Diamonds Aren't Forever

Markets need not be in sync with one another. Simultaneously, the bond market can be priced for sustained tough times, the equity market for a strong recovery, and gold for high inflation. Such an apparent disconnect is indefinitely sustainable. - Seth Klarman

Diamonds are forever - This well-known quote, extolling the durability and timeless quality of diamonds, now appears to be challenged, as reported by the US magazine Fortune this week. According to the article, the diamond market is transforming with potentially profound consequences for the diamond industry.

The article highlights a significant drop in the demand for diamonds, especially for affordable engagement rings in the US, attributed to the growing fascination with lab-grown diamonds. It is evident from the Fortune article that prices for specific categories of rough diamonds have plummeted rapidly while the demand for natural diamonds in these categories has also waned.

These shifts predominantly impact the rough diamond market and have not directly affected the pricing of engagement rings or other jewelry items. Nevertheless, the magnitude and swiftness of this price decline within a pivotal sector of the diamond industry are remarkable. This raises questions about whether the dwindling demand for natural diamonds in this category represents a lasting shift and whether lab-grown diamonds will also gain significance in higher-priced segments.

De Beers, a prominent diamond producer, has slashed prices for specific rough diamonds by more than 40% in response to the declining demand. As the article underscores, this significant price reduction underscores the influence of the growing interest in lab-grown diamonds, particularly in the United States. Interestingly, lab-grown diamonds are experiencing an even more pronounced price decline than natural diamonds, resulting in a substantial price differential between the two products.

Despite these challenges, De Beers remains steadfast in its belief that there will be long-term distinctions between natural and lab-grown diamonds, rooted in their uniqueness and rarity. Nevertheless, the evolution of the diamond market continues to be intriguing as lab-grown diamonds gain increasing prominence and reshape the industry's dynamics.

Diamonds are not the only market on the brink of significant change; the bond market may also be poised for far-reaching shifts, catching many investors off guard. In 2019, Raoul Pal, a former Goldman Sachs employee who now operates a research and news platform for financial markets, tweeted: Buy bonds, wear diamonds – Translation: If you buy bonds, you will make so much money that you will be able to wear diamonds. An old saying from the late '80s and early '90s.

Yet, anyone who followed this advice in the past year has lost a significant amount of money. During the fastest interest rate hike cycle by the Federal Reserve this century, US Treasury bonds experienced their worst price declines in history. However, despite rising real interest rates, stock and precious metal prices rebounded and are close to all-time highs.

Since the last market commentary from The Weekly Wintersberger was published at the end of June, we want to revisit the predictions made at that time and then analyze the current market conditions to provide an assessment of how the markets could evolve in the fourth quarter of 2023:

Equity markets should be supported in such an environment, and buying the dip should be a good strategy for now. For bonds, one should not be blinded by the highest returns in years, as it depends on the future actions of central banks.

When it comes to central banks, it does not depend on what analysts or economists think should be done. It depends on the actual monetary policy. According to the contraction of the money supply, we can assume that there will be a strong disinflationary impulse at the beginning of next year, which would support the thesis that no more rate hikes are needed.

However, at least in my opinion, it is more probable that another rise in consumer prices will pressure central banks to raise rates again. Thus, I still see more rate hikes than market participants currently anticipate. Concerning yields at the long end, it depends on how much short-term yields can push them upwards.

In this environment, gold will continue to struggle as higher real yields put pressure on the gold price. However, because gold prices and real yields have diverged for quite a while now, this could be a sign that gold traders anticipate a pivot. If that is true, we can expect that the divergence will converge. - The Weekly Wintersberger: My Apocalypse

The stock markets in Europe and the USA have developed largely as expected throughout the summer. The Nasdaq 500, Dow Jones, and S&P 500 are all hovering around the levels they were at the end of June. However, European stocks have lost some ground; the German DAX and the Eurostoxx 50 are down by 3 and 4 %, respectively, compared to the end of June.

The reason for the weaker performance of European stock markets compared to their US counterparts is the increasingly gloomy economic situation. On the one hand, production on the European continent continues to suffer from comparatively high energy costs, particularly affecting the German economy, which has had to import more electricity since the shutdown of its last nuclear power plants.

Over the summer, sentiment among Eurozone businesses has further deteriorated. Following the contraction in industrial production indicated by the S&P PMI for manufacturing since last autumn, the services sector has also taken a hit during the summer. The expected boost from the opening of the Chinese economy, which was anticipated in the spring, did not materialize. While Germany is already in a recession, many other Eurozone countries, including possibly France and Italy, are likely to follow suit soon.

Last winter, European economic data had exceeded analysts' expectations. Now, the tables have turned, and US economic data is surprising. This highlights the evident economic divergence between the two regions. In the Eurozone countries, the services sector is experiencing a contraction, while in the United States, the ISM numbers in this regard have been surprising.

The weakness of European stocks compared to US equities will likely persist for some time, assuming that the economic recovery expected by the ECB in the second half of this year fails to materialize. Recent data from the past few weeks support this assumption. However, caution should be exercised as the dollar has appreciated significantly over the summer, which could negatively impact US stocks at some point.

Furthermore, despite slightly decreasing over the summer, consumer price inflation is still estimated to be at 5.3%, according to the already published HICP estimate for August. This is more than 1.5 times higher than the ECB's targeted 2%. The ECB remains undecided regarding its interest rate decision in September.

Usually, high inflation and continued low unemployment would argue for further interest rate hikes, but the weak economic data suggest otherwise. It's the classic dilemma of stagflation, a central bank's nightmare. However, if the ECB adheres to its mandate, the hawks on the ECB Governing Council should prevail.

What about the Fed and its inflation-fighting stance? In early July, June inflation data bolstered hopes that the Fed was close to achieving its 2% inflation target for the first time since March 2021, as it dropped below 3% (2.97%). However, inflation rose back above 3% in July, and another increase is expected for August.

Most analysts, though, believe this is a temporary surge, and inflation is expected to recede over the course of the fourth quarter. A look at the M2 money supply development supports this presumption, as it contracts in year-on-year comparisons. A gradual slowdown in consumer price inflation in the USA remains the most likely scenario for market participants.

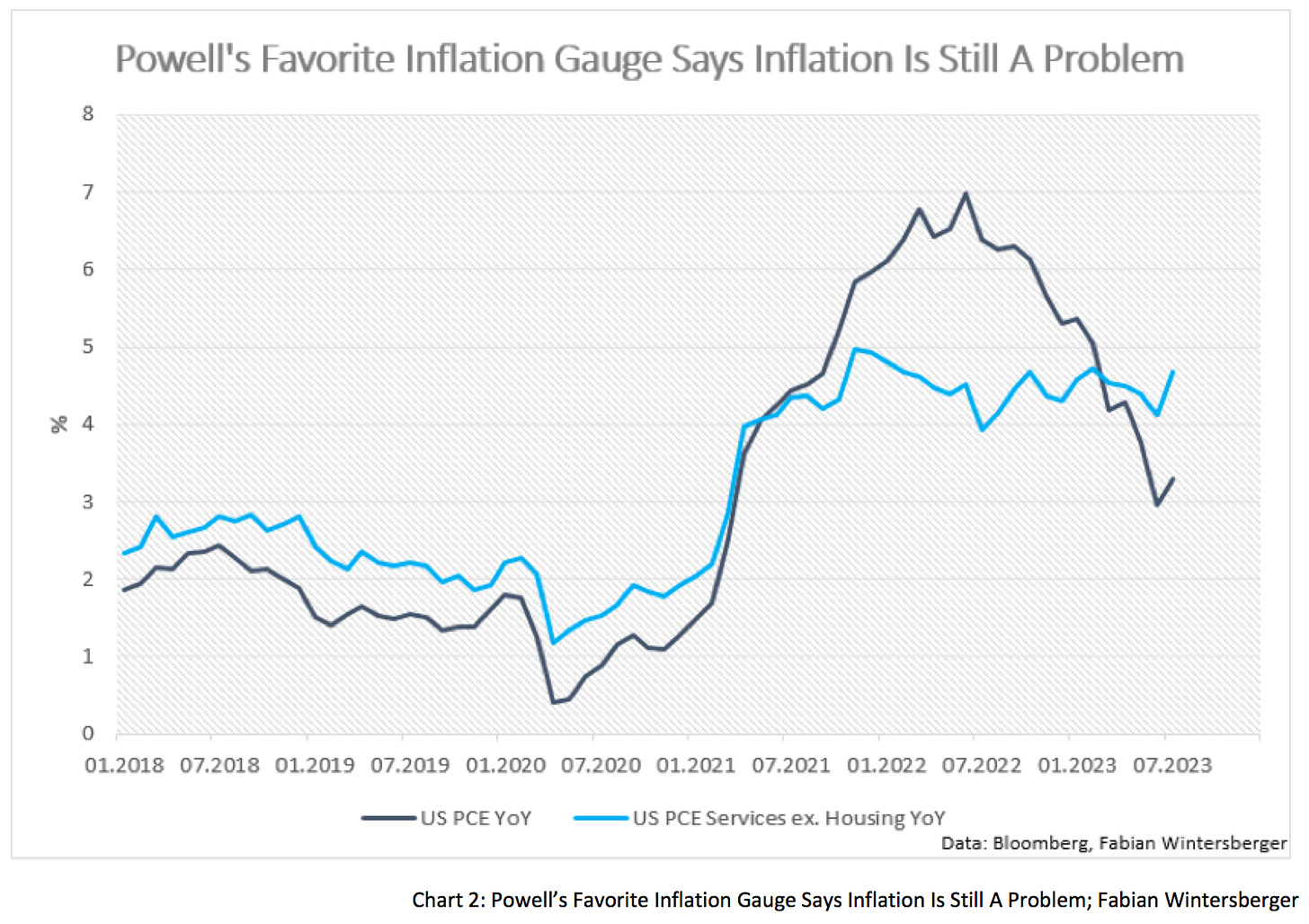

Jerome Powell's preferred inflation measure, the PCE Services ex. Housing Index shows no signs of easing; it has remained above 4% since March 2021. There is likely a reason he favors this index, as it justifies the Higher For Longer strategy, which Powell frequently has emphasized.

Oil production cuts have increased oil prices in recent months, which worries the inflation fighters in Frankfurt and Washington. At nearly $90 per barrel, the price of a barrel of oil (WTI) is about 30% higher than it was at the end of June. In response to high oil prices, the Biden Administration began emptying its Strategic Petroleum Reserve in 2022, artificially increasing supply and driving prices down.

This strategy is no longer feasible; according to the Biden Administration's plan, the reserve now needs to be replenished, with purchases between $70 and $75 per barrel. This announcement suggests that oil prices are unlikely to drop significantly below this mark.

This could be the tailwind that pushes consumer prices up again. If Biden intends to run for re-election next year, a strengthening inflation could significantly impact his chances of being re-elected.

In summary, the consumer price development situation remains uncertain in the Eurozone and the USA. Currently, I would estimate the likelihood of both central banks, the Fed and the ECB, opting for another interest rate hike or a pause in September as 50:50.

In this environment, it is still remarkable that the price of gold remains unfazed by rising real interest rates. One possible reason could be the increasing demand from central banks, which have recently bolstered their gold reserves. This additional demand is positively affecting the price of gold. However, high real interest rates suggest a correction is more likely before new all-time highs are reached.

The price movements in gold and the stock market suggest that market participants in both asset classes do not expect a monetary policy where real interest rates remain positive in the long term. However, market participants' focus is undoubtedly on the bond markets and the future trajectory of inflation.

Long-term interest rates have also risen in recent months in the USA and Europe. In both currency areas, interest rates are still on an upward trend. The driving force behind the global rise in interest rates has been the U.S. rates, where economic data increasingly indicate that the Fed will stick to its course.

Much will depend on how consumer prices develop in the coming months. Most market participants expect a continuation of the downward trend in inflation rates. The most compelling argument is the broad money supply aggregates in the Eurozone and the USA.

According to monetarist theory, the consequences of the shrinking money supply on a year-on-year basis should soon begin to affect the price level. For both currency areas, one could, therefore, anticipate, according to the theory, an ongoing disinflation that could even turn into deflation next year.

Similarly, though not quite as drastic, most market participants' expectations for the United States in the coming months are as follows: they anticipate a gradual weakening of the economy, accompanied by a continuous rise in the unemployment rate, while inflationary pressures gradually diminish. If economic activity declined too sharply, the Fed would counteract it with interest rate cuts.

For Europe, market participants also expect consumer price inflation to slow down in the coming months, following its flatlining from July to August. In year-on-year terms, the base effect is expected to have a positive impact, as prices had risen particularly strongly in September and October 2022 (1.2% and 1.6%, respectively, compared to the previous month).

Market participants are not expecting both the Fed and the ECB to maintain interest rates at their current levels in the long term. Some anticipate that the weakening economic activity resulting from tightening monetary policy could push consumer price inflation below the 2% target later this year, potentially leading to a rate cut.

If this scenario, which most market participants expect, were to materialize, it would drive higher prices for long-term bonds. Hence, it's no surprise that according to the latest global fund manager survey by Bank of America, most respondents anticipate falling long-term interest rates. In other words, they are buying long-term bonds. Is the bond bull market making a comeback?

I remain skeptical in this regard. The foundation of this scenario consists of, on the one hand, continuously weakening consumer price inflation and, on the other, central banks deviating from their Higher For Longer stance. However, I believe the path of consumer price inflation in the coming months is not as straightforward as Chart 3 might suggest.

With the depletion of the Strategic Petroleum Reserve, the U.S. government actively attempted to lower energy prices to mitigate inflation. This avenue for inflation control is no longer available while producing countries are cutting production. Meanwhile, global oil demand is at record highs. Consequently, the oil price could easily surpass the $100 mark again in the coming weeks.

Typically, price increases with a constant money supply only lead to relative price changes. However, one should consider that this is a longer process, which can result in a higher overall price level in the short term. Businesses only gradually realize when price hikes can no longer be passed on to consumers or when they dip into money reserves to absorb short-term losses. For this reason alone, it's possible that U.S. consumer prices may have reached their annual low point in June.

Furthermore, defining money can be challenging, and shrinking money supply aggregates may present a misleading picture, as they include only cash, demand deposits, time deposits, and liquidable financial assets, but not assets like stocks, government bonds, or real estate.

In times when buying or selling stocks and bonds was cumbersome, this made sense. Nowadays, people trade stocks conveniently on their mobile phones, allowing them to convert them into cash quickly.

If money remains in the financial market and is reinvested into other stocks or assets, it doesn't impact price developments in the real economy. However, when people start to finance real-world consumption through the sale of stocks, it increases the money supply in the real economy. If increased demand meets a constant, or even worse, falling, supply of goods, it pushes up prices.

The stock market is currently trading near all-time highs as everyone expects central banks to lower interest rates in the event of an anticipated economic downturn. Bond market participants also don't predict consistently high interest rates. If inflation rises again in the United States in the coming months, market participants may realize there won't be a Fed policy reversal.

It's not so much about whether interest rates will be raised again or not; it will affect the long end of the yield curve. The yield curve will normalize, meaning long-term interest rates will rise. Typically, 10-year U.S. Treasuries are about 150 bps higher than 2-year Treasuries, which translates into a 10-year Treasury yield of around 5-5.5%, given the current level of 2-year yields.

This will also push up European bond yields as the dollar currently strengthens, which drives up import prices while local production declines. Eventually, this could put highly indebted Eurozone countries in focus. Even the former poster child, Germany, anticipates that next year, it will have to allocate more than double the annual budget of the Ministry of Education for interest payments.

For these reasons, I expect the high at the long end of the yield curve has yet to come, and buying bonds will not make you wear diamonds. Moreover, diamonds are not forever...

I have lost, and I have loved,

Sleep has stolen far too much,

So don't close your eyes, not just yet

Sleep is just a cousin of deathSo throw your diamonds in the sky, we'll stay gold forever

Bring Me The Horizon – Diamonds Aren’t Forever

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! If you like my writing, you can subscribe and get every post directly into your inbox. Also, sharing it on social media or liking the position would be fantastic!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice. I may change my view the next day if the facts change)

I fully agree with your inflation thesis. Really enjoyed reading your post.

I'm with you Fabian, I fear higher long end yields are in our future and very few are ready for this consequence