Cry Of The Blackbirds

Throughout the whole history of humankind, blackbirds were considered both a positive and an unfavorable omen. In ancient times, blackbirds were seen as god-like creatures, while they were regarded as carriers of death in the mid-ages.

Counted as carriers of death, mischief, and black death in the mid-ages, women sometimes were demonized as witches just because of the mere fact that a blackbird has passed them too close.

I want to say here that blackbirds can be seen either as something good and positive or as something negative. This translates perfectly to the topic I want to discuss in this week’s text of The Weekly Wintersberger.

I want to discuss Central Bank’s Digital Currencies, or digital central bank money. In recent years, the topic has gained much interest from central banks worldwide: The People’s Bank of China, the European Central Bank, the Federal Reserve, and the Bank of Japan. All of them are investigating if the implementation of digital central bank money, or currency, is worth considering.

To put it as simple as I can: The first articulated goal (if a central bank introduces CBDCs) would be to implement it besides cash and book money. However, if implemented, I would assume that at some point, the goal is to replace cash completely with CBDC.

Everybody sees CBDC as something similar to crypto-currencies because it may or may not use Blockchain technology, although I think this is not important. (Note: Contrary to Bitcoin, for example, CBDCs would be centralized.)

Currently, our monetary systems know two sorts of money: cash (coins and banknotes, produced by central banks) and book money, bank deposits. Book money is digital money, so to say. So, what would be the new thing about CBDCs?

First of all, similar to banknotes, only the central bank can create CBDC. The central bank only indirectly influences book money, while commercial banks create most money via loans.

Cash, so the argument goes, is costlier than digital money. On the one hand, because it needs to be produced and delivered physically, and on the other hand because of costs in a sense that it takes more time to pay cash than to pay with a debit- or credit card. Digital payments can be made within a second while paying with cash takes longer. One party has to hand out the money, and the other side has to count it and give the change back. Paying cash may be anonymous, but it costs time. Out of sheer laziness, people prefer to pay more and more bills digitally.

Covid has just accelerated this trend. In Germany, cash is still widely used and preferred by many people. However, while 66 % of all transactions were made cash in 2016, this number shrank from 60 % in 2019 to 52 % in 2020.

Digital payments are 100 % traceable. Theoretically, a bank knows everything about the digital transactions of its clients. Interestingly, this is a point why some people argue that CBDCs will be beneficial to privacy.

Assume that more and more people stop paying cash, like people in Sweden. In the Scandinavian country, cash payments contributed only 9 % of total expenditures in 2020, down 30 percentage points from 2010. Sweden wants to get rid of cash in 2023.

There is a concern that banks know everything about their digital transactions. This is why proponents of CBDCs argue that digital currencies are helpful to protect privacy.

If every citizen of the monetary area gets an account at the central bank and can pay with it, commercial banks do not have access to that data. Thus, one may argue that people gain privacy through CBDC because central banks are not interested in personal expenditures. (Note: very shortsighted, in my opinion)

For central banks, CBDCs would be beneficial for more specific monetary policy, and they may then have a tool to influence desired economic outcomes through monetary policy.

You probably remember an actual debate in the US, where people argue that the Federal Reserve needs to take racial inequality into account of its monetary policy measures. Last year Ursula Burns (the first African American woman to lead Fortune 500 company) said that the Fed…was ducking its responsibility to people of color by acting as if its policies were color blind.

CBDC would make it easier for central banks to fight economic inequality. Women, people of color, the possibilities seem endless. Hence, CBDC would lead to an even more influential central bank, and I think that this is the reason why central banks are so open-minded about it.

In 2021, the ECB confirmed that it started a project about a digital Euro after a 2020 report already dealt with the subject. Of course, only in the people's interest and as an alternative to cash.

Another possibility is that government aid can be organized much more efficiently with CBDC in times of crisis. The government just orders the central bank to transfer amount X to the accounts that qualify to receive the aid.

I do not know if you took notice of that, but there is an example from Austria of how government aid could be organized much easier via CBDC. Recently, the coalition in Vienna has told the press that, to fight rising energy costs, every household will receive 150 Euros. However, the coalition was not able to make that happen. Now they want to send a coupon to every household. But the catch is this: Not every household would be allowed to cash in, and therefore there would be random controls to impede abuse. If there was a CBDC, the whole thing could be finished with just one click.

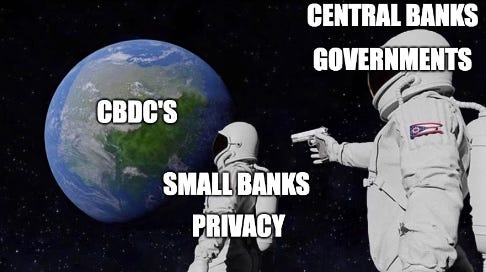

Now it must be obvious why (most) governments and central banks tend to prefer the implementation of Central Bank Digital Currency. Both would become even more influential than they already are, and financial aid could be more effortlessly organized.

For central banks, however, there is another aspect: Macroeconomic policymaking. Especially the debate about negative nominal interest rates is likely to be restarted once CBDCs are introduced.

Negative nominal interest rates on cash deposits are problematic because people who want to avoid them simply can withdraw the money from their bank accounts. However, if too many people do this, this would be fatal for the banks (a possible bank-run). The only solution to this is to abolish cash. But honestly, I want to add here that no central bank has publicly stated that it plans to ban cash.

In any case, CBDC would be a problem for commercial banks anyway, especially for smaller regional banks and their business model. Additionally, it may be another drag on economic growth.

As every person would get an account at the central bank, the central bank could possibly engage more and more in daily bank business. Some people already argue that the main goal behind CBDC is precisely this: Central banks want to compete with the private banking sector.

At first sight, this seems like fiction, but one must admit that the recent years showed a tendency that decision-makers are in high favor of centralization. Probably such a scenario is not that far-fetched.

Commercial banks already suffered from central banks' low/zero interest rate policies. They thus had to look for alternative sources of income because their primary business (lending) became less and less profitable. As a result, they started to engage more in financial markets.

Consider that central banks start to hand out (cheaper) loans for specific groups in society, and the income of commercial banks erodes further. What other is this than a regulator that becomes a competitor?

To be clear, I am not saying that this will be a done deal, and I just want to remind you that this is a possibility and that central banks have an incentive to do that (gain influence and power). The result would be a further centralization of the sector.

Apart from low-interest rates, strict regulations in the banking sector made it more and more difficult for smaller banks to operate profitably. As a result, competition within the industry is already shrinking.

But it is not only competition that is diminishing, and the ongoing centralization will be a heavy drag on economic growth. There is a lot of evidence that a banking sector with various small community banks in Austria and Germany (like general savings banks (Sparkassen) and Raiffeisen) plays a significant role in ensuring economic success.

There is an anecdote (told by Richard Werner) that Deng Xiaoping and his advisors analyzed the banking sector of the economic champions, the United States and Germany, to understand how to structure the banking sector to become a prosperous economic nation.

According to Fred Mear and Richard, the small community banks and the structure of the banking sector in the German-speaking area play a high role in why those countries have such an increased number of ‘hidden champions’

Smaller banks have an advantage over their bigger competitors: they’re closer to the customer and thus have an information advantage. Small community banks have been the guarantee for the economic prosperity of the Mittelstand (middle-class). These banks finance the hidden champions and treat them much differently than the big banks could ever do.

After zero percent interest rates and continuous growth of regulatory requirements, CBDCs would be another attack on the community banking business model. CBDC would result in more centralization and less competition because more banks would be forced out of business. Astonishingly, I have not found many critiques from CEOs of small banks that oppose the (potential plans) of CBDCs. Probably few are aware that this would be another disadvantage, or they do not pay much attention to the subject.

Other topics are of more interest currently, apart from the Ukraine war that started yesterday (regarding this, I can recommend you follow the Twitter accounts from Velina Tchakarova and Pippa Malmgren): Environmental Social Governance, ESG. Every bank and every company currently works to adjust its business to ESG criteria. For example, Austrian community banks recently declared that they would not (although they already have not) finance any nuclear energy company and consider it green. However, the EU Commission announced nuclear energy green in their green taxonomy.

With green taxonomy, the EU is turning more and more into a centrally planned economy, historian Rainer Zitelmann wrote in a commentary. What started with dividing energy production into good and evil has now separated businesses into good - and bad companies.

ESG creates a new field for lobbyists, as Zitelman writes:

[Lobbyists] now have to convince politicians of why the business they lobby for is ‘socially useful’.

Of course, pursuing a better environmental and social governance world is a noble goal. However, reaching those goals often comes with disastrous side effects.

Green taxonomy wide opened the door for political influence. Now it is the task of politicians to decide what is helpful instead of people who choose what is useful every day on the marketplace. Their behaviorism, what they are selling, and what they are buying define what is useful.

But let me get the switch back to Central Bank Digital Currencies: In case of an abolishing of cash, it is only a matter of time until a European social credit system gets implemented. Indeed our politicians are already in favor of such tools.

Assume the EU wants to penalize fossil-fuel cars and decides that users now are suffering from a negative rate on their account at the ECB. Or consider a business that wants to realize a project, but politicians do not like it (it does not matter which, just imagine that the party you dislike most is suddenly in power) and hence the business has to pay a higher fixed rate for their loan. Do you think that governments will not make use of penalizing ‘bad’ behavior?

I guess this sounds all very hypothetic and unrealistic? If you think so, then I suggest you look at Canada, where Justin Trudeau recently broke up the truckers' protests in Ottawa. To do so, Trudeau has declared a state of emergency and announced that the government would freeze all bank accounts of those who had financially supported the protesters.

Regardless of what the protesters fought for, the mere fact that a government froze people’s bank accounts without a justified right to do so is terrifying. It went so far that bank accounts of people who donated 20 Canadian dollars to the protestor were frozen when this was perfectly legal back then. Imagine what Trudeau would do when he had even more accessible access to people’s savings via CBDC. Would he?

Without a doubt, he would.

Have a great weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.)