Creeping Death

The Australian James Wan is one of the most decorated directors in Hollywood, directing movies like Fast & Furious 7 or Aquaman. He is also the director of the second Aquaman, Aquaman: The Lost Kingdom, with famous actors like Amber Heard, Jason Momoa, Ben Affleck, and Nicole Kidman.

However, Wan’s roots are in the horror-thriller genre. He is the creator of the successful Saw franchise, which was highly successful in the early 2000s, and Insidious or The Conjuring. Thus, it was only a matter of time before Wang would direct another horror movie.

In 2021, his new horror-thriller Malignant was finally released in movie theaters and HBO Max. The main character is played by Annabelle Wallis, who is eventually known from The Mumie with Tom Cruise or from the successful show Peaky Blinders.

While the reviews of Malignant remained mixed: some considered the movie a masterpiece while others wrote that the film is oversubscribed and the story is not well told, so one cannot build up a connection to the characters. Financially, the movie disappointed and grossed only 34.9 million US dollars with production costs of 40 million. Nevertheless, there is speculation about a potential sequel.

The movie tells the story of pregnant Madison Lake-Mitchell living with her abusive husband in Seattle. After a dispute (where Madison is hurt), a dark creature breaks into the house at night and kills her husband. She wakes up on the floor when the police arrive at the home after neighbors call it.

Soon after, Madison experiences hallucinations, where she witnesses a kidnapping and some murders that the murderer of her husband commits. She is always at the crime scene in her hallucinations, although she always was in her home when they started.

The police later discover that the victims are connected to Madison, as Madison was adopted from her family when she was eight. Before, she was in a clinic where the murdered doctors treated her, but Madison does not remember anything from those times.

However, videos from her stepmother show that before the birth of her younger sister Sidney, she always talked to an imaginary person called Gabriel. Her step-parents believed that she had created Gabriel in her mind to overcome whatever had happened to her before the adoption. During the course of the movie, it turns out that Gabriel is committing those murders, and he also calls Madison when the police interrogate her to talk to the officers.

Gabriel's existence is revealed in the movie's final third: neither is he an imaginary friend of Madison, as her step-parents believed, nor is he a lost twin brother. Madison’s real name is Emily, and Gabriel is an extreme version of a teratoma, a parasitic twin who cannot survive without Madison, as they share the same body. Until the killed doctors removed him, his face was at the back of Madison’s head, but he could not be removed entirely because he and Madison share the same brain.

Gabriel takes advantage of that, putting Madison in a mental prison and making her think she is living her life when in reality, he takes control of her body. Ultimately, Madison learns to use that and now puts Gabriel in a mental prison. Now you live in a world that I create, Madison tells him at the end of the movie when she is locking him away (mentally).

One can say that this story is an interesting metaphor for the ongoing fight between a person’s good and evil self or a battle between positive and negative feelings. The fact that both can trick each other’s consciousness and make them believe that they are doing things in a transfigured reality is somehow fascinating. This leads me to today’s topic.

Last week, a chart got my attention that showed that despite a reduction of 20% in natural gas consumption only led to modest decreases in industrial output. Some see that as a positive sign and argue that the European industries managed to keep production high through efficiency gains and switched to alternative energy sources.

So, can one say that Europe is doing well and has overcome the energy crisis? Is Chart 1 showing that Europe is not facing economic turbulence in the future? Is Urusula von der Leyen right when saying we got rid of Russian gas? Is this the first chapter of a successful green transformation? My view is that one should jump to such conclusions.

For a long time, Europe, especially Germany, was seen as an industrial powerhouse with a positive trade balance, which means it exports more than it imports. However, those times seem to be numbered, especially if one concludes that Europe, despite the good numbers, cannot keep industrial output at those levels steadily.

This winter, Europe had the advantage that the Chinese economy was still locked down, which kept global demand for natural gas lower than it otherwise would have been. That made it possible for Europe to buy lots of LNG on international markets and fill up gas storage. Additionally, the warm winter also played into Europe’s hands, which naturally lowered gas usage. Industries also profited from that, although one could assume that there was the mentality of let us get through the winter and then we are assessing further actions, which is why production remained only slightly below output from the year prior.

One can argue that the situation will change over time, and as the winter is close to an end, businesses will have to deal with the economic outlook to make a strategy for the upcoming years. Here, the announcement from several firms shows a darkening picture.

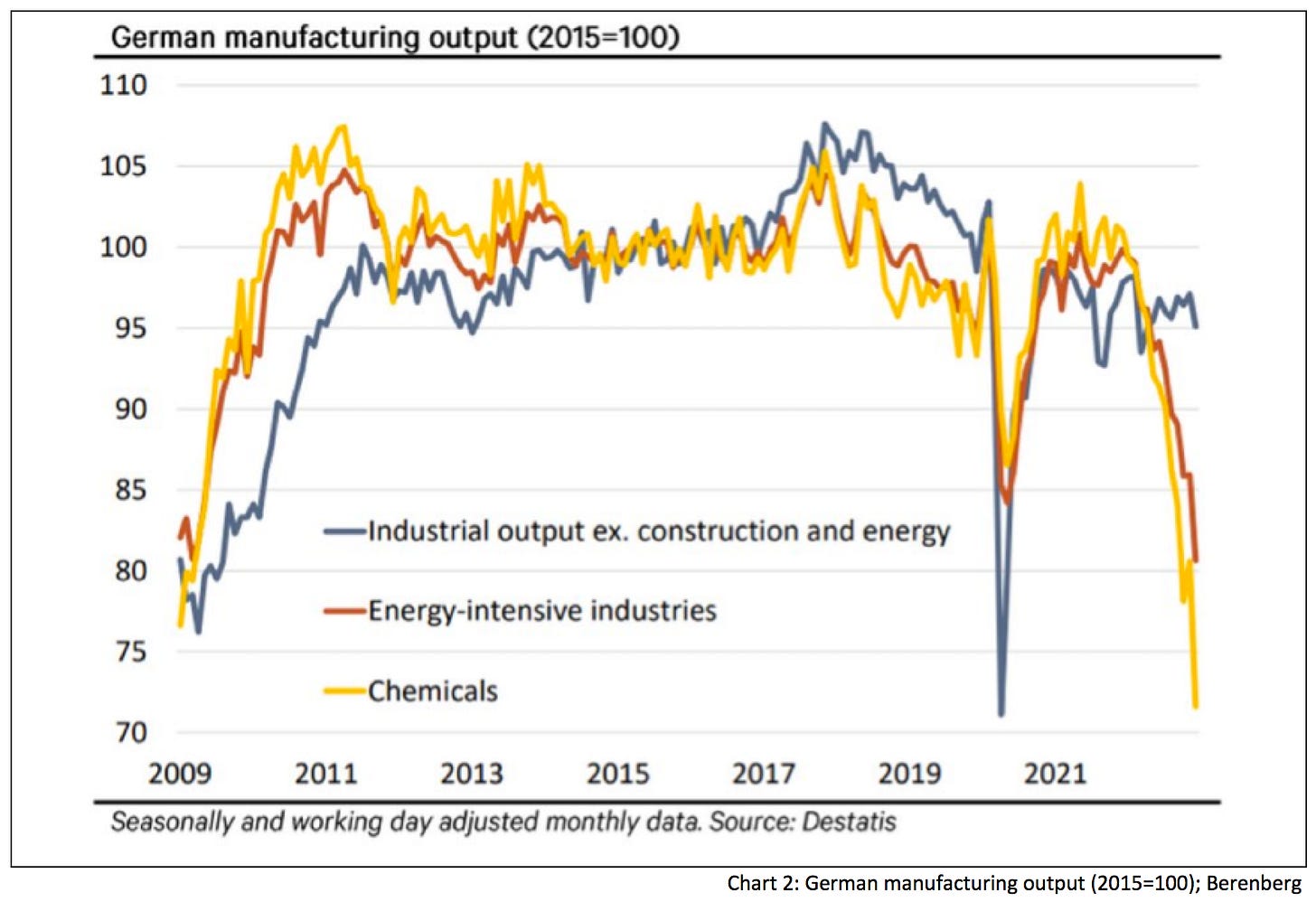

In contrast, Chart 2 shows that significantly lower production levels already accompanied this winter for some industries, namely energy-intensive and chemical industries.

Here are several examples: BASF has announced that it will close a part of the production facility in Ludwigshafen and implement job cuts. Arno Antlitz, CFO of automaker VW, said that VW does not plan to build any more electric production facilities in Europe. German economic minister Robert Habeck still offered no solution for the German refinery Schwedt, which depends solely on Russian oil for processing. And, to leave Germany beside, the former Dutch, now British group Shell announced that there are ongoing discussions about whether to move the headquarter from London to the United States.

For years, German automakers have been the top producers of cars alongside Japan. Still, since 2020 the export volume of cars made in Germany has declined substantially, while auto exports from China, where German automakers are heavily engaged, have taken off. Suppose the EU wants to stop the trend that more and more businesses consider shifting production away from Europe to other continents. In that case, the only solution might be additional government subsidies, which could also severely affect the European economies.

Additional fiscal spending drives inflation by shifting money from financial markets to the real economy. Simultaneously, one can assume that subsidies can only be used occasionally and not broadly, which might lead to a fall in production in those sectors of the economy. A Doppel-Wumms (double oomph), or high fiscal spending as governments did during the pandemic and this winter, might not be so easy in the future.

This week we got European consumer price inflation numbers, which show that the ECB is far from bringing inflation back to 2 %. In Spain, the poster child for the European left concerning fighting inflation, core inflation rose to another high of 5.1 %. In Italy, consumer prices rose more than 10 % compared to the previous year.

In the German-speaking area, there is also no sign that the current pace of consumer price inflation will come down substantially any time soon. In Austria, consumer prices rose 11.6 % year-over-year, and daily purchase prices rose 16.8 %. German HICP (EU harmonized CPI) rose again to 9.3 % year-over-year and 1 % month-over-month.

In France, consumer price inflation rose to another high as several policies to dampen inflation pressures ran out. 3-month annualized inflation in France is now at 5.2 %; last month, it was at 2.8 %. The home country of ECB chair Christine Lagarde is the second largest country (measured by population) in the EU after Germany.

As a result, hopes from dovish ECB members that the latest rate hikes were enough to bring inflation back down can be dismissed. Moreover, it is possible that an interest rate hike by 50 basis points at the next meeting of the governing council will not be the last one of that size.

There are several implications that consumer prices will rise in the short, medium, and long term. Firstly, there is the planned green transition, which, assuming it will be successful, will drive up prices for raw materials needed to buy the energy infrastructure. Additionally, the Financial Times quoted a poll from the European Investment Bank among 12,000 businesses, saying there is a lack of skilled labor to accomplish the green energy transition. Higher prices for raw materials, transportation, and workers mean higher costs, meaning higher costs.

One can assume that the EU and its member states will come up with the same solution as always: additional spending. But rising interest rates affect the debt burden, and Eurozone debt/GDP is already close to 100 %, probably higher because Germany is using bookkeeping tricks to show a lower deficit.

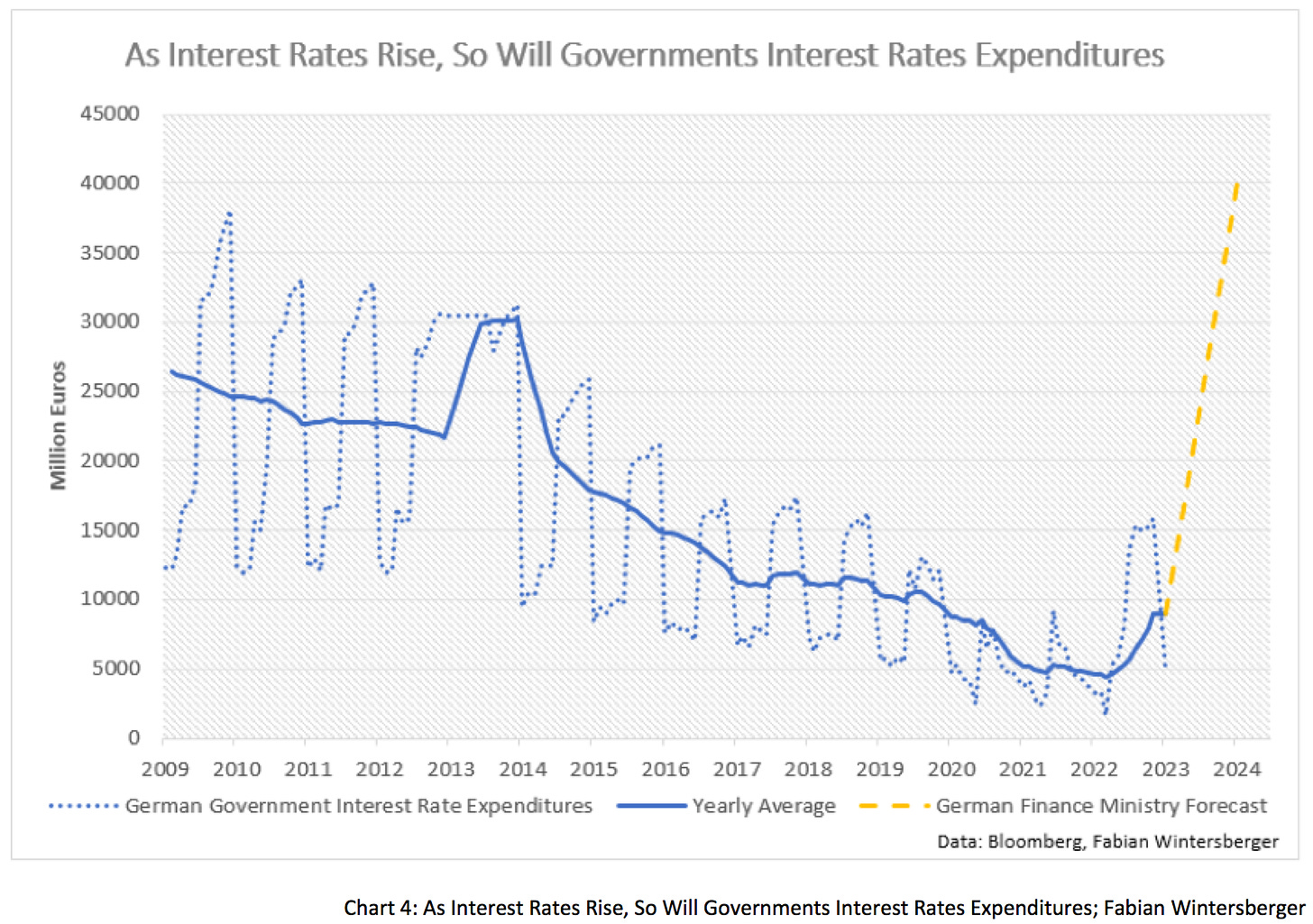

Germany’s finance minister Christian Lindner told Bild this week that German interest rates expenditures will be 40 billion euros in 2023, a tenfold increase since 2021. Currently, however, interest rate expenditures are still near record lows; the yearly average in January was about 8 billion.

Bond yields consist of interest rates and credit risks. Therefore higher debt means higher yields, as market participants demand higher compensation for countries like France, the most indebted country in the eurozone (measured in total debt, public and private), or the PIGS that would mean substantially higher yields, not to mention the fact that the ECB was the only buyer of many of those government bonds in recent years.

Suppose consumer price inflation remains higher for longer, as one might conclude from the latest numbers. In that case, the ECB will be forced to continuously hike interest rates to a higher level, as market participants currently expect.

Most analysts and economists think the terminal rate will be around 4 %. However, I expect a higher terminal rate if there is no financial event, possibly in the European government bond market. Long-term inflation expectations in the euro area are rising again, and my thesis is that they will increase further to 4 % or higher.

Since 2012, the eurozone has always had a positive trade balance with the rest of the world and exported more than it imported. However, since the war in Ukraine started, the euro area’s trade balance has become negative. The latest data shows a trade deficit of 20 billion euros, although it has been at -40 billion euros at the year-end of 2022.

One reason the trade deficit has shrunk recently was the euro's appreciation, which lowered import prices. However, the euro looks heavily overvalued against the US dollar, the currency in which most of those imports are paid.

If the euro depreciates against the dollar, import prices will rise again, the trade deficit will become more significant, and consumer price inflation will stay elevated if the ECB expands the money supply to make it able to pay for those imports.

Currently, the expansive fiscal policy of European governments keeps consumption elevated despite high consumer price inflation. Anecdotally I can say that there are not many signs that consumers are holding back. If consumption is artificially elevated, but goods production falls, that translates into a higher price level.

One can assume that European production is falling over the medium term. Because of high energy prices and an increasing burden of regulations, businesses expect higher costs, and thus relocating production away from the EU is getting more attractive. Especially international groups will take this into account.

Additionally, there is a centrally planned green transition. If there are not enough skilled workers, one needs to train workers. One cannot assume that many qualified workers will migrate to the EU because they have better options, which means that the domestic workers trained to work in the green economy are missing elsewhere. As a result, production levels in these sectors might fall.

The EU Commission is proposing more and more laws to fight climate change, which probably leads to lower agricultural production in Europe, as the Dutch example shows. More and more European farmers have been throwing the towel for years: the number of farms in Europe has decreased by 37 % since 2005. This trend will accelerate if there is a ban on chemical fertilizers, like in Sri Lanka. Lower domestic agricultural production leads to higher agricultural imports, which, given a falling exchange rate, will drive up prices.

My thesis is that if the EU (or Europe in general) stays on its current economic course, it will lose ground against other continents. The surprising data on European industrial production should not be seen as a sign of solid resilience but as the beginning of creeping death.

So let it be written, so let it be done

I’m sent here by the chosen one (it’s your turn)Metallica - Creeping Death

In Malignant, Madison tells Gabriel that she can keep him in check: Now I can all the mind tricks you can… did you forget? We share the same brain (you can watch the scene here). Bulls and bears share the same data, but in the end, we do not yet know who Madison is and who Gabriel is.

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! If you like what I write, you can subscribe and get every post directly into your inbox. Also, sharing it on social media or liking the position would be fantastic!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice)