Cross Off

While the market expects constantly higher inflation, a deflationary shock could be well in the cards at some point.

There are no facts, only interpretation – Friedrich Nietzsche

It has been an eventful week in the financial markets, with significant data releases. Eurozone activity numbers, UK inflation, and the US PPI and CPI were all published by Wednesday, while the Eurozone CPI is slated for release on Friday and, thus, is not discussed here.

To briefly recap the macroeconomic price action, I should mention right away that both the US PPI and CPI came in slightly below expectations. This resulted in a relief rally for both US and Eurozone interest rates. The dollar led the rally, recovering from a dip below 1.02 euros on Monday to trading around 1.03 now.

News regarding the Trump administration's plans to implement gradual tariff hikes under emergency powers has slightly weakened the dollar, though I believe the leak doesn't reveal much. Moreover, the proposed "gradual" increase of 2-5% per month seems more significant to me than market participants might acknowledge.

A weaker dollar has acted as a tailwind for the DAX, which reached another all-time high. It has outperformed US stocks year-to-date, with the weak euro certainly contributing to this performance. However, the unexpectedly low CPI figures also propelled US stocks upward after closing a chart gap from November.

Gold has continued its ascent this week, now grappling with the $2,700 mark. Considering global debt levels and deficits, I would expect that new all-time highs are not out of the question.

Another development that might have surprised many is the ongoing strength in oil prices. It has kept climbing, with WTI surpassing the $80 mark this week. Now, we'll need to see if it can maintain this level or if it will retract. If it holds, it might soon hit $85 per barrel. Copper has also increased, approaching an increase of more than $40.

Recent developments in commodity prices suggest increasing pressure on consumer prices. Notably, oil is up 10% year-over-year, though one must consider whether this trend will intensify, given that oil also rallied in the first quarter of last year.

Given these developments and this week's inflation data, I've decided it's worth further examining. US PPI and CPI came in below expectations, prompting an immediate rally in bond prices from their lows. The US 10-year yields dropped by about 15 basis points to 4.64%, and the 2-year yields fell by approximately 10 to 4.28%.

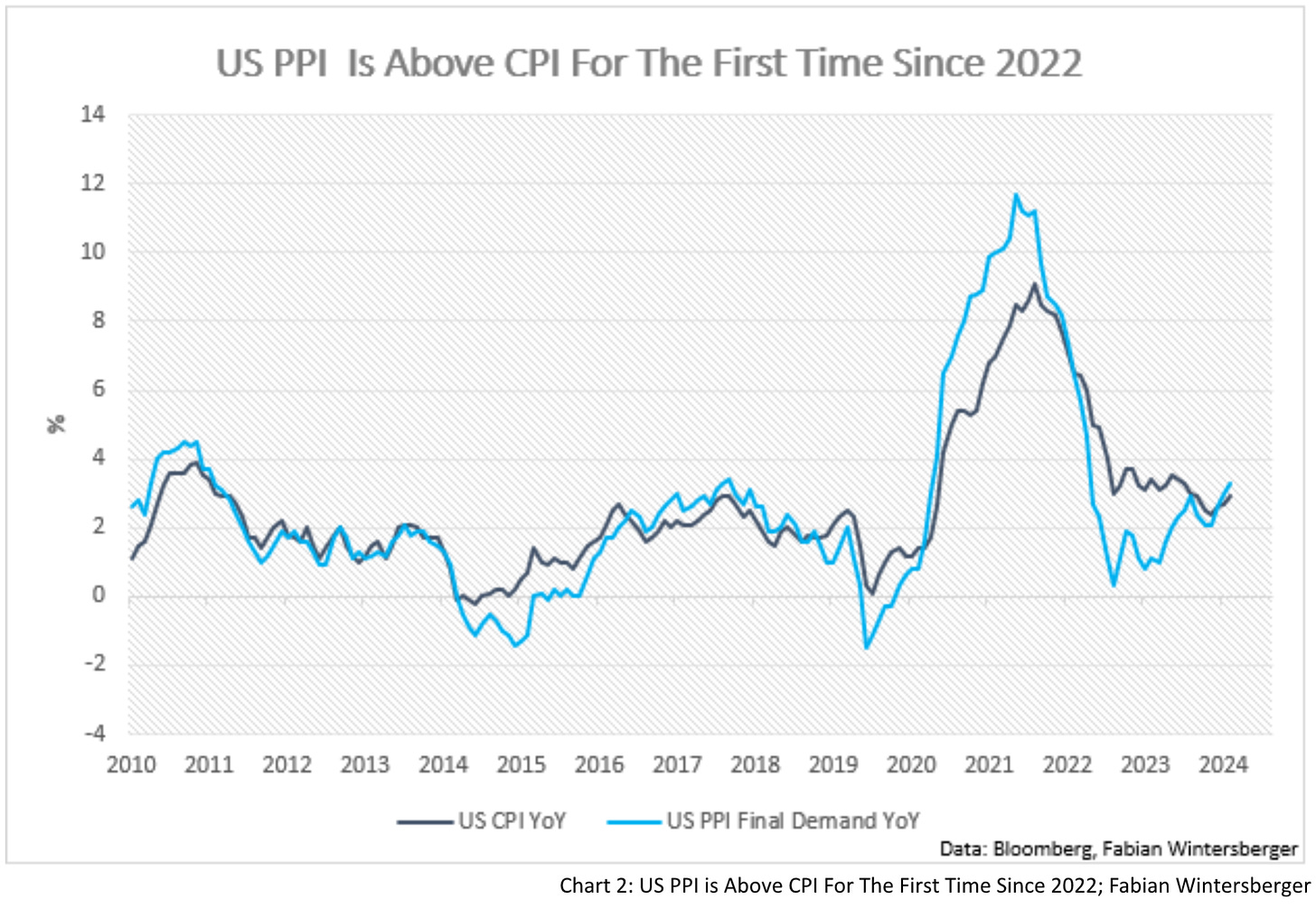

For the first time since 2021, when inflation began to surge, the yearly increase in producer price inflation has outpaced consumer price inflation. While I wouldn't assert with certainty that we'll end the year with higher inflation than now, the combination of rising commodity prices and uncertainty about the incoming administration's tariff policies could dampen inflation progress in the first quarter.

However, the expectations regarding the future trajectory of inflation are more intriguing for markets, however. The University of Michigan's survey, which questions consumers on where they see yearly inflation in 5-10 years, shows that consumers anticipate inflation rates of 3.3% year-over-year.

Financial markets hold a more optimistic view, expecting average inflation over the next 5-10 years to be around 2.5%. Here, I'm inclined to trust the market's assessment over consumer sentiment, although markets can also be mistaken.

What I believe is clear, however, is that the Fed has not provided a compelling outlook on its future interest rate policies. The US 10-year Treasury Inflation-Protected Securities rose significantly after the Fed began cutting interest rates following the summer.

One-year inflation swaps also began to rise in September of last year in anticipation of that initial cut. Post-cut, the market grew concerned that the Fed wasn't prioritizing inflation control, leading to heightened inflation expectations. This, in turn, increased the term premium, thus driving up prices for 10-year Treasuries. The market now doubts the Fed's success in managing inflation and has adjusted by removing expectations of further rate cuts in 2025.

My view here is that the market is concerned that the latest interest rate cuts will act as a tailwind for future economic activity, fueling inflation at a time when labor is scarce (unemployment is at 4.1%) and real GDP is already hovering around 3%. Frankly, current data offers little indication that this economic vigor will fade soon.

Usually, I'd emphasize that inflation is a policy, not a byproduct of growth. Real growth, all else equal, would typically lead to deflationary pressures because a fixed money supply meets an increasing quantity of goods. However, when labor is scarce, companies must raise wages to attract additional workers or invest in productivity enhancements.

Therefore, they need to borrow money, which temporarily boosts the money supply and thus elevates inflation. When not signaling economic trouble, lower interest rates attract more loan demand. As things currently stand, all these factors support the thesis that inflation might have bottomed out last year.

Yet, I'd argue this is more of a short-term perspective, where stable consumption and income growth also play a role. Over the medium term, previous changes in the money supply become more significant, counteracted only by an increase in money velocity (lower demand for money/higher demand for real economic goods). The contraction in money supply growth from two years ago still hints at potential disinflationary forces in the medium term.

Another factor contributing to the recent bond market sell-off is the fear of ballooning deficits in Western countries. GDP growth heavily relies on government expenditures that redirect funds from financial markets into the real economy.

Reducing government spending would immediately dampen GDP growth, though this is a side effect for achieving a healthier long-term economy. While this could be disinflationary or even deflationary, current deficits are decidedly inflationary. Hence, I assess that the post-CPI rally in short-term bonds might be short-lived, with yields likely to continue rising in Q1.

Over the medium to longer term, I'd say there's still a possibility for a more substantial bond rally. Just a tiny error from the Fed could lead to rapid changes. As we all know, central banks often make mistakes, and from an Austrian economics perspective, this is inevitable due to the impossibility of micromanaging an economy from a central planning agency.

Regarding the longer-term developments, Russel Napier gave an interesting interview, stating that he believes the mistake has already been made. In his view, the Fed and the ECB have overtightened, increasing the likelihood of an impending deflationary shock.

You might be curious about what event could trigger this. If asked about the source of this shock, I'd respond similarly to Napier's comments in the interview:

You and I could hypothesize about that all day. It could be a spike in French bond yields. It could...China.. It could be the yen carry trade unraveling again...[or, it could be] the unknown unknown. Somebody somewhere gets into trouble, and we’ll see something break in the financial system.

His prediction of future higher inflation still stands, but he posits a deflationary shock will come first. In his view, AI isn't the game-changer many believe; hence, financial repression is inevitable. The system he envisions, which he calls "national capitalism," seems somewhat of an understatement. What he describes sounds more like "economic fascism." According to Napier, we are witnessing the collapse of the current monetary system before our very eyes.

Napier advocates for gold, arguing that fixed-income returns will be eroded by inflation and financial repression, compelling investors to liquidate foreign assets like stocks. American stock markets would be most affected, given the global investment they've attracted over recent decades.

I think the bottom line is that Napier believes the golden age of high stock market returns is nearing its end as governments take control of economic activity. However, the central planning this implies, while possibly addressing the debt situation, will likely result in severe economic distortions and low real growth.

Nevertheless, these scenarios unfold over a long time horizon and should not be given undue weight when considering short-term economic and financial market developments. Here, the current strength persists, and bonds might struggle to rise further.

Entering new stock positions doesn't look compelling from a risk-reward perspective. And although stocks might eventually be pushed higher when interest rates begin to fall, one can likely "cross off" the days until this happens if the deflationary shock materializes at some point.

So black out and hide behind the lines,

Keep staring down the sun and hope the,

Light will finally blind your eyes from seeing,

Cross off the days gone byMark Morton & Chester Bennington – Cross Off

Have a great weekend!

Fabian Wintersberger

*NOTE: The first version falsely said that “inflation is a byproduct of growth.” That sentence was changed to “Usually, I'd emphasize that inflation is a policy, not a byproduct of growth.”

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.