Dawn Of A Golden Age

Continuous Strength Or The Start Of A Minsky Mania?

Success breeds a disregard of the possibility of failure – Hyman Minsky

This week, Donald Trump officially became president again. After the unarguably biggest comeback in American history, market participants were eager to know about his policies to fulfill his (repeated) promises to "Make America Great Again." His inauguration speech was just as everyone would expect, full of arguments about why everything would be better under his watch.

Immediately, Trump signed a variety of executive orders and declared an emergency at the southern border, an energy emergency, an energy emergency, and erased diversity laws. Yet, what he didn't invoke immediately was imposing tariffs on the US's trade partners. What followed was that the dollar lost some ground against other currencies, leading to EUR/USD wrestling with the prior 1.04 resistance again. The markets definitely seemed relieved that he wasn't implementing tariffs right away.

Trump also repeatedly mentioned that he summed up his energy policies as "drill, baby, drill," meaning he is planning to ramp up US oil and gas production. One could easily argue that this was a primary driver of the drop in oil prices this week, which are trading well below $80/barrel (WTI) again.

Anas Alhaji, a Middle Eastern energy expert, argued in an interview that the drop in oil prices had little to do with Trump's announcement of an energy emergency. He claims the decline was caused by other variables, such as the Houthis' declaration that they wouldn't attack American and British ships in the Red Sea.

According to Alhaji, Trump's declaration was a declaration of war on climate change policies in the US, Canada, and Europe. Furthermore, Alhaji argues that Trump can't deliver on his promise to increase shale production in the US rapidly. Rightfully, he argues that low interest rates fueled the growth in shale production during Trump's first term. Today, interest rates are three times as high as in 2017, he argued.

His point is that the vast amount of investments will be used to replace the high declines in the shale fields. Additionally, he argues that instead of Trump's first term, where shale production was widely distributed among a lot of companies, it is now concentrated among the big players in the market, who are not interested in increasing production to sell the company (like the smaller ones did back then), but in controlling the market.

Alhaji doubts that the Trump administration can significantly increase production. However, he believes global production will increase in 2025 because, after years of merging, companies are now looking to cut costs and increase production. Hence, failing to climb above the $80 threshold, and the facts mentioned by Alhaji, could mean that prices go towards $70.

Yet, in the future, I suspect that this means that an expected massive drop in oil prices due to increased US oil production is not in the cards and that the downside could be limited more than expected. In fact, I think revoking the Green Deal and eliminating regulation could lead to an increase in oil demand that might be bigger than the increase in production. That would also support oil prices and potentially mean they could rise again in such a scenario.

Falling oil prices and the Trump administration's aim to slash regulations could support US economic growth. As Trump also won the popular vote, one can suspect that most Americans expect a better future. Big business is already circling Trump, assuming it will get an economic policy that works in its favor.

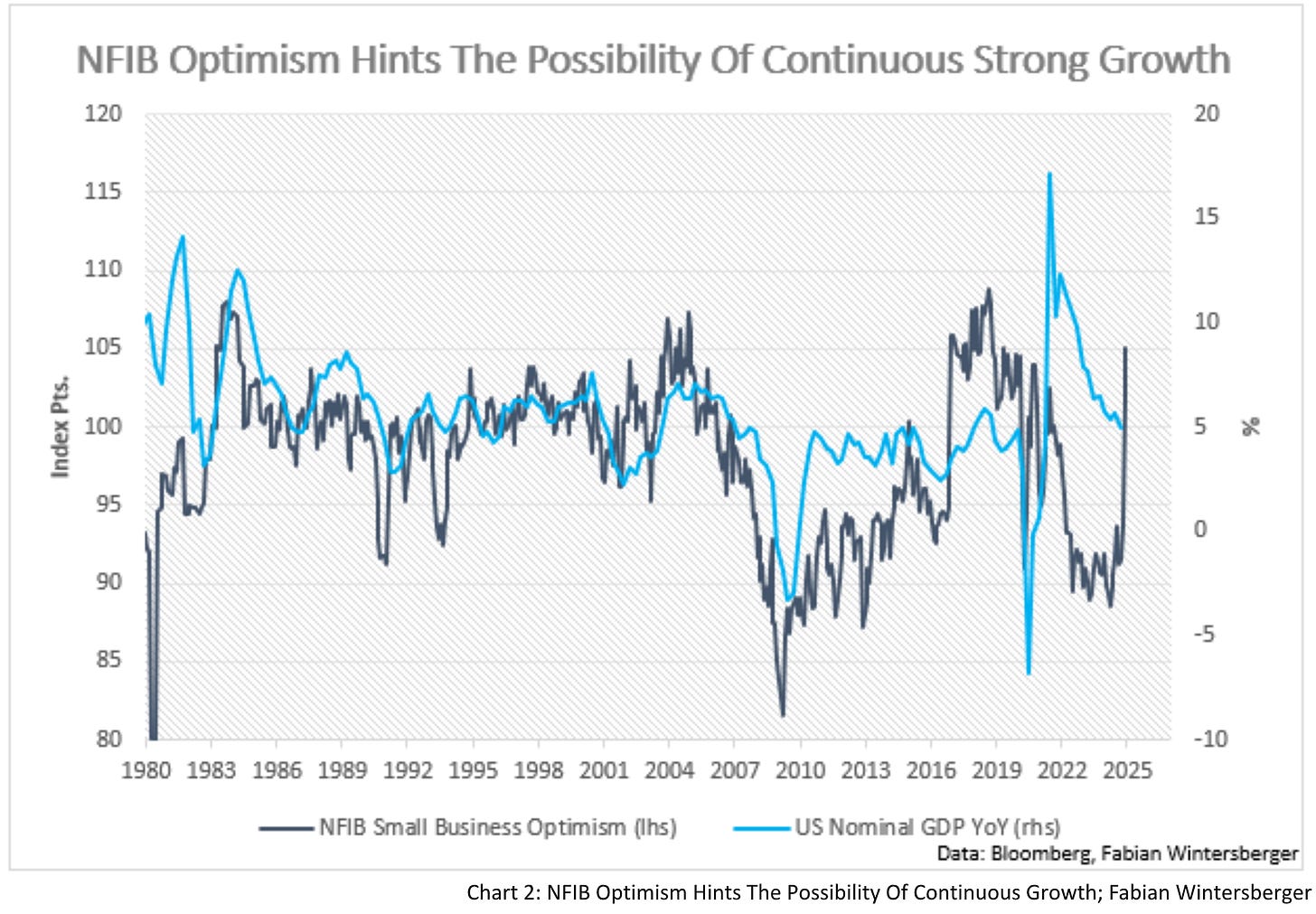

On the other hand, Small Businesses, which were outright pessimistic during the last two years of the Biden administration, are now super excited about the incoming Trump administration. The NFIB Optimism Index has recovered sharply in recent months and is near its all-time high, which probably supports growth in the short term.

The stock market continued its upward movement, with the German DAX leading the way, climbing higher and higher despite the euro strengthening in recent days. However, the S&P 500 also touched its all-time high yesterday, and with all the euphoria around in the US, I think it's poised to go higher.

As long as US growth and employment remain solid, German export businesses will benefit. Being an export nation sometimes pays off, especially if domestic consumption is subdued. Overall, I think we could be on the verge of some “Minsky mania”, which only rising long-term rates could stop.

At the moment, however, long-term interest rates have dropped, although they've been stuck a little bit since the inauguration. If we assume that inflation will not make a huge comeback next month and remain low, the market will celebrate and push its expectations to lower yields.

One of the drivers of inflation staying high was unarguably the shelter component of the CPI, which lags and has helped to keep inflation elevated. However, rents are usually led by "new rents," which the Cleveland Fed tracks. Their rate of change measure suggests that this component of the CPI is poised to drop going forward. If it does, markets will celebrate, and yields will push lower, but I think only momentarily.

To conclude, several things are coming together: increasing optimism among consumers and businesses, a potential, probably short-term, setback of inflation, and a government that is slashing regulation and freeing up business income for investments. All these things sound incredibly bullish for the economy and markets, and that's why I wrote that a potential speculative mania, as Minsky described it, could be in the cards.

Therefore, I remain optimistic that the economy won't weaken in the near term and that we could potentially witness an environment where the stock market is pushing higher sharply. One might argue that valuations are already at extremes, but one has to remember that most people don't care about these metrics in times of high enthusiasm. I'd even go so far as to argue that they simply reflect a lower probability of moving higher than lower.

However, only because of a lower probability can these things still happen, and I'd argue that the current sentiment is on its side. After all, the latest rise in yields caused some skepticism among market participants. So, does this mean we're at a continuous dawn of a golden age for markets and the economy?

That question depends on the dollar's future path and yields. Trump II could act like Trump I and try to weaken the dollar, supporting- the US economy. A potential continuation of the recent bond rally would support that. However, slashing regulations can also increase demand for labor and capital goods, increasing prices.

Eventually, expectations might lead to unsustainable price increases (from a monetary perspective), potentially causing another high inflation number somewhere down the road, with growth still high. At this point, market participants could ask whether rates are as restrictive as the Fed currently claims, and the long end of the yield curve could pick up again.

As I said last week, I don't think the high bond yields are already in for this cycle. If so, the jury will judge again whether we really are at the dawn of a golden age or if it was just unfounded extreme euphoria.

Moon child

Spawned of rage

Soon child...

The dawning of a golden ageRoadrunner United - Dawn Of A Golden Age

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.