are considering relocating their production to regions with more affordable energy sources. Meanwhile, VW has declared its intentions to scale back the production of electric vehicles at their German facilities in response to dwindling European demand and reduced government subsidies. As a result, the ECB revised their projections for real economic growth in the euro area down from 0.9 to 0.7 %. I believe that this figure is still excessively high, and it's increasingly likely that the European economy will slip into a recession this winter.

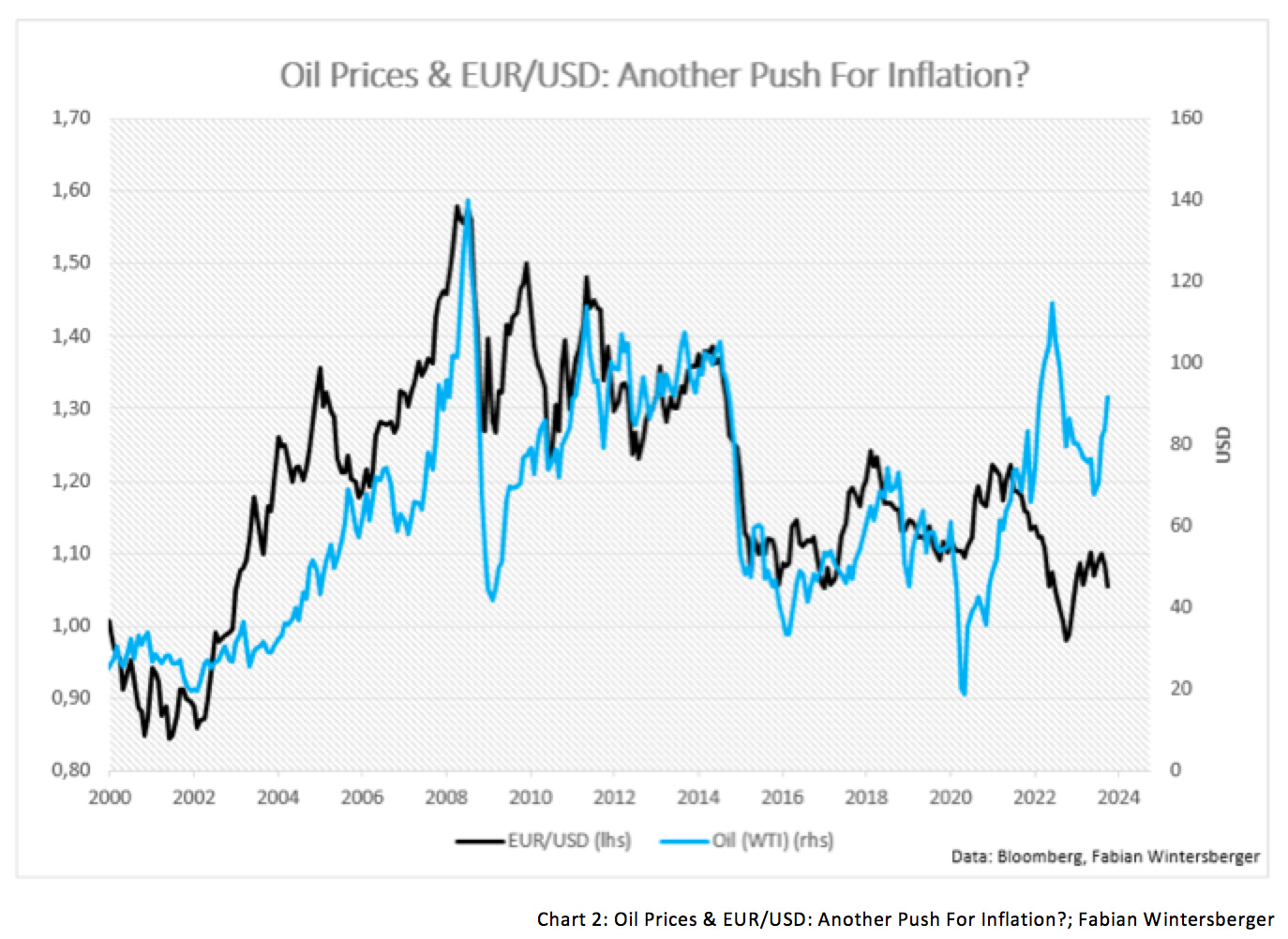

While certain factors, such as base effects, contribute to gradually easing inflationary pressures in the Eurozone, the trajectory of oil prices paints a different picture. From the beginning of the year until June, oil prices experienced a significant decline, partly driven by the US depleting its Strategic Petroleum Reserve (SPR). This, undoubtedly, provided some relief for the Eurozone, especially considering that the euro had also appreciated from September of the previous year until July of this year.

However, an intriguing divergence has become apparent at this juncture. Traditionally, a strengthening EUR/USD exchange rate coincided with higher oil prices. This correlation had been remarkably robust since the European sovereign debt crisis, but it underwent a reversal in 2021. Now, we see oil prices climbing as the EUR/USD exchange rate declines, and conversely, when the EUR/USD rises, oil prices tend to fall. This shift implies the possibility of another wave of inflation on the horizon.

Before 2021, the United States was primarily a net importer of oil. However, the US significantly boosted its domestic oil production thanks to the widespread adoption of fracking and horizontal drilling. In stark contrast, oil production in the EU has steadily declined since 2004. While oil production in the EU has plunged by more than 50% since its peak in 2004, oil and liquid fuels consumption has only seen a 16% decline from its highest point in 2006. This discrepancy translates into EU countries increasing their oil imports from abroad to meet their consumption demands.

It's worth noting that oil and refined products are traded in US dollars, which means that a stronger euro makes imports more affordable, whereas a weaker euro makes them pricier. With the EU prohibiting Russian oil and gas imports, they are compelled to purchase from alternative suppliers, driving up prices due to increased demand from these producers. In contrast, the United States doesn't grapple with this issue, as it has transitioned into a net energy exporter. A rising oil price for the US benefits domestic producers by enhancing their profit margins.

However, the Biden Administration also advocates for achieving net-zero emissions, and natural oil production decline is expected if new drilling operations aren't initiated. Recently, President Joe Biden imposed restrictions on drilling in Alaska, reinforcing his campaign promise that the US should transition away from fossil fuels.

In this regard, the US mirrors the EU’s commitment to transitioning from fossil fuels. However, the consequence of these policies has been the erosion of incentives for businesses to invest in these sectors, leading to underinvestment despite the absence of a genuine alternative to fossil fuels. In a free-market economy, surging prices typically signal heightened demand and potential profits, thereby attracting investment. But in this scenario, driven by ideologically motivated actions from Western governments, only a scant amount of investment, particularly from major players, is flowing in despite the escalating prices.

Traditionally, energy transitions occur when market participants organically shift toward superior alternatives. However, what we're witnessing today is more likely the first shift, which is being compelled from the top down, originating from the visions of environmentalists and government officials. The challenge here lies in the fact that, as far as I'm aware, renewables currently cannot function as a dependable standalone energy source due to their inherent volatility and the inability to store their output effectively. Hence, there's a need for backup technology to bridge the gaps when the wind isn't blowing and the sun isn't shining. Given that oil and coal are far from environmentally friendly options, most countries have just two viable choices: natural gas and nuclear energy.

Now, it's essential to recall my point in the introduction – politicians often refrain from admitting miscalculations and tend to redouble their efforts to achieve their goals. That's precisely what's happening here. In 2014, EU countries committed to reducing emissions by 40% compared to 1990 levels by 2030 as part of their journey toward achieving climate neutrality by 2050. However, in December 2020, they opted to raise the 2030 target to 55%.

Recently, the IEA released a study outlining a scenario for achieving net-zero emissions by 2050 in oil, natural gas, and coal supply. Bloomberg columnist Javier Blas eloquently summarized what I've encountered from numerous energy experts: The IEA’s 2030 target is unreachable. Pure and Simple. And I think everyone knows it, including nearly everyone at the IEA.

Moreover, Germany made a significant departure from nuclear energy in the spring, resulting in an increased reliance on energy imports. Furthermore, they reinforced this commitment by enacting legislation to phase out fossil fuel heating systems in buildings over the next few years. While this shift entails substantial expenditure, the government has pledged to subsidize up to 70% of these costs.

The German government's objective was to redouble its efforts, resulting in the discontinuation of nuclear energy and the imposition of mandatory renewable heating systems (interestingly with an unclear effect on the environment). Meanwhile, it's worth noting that most of the essential raw materials required for constructing these renewables are in the hands of China. In effect, after Russia, Germany willingly became reliant on yet another superpower. However, Foreign Minister Annalena Baerbock recently referred to Xi as a dictator during an appearance on Fox News.

It should come as no surprise that Germany's ambitious goal to expedite the shift toward green energy resulted in an uptick in coal usage to meet its energy requirements. Even though Germany has substantially expanded its reliance on renewables in recent years, its energy prices remain some of the highest in Europe. Hence, it's astounding that Baerbock recently asserted that she believes Germany's energy transition can be an export model for other nations.

Germany and the other EU members will continue to rely heavily on imported fossil fuels. The German industry is already exhibiting signs of strain, grappling with the recent surge in energy prices brought about by government actions (like shutting down nuclear or artificially raising energy prices with a higher carbon tax). Furthermore, current events show what could occur as the European continent slides into a deep recession, partly due to self-inflicted wounds.

Like in 2008 and 2020, EU governments will likely resort to one familiar approach to combat the economic downturn: increasing government spending to support wage earners and businesses. However, the outcome will probably resemble 2020 more than 2008, leading to more severe consequences.

Italy has already announced its intention to raise its 2024 deficit target to 4.1-4.3%, with other member states likely to follow suit. Nevertheless, this time, the problem lies primarily on the supply side, which cannot be resolved by simply handing out more money to the populace. After all, you can provide people with money, but there must be available goods and services to purchase; otherwise, there's a risk of a substantial surge in inflation, significantly if regulations increase.

The ECB finds itself in a challenging position, with two options involving significant difficulties. A strengthening dollar and soaring oil prices are driving up inflation. If the ECB raises interest rates to curb the euro's devaluation, the economy may contract further, leading to a sharp decline in supply. Consequently, governments may escalate spending, further driving inflation upward.

The second option is to refrain from raising rates or even cutting them to support the economy, which could weaken the euro. This, in turn, would make imported raw materials and energy more expensive, further exacerbating inflation, as the necessary funds to purchase imports would essentially be printed.

Yet, investors appear relatively calm about the fiscal situation. The recent uptick in yields was primarily spurred by the increase in US Treasury yields, which made European yields higher. Considering that Gilts led the sell-off last year and Treasuries are currently leading it, the question looms: What will transpire when investors shift their focus to Europe? If this occurs, long-term yields should quickly rise to reflect the mounting long-term inflationary pressures.

In a nutshell, as long as the dollar remains robust and oil prices stay elevated, the European economy will grapple with an emerging inflation problem and the potential recurrence of an energy crisis this winter. Irrespective of which of the two options the ECB opts for, the economic imbalances stemming from nearly a decade of NIRP and QE will resurface with renewed vigor.

A consequential outcome is likely to be the continued rise of extremist political parties. While they may curtail specific policies, as demonstrated by Italy's Meloni government, they may not adequately address excessive government spending and market intervention. Speculation has arisen that the ECB might maintain high interest rates to encourage reduced energy consumption, but one can only hope this remains an unsubstantiated conspiracy theory.

The entire situation brings to mind a tale where two friends find themselves in the woods, suddenly confronted by a bear. As they scramble to escape, one turns to the other, exclaiming, "We're doomed! We can't outrun the bear!" The other responds calmly, "I don't have to be faster than the bear. I just need to be faster than you." In this analogy, the first friend represents the EU, the second the US, and the bear symbolizes the economy.

Sometimes I hate that chaos surrounds me,

When all the answers that I seek are around me

Am I drowning, am I fading away

Or am I living up to all your dreams that made me this way?Crazy Town – Drowning

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! If you like my writing, you can subscribe and get every post directly into your inbox. Also, sharing it on social media or liking the position would be fantastic!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice. I may change my view the next day if the facts change.)

Bang On Fabian, I hope you have many warm sweaters and blankets for I fear unlike last winter, this one is going to be much colder in the throes of an El Niño event. I suspect that we are moving ever closer to an actual uprising, not merely protests like the Gilets Jaunes.