Breaking The Habit

My theories explain but cannot slow the decline of a great civilization. I set out to be a reformer, but only became the historian of decline - Ludwig von Mises

In the summer of 1940, a bus full of people made its way through Southern France towards Portugal, fleeing the German Nazi regime, which had just defeated the French army. Among them were Ludwig von Mises and his wife, Margit, who did not feel safe anymore in Swiss Geneva.

Shortly before the National Socialists moved into Vienna in 1939, Mises visited his hometown for the last time to take some belongings from his Viennese flat. The flat should be one of the first searched by Germans as soon as the German Gestapo gained foot on Viennese soil.

Some eventful days later, Mises and his Margit made it on a ship that took them to the New World. The belongings he left back in Vienna should never return to his possession.

Mises was already over the hill among professional economists, and his arguments against interventionism did not impress economists and policymakers who favored Keynesianism. Additionally, most economists thought of Mises’ method of economic analysis as old-fashioned, as the economic profession transformed into an empirical science.

Mises, a scholar in the tradition of the Austrian economists Carl Menger and Eugen von Boehm-Bawerk, opposed the approach to formulating mathematical theories by using historical, empirical data. Although, against what many believe, Mises believed that empirical analysis has a place within economic science to understand historical economic events better.

Most economists opposed Mises’ view, so the empirical method (as it is also used in the natural sciences) became the dominant stream. Today, hardly a student even hears of Ludwig von Mises.

If anything, the economist born in the Austro-Hungarian Lemberg (Lviv, Ukraine) is known for his work on the socialist economic calculation problem. In his book Socialism (1922), he argued that without private property and price signals, economic calculation is impossible, and thus socialism fails even if everyone has the best intentions.

In economic science, his theories did not play a significant role because they lacked mathematical models and empiricism, and Mises refused to change his habit, his approach to economic analysis. However, looking at the inflation projections nowadays, one can see that mathematical models often do not work as intended in the real world.

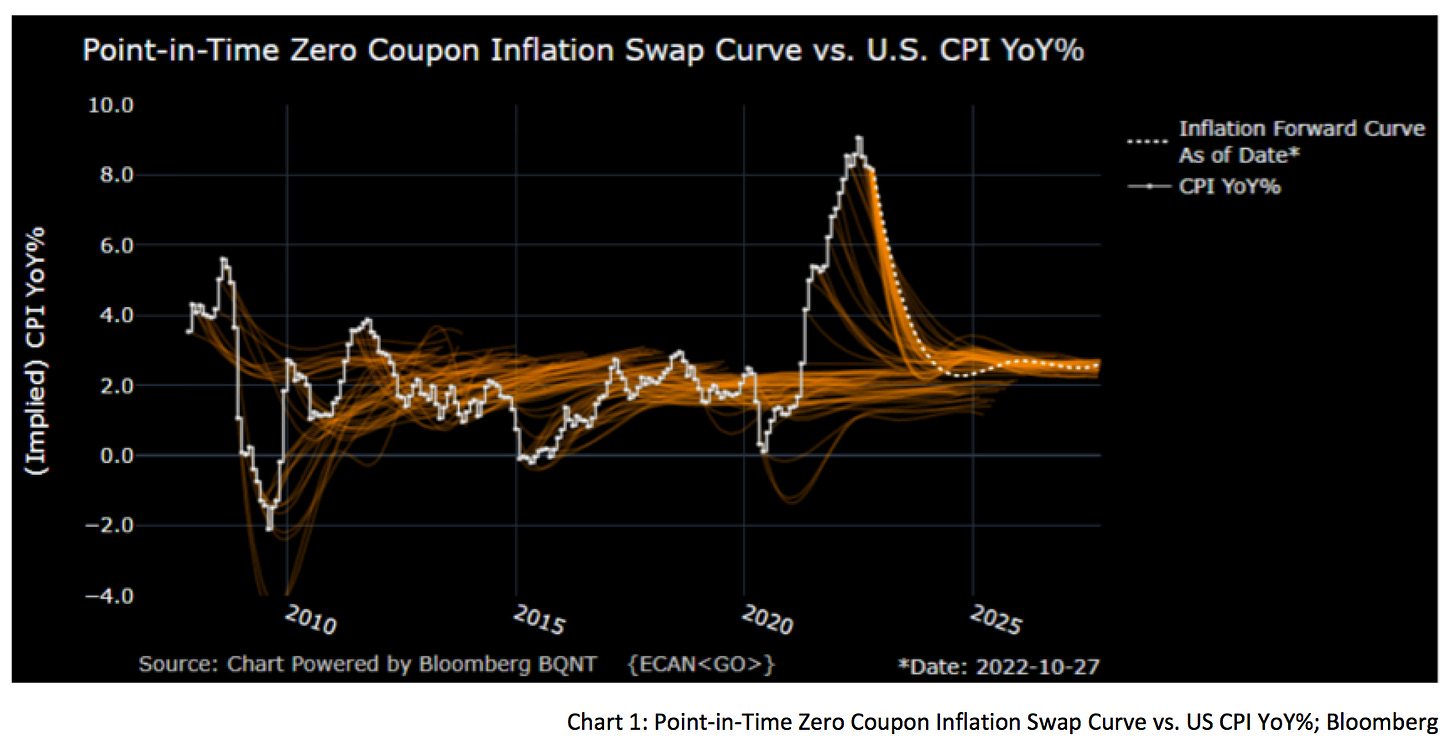

Mark Twain knew that prediction is difficult- particularly when it involves the future. Looking at past inflation projections (by markets and economists), one is reminded of a joke that says economics forecasts exist to make meteorologists look good.

I believe the Misesian economic analysis (logical-mathematical) approach is superior to the empirical method (like in physics). How people act, make a bulk of decisions every day, and create an economic environment is way too complex that an expert can gain all the information he needs.

Even economists who think of themselves as free-marketeers, and would agree that free markets lead to better results than a centrally planned economy, often believe that they can improve the market results by making small interventions. Their habitus is precisely why Mises argued that the third way (a tamed market economy) will always end in a centrally planned economy.

Many developments of the last months (years) can be traced back to government and monetary interventionism, which created economic imbalances that are now discharging. One example is the bond market, where the year-over-year change in basis points is as high as during the 1990s before central banks started to intervene heavily and suppress volatility.

Since central banks started their monetary tightening, it is merely a question of when the pivot starts. However, a 20 % drop in the S&P is not enough, obviously. The Fed is still on course to raise rates further and shrink its balance sheet.

US 30y mortgage rates are currently around 7 %. At the beginning of the year, they were at 3 %. In the last two months, house prices fell for the first time since the pandemic started, and the downturn was as severe as it was lastly during the Great Financial Crisis in 2008.

Many observers think this is already a sign of a severe recession and a significant drop in CPI on the horizon. However, a decrease in house prices takes some time to be reflected in CPI. During the 2008 crisis, house prices had started to fall two years earlier. Thus, I expect it will take at least one year until the falling house prices will find their way into CPI because the tightening cycle is faster than before the GFC, and obviously, inflation is much higher.

As a result, economists like Paul Krugman call for the Fed to slow down its future rate hikes. However, consumers were able to compensate for the fall in real wages by ramping up credit card payments. However, falling consumer confidence is already a harbinger of a possible sharp increase in the unemployment rate, which is still at a record low.

Until now, politicians had Jerome Powell’s back in his fight against inflation, which is about to change. Progressives especially see the rapid increase in interest rates as a danger to the US economy. As a result, members of the Committee on Banking, Housing & Urban Affairs wrote an open letter to Jerome Powell where they called on him to take further developments in the labor market into account more.

Now we will see whether Powell and the Fed will continue to stay on their course and will not be swayed by politicians. As Ludwig von Mises correctly noted in his writings, delaying the inevitable would only make the pain more severe.

Current monetary policy is discharging the imbalances created during the last decade. Every time those imbalances erupted, central banks came to the rescue to kick the can down the road further. As I noted last week, breaking with this habitus would be essential for the longer-term health of the US economy.

If Powell pivots as the Banking Committee wants him to, he would immediately become Arthur Burns 2.0. In 1979, Burns gave a lecture titled The Anguish of Central Banks, which mentioned the steady pressure from politics to loosen restrictive monetary policy during the 1970s. His successor, Paul Volcker, sat in the Audience, and one week later, he announced the new interest rate regime.

Now it will be revealed if Powell is breaking the habit and sending the Fed Put where it belongs, into the annals of the history books. It is a different question if he will hold through until the bitter end because it should be without a doubt that this would let many parts of the international financial economy fall off a cliff.

Now, let us move over to Europe, which deals with the impact of Russia’s war and the consequences of its imposed sanctions. Especially the sanctions are an excellent example of premature state action.

Remember that the EU Commission gave out storage goals during the summer? Until November, the EU member states should fill up gas storage by 80 %, and the countries have reached that goal already. However, it was a pricy way how to achieve it.

After Commission announced the goal, EU countries started to buy LNG like crazy on the open market and drove up prices. Briefly, gas prices on TTF rose above 300 euros/MWh (1m-forward). However, now that the gas is delivered, there is not enough storage, and many LNG ships cannot unload. Similar to 2020, when oil prices went negative, this has now happened in the European natural gas market.

Europe has driven up global LNG prices as they bid out other, poorer countries that relied on LNG. Especially Asian countries with long-term contracts with suppliers often receive less than agreed upon because producers make a higher profit (despite penalty payments) when selling their LNG to Europe.

However, negative gas prices are not a sign that the energy crisis is solved. This week, BASF announced that it plans to cut European production permanently. Germany is on the brink of a more deep recession than the Great Financial Crisis. Meanwhile, consumer price inflation is at a 40-year high.

Already, the ECB is under pressure. While proponents of a strong euro want them to continue with rate hikes, opponent countries like Italy are already calling for a stop to rate hikes to guarantee that there will be no refinancing problems. The ECB (much more than the Fed) is caught between a rock and a hard place into which it has maneuvered itself because of years of negative interest rate policy.

The ECB will have to decide whether it will guarantee financial stability within the euro area or continue fighting inflation. Currently, it is trying to fight inflation on the front while influencing bond spreads in the back through refinancing operations. But at some point, the ECB will have to answer how it plans to shrink its balance sheet via QT.

Yet, the development of producer price inflation is dangerous already. In most countries, PPI YoY is above or near 50 %. However, our globalized economy has changed the structure of the production of goods. Now, many steps in the production cycle are done by several manufacturers instead of one.

This just-in-time production was possible during times of stable prices, which guaranteed predictability for those processes. However, fluctuating producer prices could make this impossible and lead to another blow in already ailing supply chains. Price expectations of businesses suggest that price changes will say elevated. Remember that periods of high inflation always end with a collapse in production because the ability to plan production is no longer given. The current developments need further monitoring.

The European belief that it could regulate everything to perfection weakened the past years' competitiveness. The solution to every problem was more centralization, less competition, and increased spending.

In the United States, Joe Biden also thinks that more government is the solution to everything. However, such government policies work against the will of their central banks to bring down inflation.

I don’t know what’s worth fighting for, or why I have to scream

I don’t know why I instigate, and say what I don’t mean

I don’t know how I got this way, I know it’s not alright

So, I’m breaking the habit, I’m breaking the habit tonight

- Linkin Park - Breaking the Habit -

Ludwig von Mises once formulated his version of the Cobra Effect to show that government intervention always leads to more, more extensive interventionist policies. It is time that governments and other central banks follow Jerome Powell and start Breaking The Habit.

I wish you a splendid weekend!

Fabian Wintersberger

Thank you for reading! You can subscribe and get every post directly into your inbox if you like what I write. Also, it would be fantastic if you shared it on social media or liked the post!

(All posts are my personal opinion only and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.)