I watched it from the side of the stage Fred [Durst] was riling up the crowd and I saw it get increasingly rambunctious and then out of hand… I didn’t take into account what a jerk Fred Durst is. He was enjoying it. Fred could have quieted them down in a minute, but instead he was riling up the crowd. - John Schehr (promoter, Woodstock III)

Woodstock 1969 is by far the most-known music festival in history. For three days, around 400,000 members of the Hippie subculture gathered in White Lake, New York, to listen to Stars like Jimi Hendrix, Janis Joplin, The Who, and other greats of that time. Until today, Woodstock represents the other America of the time where the Vietnam war and the killings of JFK, Martin Luther King Jr., Malcolm X, and Robert F. Kennedy divided the country.

Although the festival did not go as smoothly as intended, a colossal myth surrounds the festival, fueled further by a documentary about the festival. The film was also a significant source of income for Michael Lang and his co-organizers to finally pay down the debt in 1980 for all the money they borrowed to make the festival a reality.

In the 1990s, Lang decided to let the myth become a reality again, but as Woodstock 1969 was a financial disaster, so was Woodstock II in 1994. Many visitors made their way through the fence and did not pay for tickets, and some did not even visit due to heavy rain throughout the three days. However, Lang decided to let another Woodstock Festival follow in 1999. This time, the festival took place at the former Griffis Airforce base in Rome, Upstate New York. The biggest rock bands of the time were about to play: Metallica, Rage Against The Machine, KoRn, and Limp Bizkit.

At first, the crowd was in a fabulous mood. Yet, that did not last long. Expensive ticket prices, the collection of food and drinks at the entrance, high prices for nutrition inside the festival, and extreme heat of about 40 degrees celsius lead to an explosive mindset of the crowd. In addition, one could sum up the security concept of the festival as poor. The number of securities would have been enough for a festival of approximately one-tenth of the size, and most of them were teenagers, literally picked up from the streets of New York.

At noon on the second day, when water fountains were already contaminated, the Nu-Metal band Limp Bizkit entered the stage. The band was well known for energetic performances and was probably the most-played rock band on MTV then. Hundreds of thousands of fans were ready to go crazy, and going crazy, they did. But while everybody felt great at first, tensions increased during the band’s set.

One of the last songs of the band was Break Stuff. From that song on, everything went south. During the song’s break, when the song builds up to finally kicks off again, singer Fred Durst told the crowd:

When the song kicks in, I want you to fucking kick in

And that was precisely what happened. Parts of the crowd started to tear down the plywood planks from the sound tower to crowd surf on them. Others tried to occupy the tower and started to shake the structure.

When the festival ended the day later, the raging crowd had torn everything down, and the National Guard had to come in to calm things down. The myth of Woodstock was in ruins forever.

Two recently released documentaries capture the events of Woodstock III: Woodstock 99: Peace, Love and Rage (2021) and Trainwreck: Woodstock ‘99 (2022). After watching the documentaries, I thought that the events show an excellent metaphor for central banks’ monetary policies of the last decades.

Since Alan Greenspan, monetary policy has become a spectacle. Whenever there is a press conference of a head of a central bank, market participants watch it, measuring every word to interpret it. As central banks influence liquidity, they influence the actions of market participants.

Previous cycles always ended with the central banks slashing interest rates. Similar to Woodstock III, everybody is doing great at first. The market loves low rates; additional liquidity pushes financial markets to all-time highs. Add some bond-buying programs to the mix, and investments in long-term operating tech companies become even more attractive due to the rise in the value of discounted future cash flows. That explains why so many stock prices of companies with no revenues went up because the value of expected future earnings increased significantly.

Additionally, the Greenspan Put led to more aggressive risk-taking. They always assumed that the central banks would provide additional liquidity in times of crisis because they always did.

However, beneath the surface of liquidity, imbalances increased. Like during Woodstock III, good music and hanging out with friends were slowly undermined by high prices, broken water supply, and more stuffed porta-potties.

On the first day of the Festival, KoRn entered the stage, and the crowd started to go crazy for the first time. Singer Jonathan Davies called the feeling he had the best one could ever have. If you watch videos from then, you know what he means. The crowd moves in tandem with the sound wave from the front to the back. However, securities somehow managed the increasing tensions, similar to what central bankers can do with their words. In 2012, Mario Draghi needed only one sentence to calm the European bond market. Beneath the surface, however, imbalances remained.

Measures the central banks take need to become more forceful by nature. And finally, when inflation started to kick in last year because central banks and governments flushed markets with liquidity again, Jerome Powell and his comrades had to pivot. In November last year, Powell buried transitory and assured that the Fed would do whatever it took to bring inflation back down below 2 %.

As I wrote in Between Angels And Insects, there might be evidence that Powell is trying to kill the Greenspan-Put. Like Fred Durst, who let all the pent-up emotions explode during Break Stuff, Powell is risking a systemic collapse. If that happens, and the Fed really pivots, that might be too late for many market participants who are still buying the dip.

When thinking about a central bank pivot, an investor needs to answer whether the financial system as a whole is in danger. Is there a probability of a global crisis similar to the turmoil in the British bond market in September? Will stuff break? Currently, I would argue that that is not the case.

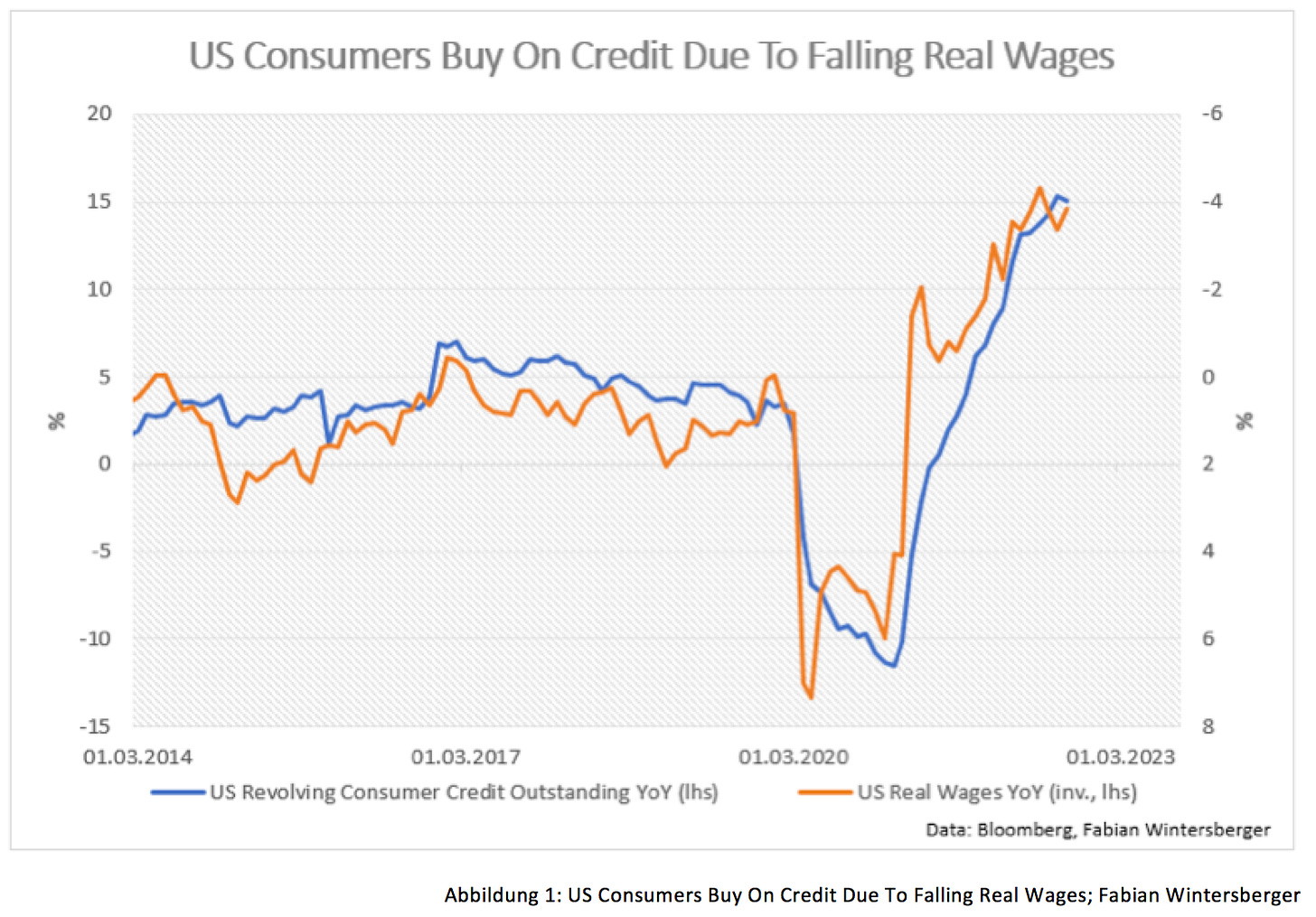

One knows that central banks can influence demand by controlling interest rates because the cost of financing goes up for consumption and investment goods. Currently, high inflation has led to negative real wage growth for consumers. Yet, businesses’ revenues increased, measured in currency units (dollars, euros, etc.). However, they also point out that the increase was due to price increases because of inflation and not necessarily because more units were sold. Recent numbers show that consumers are keeping up consuming the same amount of goods but with increasing credit card debt.

Therefore, one may conclude that the latest Fed rate hikes were not enough to bring down consumption, hence inflation, and that there will be more interest rate increases at the next FOMC meetings. Consumption did not fall as needed to bring inflation back down to 2 %. However, as buy now, pay later company Affirm notes, transaction volumes of their service increased 500 % year-over-year.

The latest NFIB survey that asked small businesses about future price plans supports that conclusion. Current numbers show that it is probable that inflation will continue to come down, but it also suggests that the Fed is still away from achieving its goal.

As I write the post before we get the US CPI numbers for October, I cannot talk about them. Nevertheless, I think that there is a chance that inflation numbers might surprise and come in below consensus because of lower energy inflation in October. One may interpret that the Fed’s tightening policies finally show some results.

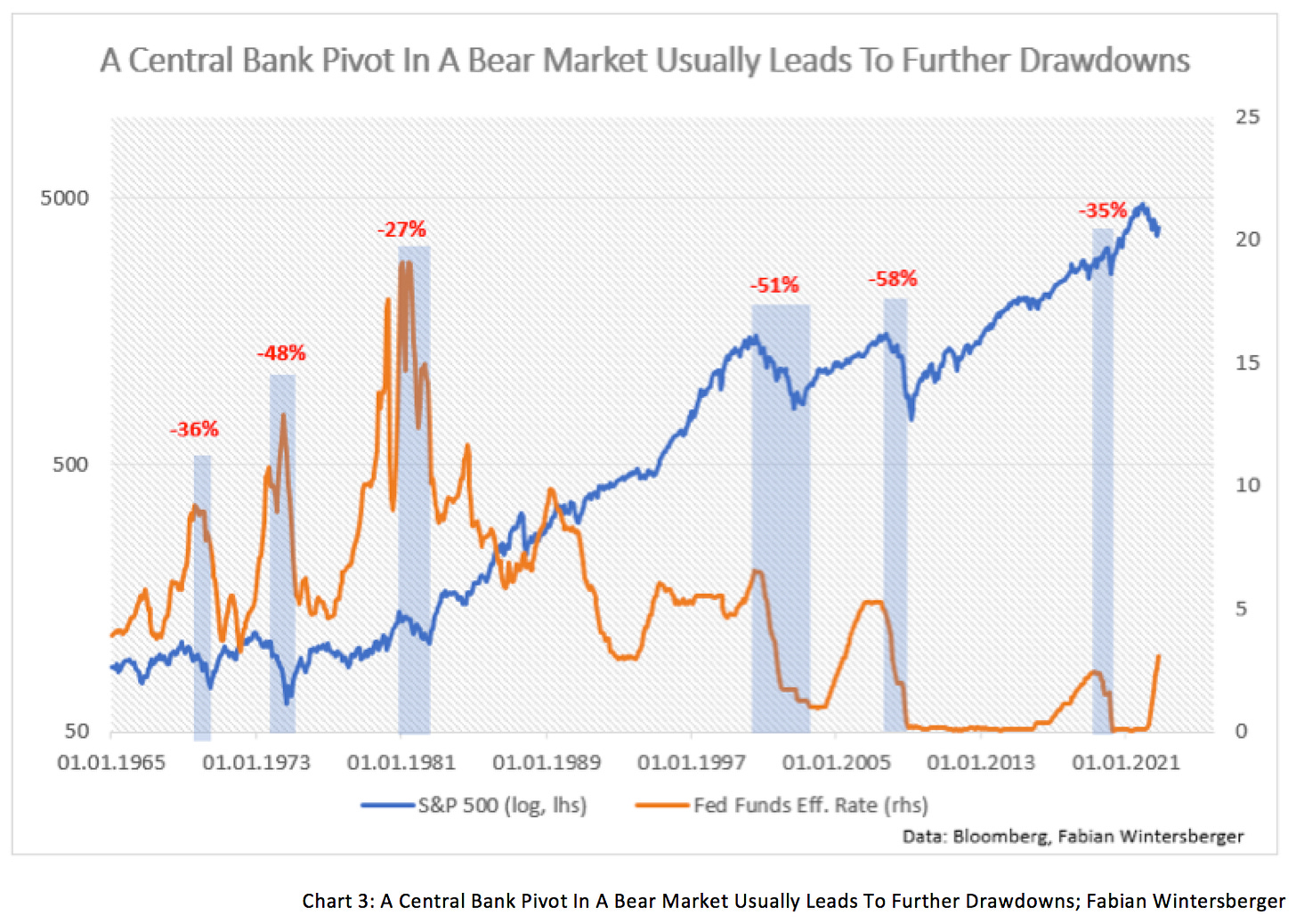

If my assumption is correct (CPI comes in line or below), we might see equity prices rally because of hopes for a sooner pause of rate hikes or a pivot. Yet, I would not interpret this as a buying signal for stocks because when one looks at previous bear markets, one notices that downturns did not end when a central bank pivoted, and it shows that stocks started to rise when interest rates hit the low of the next cycle. Thus, I would look for attractive levels to enter some short positions.

As nothing is breaking by now in the United States, one should be assured that Powell will pivot if the global financial system is at stake. My hunch is that problems will emerge somewhere else than in the US. For example, if things get ugly in Europe, similar to what happened in the UK, it might lead to global turbulence because of market size alone.

Currently, Europe is sighing relief because energy prices are coming down substantially from their heights. However, this does not mean that energy prices for businesses and consumers will decrease significantly. The spike in prices was caused by additional demand from European countries who bought anything at any price to fulfill the prescribed goals of the EU Commission. Now that gas storage levels are above 90 % and demand is satisfied, prices fall.

By now, energy costs for businesses have increased substantially. The German Ifo Institute calculates a loss in German real income of 110 billion euros that will also remain in the following years.

The declared goal of EU countries is the green transition (the commission even wants to exclude them from fiscal rules) and more energy production coming from solar and wind. However, as the Swiss NZZ reported, about one-fourth of all german windmills run at only 20 % capacity or less and can only survive because of high government subsidies. Windmills running at high capacity are those in the North near the coast, but the problem is that suitable locations are limited there.

Nonetheless, the ECB is still far behind the curve, and contrary to the events in the United States, the rate of change in year-over-year inflation is still rising. (Un-) Surprisingly the ECB is still in denial about the roots of inflation. After Christine Lagarde said that inflation came from nowhere, Belgium’s governing council member Pierre Wunsch said that stimulus is not accountable for current inflation.

It is good to read that the ECB is at least still eager to fight inflation, raise interest rates, and follow the Fed’s course. This week, Germany’s 2s10s have gone negative, five months after the US 2s10s did.

If you ask why I let US 2s10s lead five months, the answer is that the Fed is leading the ECB, and central banks and monetary tightening are the leading cause for the curve inverting. But why, one may ask? The general assumption is that the curve is inverting because investors see a recession on the horizon.

That could be if the yield curve inverts because of a collapse in longer-term yields. However, all inversions of the yield curve happened because the front end was rising rapidly and overshooting the rise of longer-term rates. It happened when central banks tightened. As (central) banks control the short end via setting the interest rate (while QE is manipulating the long end lower), an inversion of the yield curve happens because central banks tighten and pop the artificially fueled asset bubble.

Still, there are no signs that something will break in Europe soon and that the global financial system is in danger. Thus, I assume that the end of the tightening cycle is still farther as one may wish.

However, somewhere else, stuff is already breaking. The most liberalized market in the world is starting to collapse: the cryptocurrency market. Because it is such a free, unregulated market, it is a lot more volatile than the stock market, for example. Additionally, while central banks are liquidity providers or Lenders of Last Resort, who support the traditional financial markets if there is a liquidity problem, there is no such thing in the crypto market.

Banks are undercapitalized because of their business model, and Crypto exchanges are, too, especially if they offer leverage trading. Because if a trader wants to leverage a position and the crypto exchange agrees, it needs to borrow from somewhere else.

To do that, it needs to provide some collateral to get the additional money, for example, Bitcoin, from another deposit. Hence, traded volumes become blown up, but if there is a Bank-Run, the house of cards collapses. You can imagine that this happens much faster in the crypto space than in the thousand-year-old, traditional banking system. That is exactly what happened this week when Coinbase announced it wanted to sell its holdings of FTX-exchange’s token, and a chain reaction followed.

Give me something to break

Just give me something to break-Limp Bizkit - Break Stuff -

To return to the Woodstock III analogy, one can say that this week, Coinbase (Fred Durst) broke something (FTX), as the crowd did back in 1999. Liquidity got sucked out of the market, leading to a collateral shortage.

If monetary tightening continues further, the withdrawal of liquidity might lead to a real, systemic crisis in conventional financial markets. Currently, the Fed’s Reverse Repo Facility is providing collateral for liquidity. As Bloomberg reported, traders want the ECB to implement a similar European instrument.

Yet, further tightening monetary policy and draining liquidity off the market might cause some problems down the road. This year, crypto markets have been a good indicator of future developments in stock and bond markets.

Let us hope that the current turbulence is a fake signal. However, one may determine that cryptocurrency markets might already have reached the break of Break Stuff, while the old financial markets have just reached the beginning of Limp Bizkit’s set at Woodstock III. By the way, the song with which Limp Bizkit started the set is called Just Like This.

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity and are no investment advice)

Well said, I keep looking for the Powell comment that he was going to cut rates as that was how the market behaved. there is a lot of pent up pain in this market, and I fear it is coming in the next quarter or two. risk, today's darling, may find it has no friends by spring.