Perhaps, it is better to be decided than undecided. But it is certainly the best to stay decidedly undecided ― Raheel Farooq

The 2018 Italian general election, held on March 4, resulted in a significant shift in the country's political landscape, marked by the rise of populist and right-wing parties. Matteo Salvini's Lega Nord (Northern League), in coalition with Silvio Berlusconi's Forza Italia and other center-right parties, emerged as a significant force, securing approximately 37% of the vote. This coalition, however, fell short of achieving an outright majority. The anti-establishment Five Star Movement (M5S), led by Luigi Di Maio, became the single largest party with about 32% of the vote. Still, it, too, lacked the necessary majority to form a government independently.

The election results reflected widespread voter dissatisfaction with traditional political parties and concerns over issues such as immigration, economic stagnation, and unemployment. Matteo Salvini's Lega, which had transformed from a regional party focused on Northern Italy's interests to a nationalistic, anti-immigration force, capitalized on these sentiments. Salvini's campaign rhetoric, which included promises to deport illegal immigrants and prioritize Italians in social welfare programs, resonated particularly well with voters in economically struggling regions.

Following the election, Italian government bond yields rose sharply, reflecting investor anxiety over political instability and the potential for a government that might challenge European Union fiscal rules. The uncertainty over the formation of a new government and the possibility of increased public spending and tax cuts, as promised by the populist parties, led to fears of a widening budget deficit. This apprehension was mirrored in the financial markets, with the spread between Italian and German bond yields widening significantly, indicating higher perceived risk associated with Italian debt.

The protracted negotiations to form a government exacerbated market jitters. After weeks of deadlock, the Five Star Movement and Lega eventually agreed to form a coalition government, with Giuseppe Conte, a law professor with no prior political experience, proposed as the prime minister. This coalition, often referred to as a "government of change," adopted a platform that included both M5S's advocacy for a universal basic income and Lega's tough stance on immigration and tax cuts, raising further concerns about fiscal discipline.

The impact of the 2018 election extended beyond Italy, sending ripples through the European Union. The coalition's eurosceptic tone and potential to disrupt EU economic policies worried many European leaders. Salvini's success, in particular, symbolized a broader rise of right-wing populism across the continent, challenging the EU's political and economic integration efforts. The elevated bond yields and the volatility in Italian financial markets highlighted the delicate balance between national sovereignty and collective stability within the EU, underscoring the ongoing tension between populist movements and established political norms.

In some ways, the latest EU elections have led to similar developments in France. While the Italian right-wing government led by Giorgia Meloni increasingly integrated into the EU central right over time, the results of the French EU elections evoke memories of the Italian 2018 elections. Marine Le Pen's Rassemblement National garnered more than 30% of the votes in the EU election, about 50% more than the party of current French President Emmanuel Macron, surprising markets and signaling a potential shift in France's political landscape akin to what happened in Italy.

The French president shocked investors on Sunday by calling a snap vote after his party suffered a crushing defeat in European parliamentary elections. Polls show Le Pen’s National Rally — which has previously supported policies such as cutting sales taxes and reducing the retirement age — has a substantial lead going into the first round of voting on June 30.

The consequences were felt across French markets:

S&P Global Ratings last month downgraded the nation’s credit score, saying the budget deficit will remain above 3% of gross domestic product through 2027. Moody’s Corporation said in a note Monday that snap election increases the risks to plans to plug the holes in the budget.

French equity markets were also hit, with the CAC 40 index falling 2%, putting it on track for its worst week in nearly a year. Banks fell the most, with Societe Generale SA down 12% and BNP Paribas SA down 10% on the week.

The short-term volatility differential between French and German equities has also widened. One-month implied volatility for the CAC 40 is now 2.7 volatility points above that of the DAX Index, the highest spread since December 2021. Such divergence has very rarely occurred in the past eight years.

French government bond markets also faced some severe headwinds:

Investors have taken fright at Macron’s surprise decision to call a snap vote given the lead that her party enjoys in the polls. A victory for National Rally opens the door to looser fiscal policy that risks piling pressure on France’s stretched public finances.

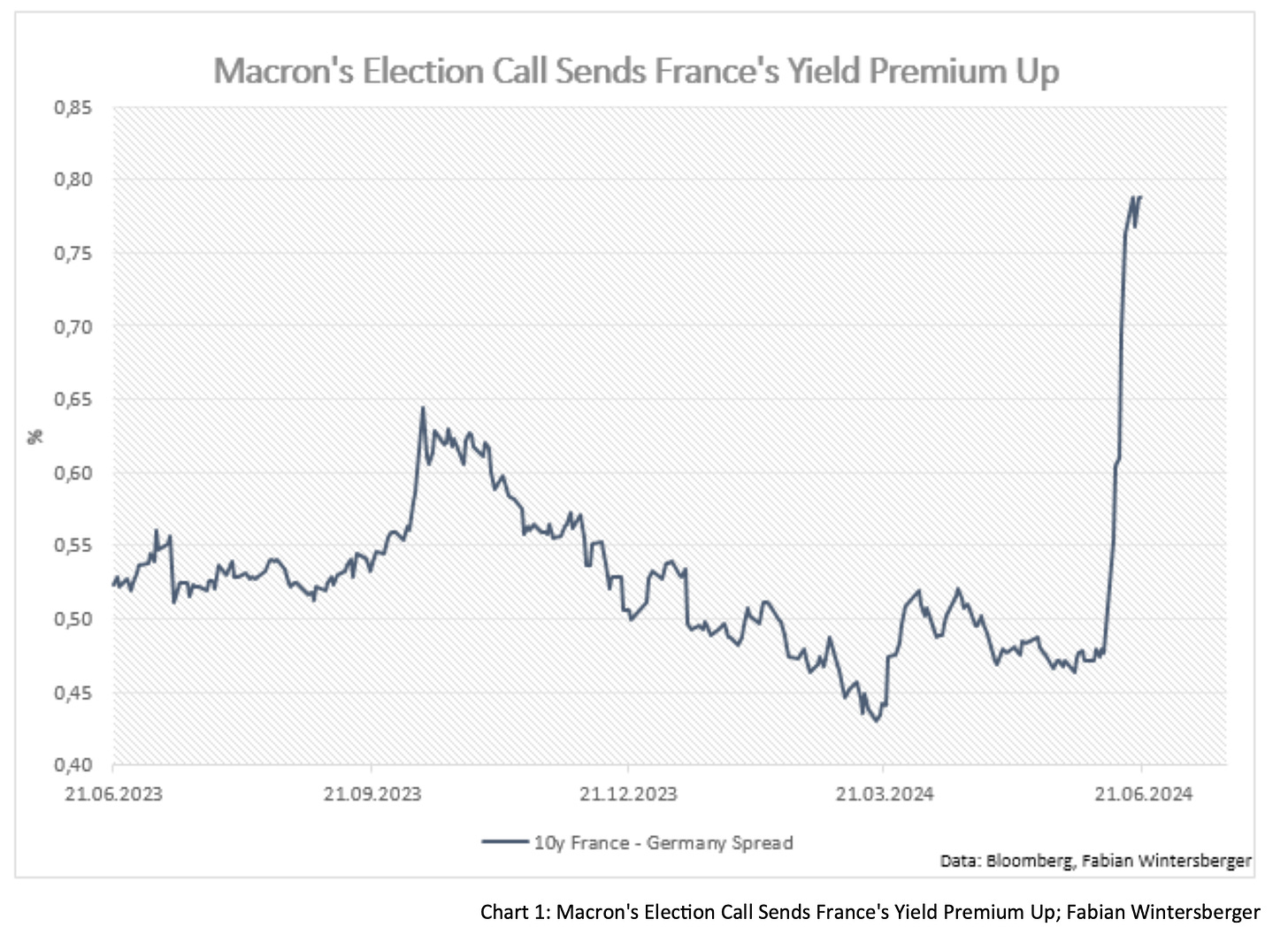

The 10-year yield spread over safer German notes widened the most on record last week, according to data compiled by Bloomberg going back to 1990.

A look at the yield spread between German and French 10-year bond yields underscores bond investors' worries. Before the EU elections, the spread was around 50 basis points. Still, Macron's announcement and the possibility of a win by Le Pen's Rassemblement National have widened it to nearly 80 basis points. This widening reflects increased perceived risk in French debt due to potential political instability and policy changes that could follow a victory by Le Pen's party.

While some might think that serious trouble could be ahead, it’s easy to argue that things aren't as dire as they seem. Reflecting on the aftermath of the 2018 Italian elections, one could contend that a potential victory for Le Pen may follow a similar trajectory. Ultimately, the policies enacted by the Italian government differed significantly from the campaign promises made before the election.

However, political uncertainties are rarely beneficial for the economy. Unsurprisingly, ruling political parties often paint a picture of doom if opposition parties gain power, attempting to sway voters to keep the status quo. Yet, there is growing evidence that fewer people are heeding these warnings, instead opting to vote for opposition parties despite some questionable members within those parties.

For instance, Germany's AfD received about 16% of the vote despite a candidate being discredited due to an espionage scandal involving China and a significant media campaign against them. While some accusations might be valid, the frequent use of such warnings has led people to disregard or distrust them. Such warnings may have been effective when the German economy was strong, but with current struggles, many voters are beginning to doubt the narrative that things would worsen if they voted for parties like the AfD.

Shifting focus from European politics to the economy, the ECB recently lowered interest rates by 25 basis points, as expected. Interestingly, Christine Lagarde stated that inflation is moving in the right direction, even as the governing council revised its inflation forecast upwards.

Notably, Robert Holzmann of OeNB was the sole member voting against the rate cut, insisting that "Data-based decisions should be data-based decisions." With recent CPI figures falling short of expectations in the Eurozone, there are concerns that the rate cut was premature.

The more significant issue, however, is not the rate cut itself but the implications of a Federal Reserve that might refrain from cutting interest rates this year. If the Fed maintains a restrictive stance for longer, the euro could come under pressure, especially with potential further cuts in the fall and winter.

In the short term, the rate cut will not impact inflation, which is determined by changes in the money supply from about a year ago. I'm not overly concerned about a resurgence of inflation as long as the broad money supply doesn’t increase significantly.

The FOMC meeting last week also revealed no immediate plans for rate cuts, disappointing Wall Street. Despite acknowledging an unexpectedly positive CPI report, Powell emphasized the need for greater confidence before committing to a cut. US economic data remains resilient, with the NFP report exceeding expectations according to the establishment survey. However, the unemployment rate ticked up to 4% due to a decline in labor force participation.

While the report indicates a weakening labor market, the numbers aren’t weak enough to justify a hasty rate cut by the Fed. Powell seems keen on preserving as much room as possible for rate cuts if economic conditions deteriorate. Furthermore, expectations for a soft or no-landing scenario are at extreme levels, as this chart from BofA indicates.

Markets are heavily influenced by expectations, particularly with the current anticipation of strong economic performance. A rate cut in such a climate could potentially drive the stock market even higher. However, it might be wiser to maintain steady rates to create some resistance for the stock market, thereby tempering excessively optimistic expectations.

From this perspective, I'm inclined to view the recent uptick in bonds not as the start of a trend reversal but possibly a bull trap. Many investors remain bullish on bonds, a sentiment that has persisted for quite some time. Looking forward a year, they may be proven right, but another increase in bond yields could disrupt sentiment enough to make long-term bonds more appealing.

Corporate bond spreads are still at historically low levels, meaning there's minimal additional return for moving further out on the risk curve. While stock markets are currently at lofty heights, historical trends suggest that not owning stocks at all tends to be the riskiest decision. Moreover, I believe a significant stock market sell-off isn't imminent unless we see some normalization in the yield curve, which could happen either through a drop in short-term yields or an increase in long-term yields. Given the current economic strength and persistently above-target inflation, the latter scenario seems more probable at present.

Following the ECB rate cut and the Fed's decision to hold rates steady, the dollar will likely strengthen in the coming weeks if the US economy continues to demonstrate resilience. Meanwhile, the Bank of Japan has taken minimal action toward rate normalization, potentially posing another drag on global bond prices.

In conclusion, the current market environment remains ambiguous and uncertain. We'll need to await further developments to gain more clarity in the coming weeks.

Separate the symptoms

From the real disease

A pale ghostlike redition of consequence

The irony covers the crimeThe Haunted - 99

Have a great weekend!

Fabian Wintersberger

Thank you for taking the time to read! If you enjoy my writing, you can subscribe to receive each post directly in your inbox. Additionally, sharing it on social media or giving the post a thumbs-up would be greatly appreciated!

All my posts and opinions are purely personal and do not represent the views of any individuals, institutions, or organizations I may be or have been affiliated with, whether professionally or personally. They do not constitute investment advice, and my perspective may change over time in response to evolving facts. It is strongly recommended to seek independent advice and conduct your own research before making investment decisions.