A Flag To Wave

The week in review, small-caps at ATHs, and is there finally a turnaround in bonds?

There is only one side to the market; and it is not the bull side or the bear side, but the right side. - Jesse Livermore

And here we are again, grappling with the ongoing tit-for-tat in the U.S.-China trade war. On Friday, a Trump post on Truth Social sent equities tumbling as he threatened China with “new 100% and above tariffs.”

The sharpest declines hit the crypto market, where massive liquidations took place:

The spark was familiar but unexpected. Donald Trump’s 100% tariff threat on Chinese imports rattled global markets bloated with speculative excess. But the pain was most acute in crypto, with an index tracking altcoins — the smaller tokens beyond Bitcoin and Ether that rely on fragile liquidity and speculative zeal – dropping as much as 40% within minutes.

Over the weekend, however, the usual backtracking followed. At this point, it’s hard to believe markets still react to Trump’s recurring threats. Perhaps it’s because no one knows if he’s serious this time, or because sell-offs prompt him to dial back the rhetoric. For now, one can only speculate why markets still take these threats seriously.

While stock market bears reveled over the weekend, calm returned by Monday, though most equity indices couldn’t reclaim last week’s highs. Still, I suspect bears will be disappointed again. The market may stay choppy for days or weeks, but as long as price action forms higher lows and higher highs, the bull market remains intact.

Before diving deeper into financial markets and my outlook on their trajectory, let’s address a few pressing issues. The most bearish stories currently stem from Europe, particularly Germany.

Just when it seems Europe’s economic crisis might ease, things take a darker turn. The auto sector is under immense pressure, with sluggish vehicle demand, high production costs, and rising foreign competition.

Volkswagen AG closed its plant in Zwickau, Germany for a week this month while Stellantis NV is temporarily halting output at sites that make models like the Fiat Panda and Alfa Romeo Tonale.

The trade war is also pushing producers to invest elsewhere. In that sense, Trump’s tariffs are yielding results: This week, Stellantis announced a $13 billion investment in the U.S. over the next few years, its largest in its 100-year history.

Germany’s export manufacturers are also reeling from tariffs, as exports have declined for two consecutive months. No matter how you look at it, Europe’s outlook is far from compelling. Policymakers’ rhetoric suggests they’re aware of the issue and see a shift to military equipment production as a way out.

However, this pivot may boost GDP but could strain production of non-military goods by limiting available resources, potentially leading to reduced output and higher prices. Moreover, there’s reason to believe these programs will fall short of expectations, merely inflating government debt ratios.

This plan aligns with the corporatist trends I discussed last week. In the U.S., escalating trade tensions reveal another dimension. Beyond taking stakes in companies and doling out hefty subsidies, the Trump administration has more in store, as Treasury Secretary Bessent told CNBC.

One proposed industrial policy involves price floors across industries to counter cheap imports. The aim is to prop up U.S. industries struggling against China’s low-cost producers. But, as with most interventions, this risks unintended consequences, such as resource misallocation and price hikes.

As with tariffs, American importers and consumers will likely foot the bill while select businesses profit. From where I stand, this intervention spiral will only deepen. The Trump administration’s push to supercharge production could fuel price inflation in the years ahead.

For now, I’m not overly concerned about runaway inflation, though it could edge slightly higher. With the job market stabilizing, the Fed will likely pay less attention to it. Markets expect two more rate cuts this year, which aligns with recent Fed comments. For instance, Trump’s Fed appointee, Stephen Miran, called two cuts reasonable but urged quicker action:

“I wouldn’t say that I want even lower rates now than I did a week or a month ago,” Miran said. “However, with the change to the balance of risks, I think it becomes even more urgent that we get to a more neutral place in policy quickly.”

Fed chair Jerome Powell also signaled more rate cuts this week, noting the Fed will soon halt its balance sheet reduction. He added that the outlook hasn’t shifted much since the last FOMC meeting.

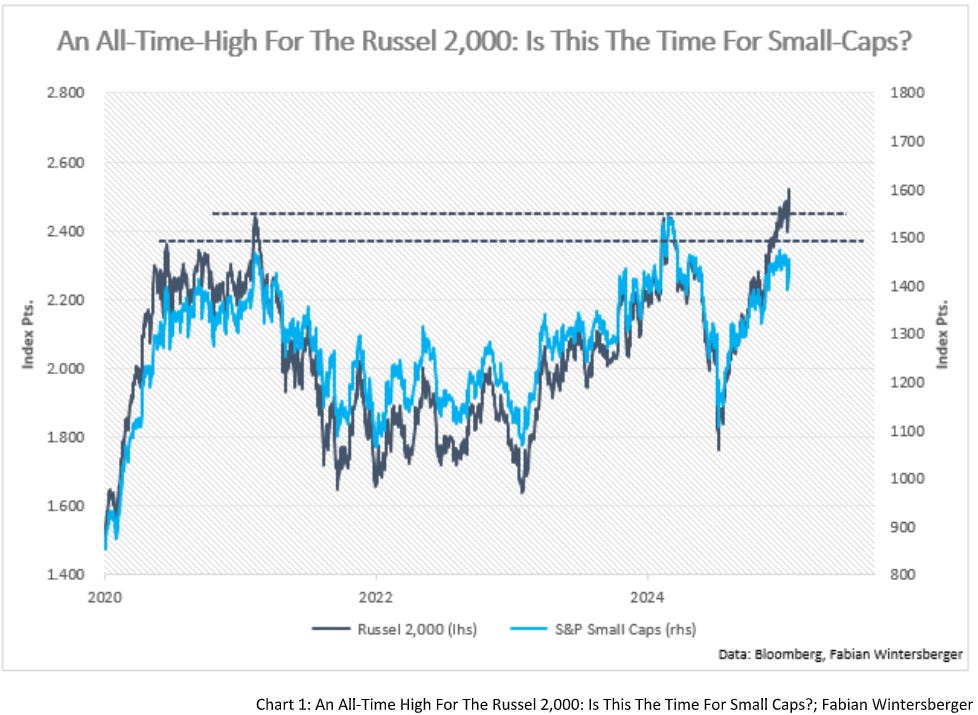

As for my financial market outlook, my view on equities remains essentially unchanged. As long as the bullish trend holds, the bull market should persist. With more Fed cuts on the horizon, small-caps could outperform, as they benefit most from falling short-term interest rates. The Russell 2,000 also hit an all-time high this week, a potential sign that small-caps have room to run.

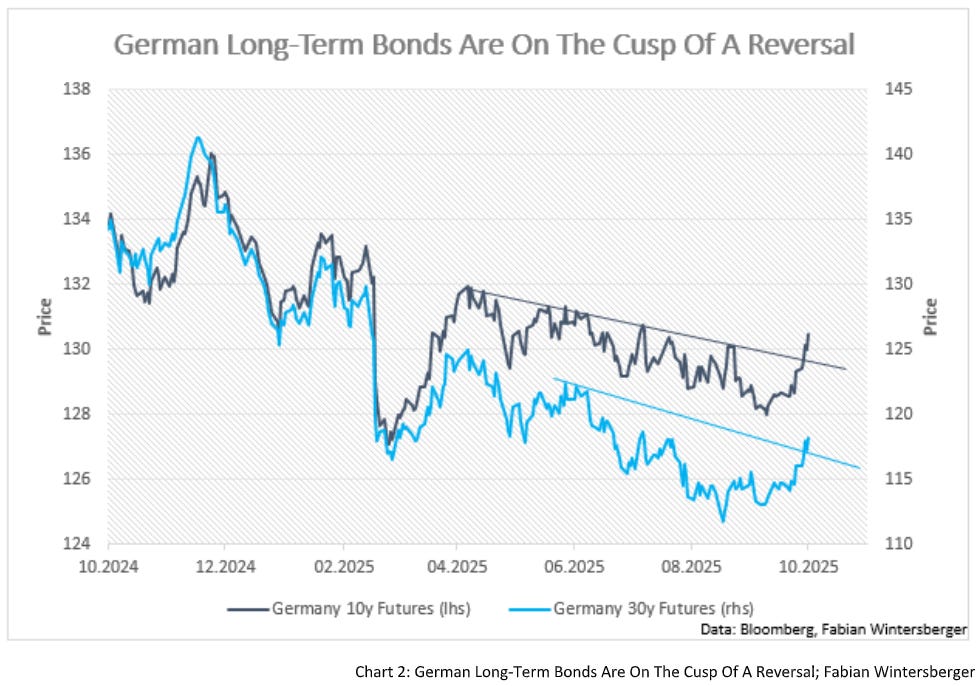

Regarding the bond market, I think that the time has come for a reversal. In the bond market, I sense a reversal brewing. While I’m uncertain about U.S. Treasuries, Europe’s slowdown, grim news, and the ECB’s signal that rates may hold steady for 2025 lead me to believe German government bonds could rally. The 10-year Bund Futures have broken their downtrend, and 30-year Buxl Futures are nearing a breakout. Fundamentally and technically, this view holds water.

Bears will likely struggle going forward, though the U.S. jobs market bears watching. Still, with consumption proving remarkably resilient, signs point to the bull market’s continuation.

Juliette Declerq of JDI Research offered an intriguing thesis his week. She argues that labor market slack is less threatening than in past cycles due to AI, which primarily displaces low-level entry jobs, as seen in rising youth unemployment. That keeps consumption robust, as middle- and high-income earners, along with wealthier households, drive most spending. Paired with falling rates, this should lift stock and bond prices, Declerq says.

Her take on inflation is compelling, as she’s less concerned than other macro observers. She argues that the wealthy spend less on CPI-tracked goods, so price increases occur outside CPI categories, dubbing this the “Champagne Economy.”

I’m less optimistic about U.S. inflation but expect it to stay within the 2-4% range. I also question her view that European stocks have more upside than U.S. stocks, given their extended underperformance. That potential hinges on European governments easing their regulatory grip, which I doubt will happen.

Still, I agree the bull market has legs, supported by falling interest rates. Whether stocks, bonds, gold, or Bitcoin, the trend still points up. I think bears have yet a white flag to waive

.

I long for something that I can represent

A flag to wave to find my foundation

I long for something to carry to the end

A flag to wave, a flag to waveCurrents – A Flag To Wave

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, I would greatly appreciate it if you shared it on social media or gave the post a thumbs-up!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. THEY DO NOT CONSTITUTE INVESTMENT ADVICE, and my perspective may change over time in response to evolving facts. IT IS STRONGLY RECOMMENDED TO SEEK INDEPENDENT ADVICE AND CONDUCT YOUR OWN RESEARCH BEFORE MAKING INVESTMENT DECISIONS.