I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal. – Scott Bessent

Since I wrote my last piece two weeks ago, things in financial markets did what they always do: they moved forward. As everyone awaited Wednesday’s FOMC press conference this week, it’s probably a good start for this “Weekly Wintersberger.”

The interest rate decisions were pretty much in line with what the market expected, as it has been for quite a few FOMC decisions before. In that sense, the Fed was just following the market.

In his statement, Jay Powell, Chair of the Federal Reserve, noted that the economy remains strong and has made significant progress toward the Fed’s goals of maximum employment and 2% inflation. Hence, it decided to keep rates unchanged. The Fed also chose to slow the decline in the balance sheet, reflecting a cautious stance amid growing economic uncertainty from potential policy shifts in trade, immigration, fiscal policy, and regulation under the new administration.

The Fed projects that inflation will reach 2% by 2027. Powell stressed that monetary policy will stay data-driven. The Fed is ready to adjust rates—either holding them steady or easing—based on economic developments while managing balance sheet tweaks to keep money markets stable.

Apparently, the decision to slow Quantitative Tightening stood out. To clarify, that doesn’t mean Quantitative Easing is back, as some Fed critics quickly claimed. Given the Trump administration's economic policy hints, Powell's reasoning (rising economic uncertainty) seems understandable.

Asked about tariffs’ inflationary effects, Powell said the Fed looks through them, preferring to track long-term inflation expectations for future decisions. In his words:

As I mentioned, it can be the case that it’s appropriate sometimes to look through inflation if it’s going to go away quickly without action by us if it’s transitory and that can be the case in the case of tariff inflation.

That backs up one of my constant points about the Fed and other central banks: they’re reactive, not proactive. Not that I think they’d nail it by being proactive, but it shows they’ll always be behind the curve.

Rightfully, Powell pointed out that hard labor market data isn’t showing significant weakening yet. Still, I’d argue that changing policy only when labor market data weakens is reactive, too. That said, survey data hasn’t been beneficial in the last few years, either.

Another interesting bit was Powell’s answer to Nick Timiraos’s question on price stability, tied to Alan Greenspan’s idea that it’s when people make buying choices without worrying about inflation expectations. Powell said:

So I think a world where people can make their daily economic decisions and businesses and they’re not having to think about the possibility of significantly high inflation—we know inflation will bounce around—that’s—that is price stability.

The theory that inflation expectations drive consumer price inflation is big with New Keynesian economists. Still, there’s a flaw: no one can logically explain why expectations spark inflation without more money in the system. Sure, they might nudge financial market prices, but that’s just a disequilibrium that corrects over time.

The FOMC also gave their forecasts for growth and inflation. Compared to last time, they bumped inflation up and cut growth down. So, I suspect the Fed ties the recent drop in interest rates to markets’ lower growth expectations.

That fits with what Treasury Secretary Bessent said in interviews, stressing that hoping the Trump administration will judge success by stock market gains is off base. On the latest US stock market correction, Bessent again called it healthy and said they’d look past it.

So the Fed’s logic seems that the US government’s plan to cut reliance on deficits will hit growth, while planned—or threatened—tariffs will push prices up. In short, that could happen: businesses raise prices due to tariffs, which shows in consumer costs. Yet, Powell didn’t say it outright, but the Fed seems to think it won’t kick off an inflation cycle.

I’d go further and say the claim tariffs fuel inflation is weak. China and Europe have tariffs, and their inflation is below US inflation. To me, it’s mostly about money supply and velocity (inverse money demand).

None of the Trump administration’s announcements have kicked in yet, so my hunch is the latest stock price dip comes from people’s expectations of these policies. Despite DOGE noise rattling Washington’s bureaucracy, government spending is up, not down, compared to last year so far.

As I noted a few weeks back, the administration’s latest moves might have cut spending, which boosts GDP but not total spending. After all, that would be the worst outcome for markets.

Is it time to worry outright? Probably not. US yield spreads have been up recently but are just back to 2024 levels. You could say uncertainty’s rising, but markets aren’t overly stressed—spreads are still far from the 2010s “stress” zone.

Before moving to market price action, it’s also worth touching on Germany and Europe. Germany’s old parliament passed plans from possible future Chancellor Merz and his Social Democratic partners (with Green help) to ramp up government spending. It’s also expected to pass Germany’s Federal Council of States on Friday.

Is this a big win for Merz? Not really. As expected, the Social Democrats and Greens stripped out many of his other campaign promises in return. The Greens got their “climate neutrality by 2045,” and the Social Democrats got a softer immigration stance.

The European Commission is also pushing to boost its power with a collective re-armament plan run by Brussels. Given the shady COVID vaccine buying purchase of Covid-vaccines, it's at least questionable if that's smart. Commission president Ursula von der Leyen's record of lack of transparency even goes back to her time as German defense minister. As Politico reported in 2019:

Their report portrayed a dysfunctional organization, describing some ministry officials as overwhelmed and highlighting procurement contracts that heavily favored the interests of Germany’s arms industry.

So, the big spending plans might end up being wasteful. Still, expectations for massive EU spending have dialed back lately, with some countries resisting more Ukraine military aid. Markets’ reaction to this week’s news stayed muted.

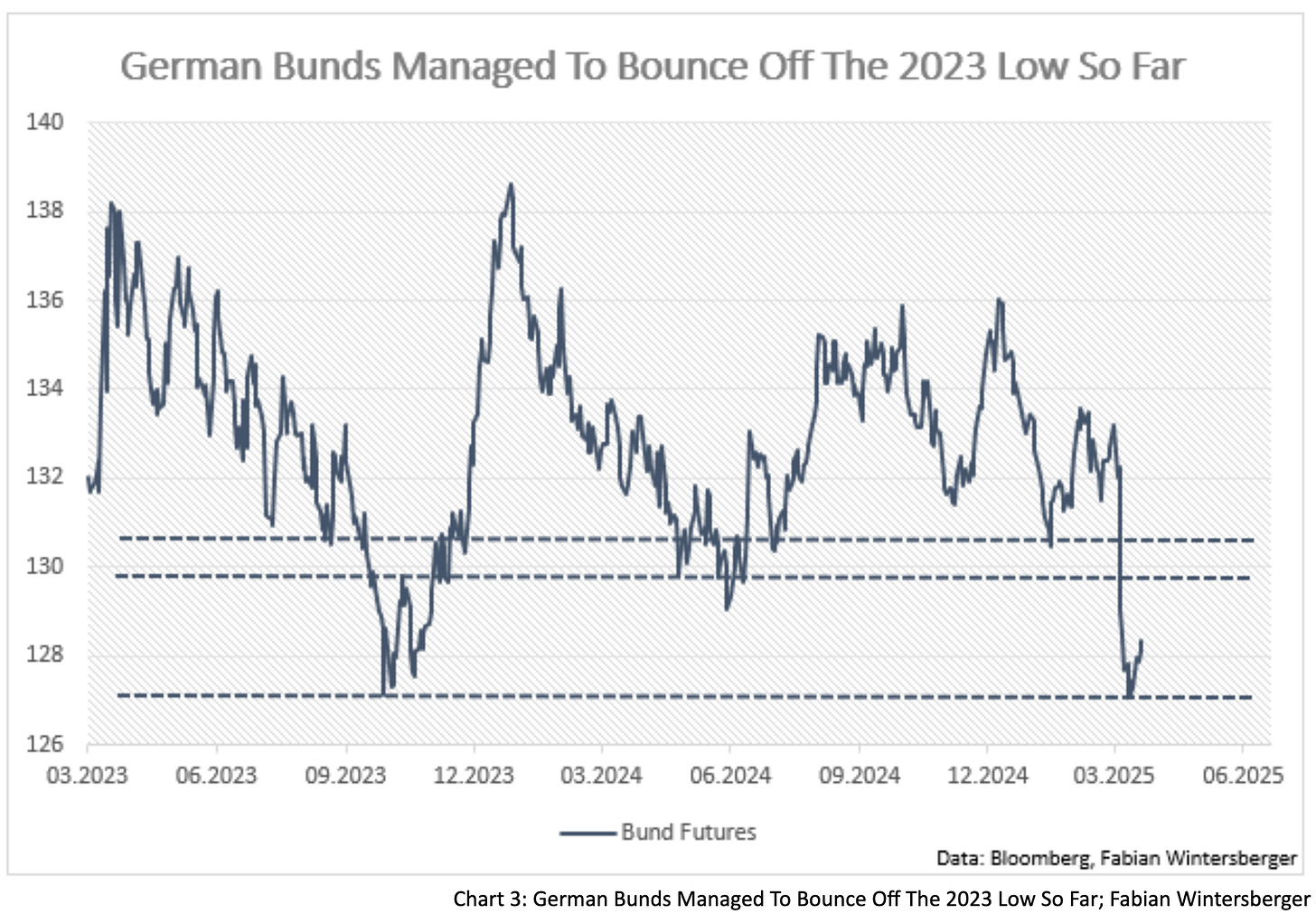

The sharp drop in German 10y yields didn’t keep going, and though fundamentals don’t point to lower yields long-term, bonds might be set for a bounce if Europe skips big spending surprises. Lately, the Euro area macro drove yields up, but the US macro pulled them down. German Bunds stopped near their 2023 lows—if that holds, they could climb to 130 resistance. The next few weeks will tell.

Higher European yields versus US ones lifted the euro against the dollar. EUR/USD ran to its November 2024 high, then pulled back, and now sits in a tight range. Like European bonds, a countermove could be coming.

On to stocks: US outperformance over Europe flipped this year. The DAX hit all-time highs while the S&P 500 lost ground, stuck in a correction since mid-February. The euro’s strength reflects Europe’s better growth outlook, pulling in investment and increasing yields and the currency.

Another winner this year is gold, breaking past $3,000. Whether it keeps rising is up in the air—more chatter about it could mean a correction’s near, but long-term fundamentals still hold. Gold’s outrun the S&P 500 and pulled ahead solid.

Copper prices have also had a good run, nearing the 2024 high of $520. Will they drop like last year? I’ll leave that to commodity folks.

Connecting the dots, US data isn’t signaling a recession, but tariff and budget-cut plans hint at a slowdown. If data disappoints going forward, US stocks could see more corrections.

While improving economic expectations might help European stocks, a weakening US economy could spill over. Plus, European consumption must pick up, as the strong euro might hurt exports.

That could boost European bond prices, and a US slowdown caused by Trump’s trade policies could also slow growth. With the Fed holding rates, tighter financial conditions might also slow growth.

But global political uncertainty, also propping up bonds, could flip this. Trump has made little headway on Ukraine peace, and the EU is backing a likely unwinnable war there. Meanwhile, the Middle East is heating up—Israel is bombing Gaza again, the US is hitting Yemen, and Trump is eyeing Iran. Politics shifts fast, though, so the market stays a “Dance With The Devil.”

Say goodbye

As we dance with the devil tonight

Don't you dare look at him in the eye

As we dance with the devil tonightBreaking Benjamin — Dance With The Devil

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.